NACTI Aff – MNDI DM - Open Evidence Project

advertisement

NACTI Aff – MNDI DM

Plan(s)

1ac – plan

The United States federal government should propose the creation of a North American Court

on Trade and Investment for the United States and Mexico, staffed by a permanent tribunal with

members from both countries, to resolve interstate and investor-state trade disputes under

Chapters 11, 14, 19, and 20 of the North American Free Trade Agreement.

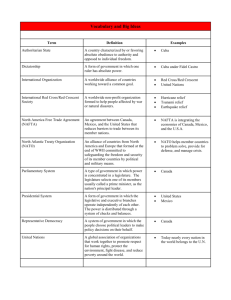

NAFTA Advantage

1ac NAFTA

Advantage ____ is NAFTA

Trade disputes within NAFTA are currently handled by ad hoc

tribunals, which undermine the agreement’s credibility

Pastor 11 – (Robert Pastor, former US national security advisor and writer on foreign affairs) “North American Idea: A Vision

of a Continental Future.” 2011 p. 196 http://site.ebrary.com/lib/umich/Doc?id=10480770&ppg=219

NAFTA established four distinct dispute-settlement

mechanisms to deal with problems related to investments, trade remedies, finance, and higher-level trade issues. Chapter 11

Permanent Tribunal for Trade and Investment Disputes.

of NAFTA provides assurances that a firm’s investment would not be expropriated without prompt, adequate, and effective

compensation. While it was mainly intended to reassure foreign investors in Mexico, it has been

used against all three countries and in ways that no one had contemplated. The most controversial cases involved

firms protesting new environmental rules that were judged “tantamount to expropriation.” In subsequent free-trade agreements

with Chile and Central America, the United States revised the wording so as to preclude any effect on environmental or health

policies. 42 The three governments should sign a memorandum of agreement that would make NAFTA consistent on this matter

with the newer agreements. Chapter 19 was intended to prevent arbitrary, protectionist use of U.S. trade

laws, and although it set a limit of 315 days for completion of panel proceedings, the average length has been nearly twice that, and

the United States has been reluctant to accept any rulings against it. The most notorious case involved softwood lumber “where the United States stalled cases interminably and Canadians eventually were forced to pay $1 billion to settle

legal cases they had won before bi-national panels and in U.S. courts.” 43 That $1 billion went to lawyers’ fees and nongovernmental

organizations connected to the forestry companies and the George W. Bush administration. This has left a very bad taste in the

mouths of Canadians. The current ad hoc dispute-settlement mechanisms rely on temporary panelists

that are increasingly likely to have a conflict of interest since many of the panelists have used their past

experience to bring cases to the courts. Moreover, it is not possible to establish precedents or build

any institutional memory if one uses an ad hoc mechanism. The three North American leaders

should therefore establish a Permanent Tribunal for Trade and Investment Disputes and fold the other dispute mechanisms into it.

A Permanent Tribunal should prevent the three governments from gaming the system and

eroding the region’s confidence in NAFTA. The World Trade Organization (WTO) has

established such a permanent court, and it is functioning very effectively. It’s time to apply it to

North America.

NAFTA integration risks failure now – hurts US and Mexican

economic competitiveness

Peters, 09 – Enrique Dussel, professor at the Graduate School of Economics, Universidad Nacional Autónoma de México (“Manufacturing

Competitiveness: Toward a Regional Development Agenda,” The Future of North American Trade Policy: Lessons from NAFTA, Pardee Center,

November 2009, http://www.ase.tufts.edu/gdae/Pubs/rp/PardeeNAFTACh2PetersManufNov09.pdf)

First, Mexico´s manufacturing share in GDP has fallen constantly since the end of the 1980s , from

levels above 23 percent to levels below 19 percent in the last quarter of 2008 (and since 2001). In terms of formal permanent employment, the

from 1994 to March 2009 manufacturing´s share of total formal and

permanent employment fell from 33 to 26 percent. Since its peak in October 2000, the sector

lost 1.04 million permanent jobs through March 2009—or 25 percent. In the recent economic crisis,

manufacturing has been hit particularly hard, suffering 59 percent of the country’s total

employment losses from October 2008 to March 2009. Weakening Integration Second, the integration process within

NAFTA, and concretely between Mexico and the United States, has been weakening steadily since

2000. From a Mexican perspective, the share of trade with the United States fell from levels above 86 percent

in the 1990s to 73 percent in 2008. In manufacturing the fall has been more substantial, with

Mexico’s share of U.S. manufacturing imports dropping from levels above 80 percent in the 1990s to

45 percent in November 2008. Similarly, as measured by the Grubel-Lloyd Index that calculates the percent of trade that is within industries,

intra-industry trade (at the four-digit level of the Harmonized Tariff System) reached its highest level in 1998 with 48

percent and fell since then to levels below 43 percent. This trend is a clear indicator of declining

conditions have been harsher:

economic integration between Mexico and the United States. Dependence on the U.S. Third, these tendencies have been evident in

value chains that are of particular regional importance—yarn-textile-garments, electronics, and auto parts-automobiles. The current global crisis has

taken a heavy toll on these industries. In automobiles, for example, it is very possible that only one or two of the Big Three U.S. auto companies—GM,

Chrysler and Ford—will survive the crisis. Mexico´s auto parts-automobile industry is highly dependent on these three firms, since they account for

almost 60 percent of total auto parts and automobile production. New Competitiveness Finally, it is worth remembering that during the period 1994–

2000, the implementation of NAFTA helped the auto parts-automobiles, electronics, and yarntextilegarments industries restructure. In both the United

States and Mexico, this increasing integration contributed to new competitiveness in North America to better compete with Asia. Causes and Effects A

number of factors contribute to these trends. NAFTA made the auto, electronics, and garment industries more dynamic. Yet the dynamism was largely

cut off from the broader economy because the firms in this sector tended to ignore Mexico as a source of inputs or markets, preferring to import the

majority of its inputs and export the majority of its output. Thus, much of Mexico’s domestic manufacturing sector was hollowed out. This was a result

of certain preferential programs in Mexico that favored importing inputs, a persistently overvalued exchange rate due to Mexico’s tight monetary

policy, and low tariffs under NAFTA. NAFTA’s investment and intellectual property rules also made it difficult to pursue East Asian-like policies to

enhance industrial competitiveness (though it is not clear the Mexican government would have used such policies if they had the space to do so).

China’s accession to the WTO accentuated these forces. Mexico’s exchange rate became even more overvalued relative to competitors (China) in the

U.S. market. These factors, in addition to the preference toward imports in national programs and in NAFTA, made importing all more important.

More importantly, those sectors that experienced dynamism from 1994 to 2000 began to lose competitiveness in the U.S. market with respect to

Manufacturing sectors in all three NAFTA countries are in a deep crisis, a crisis which has

been growing since the end of the 1990s. More worrisome than the short term is probably the

medium- and long-term state of the sector in terms of its competitiveness in Mexico and in the

U.S. market, particularly in comparison with China and the rest of Asia.

China.5

Competitiveness prevents great power war – and economic

perception is key

Baru 9 - Visiting Professor at the Lee Kuan Yew School of Public Policy in Singapore (Sanjaya,

“Year of the power shift?,”

http://www.india-seminar.com/2009/593/593_sanjaya_baru.htm

There is no doubt that economics alone will not determine the balance of global power, but there is no doubt either that economics

has come to matter for more.¶ The management of the economy, and of the treasury, has been a vital aspect of statecraft from time

immemorial. Kautilya’s Arthashastra says, ‘From the strength of the treasury the army is born. …men without wealth do not attain

their objectives even after hundreds of trials… Only through wealth can material gains be acquired, as elephants (wild) can be

captured only by elephants (tamed)… A state with depleted resources, even if acquired, becomes only a liability.’4 Hence,

economic policies and performance do have strategic consequences.5¶ In the modern era, the idea that

strong economic performance is the foundation of power was argued most persuasively by historian Paul Kennedy. ‘Victory (in war),’

Kennedy claimed, ‘has repeatedly gone to the side with more flourishing productive base.’6 Drawing attention to the

interrelationships between economic wealth, technological innovation, and the ability of states

to efficiently mobilize economic and technological resources for power projection and national

defence, Kennedy argued that nations that were able to better combine military and economic

strength scored over others.¶ ‘The fact remains,’ Kennedy argued, ‘that all of the major shifts in the world’s

military-power balance have followed alterations in the productive balances; and further, that the

rising and falling of the various empires and states in the international system has been

confirmed by the outcomes of the major Great Power wars, where victory has always gone to the side with the

greatest material resources.’7¶ In Kennedy’s view the geopolitical consequences of an economic crisis or even

decline would be transmitted through a nation’s inability to find adequate financial resources to

simultaneously sustain economic growth and military power – the classic ‘guns vs butter’ dilemma.¶ Apart

from such fiscal disempowerment of the state, economic under-performance would also reduce a nation’s attraction as a market, a

source of capital and technology, and as a ‘knowledge power’. As power shifted from Europe to America, so did the knowledge base

of the global economy. As China’s power rises, so does its profile as a ‘knowledge economy’.¶ Impressed by such arguments the China

Academy of Social Sciences developed the concept of Comprehensive National Power (CNP) to get China’s political and military

leadership to focus more clearly on economic and technological performance than on military power alone in its quest for Great

Power status.8¶ While China’s impressive economic performance and the consequent rise in China’s global profile has forced

strategic analysts to acknowledge this link, the recovery of the US economy in the 1990s had reduced the appeal of the Kennedy

thesis in Washington DC. We must expect a revival of interest in Kennedy’s arguments in the current context.¶ A historian of power

who took Kennedy seriously, Niall Ferguson, has helped keep the focus on the geopolitical implications of economic performance. In

his masterly survey of the role of finance in the projection of state power, Ferguson defines the ‘square of power’ as the tax

bureaucracy, the parliament, the national debt and the central bank. These four institutions of ‘fiscal empowerment’ of the state

enable nations to project power by mobilizing and deploying financial resources to that end.9 ¶ Ferguson shows how vital

sound economic management is to strategic policy and national power. More recently, Ferguson has been

drawing a parallel between the role of debt and financial crises in the decline of the Ottoman and Soviet empires and that of the

United States of America. In an early comment on the present financial crisis, Ferguson wrote:¶ ‘We are indeed living through a

global shift in the balance of power very similar to that which occurred in the 1870s. This is the story of how an over-extended

empire sought to cope with an external debt crisis by selling off revenue streams to foreign investors. The empire that suffered these

setbacks in the 1870s was the Ottoman empire. Today it is the US… It remains to be seen how quickly today’s

financial shift will be followed by a comparable geopolitical shift in favour of the new export and

energy empires of the east. Suffice to say that the historical analogy does not bode well for

America’s quasi-imperial network of bases and allies across the Middle East and Asia. Debtor

empires sooner or later have to do more than just sell shares to satisfy their creditors. …as in the 1870s the balance of financial

power is shifting. Then, the move was from the ancient Oriental empires (not only the Ottoman but also the Persian and Chinese) to

Western Europe. Today the shift is from the US – and other western financial centres – to the autocracies of the Middle East and

East Asia.’10 ¶ An economic or financial crisis may not trigger the decline of an empire. It can certainly speed up a process already

underway. In the case of the Soviet Union the financial crunch caused by the Afghan war came on top of years of economic underperformance and the loss of political legitimacy of the Soviet state. In a democratic society like the United States the political

legitimacy of the state is constantly renewed through periodic elections. Thus, the election of Barack Obama may serve to renew the

legitimacy of the state and by doing so enable the state to undertake measures that restore health to the economy. This the Soviet

state was unable to do under Gorbachev even though he repudiated the Brezhnev legacy and distanced himself from it.¶ Hence, one

must not become an economic determinist and historic parallels need not always be relevant. Politics can intervene and offer

solutions. Political economy and politics, in the form of Keynesian economics and the ‘New Deal’, did intervene to

influence the geopolitical implications of the Great Depression. Whether they will do so once

again in today’s America remains to be seen.

Mexican economic decline spills over to the US and collapses antinarcotics effects and stability

Council on Hemisphere Affairs 9 (independent research and information organization established to promote

the common interests of the hemisphere, raise the visibility of regional affairs and increase the importance of the inter-American

relationship, as well as encourage the formulation of rational and constructive U.S. policies towards Latin America) “As Mexico’s

Problems Mount: The Impact of the Economic Recession on Migration Patterns from Mexico: A COHA Analysis” March 5, 2009

<http://www.commondreams.org/newswire/2009/03/05-3>

Implications for Mexico and the United States Evidently, through migration, remittances, and NAFTA-induced trade integration,

the Mexican economy has become increasingly dependent upon that of the United States, making the

former extremely vulnerable to the effects of the current financial crisis. The decrease in migration flows and remittances is thus

implicit in the current debate about Mexico's descent into being a "failed state." A Mexican economic collapse, spurred by

would weaken the state's

capacity to finance counter-narcotics activity, increase pay-rolls to prevent political and military officials from

corruption related to drug trafficking, recuperate the depressed economy, and keep their best and brightest at

home. These series of developments would have a negative consequence for the United States

economy and the Obama administration, as well. Mexico is the United States' third largest export market, and

the cheap labor that Mexican immigrants provide, although not nearly as coveted given the current recession, is

an important part of the national economy. Additionally, Mexico's potential economic and military collapse

deserves to be viewed as a national security threat to the U.S., given the spread of drug-related violence to

a decrease in the migrants and remittances upon which the country' s economy is reliant,

border states such as Arizona, where authorities blame a rise in home invasions and kidnappings on organized crime from south of

the border.

That turns Mexico into a failed state

Brad MacDonald, 1-29-2009; columnist for The Trumpet; Mexico: Bordering on Collapse;

http://www.thetrumpet.com/?q=5887.4259.0.0

First,

Mexico’s economy, which is tied closely to the American economy, is being hit hard by the global

economic crisis. Economic growth is slowing, the peso appears unstable and has devalued by about 20

percent since the beginning of 2008, less cash is flowing from America into Mexico, and, perhaps most dangerously, unemployment

is rising, which ultimately leads to a disgruntled, restless society. In addition to those economic woes, oil revenues, which comprise

40 percent of the federal budget, will soon begin to plummet. In short, the Mexican economy verges on collapse! Second,

Mexico’s political landscape is shifting and steadily growing more unstable. “Mexico has seen a massive spike in crime and drugrelated violence coincide with the first eight years of rule by Calderón’s National Action Party (pan),” Stratfor reported. “To make

things worse, the global financial crisis has begun to impact Mexico … and the impact on employment could be devastating. Given

the confluence of events, it is almost guaranteed that Calderón and the pan will suffer political losses going forward, weakening the

party’s ability to move forward with decisive action” (Dec. 9, 2008). Stratfor concluded its analysis with a warning similar to the one

issued by the American government: Mexico’s most critical challenge is the convergence of events it now faces. The

downturn

in the economy, the political dynamics or the deteriorating security situation, each on its own,

might not pose an insurmountable problem for Mexico. What could prove insurmountable is the

confluence of all three, which now appears to be in the making. Perhaps it’s difficult for Americans to replace

the images of Mexico’s white, sandy beaches, deluxe hotels and bright, cheap tropical fruit with images of a failed state. Try this.

Think about Pakistan. Nestled between the Middle East and Asia, it can be much easier to consider Pakistan in those terms.

Its economy is tanking and unemployment is growing. Infrastructure

is crumbling, and social unrest and

dissatisfaction are seething. Handicapped by political gridlock, Pakistan’s central government is

weak and ineffective. It has lost control over large swaths of territory, and is now unable to make

major decisions, enact legislation and implement a united foreign policy. In short, the nation cannot set

itself back on the path to success. Worse still, Pakistan’s government has been deeply infiltrated by radical Islamists who wield

significant influence over the nation’s military and intelligence departments. Entire regions of Pakistan are now controlled by radical

Islamic groups, which, blinded by their religious aspirations, have little desire to ensure people are fed, create jobs, stimulate an

economy or guarantee social stability, thereby exacerbating the nation’s spiral toward disaster. Now take it one step further.

Pakistan’s internal chaos makes it a national security threat to adjacent states, and even the

world. The terrorist attacks last November in Mumbai, India, you might remember, were traced back to radical Islamists

operating out of Pakistan. In Pakistan, chaos reigns supreme. Finally, imagine if Pakistan was situated

on America’s southern border!

This would destabilize Latin America and cause regional war

Tobin 2006 (Rick, TAO Emergency Management Consulting, “THE COMING CIVIL WAR IN

MEXICO”, 4-29, http://www.ricktobin.com/papers/thecomingcivilwarinmexico.pdf)

In a fast moving State of War in Mexico, the U.S. government would have to declare neutrality and seal its

borders immediately. Within days, the President and Congress would take actions that would be condemned by every country in the

world…and of course the U.N. The map on the next page shows the 100-mile buffer zone that would be taken by force by the U.S. military. This would become the new no-man’s

zone. Military exchanges would occur between the U.S. and Mexico along the new boundary. After a number of air losses and ground losses, the Mexican government would

withdraw and accept the boundary. Every Mexican citizen that remained there would have to carry dual identification at all times. The entire area would be sealed so that traffic

of any kind would be highly restricted and monitored. Martial law would be in place with open “shoot-to-kill” orders. At the “old” border, anyone attempting to cross illegally

would be shot. The border would be surveilled by the same flying drones now used over Afghanistan and Iraq. They would also be armed with Hellfire missiles. In addition,

particularly well-known pathways would be mined and re-mined weekly. In the United States the order would be given to round up all undocumented aliens with Mexican

heritage for immediate deportation to the “no-man’s zone.” Those who resisted would be arrested and held in internment camps at abandoned military bases until they could be

processed (under the Rex 84 Program and supporting Executive Orders such as 11051 and 11002, etc). A permanent marking would be placed on the hands of those so interned

(or a RFID chip). If they were found back in the United States they would face felony imprisonment. An underground railroad would develop to move illegal Mexican aliens to

the U.S. would take the oil fields and nationalize

them for the U.S. Again, this would raise the threat of intense hostilities, leading to new alliance in the

Western Hemisphere. Canada would become a neutral party and no longer support NAFTA or trade with

the U.S., including cutting water, electrical and petroleum exports. The Latin American countries might

unite as a block and form a powerful alliance with a strong socialist, anti- American focus, led by the triad

of Mexico, Cuba, and Venezuela. Later, Brazil would join to make the fourth major power. The United States federal

Canada. The U.S. would then demand that if Pemex products were interrupted for even a day,

government would now face the existence of threats that included unfriendly border neighbors to the north and south, a declining world position, and internal strife with its own

citizens, especially those with Mexican heritage or Latin America links.

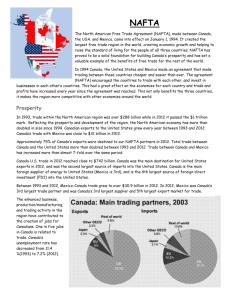

Independently, ensuring NAFTA’s symbolic success is key to

American global leadership

Agrasoy, 4 - Bachelor of Arts degree in International Trade and a Bachelor of Science degree in Management Information

Systems from Bogazici University in Istanbul, Turkey, where he specialized in international trade and investment, Master of Arts in

Economics from McGill University in Montreal, ROI Research Analyst Director of Operations, Public Sector, overseeing worldwide

public sector operations at ROI (Emre, “NAFTA: as a Means of an U.S. Hegemony Creation in the Region?” May 23 2004,

http://emreagrasoy.awardspace.com/nafta.pdf)

Although U.S.

seemed the sole dominant power after the collapse of Soviet Union, U.S. envisaged that some

areas of influence 2 would have a huge potential to challenge its politic and economic hegemony

in the world, which is leading towards a tripolar economic structure. 3 Thus, “Fortress North America” must be erected to challenge

“Fortress Europe”. Both must be prepared to repel onslaught of Asian products. 4 At that time the North American Free Trade

Agreement (NAFTA) came into effect with the initiatives of U.S. The NAFTA includes Canada, the United States,

and Mexico, with a total (as of 2000) combined population of 410 million inhabitants, and combined GDP of over $11 billion U.S. 5

It created the world’s largest regional freetrade zone, directly challenging the growing

primacy of the European Community and the Japan-East Asia bloc 6 and aiming to maintain

its superpower position. In contrast to the EU, the NAFTA represents a less ambitious effort 7 to establish a common

continental market for goods and services, and common protections for private investors and businesses, with little attention or

interest devoted to developing a continental political or institutional dimension. The important structural and institutional

differences among the NAFTA partners are the reasons behind that the NAFTA has limited its scope to the deregulation of trade and

investment flows within the NAFTA zone, rather than attempting a deeper, European-style political and regulatory harmonization.

The model of the world economy assumes cut-throat trade competition between the three regional blocks. To survive in this

competition each block should have a leading nation, which provides the capital and managerial skills, and a group of less developed

nations, which supply the cheap labor and mineral resources takes the role of a regulatory body and dominates the NAFTA

economically and politically. So, U.S. as the dominant nation 8 intended to hook up with Mexico to obtain

low-cost labor and oil. Canada’s role is primarily “an energy and resource hinterland”. 9 For U.S., NAFTA will

mean a chance to regain competitive positions eroded by Japanese and European rivals. 10

For the U.S. the implementation of a North American free trade zone represented an important but hardly epochal

development, one which mostly served to reinforce its already-existing economic and strategic

dominance on the continent and even in the world. Trade patterns within the NAFTA

conform largely to a “hub-and-spoke” structure 11 , with the U.S. located at both the

geographical and the economic center of the continent. 12 The United States adopted economic

regionalism toward the end of the twentieth century. NAFTA of the early 1990s were crafted to apply the liberal

policies and free market principles closer to U.S policies. The United States did not impose

NAFTA on North America but it clearly had an inordinate and even hegemonic influence on North

America’s adherence to the disciplines and principles favored by the United States. 13 Free trade,

reciprocity, national treatment of investment, domestic trade policy, dispute settlement, labor and environment protection, and

liberalization of services as well as agriculture were NAFTA tenets. 14 NAFTA is a U.S.-led RIA, a symbolic and

genuine innovation that more formally organized North America with the United States at its

geo-economic hub. The NAFTA would draw both neighbors more closely into the U.S. sphere of

influence, reducing the perceived geopolitical risk to U.S. interests that had been posed by

occasional outbreaks of nationalist sentiment in Mexico and Canada. 15 Mexico’s place in North America

raises issues about the tradeoffs involved in integrating more closely developed and developing economies. This is what made

NAFTA so consequential for the possibility of linking the global North and the global South in

the

Americas. The NAFTA is contributing to the broad US goal of promoting economic growth,

political stability, and progress toward democracy in Mexico. 16 The NAFTA’s provisions should complement

and augment the extensive economic reforms already under way in Mexico and provide an insurance policy against any

reversion to past protectionist and interventionist policies that impeded US trade with Mexico. 17 As a result, a

prosperous Mexico would become a thriving market for U.S. exports. 18 NAFTA reinforces ongoing Mexican trade and

investment reforms 19 , which along with reforms in Mexican laws relating to intellectual property rights have generated

substantial new opportunities for U.S. firms. The United States has long championed a Pan American

vision of a liberal, democratic, capitalist hemisphere based on precepts long held to be

sacrosanct among its public 20 and private leaders. Integrating North and South America or at least

bringing them closer together meant allowing for a substantial role in Latin America for U.S.

power and policy. For the United States, organizing a RIA in North America was a strategy more than an ultimate goal.

Befitting its global status, it had a more ambitious agenda for the world economy beyond its own neighborhood. The United States

pursued two tracks in economic regionalism during the waning years of the twentieth century. One was a North American or

continental track. The second track is Pan American. As a unipolar region, North America had unique

advantages; its hegemonic structure made NAFTA an obvious first step for a free trade area. After

NAFTA, trade dependence and other economic relations are greater than before. The steep concessions that Mexico had to make to

gain admittance to this exclusive North American club were palatable to most Mexicans because the two highly interdependent

economies made structure and policy more congruent. 21 The same is not true of the hemisphere in general. 22 During the mid1990s, the United States entertained the view that NAFTA would be the vehicle for the more ambitious project

of building a RIA for the entire hemisphere. It did not quite work out that way. The idea was to widen or broaden

NAFTA by including new members through the accession clause 23 , but NAFTA did not expand. 24 NAFTA was bereft of support as

the vehicle for creating a FTAA 25 . While structural power is important, so too are two other elements of power: the soft power of

economic liberalism and the use of leadership to affect outcomes. U.S. influence depends partially upon an inter-

American convergence around liberal market ideas and trade policy preferences of the United

States. In other words, if Latin American leaders agree with the United States on the

principles and disciplines it advocates in the FTAA process, U.S. dominance is more

assured. The ultimate goal of U.S. is that the nations will converge around political and

economic liberalization. 26 Especially, in the wake of the terrorist acts of September 11, Iraq War and thus increasing

sociotropic threat 27 and patriotism in different countries, the American

foreign policy in NAFTA become more

important in preserving the support of its neighbors and indirectly of the entire world. U.S.

should change the context of NAFTA from mere a free trade area to a union with a Social Charter characteristic. NAFTA should

better use a regime of fair and peaceful competition, through positive integration and institution building strategies. 28 U.S should

emphasize the social quality aspects of NAFTA and help its NAFTA partners improve their economic as well as socio-

political conditions to gain new allies at the same level in the world arena. The improvement of the rule of

law and democracy should not be left in the hands of U.S., but they should be realized by institutionalization 29 taking the E.U as a

model. 30 Taking all these arguments into consideration, the NAFTA’ s success will not only shape North America’s

faith, but also the

future of the U.S influence on world politics as a superpower. NAFTA is

used by U.S. to some extent as a model 31 and a vehicle to maintain its superpower role

throughout the world. U.S. is given the opportunity to compete with the European Union and China, the most potential

emerging power, by exploiting Mexico’s cheap labor force and Canada’s natural resources. The strategic policies and actions will

determine its NAFTA partners’ position against U.S. They will either lead to stronger strategic alliances between these

countries, even including other Latin American counties, which will

enhance the U.S. dominance or lead to an

future will play an

important role; the success can help U.S. sustain its superpower role, but failure, such faced by U.S.

in the FTAA, can lead to a loss of this power, thus being a follower of E.U. in the world economy and politics it

opposition in Mexico and Canada, which could mean the loss of its superpower role. NAFTA’s

would be sufficient for U.S.

Hegemony and institutional leadership prevents extinction

Barnett 2011 – Former Senior Strategic Researcher and Professor in the Warfare Analysis & Research Department, Center

for Naval Warfare Studies, U.S. Naval War College, worked as the Assistant for Strategic Futures in the Office of Force

Transformation in the DOD (3/7, Thomas, World Politics Review, “The New Rules: Leadership Fatigue Puts U.S., and Globalization,

at Crossroads”, http://www.worldpoliticsreview.com/articles/8099/the-new-rules-leadership-fatigue-puts-u-s-and-globalizationat-crossroads, credit to LDK)

Events in Libya are a further reminder for Americans that we stand at a crossroads in our continuing evolution as

the world's sole full-service superpower. Unfortunately, we are increasingly seeking change without cost, and shirking from

risk because we are tired of the responsibility. We don't know who we are anymore, and our president is a big part of that problem.

Instead of leading us, he explains to us. Barack Obama would have us believe that he is practicing strategic patience. But many

experts and ordinary citizens alike have concluded that he is actually beset by strategic incoherence -- in effect, a man overmatched

by the job. It is worth first examining the larger picture: We live in a time of arguably the greatest structural change

in the global order yet endured, with this historical moment's most amazing feature being its relative and absolute lack

of mass violence. That is something to consider when Americans contemplate military intervention in Libya, because if we

do take the step to prevent larger-scale killing by engaging in some killing of our own, we will not be

adding to some fantastically imagined global death count stemming from the ongoing "megalomania"

and "evil" of American "empire." We'll be engaging in the same sort of system-administering activity that has marked our

stunningly successful stewardship of global order since World War II. Let me be more blunt: As the guardian of

globalization, the U.S. military has been the greatest force for peace the world has ever

known. Had America been removed from the global dynamics that governed the 20th century, the mass murder never

would have ended. Indeed, it's entirely conceivable there would now be no identifiable human civilization left,

once nuclear weapons entered the killing equation. But the world did not keep sliding down that path of

perpetual war. Instead, America stepped up and changed everything by ushering in our now-perpetual greatpower peace. We introduced the international liberal trade order known as globalization and played loyal

Leviathan over its spread. What resulted was the collapse of empires, an explosion of democracy, the persistent

spread of human rights, the liberation of women, the doubling of life expectancy, a roughly 10fold increase in adjusted global GDP and a profound and persistent reduction in battle deaths from statebased conflicts.

Success leads to global modeling of NAFTA

Pastor, 04

– Robert A., Robert A., Professor at and Founding Director of the Center for North American Studies at American University

(“North America's Second Decade,” Foreign Affairs, Jan/Feb 2004)

North America's second decade poses a distinct challenge for each government. First, the new Canadian prime minister, Paul Martin, should take the

lead in replacing the dual bilateralism of the past with rule-based North American institutions. If he leads, Mexico will support him, and the United

States will soon follow. Mexico, for its part, should demonstrate how it would use a North American Investment Fund to double its growth rate and

begin closing the development gap. Finally,

the United States should redefine its leadership in the twenty-first

century to inspire support rather than resentment and fear. If Washington can adjust its

interests to align with those of its neighbors, the world will look to the United States in a new way.

These three challenges constitute an agenda of great consequence for North America in its second decade. Success will not only

energize the continent; it will provide a model for other regions around the world.

That solves war – ensures interdependence

Griswold, 07 (Daniel T. -the associate director of the Center for Trade Policy Studies at the

Cato Institute in Washington, 12/31/98, “Trade, Democracy and Peace: The Virtuous Cycle,”

http://www.cato.org/publications/speeches/trade-democracy-peace-virtuous-cycle

First, as I argued a moment ago, trade and globalization have reinforced the trend toward

democracy, and democracies tend not to pick fights with each other. Thanks in part to

globalization, almost two thirds of the world’s countries today are democracies—a record high.

Some studies have cast doubt on the idea that democracies are less likely to fight wars. While it’s

true that democracies rarely if ever war with each other, it is not such a rare occurrence for

democracies to engage in wars with non-democracies. We can still hope that has more countries

turn to democracy, there will be fewer provocations for war by non-democracies.¶ A second and

even more potent way that trade has promoted peace is by promoting more economic

integration. As national economies become more intertwined with each other, those nations

have more to lose should war break out. War in a globalized world not only means human

casualties and bigger government, but also ruptured trade and investment ties that impose

lasting damage on the economy. In short, globalization has dramatically raised the economic

cost of war.¶ The 2005 Economic Freedom of the World Report contains an insightful chapter on

“Economic Freedom and Peace” by Dr. Erik Gartzke, a professor of political science at Columbia

University. Dr. Gartzke compares the propensity of countries to engage in wars and their level of

economic freedom and concludes that economic freedom, including the freedom to trade,

significantly decreases the probability that a country will experience a military dispute with

another country. Through econometric analysis, he found that, “Making economies freer

translates into making countries more peaceful. At the extremes, the least free states are about

14 times as conflict prone as the most free.”¶ By the way, Dr. Gartzke’s analysis found that

economic freedom was a far more important variable in determining a countries propensity to

go to war than democracy.¶ A third reason why free trade promotes peace is because it allows

nations to acquire wealth through production and exchange rather than conquest of territory

and resources. As economies develop, wealth is increasingly measured in terms of intellectual

property, financial assets, and human capital. Such assets cannot be easily seized by armies. In

contrast, hard assets such as minerals and farmland are becoming relatively less important in a

high-tech, service economy. If people need resources outside their national borders, say oil or

timber or farm products, they can acquire them peacefully by trading away what they can

produce best at home. In short, globalization and the development it has spurred have rendered

the spoils of war less valuable.¶ Of course, free trade and globalization do not guarantee peace.

Hot-blooded nationalism and ideological fervor can overwhelm cold economic calculations. Any

relationship involving human beings will be messy and non-linier. There will always be

exceptions and outliers in such complex relationships involving economies and governments.

But deep trade and investment ties among nations make war less attractive.

Maximizing the legitimacy of arbitration procedures would shore up

NAFTA’s symbolic credibility

Cordero-Moss 2013 – member of the Commission on Arbitration of the International

Chamber of Commerce; Senior Research Fellow and Honorary Lecturer on International Business Law at

the Centre for Energy, Petroleum, and Mineral Law and Policy; Ph.D in Law at Russian Academy of

Sciences (Giuditta, “INTERNATIONAL COMMERCIAL ARBITRATION: DIFFERENT FORMS AND

THEIR FEATURES” 2013 //SRM)

The identity, or rather renown of the relevant institution is perceived by many parties both as a

security for orderly proceedings and as a ‘brand’ in support of award enforcement. Instead of parties

and arbitrators having to spend time on reinventing the wheel, institutional arbitration offers procedural rules

that have been proved to work in practice and that exist conveniently at the outset of the

proceedings. Further, it may well be true that a recognized institutional brand carried by an award can make it

easier at times to enforce the award in local courts, the brand serving as a form of guarantee of

the legitimacy of the proceedings. Institutional quality control of award may further help to

ensure effective award enforcement and in the 2010 Study, scrutiny of the award by an

institution was mentioned by 33% of the participants as one of the factors that favourably

influenced their choice of institution. Further, institutions make decisions in support of arbitration based on

their experience. They make initial decisions whether the institution (or any arbital tribunal that would be appointed by it) has or

manifestly lacks jurisdiction to proceed with the case. They appoint or replace arbitrators, in which task they are

assisted by their knowledge of the pool of available arbitrators, and of the arbitrators’ expertise

and track record of pervious case handling (under the auspices of that institution). As the specialization of

arbitration increases, so does the need for assistance in finding the right arbitrator for the

dispute. Institutions also perform a gap-filling function where the arbitration’s agreement is silent (e.g. fixing the language or the

seat of the arbitration). They handle the financial aspects of the arbitration, fixing advances on costs and confirming fees and

expenses payable to arbitrators – costs being determined according to established schedules and thus predictable to the parties.

Institutions also manage time limits and other administrative aspects of the case and their staff are available for consultation on

various questions that may arise during the proceedings.

2ac NAFTA Uniqueness

Economic disintegration is hollowing NAFTA now

Peters, 09 – Enrique Dussel, professor at the Graduate School of Economics, Universidad Nacional Autónoma de México (“Manufacturing

Competitiveness: Toward a Regional Development Agenda,” The Future of North American Trade Policy: Lessons from NAFTA, Pardee Center,

November 2009, http://www.ase.tufts.edu/gdae/Pubs/rp/PardeeNAFTACh2PetersManufNov09.pdf)

One of the Mexican government’s goals in signing NAFTA was to expand its manufacturing sector by stimulating exports. In the early years following

implementation, Mexico succeeded in attracting foreign investment and increasing manufacturing exports, with notable expansion in automotive,

the three NAFTA countries

together have been losing their ability to compete in manufacturing in the global market. This

suggests the need for a more proactive and long-term regional response. Even before the recent global financial and

economic crisis1, the manufacturing sectors in the NAFTA-region were under similarly extreme

pressures. The share of manufacturing in terms of GDP and employment has been falling in the three NAFTA countries, particularly since 2000

(See Figure 1). Contrary to the period 1994–2000, which saw increasing regional integration in a

highly competitive global market, from 2000–2009 (March) the NAFTA region together lost 6.3

million jobs in manufacturing, or 27 percent of total employment in the sector.2 This suggests that

in general, and in particular since 2000, the process of regional integration has deteriorated; in

fact, an increasing process of “disintegration” has been taking place since then. These

tendencies have only deepened since the second half of 2008 with the global crisis. In recent years, the original

NAFTA integration agenda among the NAFTA countries has given way to one focused on security topics, with

little sustained attention to socioeconomic, infrastructure, and other regional development issues.

apparel, and electronics, among others. Yet this apparent success masks fundamental weaknesses, as

Mexican Economy – Uniqueness

The Mexican economy is improving, but signs are grim unless

something is done

Hernandez May 03, 2013 *Journalist at LA times citing various government agencies, blogger, Emerging Journalist of the

year in 2006, Specializing on Mexico City, lived and worked there for many years¶ (Daniel, “Small growth for Mexico's economy in

first quarter of 2013,” http://articles.latimes.com/2013/may/03/world/la-fg-wn-mexico-first-quarter-economy-201320130502)//MW

MEXICO CITY - Mexico's

economy grew only 1% in real terms in the first quarter of 2013, the Finance

project Mexico will grow by

3.5% for the year overall.¶ The figure represents a "deceleration," economists at the Finance Ministry said in

a news conference. They laid the blame mostly on external factors, such as growth rates in the United

States.¶ ¶ The news of a slowdown came as Mexican President Enrique Peña Nieto's administration hosts President Obama for the

Ministry said Thursday, a stark result for government economists who continue to

first time Thursday and Friday, with the intertwined national economies high on the binational agenda. The two leaders held a news

conference Thursday at the National Palace in the heart of the historic center in Mexico City. On Friday, Obama will deliver a speech

to students at the capital's Anthropology Museum.¶ Other financial signals looked grim for Mexico as Obama arrived here,

contrasting with an aggressive media campaign meant to boost global confidence in Mexico's economy.

Retail sales have dropped and industrial output has slowed in the first months of 2013, financial news reports said.¶ In

another indicator that hits at the wallets of Mexico's workers and consumers, the inflation rate hit 4.25% in March, an almost 68%

increase over December 2012, Mexican economists said.

Mexican Economy – Ad Hoc Bad

Mexico is being economically harmed by each new dispute under the

current arbitration system

Raymond 2013 – Federal court correspondent and legal journalist at Thomas Reuters; Senior

Reporter at ALM Media; bachelor’s degree in journalism from University of Alaska Fairbanks

(Nate, “UPDATE 1 – CARGILL SETTLES NAFTA DISPUTE WITIH MEXICO” Feb 21, 2013

7:50pmEST http://www.reuters.com/article/2013/02/22/cargill-mexicoidUSL1N0BM08S20130222//SRM)

Cargill Inc has reached a settlement with Mexico in a dispute that resulted in a $77

million arbitration award for the U.S. agribusiness company, according to court

documents filed on Thursday. A North American Free Trade Agreement arbitration tribunal

awarded Cargill the sum in 2009 over trade barriers the company said Mexico

erected against high-fructose corn syrup from 2002 to 2007.The terms of the settlement,

reached on Feb. 5, were not disclosed. The settlement was detailed in papers filed in U.S.

District Court in New York, where Cargill had filed a lawsuit to enforce the arbitration award. A

spokeswoman for Cargill welcomed the resolution of the matter."We are dedicated to

compliance with NAFTA and believe NAFTA is a positive force for trade relations among the

United States, Canada and Mexico," she said, adding that the company will continue to invest in

its Mexican operations.A representative for Mexico's Economy Ministry did not respond to a

request for comment.Cargill filed its claims against Mexico in 2005 under Chapter 11 of

NAFTA, which allows companies to sue countries that are members of the treaty for

actions that affect their investments.In 2009, the tribunal awarded Cargill $77.3 million plus

interest and costs. In May 2012, the Supreme Court of Canada, the country where the original

NAFTA panel was held, let the award stand.Cargill in November filed the federal lawsuit in

New York to enforce the award. It said that, with interest, the award was now worth

$94.6 million.The case is Cargill, Incorporated v. United Mexican States, U.S. District Court,

Southern District of New York, 12-08225.

Mexico will continue to be negatively affected by investment disputes

Gottwald 2007 – American University International Law Review, Volume 22/Issue2/Article 3(Eric,

“LEVELING THE PLAYING FIELD: IS IT TIME FOR A LLEGAL ASSISTANCE CENTER FOR

DVELOPING NATIONS IN INVESTMENT TREATY ARBITRATION?”

As net importers of global capital, developing nations have

borne the brunt of the burden of defending the growing

number of investment treaty claims. According to U. N.

Conference on Trade and Development ("UNCTAD") data,

nearly two-thirds of the 219 known investment treaty

claims have been filed against developing nation

governments.61 Thirty-seven different developing nations are

known to have been defendants in investment treaty arbitration,

with several facing multiple claims.62 Argentina has faced an

incredible forty- two claims, with Mexico a distant

second at seventeen.63 Developing nations' experience with

investment treaty arbitration is almost exclusively as defendants:

there are only eleven known instances where developing nation

firms have filed investment treaty claims. 64 Due to the

confidentiality surrounding non-ICSID arbitrations, the

actual number of claims against developing nations is

likely to be significantly higher.65

Other Latin American countries are trending toward regional

arbitration courts to combat costly unfair procedures

Martinez 2012 – Vice president of the International Centre for Dispute Resolution (Luis M.,”LATIN

AMERICA AND THE ARBITRATION BACKLACK” 2012

http://www.adr.org/aaa/ShowPDF?doc=ADRSTG_022214 //SRM)

Increasingly, Latin American states have been taking the position that

their national courts should reassert their authority over investment

treaty arbitration.6 The return of the Calvo7 doctrine is being discussed in the

context of investment treaty arbitrations where there are trends towards greater

sovereign policy being reserved by the states in the international investment

regime. One commentator noted with concern a complete retreat from

investor-state arbitration, citing as one example the recent US–

Australia BIT which foregoes investor-state arbitration in favour of

local courts.8 Of course, states determine what dispute resolution mechanisms

they will consent to and a number of states are not party to the ICSID

Convention, including Mexico and Brazil. While Mexico is a party to the NAFTA

agreement, which does provide for international arbitration of NAFTA-related

disputes, Brazil has passed its PPP (public-private partnership) law allowing for

arbitration between state-owned entities and private individuals provided they

take place in Brazil and are conducted in Portuguese.9 The majority of BITs also

contain the possibility of ad hoc arbitration pursuant to the UNCITRAL

Arbitration Rules as an alternative or if the ICSID option is in question.

Moreover, states as well as state-related parties may opt to select a dispute

resolution mechanism that calls for institutional arbitration by the incorporation

of a specific arbitration clause in their contract with investors which references

the Rules or, although less likely, by executing a post dispute submission

agreement providing for institutional arbitration.10

Trade Key to Mexican Economy

Trade is key to Mexico economy- most of trade is from NAFTA

Global Tender, ( “Economy of Mexico” http://www.globaltenders.com/economy-mexico.htm)

//ST

The economy contains a mixture of modern and outmoded industry and agriculture, both of

which are increasingly dominated by the private sector. Recent administrations have expanded

competition in ports, railroads, telecommunications, electricity generation, natural gas

distribution and airports, with the aim of upgrading infrastructure. As an export-oriented

economy, more than 90% of Mexican trade is under free trade agreements (FTAs)

with more than 40 countries, including the European Union, Japan, Israel, and much of Central

and South America. The most influential FTA is the North American Free Trade

Agreement (NAFTA), which came into effect in 1994, and was signed in 1992 by the

governments of the United States, Canada and Mexico. In 2006, trade with Mexico's two

northern partners accounted for almost 90% of its exports and 55% of its imports.

Recently, the Congress of the Union approved important tax, pension and judicial reforms, and

reform to the oil industry is currently being debated. According to the Forbes Global 2000 list of

the world's largest companies in 2008, Mexico had 16 companies in the list. Mexico is an export

oriented economy. It is an important trade power as measured by the value of merchandise

traded, and the country with the greatest number of free trade agreements. In 2005, Mexico was

the world's fifteenth largest merchandise exporter and twelfth largest merchandise importer

with a 12% annual percentage increase in overall trade. In fact, from 1991 to 2005 Mexican trade

increased fivefold. Mexico is the biggest exporter and importer in Latin America; in 2005,

Mexico alone exported US $213.7 billion, roughly equivalent to the sum of the exports of Brazil,

Argentina, Venezuela, Uruguay, and Paraguay. However, Mexican trade is fully integrated with

that of its North American partners: close to 90% of Mexican exports and 50% of its imports are

traded with the United States and Canada. Nonetheless, NAFTA has not produced trade

diversion. While trade with the United States increased 183% from 1993–2002, and that with

Canada 165%, other trade agreements have shown even more impressive results: trade with

Chile increased 285%, with Costa Rica 528% and Honduras 420%. Trade with the European

Union increased 105% over the same time period. The North American Trade Agreement

(NAFTA) is by far the most important Trade Agreement Mexico has signed both in

the magnitude of reciprocal trade with its partners as well as in its scope. Unlike the

rest of the Free Trade Agreements that Mexico has signed, NAFTA is more comprehensive in its

scope and was complemented by the North American Agreement for Environmental

Cooperation (NAAEC) and the North American Agreement on Labor Cooperation (NAALC).

Yes Mexican NAFTA Withdrawal

Brazil quit NAFTA-like trade agreements because of similar

investment arbitration issues; this could inspire Mexico to leave

NAFTA if the U.S. doesn’t initiate a plan to fix them

Whitsitt 2008 – journalist for Investment Treaty News, law degree from NYU, assistant professor of

International Trade Law and International Investment Law at University of Calgary Law School

(Elizabeth, Damon Vis-Dumbar “INVESTMENT ARBITRATION IN BRAZIL: YES OR NO?” 30 November

2008 http://www.iisd.org/itn/2008/11/30/investment-arbitration-in-brazil-yes-or-no/ //SRM)

As of January 2006, Brazil had realized approximately US$ 88 billion in sales

revenue and some US$ 18 billion in debt transfer as a result of its privatization

program. Foreign investment accounted for approximately 48% of that total. Despite

the importance of foreign investment to its economy and unlike all other South American states,

Brazil is not a party to any bilateral investment treaties (BITs) and has not ratified the

ICSID Convention. One of the reasons for Brazil’s apparent reluctance to bind itself

to such agreements is legal uncertainty. Specifically, there is controversy in Brazil

with respect to whether ratification of such agreements is prohibited under Brazilian

law on grounds that it impedes the sovereign right of the state. However, others note that

Brazil may lawfully, and in fact has previously consented to binding foreign

arbitration by routinely entering into contracts that provide for such dispute resolution

mechanisms. Meanwhile, pressure to ratify BITs builds from Brazilian investors, who have

become increasingly internationalized. Indeed, in 2006, Brazilian companies invested more

overseas (US$28 billion) than the country received in foreign investment. While Brazil’s

outward foreign investment flows have since dipped, according to the United Nations

Conference on Trade and Sustainable Development, Brazil remains one of Latin

America’s leading exporters of capital. Not surprisingly, Brazilian multinationals are

asking for BITs and the protection they promise. ITN has interviewed three lawyers to seek their

views on whether Brazil should begin ratifying bilateral investment treaties, and if so, why.

Nathalie Bernasconi Osterwalder is the Managing Attorney at the Centre for International

Environmental Law. Todd Weiler, is a professor, arbitrator, legal counsel and consultant in

international economic law. Pedro Alberto Costa Braga de Oliveira is a Brazilian lawyer, and

currently general counsel of Enel Brasil Participações, an indirect subsidiary company of Enel

S.p.A.

Mexicans don’t like NAFTA—they want revisions

Faux o3

[Jeff Faux. Founder of the economic policy institute. How NAFTA failed Mexico. June 16 2003.

http://prospect.org/article/how-nafta-failed-mexico. //SRSL]

During the 1993 battle over the North American Free Trade Agreement, the proposal's promoters' most politically effective

argument was that NAFTA would keep Mexicans out of the United States. As political writer Elizabeth Drew later observed, "Antiimmigration was a sub-theme used, usually sotto voce, by the treaty's supporters." The voce was not always sotto. "We don't want a

huge flow of illegal immigrants into the United States from Mexico," said former President Gerald Ford, speaking at one of thenPresident Bill Clinton's pro-NAFTA rallies. "If you defeat NAFTA, you have to share the responsibility for increased immigration into

the United States, where they want jobs that are presently being held by Americans." Leaving aside the xenophobia,

Ford's argument made economic sense: If NAFTA were to create more jobs in Mexico, fewer

Mexican workers would leave. When people can earn a decent living in their own country, they

would generally rather stay put. Thus although workers in the poorer European countries can get jobs anywhere in the

common market, few have moved across national borders because jobs in their own countries are expanding. Growth in the

European Union periphery was largely stimulated by so-called cohesion funds, provided by richer nations for public investment.

The program was so successful that, after centuries of exporting people to the rest of the world, Ireland in 1996 became a net

importer of migrants. NAFTA proponents, on the other hand, claimed that merely opening Mexico to free trade and unregulated

foreign investment would produce the job growth and rising incomes needed to create a stay-at-home middle class. It was the

capstone on an effort begun in the early 1980s by a group of U.S.-educated economists and businesspeople who took over the ruling

Partido Revolucionario Institucional (PRI) in order to build a privatized, deregulated and globalized Mexican economy. Among their

chief objectives was tearing up the old corporatist social contract in which the benefits of growth were shared with workers, farmers

and small-business people through an elaborate set of institutions connected to the PRI. NAFTA provided no social

contract. It offered neither aid for Mexico nor labor, health or environmental standards. The

agreement protected corporate investors; everyone else was on his or her own. Indeed, NAFTA

is the nation-building template imposed on developing countries by recent corporate-dominated

U.S. administrations and their client international finance agencies. It is the model for the

proposed Free Trade Agreement of the Americas, as well as for the Bush administration's

development plans for Iraq. Americans' understanding of NAFTA's impact on the Mexican

people is obscured in part by the gap between what Mexican elites tell U.S. elites and what

Mexicans tell one another. Last December former Mexican President Carlos Salinas, who

negotiated NAFTA, told a Washington conference of applauding corporate lobbyists,

government officials and free-market think tankers that NAFTA was a great success. "The level

of trade and type of products that cross the borders," he said, "silenced even the most ardent

critics." The next day, in Mexico City, a large group of very ardent Mexican farmers

broke down the door of the lower house of the Mexican Congress to denounce

NAFTA and demand that it be renegotiated . Similar demonstrations -- joined by

teachers, utility workers and others -- have erupted throughout the country, closing bridges and

highways and taking over government offices. Polls show that most Mexicans think

NAFTA was bad for Mexico . Largely because of the agreement, Salinas is the most unpopular ex-president in

modern Mexican history. NAFTA's critics did not doubt that it would stimulate more trade; that was,

after all, its function. Rather, they predicted that any benefits would go largely to the rich while

the middle class and the poor would pay the costs, and that the promised growth would not

materialize. They were right. NAFTA is not the cause of all Mexico's economic troubles, but it

has clearly made them worse. Since NAFTA's inception in 1994 -- indeed, for the 20 years of neoliberal "reform" -- the

Mexican middle class has shrunk and the number of poor has expanded. Economic growth has been below the old corporatist

economy's performance and substantially less than what is needed to generate jobs for Mexico's growing labor force. During his

2000 campaign, Mexican President Vicente Fox promised that under his six-year term the country would grow 7 percent per year.

Two and a half years after his inauguration, growth has averaged less than 1 percent. So the northward migration continues. Between

the U.S. censuses of 1990 and 2000, the number of Mexican-born residents in the United States increased by more than 80 percent.

Border-crossings diminished temporarily after September 11, but they are now as great as ever. Some half-million Mexicans come to

the United States every year; roughly 60 percent of them are undocumented. The massive investments in both border guards and

detection equipment have not diminished the migrant flow; they have just made it more dangerous. In the past five years, more than

1,600 Mexican migrants have died on the journey to the north, including 19 people who were found asphyxiated in a truck near

Houston in May. Still, as a neighbor of one of the 19 who left told The Washington Post, "If you're going to improve your life, you

have to go to the United States." The failure of NAFTA to deliver on its promise of a better life for

Mexicans represents more than just a misplaced faith in free trade.

Behind the laissez-faire rhetoric,

Mexico's neoliberals were pursuing a large-scale program of government social engineering aimed at forcing Mexico's rural

population off the land and into the cities, where it could provide cheap labor for the foreign investment that the new open economy

would attract. Salinas and the PRI reformers did not, of course, announce that they intended to depopulate rural Mexico. The

Mexican government promised that as tariffs on U.S. agriculture products fell, generous financial and technical assistance would

enable small farms to increase their productivity in order to meet the new competition. But, after the treaty was signed, the

reformers pulled the rug out from under the rural peasantry. Funding for farm programs dropped from $2 billion in 1994 to $500

million by 2000. Meanwhile, the U.S. Congress massively increased subsidies for corn, wheat, livestock, dairy products and other

farm products exported to Mexico. American farmers now receive 7.5 to 12 times more in government

help than Mexican farmers do. This "comparative advantage" enabled U.S. agribusiness to blow

thousands of Mexican farmers out of their own markets. But when the displaced campesinos

arrived in nearby cities, few jobs were waiting. NAFTA concentrated growth along Mexico's

northern border, where factories -- called maquiladoras -- processed and assembled goods for

the then-booming U.S. consumer market. Between 1994 and 2000, maquiladora employment doubled while

employment in the rest of the country stagnated. Neoliberalism was supposed to reduce the income gap between Mexico's relatively

rich border states and the poorer ones in the country's middle and south. Supporters claimed that privatizing banks and opening

them to foreign ownership would make more capital available for domestic firms in domestic markets. But -- in the depressingly

familiar pattern of privatization the world over -- the PRI reformers sold off the banks to friends, then bailed out the new owners

when the peso collapsed a year after NAFTA was passed. Made whole with more than $60 billion of the taxpayers' money, these

crony capitalists resold their banks at a handsome markup to foreign investors. For example, an investment group headed by the

well-connected Roberto Hernandez bought Mexico's second-largest commercial bank for $3.2 billion and sold it to CitiGroup for

$12.5 billion. Yet, as 85 percent of the country's banking system was being turned over to foreigners, lending to Mexican business

actually dropped from 10 percent of the country's gross domestic product in 1994 to 0.3 percent in 2000. The global bankers were

more interested in taking deposits and making high-interest-rate consumer loans than in developing Mexico's internal economy.

Meanwhile, booming investment in the exporting sweatshops of the north has created a social and ecological nightmare. Rural

migrants have overwhelmed the already inadequate housing, health and public-safety infrastructures, spreading shantytowns,

pollution and crime. Maquiladora managers often hire large numbers of women, whom they believe are more docile and more

dexterous than men at assembly work. Earnings are typically about $55 a week for 45 hours -- poverty wages in an area where acute

shortages of basic services have raised the cost of living. Families break up as men cross the border in search of jobs, leaving women

vulnerable to the social chaos. An Amnesty International report on the border town of Ciudad Juárez, where hundreds of young

women have been killed, quotes the director of the city's only rape crisis center (annual budget: $4,500): "This city has become a

place to murder and dump women. [Authorities] are not interested in solving these cases because these women are young and poor

and dispensable." As the U.S. economy slowed down after 2000, the number of jobs in the maquiladoras stopped growing.

Moreover, the privileged access that Mexicans thought NAFTA had given them began to erode.

The same global corporate coalition that forced NAFTA through Congress later successfully lobbied for the United States to sponsor

China's full entry into the World Trade Organization (WTO), paving the way for a huge increase in Chinese exports to the United

States. In the last two years, an estimated 200,000 maquiladora jobs have left Mexico for China, where workers can be had for oneeighth the Mexican wage. In a deregulated world, there is always someone who will work for less. Hope that NAFTA would enable

Mexico to export its way to prosperity has largely vanished. In order to relieve the pressures of unemployment, Fox has been

badgering George W. Bush to liberalize migration, create guest-worker programs, and provide Mexican migrants with civil rights

and social benefits. The Mexican president regularly refers to migrants in the United States as "heroes," and their remittances have

become one of the country's most important sources of foreign earnings. The White House has been unresponsive. After Fox -facing a July election with 80 percent of Mexicans opposed to the invasion of Iraq -- declined to join Bush's war coalition,

Washington is even less interested. In time White House pique will fade. But, in any event, Mexico cannot develop

by sending its most ambitious and industrious workers to the United States. It is not the poorest and

least educated that migrate; it is the working-class risk takers -- those who save up the $2,000 to pay a smuggler to take them across

the river and who, once in the United States, sacrifice to send home their exploitation wages. Mexico needs these people. It paid for

the cost of their upbringing and education, in effect subsidizing U.S. consumers of low-wage work. The Mexican government, aided

by some U.S. foundations and nongovernmental organizations, is attempting to channel migrant remittances into quasigovernmental credit unions that would provide capital to businesses and local governments. This may be useful. But migrants send

money home for immediate consumption to maintain the living standards of parents, grandparents and children in a depressed

domestic economy. It is an odd notion of economic development that rests on the meager savings of low-wage Mexican workers in

America while wealthy Mexicans regularly ship their capital to New York, London and Zurich. In fact, for Mexico's oligarchs, the

public focus on the condition of Mexican workers in the United States has the great virtue of diverting political attention from the

condition of Mexican workers in Mexico. Fox has been eloquent on the maltreatment of undocumented migrants at U.S. farms and

factories. Rightly so. But he has been silent about the harsh and brutal conditions suffered by Mexico's own domestic migrants,

including those as young as 11 years old who were found -- after Fox's election -- to be working in his own vegetable packing plant.

As in many developing countries, the largest part of Mexico's economic problem lies not in restricted export markets but in the

stifling maldistribution of wealth and power that restricts internal growth. The gap between Mexico's rich and poor is among the

worst in the Western Hemisphere. The rich hardly pay any taxes. Despite the image of Mexico as a country with a strong state, the

public revenue is 19 percent of GDP, compared with the 30 percent that the presumably more conservative American public sector

takes. Mexico -- even more than did the poorest nations of Western Europe -- needs substantial investment in education, health and

infrastructure to create sufficient jobs for its people. A contribution to that investment by the United States and Canada equivalent

to the EU's cohesion funds would approach $100 billion. The only imaginable scenario for anything near that level would require,

among other things, a dramatic democratic reform of Mexico's corrupt and inefficient public sector. Ironically, hopes for

such a future lie in the political fallout from NAFTA's lack of success. By 2000, Mexican voters

were so disgusted with the failed promises of PRI neoliberals that they ousted the party after 71

years of continuous rule. Whatever else Fox may accomplish, his breaking of the PRI's political stranglehold has

reverberated throughout Mexico's political economy. Not only are elections contested at all levels, the major institutions of the old

corporatist system -- the client labor unions, rural organizations and small-business groups -- are being slowly democratized by a

younger generation of leaders demanding accountability. It is too early to tell if or when these forces will produce a more effective

and broadly shared growth agenda for Mexico. But one lesson is already clear: Of all the world's developing countries, Mexico was by

far in the best position to exploit the neoliberal model. Its proximity to the U.S. market and a domestic U.S. constituency of millions

of Mexican American voters gave Mexico advantages under NAFTA that no other Third World nation had. The testimony of

hundreds of thousands of Mexican workers each year making the hard and dangerous trip north

is evidence that, after two decades, the model is not working in Mexico. If it is not working there, it is

unlikely to work anywhere.

Farmers don’t like NAFTA—maize prices rising

Bury 04

[Scott Bury. Teacher and writer. Maize farmers unhappy with

NAFTA’s price. Winter of 2004.

http://www.cec.org/Page.asp?PageID=122&ContentID=2522&SiteNo

deID=454. //SRSL]

"I have nothing," protested Francisco Martinez during a 2002 demonstration in Mexico City. "I am here out of desperation because I

am poorer than I have ever been." A sign carried nearby squarely pointed a finger at the alleged culprit:

"NAFTA," it read, "Equals Death." Given the changes suffered by many small farmers in the past

ten years, it's understandable they felt moved to protest. Maize prices paid to producers dropped

44 percent. A wave of cheap, subsidized US maize flooded the domestic market. And many

farmers left the land, while others struggled to earn enough to provide for their families. The

roots of Mexico's corn crisis go deep, however, beginning years before NAFTA. "The problem

started back with Mexico's entry into the GATT [General Agreement on Tariffs and Trade] in

1986," according to Laura Carlsen, director of the Americas Program with the InterHemispheric Resource Centre in Mexico City. "The Mexican government began to dismantle policies that had

ensured a basic price support for corn." The removal of tariffs, quotas and direct supports was accelerated with the signing of

NAFTA and the opening of Mexico to international markets, says Carlsen. From 1994 to 2002, US exports of maize to Mexico nearly

tripled, from 2.2 million tonnes annually to 6 million tonnes. Mexico also became the second-largest export market for US maize,

accounting for 11 percent of all exports in 2000, or about US$550 million worth. The effects in rural Mexico have been pronounced.

As many of the larger farmers shifted from maize to other crops, smaller, poorer farmers actually increased the cultivated land under

maize to offset their decreasing income and feed their families. The unfortunate irony is that these smaller farmers lost even more

money on corn every year, and fell deeper into poverty. The expansion of maize agriculture into more marginal lands has also proven

costly for Mexico's rich biodiversity. According to NAFTA's Promise and Reality: Lessons from Mexico for the Hemisphere,

published by the Carnegie Endowment for International Peace, this practice has resulted in an average deforestation rate of more

than 630,000 hectares per year since 1993 in the biologically rich regions of southern Mexico. NAFTA's impact on

agriculture in Mexico, however, is decidedly mixed. Some sectors are clear winners while

others—maize in particular—have faced a harsher adjustment to open borders despite tariff

protections Mexico built into the trade agreement. But Brian Doidge of the Ontario Corn Producers Association

says the low prices are not the result of free trade: "Pricing has always been determined in the Chicago exchange," he says. What is

keeping the price of corn so low is the US agricultural policy, expressed most recently in the 2002 Farm Bill, which provides

substantial support for corn producers. "Corn is considered the most heavily-subsidized food crop in the US," says Tim Wise, a

researcher at Tufts University. US farmers benefit from subsidies amounting to some US$10 billion