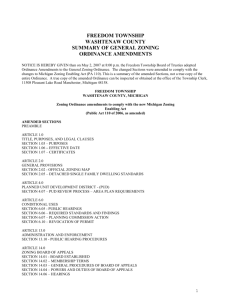

Ordinances

advertisement

Frankfort City Comprehensive Plan Charrette 3, March 8, 2006 Ordinances & Authorities Bruce Frankel Indiana City Corporation Ordinances Zoning Forms Impact Fees Inclusionary Development Concurrence & Phasing Tax Policies for Redevelopment Zoning Forms Traditional Planned Unit Form-Based Performance Combinations of above 3 ZONING Tradition [Euclidean] Separation by narrow range of uses and intensities in “districts” 4 ZONING Planned Unit IC 36-7-4-1500 5 Moderate mixture of uses and intensities Large parcels planned and developed as a unit Phasing Plan Promotes useful public spaces + land conservation ZONING Form-Based Broad mixture of uses, separated by intensities Restrictions center on permitted forms Degrees of intensities [urbanization] moving from the center 6 Central business district form Inner neighborhood form Outer neighborhood and working landscapes forms ZONING Form-Based Zoning Principles 7 ZONING Form-Based Design Components 8 9 ZONING Steps Toward Form-Based Zoning 1. Inventory existing conditions of the jurisdiction: – – 2. Identify a set of organizing principles for the spatial structure, based on: – – – – 3. 10 establishing commercial street design guidelines, with the goal of "shaping the public space of the street." Define architectural standards: – 5. neighborhood, district, and corridor Transect, which defines intensity of activity based on the transect zone that applies Street-system-based regulatory plan Special purpose zones Define urban design standards: – 4. Street, block and building types appropriate form and massing of buildings E.g., building types and frontage types Illustrate the standards, to make it easier for those who will be implementing the code. ZONING Transect Planning Andres Duany – 11 “Transect Planning,” APA Journal, Summer 2002, Vol. 68, No. 3 The Transect is a natural law that can be observed anywhere and everywhere. A natural law is defined as a principle derived from observation of nature by right reason and thus ethically binding in human settlements. The first appearance of the Transect as an intellectual construct was the “Valley Section” conceived by Sir Patrick Geddes early in the 20th century. Currently promoted by the Congress of New Urbanism ZONING Transect Planning Construct of human habitats – – – Vary by level and intensity or urban character Range from natural to urban Basis for organizing by the components of the built environment 12 Building Lot Land use Street Public space Etc. ZONING Transect Planning 13 ZONING Transect Planning 14 Transect Planning 15 ZONING By City – New Orleans, Washington, San Francisco 16 ZONING By City – Miami, London, Paris 17 ZONING Examples of Form-Based Zoning Codes 18 Chicago [refer to blackboard course doc] ZONING Chicago 19 The 1909 Plan of Chicago is one of the seminal documents of modern urban planning. The city’s 1923 zoning ordinance was among the first in the nation The 1957 ordinance introduced innovations Since 1989, more than a dozen major amendments to the 1957 zoning ordinance—including provisions designed to protect the riverfront, improve landscaping, and limit building height. ZONING Preamble to the Form-Based Chicago Zoning Ordinance 20 Chicago is a city of neighborhoods— and the vast majority of its residential areas have a very consistent scale and character. A new zoning ordinance should reinforce these established patterns, which will help stabilize property values and encourage continued investment. Most of the city’s low- to moderate-density neighborhoods were built prior to any zoning regulations. Builders used common development practices for each area. Front and rear yards on any given block were generally of an equal size. Yards were used as yards, not as pavedover parking pads. Building heights were matched to the surrounding structures, not to what could be squeezed out of regulatory loopholes. During the past decade, however, many developments have deviated from those traditions. ZONING Principles – Residential Neighborhoods 21 Replace the bulk control formulas (FAR) used in some residential districts with building height, setback and coverage limits. Eliminate front yard interruptions [“gap tooth effect”] —such as driveways, blank walls, and patio pits—while ensuring that residential buildings have consistent setbacks in both front and rear yards. Remove the regulation that encourages high-rise residential buildings in areas where mid-rise development would be more compatible. ZONING Performance 22 Broad or Narrow range of uses Intensities and some uses conditioned on “performance” Performance = Impact on neighboring properties neighborhood city as a whole Evaluation of impacts [positive and negative] constitutes a “grade” [e.g., 75 of 100] Very sophisticated While traditional zoning specifies allowable land uses in each district, performance zoning specifies standards of land use intensity that are acceptable in each district. Performance zoning focuses on the performance of the parcel and how it impacts adjacent lands and public facilities, not on the use of the land. This gives municipalities and developers more flexibility in designing projects, because the use of a property is not restricted as long as the impacts to the surrounding land are not negative (as defined in the specific regulation). Performance Standards Performance Zoning Model Ordinance Bucks County, Pennsylvania Natural Resource Protection Standards Open Space & Recreational Standards [NRPA] Architectural Design Standards Community Facilities and Associated Cost Responsibilities Fiscal Impact e.g., – – Other Public Amenities e.g., – – 23 Offsite infrastructure School District Costs – – Art Mixed Use [commercial and residential] Non-gated [public access] TOD [transit] ZONING Performance 24 Ordinance “Concurrence” & Phasing 25 May require more broadly defined infrastructure in place at time of new development E.g., public schools, police, fire and other essential facilities and services Ordinance Impact Fee IC 36-7-4-1300 Impact – Municipal or County Capital Budget only Infrastructure hard [“direct”] and soft [“indirect”] costs Land acquisition cost Associated cost of – – – – – Infrastructure – Sewer/ water/ drainage Thoroughfare Recreation Calculate fee in accord with IC 36-1-3-8[6] and 7-4-1318-et.seq 26 Planning [including comprehensive plan update] Legal Administrative Other pro rata impact over 10 years Allows reduced fee for affordable housing Resulting schedule of fee by type and intensity of development and an aggregate fee of every impact Ordinance Inclusionary Development Establish districts for inclusionary development OR Floating district as a conditional use Exchange – – Common features – – – – – Required fee simple ownership or required rental [not permitted on market rate units] Indistinguishable façade and grounds from market rate units Price controls for a period of time [e.g., 30 or more years] Household income eligibility at time of initial occupancy Affordable at 50% and 80% of County Median Income Merits – – – – 27 Set-aside [e.g., 20% fee simple affordable d.u.’s] Density bonus and other affirmative measures Controls form and tenancy of subsidized housing and integrates into community Developer provides subsidy Does it produce MORE affordable housing? Does it produce BETTER affordable housing? Innovative Affordable Housing Pyatok’s Adaptive Reuse of – – 28 Big Box Retail Industrial Michael Pyatok Break Up the Box Outside Walled Security Interior Courtyard Apartments 29 Industrial to Live-Work Lofts Potrero Square Lofts San Francisco, California Formerly an industrial building in San Francisco's Potrero Square neighborhood, this brick structure was transformed to accommodate live-work lofts. Each loft has double height spaces and mezzanines. Five courtyards are carved into the mass of the 100year structure to increase light and open space for the new occupants and a garage and elevator are included to meet their needs. The courts are carefully landscaped as surprising oases protected by a tough, brick fortress like exterior. Each unit has a large window facing a street and larger windows facing one or more of the interior courts. 30 Awards Grand Award for best Rehabilitation or Conversion 1994, Gold Nugget Awards, Pacific Coast Builders Conference Mixed Use Downtown Includes Affordable Housing Swan's Marketplace Oakland, California The renovation of this historic downtown Market Hall by the non-profit East Bay Asian Local Development Corporation includes a new fresh food market hall, restaurants, street oriented retail, 20 Cohousing condominium units and common house, 18 affordable rental units, live/work space, commercial office space, on-site parking and the Museum of Children's Art. 31 32 Downtown Oakland continued 33 Tax Ordinance Tax Innovations for Redevelopment 34 TIF [Tax Increment Financing] Special Assessment Land Tax Tax Abatement Tax Ordinance TIF [Tax Increment Financing] Establish a redevelopment district Set up a trust account Capture increment in taxes from private improvements and market value appreciation [accounts for public improvements] Reinvest the added taxes of development/ redevelopment back into the district District need not be contiguous – 35 SR 28 improvements support the downtown Can issue public bonds based on projected TIF revenue stream Mainstay of Circle Center Square with Simon Properties Tax Ordinance Special Assessment Used for Code violations or abrogation of HOA responsibilities Sequence: – – – – 36 City makes Improvements Impose Special Assessment Tax Default and Foreclosure Tax Redemption Tax Ordinance Land Tax Convert Property Tax in a Redevelopment area to a tax on land only – Features – – 37 [based on size and location, not improvements] Aggregate tax bill remains the same initially Induces private improvements by removing the tax penalty; actually, if there is a penalty it is on not making improvements Tax Ordinance Tax Abatement Tax Abatement – Phased-in – Special assessment As in “agricultural assessment” But, could apply to other categories [e.g., historic districts] PILOT [Payment In-Lieu Of Taxes] – – 38 To induce redevelopment district improvements on private properties Removal from the property tax rolls PILOT to general purpose municipal government Tax Ordinance Types of Tax Abatements Brownfield Brownfield Revitalization Zone Tax Abatement – – – IC 6-1.1-42 Assessed valuation deduction until the zone “expires” Amount of Deduction 39 3-Year [100%; 66%; 33%] 6-Year [100%;85%;66%;50%;34%;17%] 10-Year [100% and then decrements of 5-10%] OR Local trust of State Taxes for revenue collected on redeveloped brownfield Tax Ordinance Deduction for Rehabilitation or Redevelopment of Real Property in Economic Development Area IC 6-1.1-12.1 Limited Economic Development Area to 10% of the area within corporate boundary Excluded facilities [e.g., golf courses; retail food and beverage; alcoholic sales; auto sales] Types of Deductions – 40 1-Year through 10 Years Tax Ordinance Other Enterprise Zone Deduction of 1 to 10 Years – 41 IC 6-1.1-45 Historic District Deduction Authorities & Partners Corporate Sponsors Improvement Authorities Private Nonprofit Partners Corporate-Sponsored Housing 43 Mortgage Guarantees Employees Neighborhood-Based to raise market values West-Philadelphia Initiative West Philadelphia Initiative President Judith Rodin Urban Land Institute's Award for Excellence Components – – – – – – 44 University Square, a 300,000-square-foot mixed-use project that boasts a luxury hotel, the Penn bookstore, numerous retail amenities, and valuable green space Hamilton Square, a 75,000-square-foot project featuring a specialty grocer, theater complex, and parking facility The Left Bank, a 700,000-square-foot, previously blighted warehouse that the university acquired and converted into apartment units, retail, and offices Penn Alexander Community School for students in grades pre-K-8 Buy West Philadelphia fiscal year 2005 alone, Penn purchased over $70 million in products and services from West Philadelphia based suppliers, bringing the 10-year total of Buy West Philadelphia to $544.8 million. Mortgage Guarantees to both faculty and staff to attract residents into the neighborhood. 45 Authority Improvement Authorities Housing – Redevelopment – IC 36-7-14-25 Economic Development – 46 IC 36-7-18-19 IC 36-7-11.9-27 Private Non-Profit Instruments IRC Section 501c3 CHDO [Community Housing Development Organization] – – CDC [Community Development Corporation] CDFI [Community Development Financial Institution] – – – 47 LIHTC Home Program of HUD Community Development Banking and Financial Institutions Act of 1994, as amended (12 U.S.C. 4701 et seq.) Federal Credit Unions NMTC Housing Authority Section 8 Housing Choice Voucher – – – 48 Lafayette HA issues > 1,000 Lafayette, W. Lafayette and 5 mile radius Edie Pierce-Thomas - Director Tax-Exempt Bonds for Affordable Housing Low Income Housing Tax Credit Allocation Redevelopment Assemble Parcels in blighted area Sell under performance contract to developer OR serve as the developer Issue Tax-Exempt Bonds Lafayette Redevelopment Commission – 49 Dennis Carson - Redevelopment Director Economic Development Issue Bonds – – – – Self-Liquidating and Not General Obligation Notes Conduit Bonding [Letter of Credit, not the Authority, guarantees] Taxable Bonds Tax-Exempt Industrial Revenue Bonds <= $10M < $2M with IFA’s Small Bond program <= $250K for first time farmers on capital assets <= 40 years APR 65-75% of prime 100% LTC Eligible Activities – – – – 50 Manufacturing plants & equipment Pollution control facilities Qualified residential rental facilities 501[c][3] organizations Requires both EDA and City Council “inducement resolutions” Coordinate with Municipal and County Tax Abatement and Other Incentives New Market Tax Credit Program Initiative of the Federal CDFI [Community Development Financial Institutions] – – Riegle Community Development Banking and Financial Institutions Act of 1994, and administered by Treasury 7 CDFI’s in Indiana investing > $4.8M 51 2 Indianapolis, e.g., Indiana Redevelopment Corporation serves entire state 2 Lafayette 2 Fort Wayne Only in census tracts of >= 20% poverty Tax credit totals 39% over 7 years Forms of subordinated, low cost debt or joint equity Combine with Historic Tax Credits, Enterprise/ Empowerment Zone benefits Leveraging of $21/$1 Option: Frankfort creates a CDE [Community Development Entity] as a nonprofit ShoreBank 52 ShoreBank was the first and is the largest community development bank holding company in the U.S. $1.4 billion corporation with for-profit and non-profit subsidiaries in Chicago, Cleveland, Detroit, the Pacific Northwest and the Upper Peninsula of Michigan 7054 S. Jeffery Blvd. Chicago, IL 60649 773.288.1000 phone info@shorebankcorp.com