MANAGING INTRACOMPANY FUND FLOWS

advertisement

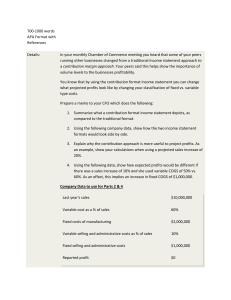

MANAGING INTRACOMPANY FUND FLOWS THE MNC’s DISTINCT VALUE MNCs can arbitrage 1. Financial markets 2. Tax systems 3. Regulatory systems International Taxation The goal to international tax management is to increase the parent’s after-tax profits, usually by reducing the total amount of taxes paid. (Usually, but not always-Timing matters) TAXES MATTER Complicated One must take account of: Home country tax policy Host country tax policy Primarily corporate income tax Elements of national tax policy: tax base, tax rates, treatment of foreign taxes paid, administration Remembering always that the host country always gets “First Crack” at tax base within its borders International Taxation General principle of international taxation: There is a clear distinction between returns to debt and returns to equity. 1. Tax deductibility of interest payments 2. Treatment of foreign exchange gains/losses Corporate income tax is designed as a tax on the returns to equity only International Tax Policy Equity returns are taxed in the host country, then may be taxed in home country (possibly different timing) Host government acts first Home government determines policies vis-à-vis the host government Treatment of foreign income and taxes paid Type Summary Implication Exempt from Domestic Firm will not be taxed on any income earned aboard Foreign tax rate governs taxes paid by the firm Full Tax Credit Profits earned overseas are taxed at same rate as profits earned at home; full tax credit given for foreign taxes paid Home tax rate generally governs taxes paid by the firm, except where foreign tax rates are higher Deduction Profits earned overseas are taxed at domestic rate; deduction given for foreign taxes paid Foreign taxes paid reduce total taxable income. Some double taxation (not used much) Double Tax Profits earned overseas are taxed at domestic rate; no deduction given for foreign taxes paid Double taxation Example 11.1 Peripatetic Enterprises headquartered in Nide, has foreign income from Serendip. Foreign Income $1000 Serendip Tax Rate 35% Domestic Tax Rate 45% Example of Home Policies Exemption Credit Deduction Double Tax Foreign Income $1000 $1000 $1000 $1000 Foreign Taxes Paid $350 $350 $350 $350 Home Taxes Paid $0 $100 $293 $450 Net Income $650 $550 $357 $200 Peripatetic prefers tax exempt policy. Beyond that, tax credit over deduction, and prefers either of these over double taxation. Timing of Taxation Contemporaneous Taxation: home country may choose to tax foreign equity returns during fiscal year in which they are earned. • Used mostly for foreign branches of MNE. • Branch is an extension of parent company Tax Deferral: taxation occurs at time profits are repatriated as dividends. • Used for foreign subsidiaries of MNE. • Subsidiary is an affiliate of a MNE that is incorporated in the country in which it operates • Encourages profits to be reinvested abroad rather than repatriated. Summary of International Tax Policies • First Crack Principle: Host country sets corporate tax rates • Home country reacts to host country’s policies by deciding treatment of foreign income and taxes, as well as timing of taxes. • MNEs prefer to invest where taxes are lower • Tax laws are more complicated then the framework presented. Subpart F: Subsidiary income taxed regardless of repatriation. International Tax Management MANAGING INTRACOMPANY FUND-FLOWS Unbundling decomposes total international transfer of funds between pairs of affiliates (parents, subsidiaries, branches) into separate portions. • Allocation of profits (branch vs. subsidiary) Dividends Most important method of transferring funds to parents Cost Allocation A. Definition: Allocation of pooled and joint costs to subsidiaries , can be used move profits to more tax-friendly nations. B. Uses of cost allocation. 1. 2. 3. Reduce corporate taxes paid Reduce ad valorem taxes (VATs, excises, and tariffs) Avoid exchange controls Transfer Pricing A. Definition: prices on internally-traded goods, can be used move profits to more tax-friendly nations. B. Uses of Transfer Pricing. 1. Reduce corporate taxes paid 2. Reduce ad valorem taxes (VATs, excises, and tariffs) 3. Avoid exchange controls Reinvoicing Centers A. B. C. D. Set up in low-tax nations. Center takes title to all goods. Center pays seller/paid by buyer all within the MNC. Advantages: 1. 2. E. Simplifies currency exchange Can invoice in currencies other than the local one. Disadvantages of reinvoicing. 1. 2. Increased communication costs Suspicion of tax evasion by local governments. Fees and Royalties A. Firms have control of payment amounts. B. Host governments less suspicious. Intracompany Loans Protect against confiscation, reduces taxes, accesses blocked funds especially when following are present: 1. 2. 3. Credit rationing Currency controls Differential tax rates Types of Inter-company Loans 1. 2. Back-to-back loans: Often called fronting loan, channeled through a bank and collateralized by parent deposit Parallel loans consist of 2 related but separate loans with 4 parties in 2 nations. Case Study CC&S, a Multinational Company headquartered in Chicago and traded on NY Stock Exchange. Branches located in Japan, Canada, Ireland, Great Britain and Germany. The tax structure is based on worldwide tax principle: gross foreign branch income is taxed and a full credit is given for foreign taxes paid up to the amount of the US tax liability. Cost Allocation Currently, expenses incurred at C&C Enterprise headquarters in Chicago total $50,000, each branch is charged $10,000. There is a proposal to allocate costs to high-tax countries in order to achieve the largest tax deductions possible. As such: • This decreases foreign taxes paid from $88,100 to $83,400 • US tax liability increases from $300 to $5000 • Net branch income remains unchanged, $171,600 Taxes are shifted from host countries to home country, but total taxes remain the same. By using the credit method, home country taxes total branch income regardless of where the income is earned or where the taxes are paid. International Tax Management Principle I: If there are no excess tax credits, cost allocation decisions do not matter for branches. If there are excess tax credits, show branch profits in the lowest-tax jurisdictions by allocating costs to the highest-tax jurisdictions, without making negative profits. Transfer Pricing Pricing of internally-traded goods. Management may suggest altering the company’s transfer prices to show profits in low-tax jurisdictions. The Vice-President of C&C Enterprises suggests raising transfer prices from $16 to $18 for countries with high-tax jurisdictions. By increasing the transfer prices, it: • • • Reduces total foreign taxes paid from $88,100 to $81,500 Domestic tax liability increases from $300 to $6,900 Net branch income remains unchanged, $171,600 Total net income remains unchanged because US tax liability increases while the foreign taxes paid decreases. Transfer pricing affects what government receives the tax revenue, but it does not affect the total taxes the corporation pays. International Tax Management Principle II If there are no excess tax credits, transfer pricing decisions do not matter for branches. If there are excess tax credits, show branch profits in the lowest-tax jurisdictions by following a simple rule: If one branch is selling to a foreign branch, set the transfer price as high as possible when T*> T without making profits negative, and as low as possible when T*<T without making profits negative. T=Tax rate on profits earned by the branch T*=Tax rate on profit earned by the foreign branch. Tariffs and Transfer Pricing Tariffs are additional costs imposed on goods and services imported to a country. Management can minimize import duties paid by setting transfer prices as low as possible. Tariffs are levied on the transfer prices selected and are deductible expenses in figuring the branches’ income taxes. Setting low transfer prices to $14: • • • • Can minimize the import duty paid from $64,000 to $56,000 Total foreign income taxes rise from $62,900 to $69,220 The US tax liability falls from $3,740 to $140 Net Branch Income increases $5,280 to $134,640 Because an import tariff is a deductible expense, it does not generate a US tax credit, thus affecting net branch income. International Tax Management Principle III If there are no excess tax credits, use the lowest possible transfer price between branches in the presence of import tariffs. If there are excess tax credits, minimize branch taxes paid in the presence of import tariffs by comparing T* to [T + Td*(1-T*)]: Use the high transfer price if T*>[T +Td*(1- T*)] without making profits negative, and use the low transfer price if T*<[T +Td*(1T*)] without making profits negative. Summary of Tax Management Principles Decision No Excess Tax Credits Excess Tax Credits Cost Allocation Does not matter Allocate costs to hightax countries Transfer Pricing Does not matter Show profits in low-tax countries Transfer Pricing with Tariff Low transfer price Minimize total taxes by comparing T* to [T +Td*(1- T*)] DESIGNING A GLOBAL REMITTANCE POLICY A. Factors: 1. Number of financial links 2. Volume of transactions 3. Ownership patterns 4. Product standardization 5. Government regulations Information Requirements 1. 2. 3. 4. 5. 6. 7. Subsidiary financing requirements Sources/costs of external capital Local investment yields Financial channels available Transaction volume Relevant tax factors Government restrictions on transfer of funds. Questions