File - Ms. Nancy Ware's Economics Classes

advertisement

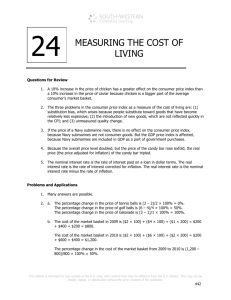

1. How is the inflation rate measured? 2. What a price index is and how it is calculated? 3. What is the importance of the consumer price index and other price indexes? Aggregate price level: measure of the overall level of prices in the economy Market basket: hypothetical set of consumer purchases of goods and services Price Index: measures the cost of purchasing a given market basket in a given year. The index value is normalized so it is always equal to 100 in the selected base year. In other words it is used to track inflation. 1. With millions of products being purchased throughout the day and across America, how can we tell if overall prices are rising or falling? 2. And if they are rising, are they rising quickly or slowly? 3. First it needs to be determined what Americans are buying in their “market basket”, and then the prices of those goods, and then all that information is compiled into one statistic: a price index. This Consumer Price Index (CPI) is the most widely used measure of price inflation. It is computed every month and uses prices for a market basket of about 80,000 goods and services that a typical urban family of four consumes. ftp://ftp.bls.gov/pub/special.req uests/cpi/cpiai.txt http://www.bls.gov/cpi/#tables Consumers buy all sorts of different goods and services in a typical year. This typical basket of goods and services purchased is called the market basket. Price Index in given year = Inflation Rate = Cost of market basket in a given year X 100 Cost of market basket in base year Price index in year 2 - Price index in year 1 Price index in year 1 X 100 The base year is the benchmark year. All other years, past and future, are compared to the base year to see if the market basket was more or less expensive than it was in that year. The market basket for 2008 was $3900 and for 2009 was $4600. Use 2008 as the base year and calculate the price index for 2009 & the inflation rate. Price Index in given year = Inflation Rate = 1. 2. 3. 4. 5. 6. Cost of market basket in a given year X 100 Cost of market basket in base year Price index in year 2 - Price index in year 1 Price index in year 1 X 100 The base year is the benchmark year. All other years, past and future, are compared to the base year to see if the market basket was more or less expensive than it was in that year. The market basket for 2008 was $3900 and for 2009 was $4600. Use 2008 as the base year and calculate the price index for 2009 & the inflation rate. CPI2008 = ($3900)/($3900) x 100 = 100 *NOTE: any price index is always 100 in the base year* CPI2009 = ($4600/($3900) x 100= 117.9 Calculating the inflation rate is just calculating the percentage change between any two values of the price index. Inflation from 2009 to 2008 = (CPI2009 – CPI2008)/(CPI2008) x 100= (117.9100/100) x 100 = 17.9% 1. 2. 3. Calculate the prefrost market basket & the post frost market basket. The price index prefrost is equal to 100. What is the post frost 2009 price index? Calculate the inflation rate from the pre frost 2008 to the post frost 2009. 1. 2. 3. Calculate the prefrost market basket & the post frost market basket. The price index prefrost is equal to 100. What is the post frost 2009 price index? Calculate the inflation rate from the pre frost 2008 to the post frost 2009. Answers: 2. CPI $175_ x 100 = 184.2 $95 3. IR: 184.2 – 100 x 100 = 84.2% 100 2009 The Producer Price Index (PPI) measures the cost of a typical basket of goods and services—containing raw commodities such as steel, electricity, coal, and so on—purchased by producers. The GDP deflator is technically not a price index, but it is used in the same way. GDP deflator: for a given year is 100 times the ratio of nominal GDP to Real GDP expressed in prices of a selected base year. Example: Real GDP is currently expressed in 2000 dollars, the GDP deflator for 2000 is equal to 100. If nominal GDP (GDP with inflation) was to increase by 5%, but real GDP does not change, the GDP deflator indicates that the aggregate price level increased by 5%. End of Module 15 & Section 3! Complete Module 15 Review questions. Prepare for your test Wednesday October 2nd