Diapositiva 1 - Sociedad de Inversiones en Energía

advertisement

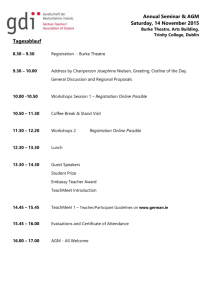

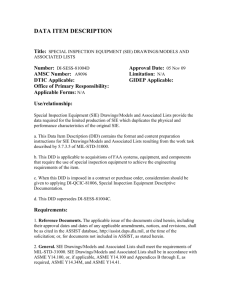

Historia SIE Corporate Presentation Sociedad de Inversiones en Energía S.A. July 2013 General Information Historia SIE Corporate Name Sociedad de Inversiones en Energía S.A. TIN* Main Domicile Calle 67 No. 7-35, Of. 608 Telephone 3212925 City Bogotá Fax 3212925 A.G.S. S.A.S. Legal Felipe Tovar De Representative Andreis Web Site www.inversionesenenergia.com SFC Action Code** ISIN COT05PA00017 COT05PAAO001 *TIN: Stands for Taxpayer Identification Number **SFC: stands for Office of the Superintendent of Finance of Colombia 830.080.718-2 Structure Historia SIE COMPAÑIA DE PETROLEOS DE CHILE COPEC S.A. www.copec.cl PROENERGÍA INTERNACIONAL S.A. www.proenergiainternacional.com SOCIEDAD DE INVERSIONES EN ENERGÍA S.A. www.inversionesenenergia.com TERPEL DEL CENTRO S.A. ORGANIZACIÓN TERPEL S.A. www.terpel.com Historia SIE Shareholder Composition 32,79% Proenergía Copec Otros 52,79% 14,39% July 2013 Gazel Capitalization process ends (OT) / SIE acquires 88,9% of OT Merger of six Terpeles with OT, SIE is listied in BVC / Change of Control (Proenergia) 2006 2007 Reacquisition of 16 million SIE shares Change of Control (indirect) COPEC Merger Gazel OT 2013 Acquisition Shares Terpeles 2012 2010 2006 Beginning of Gazel capitalization in OT 2009 Terpeles Reorganizatión capitalization of Organización Terpel (OT) (contribution) 2008 Incorporation of SIE, Integrates 75% of Terpel Shareholders 2004 2001 Historia SIE 2002 2006 Hitos en la Historia de la SIE Bonds Issue OT Historia SIE Sociedad de Inversiones en Energía S.A. is a business corporation created on December 28, 2000 by means of public deed number 6886 granted by the 6th Notary Office of the Bogotá Circle, and domiciled in Bogotá, Colombia. Its main corporate purpose is the acquisition of interests in companies engaged in the exploration, exploitation, refining, import, export and distribution of oil and its derivatives or of any other energy resource. Historia SIE Its principal investment is Organización Terpel SA, leading distributor of Liquid Fuels and Vehicle Natural Gas in Colombia, with a share in market of 40% and 45% respectively, according to estimates based on information from the Ministry of Finance and the Ministry of Energy Mines. Additionally it has presence in Ecuador, Panama, Mexico, Peru and Dominican Republic and has a broad portfolio of business services in EDS, enterprise mobility, industry, aviation, marine and Lubricants and other additional services related to the stations. www.terpel.com Historia SIE The Company has acquired shares of its own and shares of Organización Terpel (OT), which has represented an increase with respect to the original participation that now is 88.9%. This was carried out through more than ninety-five (95) transactions, including two (2) takeover bids (Terpel Sur and Antioquia) and a public bid (Fogafin). The value of the acquisitions was 180 thousand million pesos, all of them obtained through loans with from local banks, and for which several valuations were carried out by external and independent advisors. La Sociedad de Inversiones en Energía is a holding company and its operating income comes from equity method. The Company has paid more than $557 thousand million pesos in dividends. Historia SIE The Business Reorganization Process concluded in July 2004, with the capitalization of the OT with contributions in kind (productive assets) made by the seven (7) Terpel companies. The acquisition of Gazel concluded in January 2008. This process took about two (2) years and required two (2) takeover bids to dislist the shares of Terpel Centro and Terpel del Sur from the Stock Exchange of Colombia. The merger of six (6) Terpel companies into the OT concluded in August 2009, constituting the second most complex merger conducted in Colombia. This transaction required four (4) shareholders’ extraordinary meetings and took two (2) years. Historia SIE The dematerialization of SIE shares and the registration of the company in the National Securities and Issuers Register (RNVE by its acronym in Spanish) and at the Stock Exchange of Colombia were carried out in October 2009. In this same year, an internal control system was implemented that has allowed more and better controls. In year 2010, Compañía de Petróleos de Chile Copec S.A. registered an indirect control situation exercised thereby over SIE. In 2012 the merger process between Organización Terpel and Gazel is concluded. In 2013 Organización Terpel issues bonds. Historia SIE Liquidity Current Ratio (times) Working Capital (million $) Solvency and Coverage Indebtedness / Total Assets Ratio EBITDA (million $) EBITDA Coverage/Financial Expenses Financial debt / EBITDA (times) Profitability Return on total assets at beginning of period. Return on equity at beginning of period. Intrinsic value per share (pesos) FINANCIAL INDEXES As at As at December December 31, 31, 2011 2012 0,40 (2.410) 0,10 (5.037) 12,53% 12,49% 105.772 135.322 7,35 1,71 10,73 1,34 6,20% 8,35% 7,12% 9,58% 6.840,25 6.870,54 Historia SIE Liquidity Current Ratio and Working Capital: these figures present a positive variation due to an increase in accounts receivable from economically related companies ($1,124 MM) and a reduction in the equity tax liability ($1,506 MM). Solvency and Coverage Indebtedness/Total Assets Ratio: this indicator did not show significant variations in this period. EBITDA EBITDA Coverage/Financial Expenses: this indicator varied because Term Deposits increased in year 2012 in spite that the debt did not vary and EBITDA decreased due to a decrease in the profits of Organización Terpel S.A. Financial Debt / EBITDA (times): Stable indicator; the debt has not increased and EBITDA decreased due to a decrease in the profits of Organización Terpel S.A. Profitability Return on total assets and equity at the beginning of the period: the return on assets and equity decrease as a result of a decrease in the profits of Organización Terpel S.A. Historia SIE FELIPE TOVAR DE ANDREIS gerencia@inversionesenenergia.com Calle 67 # 7 – 35 Oficina 608 Tels: 321 2925 www.inversionesenenergia.com