OCSDrillingNeg-GDS2014-BHSE-062914

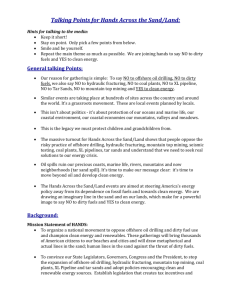

advertisement