PCE Part B – General (Chapter 14-20)

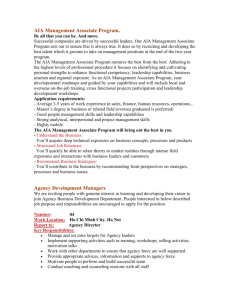

advertisement

PCE – Part B General Insurance • Revision 01 (25/11/2011) AIA.COM AIA confidential and proprietary information. Not for distribution. CHAPTER 14 CHARACTERISTICS OF GENERAL INSURANCE PRODUCTS (OVERVIEW) How much do you understand about General Insurance? Share only 1 point about GI that comes across to your mind… AIA confidential and proprietary information. Not for distribution. CHAPTER 14 : CHARACTERISTICS OF GENERAL INSURANCE PRODUCTS (OVERVIEW) 9.1 Introduction 9.2 Characteristics of General Insurance Products AIA confidential and proprietary information. Not for distribution. 14.1 : Introduction • General insurance provides cover against risks usually not covered by life insurance. • In general, not every policy will eventually become a claim. AIA confidential and proprietary information. Not for distribution. 14.2 : Characteristics of General Insurance Products • General insurance contracts are short-term contracts with varying premiums at renewals. • General insurance contracts are contracts of indemnity. • Payment of a claim does not terminate a general insurance contract • The risk to be insured does not necessarily increase with time AIA confidential and proprietary information. Not for distribution. CHAPTER 15 CLASSES OF GENERAL INSURANCE BUSINESS & GENERAL TAKAFUL BUSINESS AIA confidential and proprietary information. Not for distribution. CHAPTER 15 CLASSES OF GENERAL INSURANCE BUSINESS & GENERAL TAKAFUL BUSINESS How many classes of General Insurance available in the market? Please name me 1… AIA confidential and proprietary information. Not for distribution. CHAPTER 15 CLASSES OF GENERAL INSURANCE BUSINESS & GENERAL TAKAFUL BUSINESS 15.1 15.2 15.3 15.4 15.5 Marine Insurance Fire Insurance Motor Insurance Miscellaneous Accident Insurance Types of Takaful Business AIA confidential and proprietary information. Not for distribution. 15.1 : Marine Insurance Type of policy Subject matter of insurance - Hull - Vessel, machinery & limited collision liability - Cargo - Cargo (goods carried on the vessel) - Freight - Building Risk - Freight (money/fee charged for carriage of goods by the vessel) - Vessel under construction AIA confidential and proprietary information. Not for distribution. 15.1 : Marine Insurance Institute Cargo Clauses B Institute Cargo Clauses A AIA confidential and proprietary information. Not for distribution. Institute Cargo Clauses C 15.1 : Marine Insurance Perils Clauses AB C Fire, explosion, collision Earthquake, volcanic eruption, lightning Jettison, general average & salvage Discharge of cargo at port of distress Striking, stranding, capsizing AIA confidential and proprietary information. Not for distribution. 15.1 : Marine Insurance Perils Clauses AB C Entry of sea water into vessel Total loss of package(loading/discharge) Pirates and thieves Deliberate damage or destruction Washing overboard AIA confidential and proprietary information. Not for distribution. 15.2 : Fire Insurance Fire Insurance Consequential Loss Houseowner Householder AIA confidential and proprietary information. Not for distribution. 15.2 : Fire Insurance Type of policy - Fire - Houseowner - Householder - Consequential Loss AIA confidential and proprietary information. Not for distribution. Subject matter of insurance - Buildings and contents - Private dwellings - Household content - Insured’s profit CHAPTER 15 10.2 : Fire Insurance A: Standard Fire B: Standard Houseowner C: Standard Householder Perils AB C Fire, lightning, explosion (domestic gas) War, nuclear Burning of property by authority Earthquake, volcanic eruption # # Subterranean fire, flood #: Extension is available AIA confidential and proprietary information. Not for distribution. 15.2 : Fire Insurance Perils Aircraft damage, impact damage Overflowing of water tanks Removal of debris, architect fee, rental Typhoon, hurricane, windstorm Burning of forest & bush lallang A: Standard Fire B: Standard Houseowner C: Standard Householder AB # # # # # ## #: Extension is available, : Extension with condition AIA confidential and proprietary information. Not for distribution. C 15.2 : Fire Insurance Perils Fermentation, natural heating Spontaneous combustion Riot, strike and malicious damage Subsidence or landslip Plate glass A: Standard Fire B: Standard Houseowner C: Standard Householder AB ### # ## # ## ### ## # #: Extension is available, : Extension with condition AIA confidential and proprietary information. Not for distribution. C 15.2 : Fire Insurance (Consequential Loss) Basic Cover (i) Loss of gross profit due to reduction of turnover (total amount of goods or services sold) Exclusio n Extensio n (ii) Additional expense to minimize loss of turnover Similar to fire policy (i) Similar to fire policy (ii) Loss of gross profit arising from business interruption in other’s premises AIA confidential and proprietary information. Not for distribution. 10.3 : Motor Insurance (Types of Vehicles) Commercial Vehicle Private Car AIA confidential and proprietary information. Not for distribution. Motorcycle 15.3 : Motor Insurance (Types of Cover) Act Only Third Party, Fire & Theft AIA confidential and proprietary information. Not for distribution. Third Party Only Comprehensive 15.3 : Motor Insurance (Types of Cover) Act Only Death/Bodily injury to 3rd party 3rd Party Cover Act only + 3rd party property 3rd Party, Fire & Theft 3rd Party + Loss/Damage to insured vehicle by fire or theft Comprehensive 3rd Party, Fire & Theft + Accidental Damage + medical Expense + Personal Accident AIA confidential and proprietary information. Not for distribution. 15.4 : Miscellaneous Accident Insurance Theft Insurance Liability Insurance Personal Accident Engineering Insurance AIA confidential and proprietary information. Not for distribution. Fidelity Guarantee Aviation Insurance 15.4.1 : Theft Insurance Burglary Insurance All Risks Insurance Goods in Transit Money Insurance AIA confidential and proprietary information. Not for distribution. 15.4.2 : Liability Insurance Workmen’s Compensation Products Employers’ Liability Liability Professional Indemnity AIA confidential and proprietary information. Not for distribution. Public Liability 15.4.3 : Personal Accident (Types of Benefit) Death Permanent Disablement Temporary Disablement Medical Expenses AIA confidential and proprietary information. Not for distribution. 15.4.4.1 : Fidelity Guarantee (Types of Policies) Collective Policy Individual Policy AIA confidential and proprietary information. Not for distribution. Blanket Policy 15.4.4.2 : Bonds (The 3 Parties) Contractor Employer AIA confidential and proprietary information. Not for distribution. Surety (Insurer) 15.4.5 : Engineering Insurance Boiler Explosion Erection All Risks Contractors’ All Risks AIA confidential and proprietary information. Not for distribution. Machinery Breakdown Electronic Equipment 15.4.6: Aviation Insurance Personal Accident Freight Liability AIA confidential and proprietary information. Not for distribution. Loss of Licence 15.4.7 Medical And Health Insurance (MHI) - A policy of insurance on disease, sickness or medical expense that provides specified benefits against risks of persons becoming totally or partially incapacitated as a result of sickness or accident. - Policy benefits are usually paid out in the manner according to the policy type or cover purchased as follows: • reimbursement of medical expenses • lump sum payment of the sum insured, or • an allowance for the period the policyowner is hospitalized. AIA confidential and proprietary information. Not for distribution. CHAPTER 15 CLASSES OF GENERAL INSURANCE BUSINESS & GENERAL TAKAFUL BUSINESS Basic Cover 1) Hospitalization and Surgical Insurance. Common Policy Extensions/ Benefits: a) Outpatient Clinical Insurance b) Maternity Benefit 2) Major Medical Insurance 3) Dread Disease/ Critical Illness Insurance 4) Disability Income Insurance 5) Hospital Income Insurance AIA confidential and proprietary information. Not for distribution. CHAPTER 15 Policy Benefit Limitations a. General Waiting Period c. Co-payments Shall not exceed 30 days from policy effective date b. Specified Illnesses Shall not exceed 120 days from policy effective date AIA confidential and proprietary information. Not for distribution. CHAPTER 15 Exclusions 1) Pre-existing conditions 2) Congenital abnormalities or deformities including hereditary conditions 3) Plastic/ Cosmetic surgery, circumcision and eye examination 4) Pregnancy, childbirth, miscarriage and abortion 5) Disabilities arising out of duties of employment that are covered under workmen’s compensation insurance AIA confidential and proprietary information. Not for distribution. CHAPTER 15 Exclusions 6) Psychotic, mental or nervous disorders 7) Sickness or injury arising from racing of any kind (except foot racing) 8) Expenses incurred for sex changes 9) Investigation and treatment of sleep and snoring disorders, hormone replacement therapy and alternative therapy 10)Costs of services of a non-medical nature such as television,telephones etc 11) Private flying other than as a fare paying passenger AIA confidential and proprietary information. Not for distribution. CHAPTER 15 Golfers Insurance Basic Cover 4)Hole in one expenses 1) Liability to the public 3)Golfing Equipment/ Golf Clubs 2) Personal Accident AIA confidential and proprietary information. Not for distribution. CHAPTER 15 CLASSES OF GENERAL INSURANCE BUSINESS & GENERAL TAKAFUL BUSINESS Exclusions - War risks, riot strike and civil commotion - Wear & Tear, depreciation, gradual deterioration or any process of repairing - Loss destruction/ Damage directly caused by or contributed to by or arising from radioactive or nuclear risks - Terrorism risk AIA confidential and proprietary information. Not for distribution. CHAPTER 15 CLASSES OF GENERAL INSURANCE BUSINESS & GENERAL TAKAFUL BUSINESS 15.5 : Takaful Business • General Takaful business is all takaful business which is not Family Takaful Business • General Takaful scheme is short-term Tabaruk Contract • Participants in the scheme agree to pay entire contributions to create General Takaful Fund • After deducting operational costs, the surplus shall be shared between participants and Takaful company according to Principle of Mudharabah AIA confidential and proprietary information. Not for distribution. CHAPTER 16 PRACTICE OF GENERAL INSURANCERISK ASSESSMENT, UNDERWRITING & RATING AIA confidential and proprietary information. Not for distribution. CHAPTER 16 PRACTICE OF GENERAL INSURANCERISK ASSESSMENT, UNDERWRITING& RATING Who are involving in the process of Underwriting? AIA confidential and proprietary information. Not for distribution. CHAPTER 16 PRACTICE OF GENERAL INSURANCERISK ASSESSMENT, UNDERWRITING& RATING 16.1 16.2 16.3 16.4 16.5 16.6 16.7 16.8 16.9 16.10/12 Underwriting The Underwriting Process Determination of Premiums, Terms & Conditions Confirmation of Acceptance Reinsurance & Coinsurance Rating Minimum Premium Minimum Sum Insured Refund of Premium How to Use Tariff AIA confidential and proprietary information. Not for distribution. CHAPTER 16 16.1 : Underwriting • The purpose of underwriting is to - Guard against anti-selection - Charge a premium that is commensurate with the risk transferred • When anti-selection exists within a class of risks, the actual loss will be greater than the expected loss because the class of risks does not represent a randomly selected group (Law of Large Number) AIA confidential and proprietary information. Not for distribution. CHAPTER 16 16.2 : The Underwriting Process • Underwriting can be defined as: - A process of assessment and selection of risks - Determination of premium, terms and conditions AIA confidential and proprietary information. Not for distribution. CHAPTER 16 16.2 : The Underwriting Process - Physical Hazards Fire - Type of construction, Height of Building - Nature of Flooring, Type of Occupancy etc Motor - Type of vehicle, Cubic capacity, Use of Vehicle - Age & condition of vehicle, Modification on Vehicle Burglary - Nature of Stock, Situation - Type of Construction, Security Precaution Personal - Age of Person, Type of Occupation Accident - Health & Physical Condition, Hobbies AIA confidential and proprietary information. Not for distribution. CHAPTER 16 16.2 : The Underwriting Process- Moral Hazards Unreasonableness Carelessness AIA confidential and proprietary information. Not for distribution. Fraud CHAPTER 16 16.3 : Determination of Premiums, Terms & Conditions Risk Improvement Warranties Exclusion Excess AIA confidential and proprietary information. Not for distribution. Restricted Cover Franchise CHAPTER 16 16.4 : Confirmation of Acceptance • If the terms and conditions are acceptable to proposer, the insurer will usually issue cover note as evidence of temporary cover. AIA confidential and proprietary information. Not for distribution. CHAPTER 16 16.5 : Reinsurance & Coinsurance • Reinsurance is an arrangement where the insurer reinsures/cedes the part of risk assumed which is in excess of his retention to reinsurer • Coinsurance is an arrangement between two or more insurers to share original risk AIA confidential and proprietary information. Not for distribution. CHAPTER 16 16.6 : Rating Individual Class AIA confidential and proprietary information. Not for distribution. Merit CHAPTER 16 16.7/8 : Minimum Premium /Minimum Sum Insured Minimum Premium Fire RM 50 Private Car RM 50 Motorcycle RM 20 Workmen Compensation RM 35 AIA confidential and proprietary information. Not for distribution. CHAPTER 16 16.10/12 : How to Use Tariff Workmen Compensation Fire AIA confidential and proprietary information. Not for distribution. Motor CHAPTER 16 16.9 : Refund of Premium • Premium is refundable due to - Failure of consideration - Provision in the policy AIA confidential and proprietary information. Not for distribution. CHAPTER 17 INSURANCE DOCUMENTS AIA confidential and proprietary information. Not for distribution. CHAPTER 17 Why do we need to fill up a Proposal Form? AIA confidential and proprietary information. Not for distribution. CHAPTER 17 Part A : Overview • The Proposal Form • The Cover Note • The Certificate of Insurance • The Policy Form • Endorsement • Renewal Notice • Renewal Certificate • Claims Form • Discharge Form AIA confidential and proprietary information. Not for distribution. CHAPTER 17 Part B : Proposal Form 1. An insurance contract is effected when the offer made by one party (the proposer) is accepted by the other party (the insurer). 2. It is a document drafted by insurer in the form of questionnaires to gather information required to access a risk being proposed. 3. Proposal Forms are not used in Marine Cargo Insurance and For Large Risks AIA confidential and proprietary information. Not for distribution. CHAPTER 17 Part B : Proposal Form 17.1.1 : The Structure of A Proposal Form It is divided into 5 sections:(a) Requirements of Insurance Act, 1996 (b) Questions of a General Nature (c) Insurance related Questions (d) Declaration (e) Signature AIA confidential and proprietary information. Not for distribution. CHAPTER 17 17.1.1 : The Structure of A Proposal Form (a) Requirements of Insurance Act, 1996 Subsection 149(4) You are to disclose in the proposal from, fully and faithfully all the facts which you know or ought to know, otherwise the policy issued hereunder may be invalidated. AIA confidential and proprietary information. Not for distribution. CHAPTER 17 17.1.1 : The Structure of A Proposal Form (b) Questions of a General Nature • Proposer’s Name • Proposer’s Address • Risk Address • Proposer’s Occupation • Previous and Present Insurance • Loss Experience • Sum Assured • Subject Matter AIA confidential and proprietary information. Not for distribution. CHAPTER 17 17.1.1 : The Structure of A Proposal Form (c) Insurance Related Questions Some examples:Fire Insurance Type of construction and use of the building Whether building is detached or adjoined to another Type of power used Occupation of adjoining building (left & right) AIA confidential and proprietary information. Not for distribution. Motor Insurance Cubic capacity Year of manufacture Driving offences Cover required CHAPTER 17 Part C : The Cover Note A Cover Note is issued: in advance of a policy when negotiation is completed during the course of negotiation when a survey has to be carried out AIA confidential and proprietary information. Not for distribution. CHAPTER 17 A Cover Note : a temporary policy evidence of the insurance contract provides the usual coverage found in a standard policy provides that the insurance is subject to Tariff warranties if the risk proposed is governed by a Tariff AIA confidential and proprietary information. Not for distribution. CHAPTER 17 Part D : The Certificate of Insurance A certificate of Insurance is issued when insurance is made compulsory by law The marine certificates (not compulsory by law) are issued by mutual agreement between Insured and Insurer The marine certificate provides evidence of insurance to interested parties including banks and consignees AIA confidential and proprietary information. Not for distribution. CHAPTER 17 Part E : The Policy Form A policy is a document drafted by the insurer A policy has to be stamped Use the wording provided by the Tariff if the insurance is governed by Tariff Types of policy form :- * Scheduled * Narrative AIA confidential and proprietary information. Not for distribution. CHAPTER 17 17.4.1 : The structure of a Scheduled Policy Form Heading The Preamble or Recital Clause The Operative or Insurance Clause Exclusion The Schedule Attestation or Signature Clause Conditions AIA confidential and proprietary information. Not for distribution. CHAPTER 17 17.4.1.5 : The Schedule The information in the schedule: Insured name and address Risk covered Premium Period of Insurance Policy number Property Insured Date of issue Sum Insured Agency Warranties applicable AIA confidential and proprietary information. Not for distribution. CHAPTER 12.4.1.7 : Conditions Classification of conditions:(i) Express (ii) Implied (iii) the time that conditions need to be fulfilled * Conditions Precedent to Contract * Conditions Subsequent to Contract * Conditions Precedent to Liability AIA confidential and proprietary information. Not for distribution. CHAPTER 17 17.4.2 : Policy Register Section 47 of Insurance Act 1996 - every insurer shall maintain an up-to-date register of all policies and none of them shall be removed as long as the insurer is still liable for these policies. AIA confidential and proprietary information. Not for distribution. CHAPTER 17 Part F : Endorsement (a) Endorsements are used to modify The Terms & The Standard Policy Document The endorsement form part of the policy In certain classes of business, the attachment of endorsement to the policy is compulsory. Eg. Workmen’s Compensation Insurance and Motor Insurance AIA confidential and proprietary information. Not for distribution. CHAPTER 17 (b) Endorsements May Incorporate Alterations to an Existing Policy Variation in Sum Insured Change of Insurable Interest Extension of insurance Change of risk Transfer of property to another location Cancellation of insurance Change in name and address AIA confidential and proprietary information. Not for distribution. CHAPTER 17 Part G : Renewal Notice Insurers usually issue a renewal notice one month in advance of the date of expiry Important notes in renewal notice:* A note advising the insured to disclose any materials alterations in the risk since the inception of policy (or last renewal date) * “No risk can be assumed unless the premium is paid in advance” AIA confidential and proprietary information. Not for distribution. CHAPTER 17 Part H : Renewal Certificate Renewal Certificate will be issued if the renewal is on similar terms as the original contract If the renewal is on different terms, a fresh policy is usually issued AIA confidential and proprietary information. Not for distribution. CHAPTER 17 Part I : Claim Form Claim forms are documents drafted by the insurers to gather information relevant to assessing claims The issue of a claim form does not constitute an admission of liability on the part of the insurance Claim forms are not used in marine insurance except in respect of inland transit claims AIA confidential and proprietary information. Not for distribution. CHAPTER 17 Part J : Discharge (i) Claims Settlement Methods settlement with an insured in respect of an insured loss(own loss); or settlement with 3rd party on behalf of an insured in respect of the insured’s liability for loss caused to the 3rd party(Liability to 3rd party) (ii) The Purpose of a Discharge To avoid the possibility of any further claims being made in relation to the loss AIA confidential and proprietary information. Not for distribution. CHAPTER 17 Part J : Discharge (iii) The Declaration Section of The Discharge Form [a] “Own loss” declaration stating that the insured claimant: has received a sum of money from the insurer the money received is in full satisfaction of his claim under the policy in relation to that loss AIA confidential and proprietary information. Not for distribution. CHAPTER 17 Part J : Discharge (iii) The Declaration Section of The Discharge Form [b] “Liability to 3rd party” declaration stating that the 3rd party claimant: has received a sum of money from the insurer the money received is paid by the insurer on behalf of the insured, and the money received is in full satisfaction of the 3rd party’s right to claim from the insured person in respect of the loss AIA confidential and proprietary information. Not for distribution. CHAPTER 17 Part J : Discharge (iv) If Settlements is Not by CASH... The insurers would issue a discharge form known as completion / satisfaction note which usually incorporates a declaration stating that: The repair, reinstatement and/or replacement has been effected by a person (on behalf of the insurer), and They are carried out to the satisfaction of the claimant AIA confidential and proprietary information. Not for distribution. CHAPTER 17 Part J : Discharge (v) Other information Provided by a Discharge Form Name and identity of the claimant Details of the loss:* date and time of loss * place of loss * parties affected * subjected matter of loss * Signature of attesting witness, if required AIA confidential and proprietary information. Not for distribution. CHAPTER 18 PRACTICE OF GENERAL INSURANCE: CLAIMS AIA confidential and proprietary information. Not for distribution. CHAPTER 18 : CLAIMS What are our roles in facilitating a Claim? AIA confidential and proprietary information. Not for distribution. CHAPTER 18 Part A : Overview Claims Procedure Claims Documentation Settlement of Claims Recoveries from Reinsurers, Co-insurers, Subrogation and Contribution Repudiation of Liability by insurers Average Claims Settlement Agreement Disputes Post-Settlement Action AIA confidential and proprietary information. Not for distribution. CHAPTER 18 Part B : Claims Procedure 18.1.1 : Notification of Loss Immediate notification of loss is expected The Duty of Good Faith requires the Insured to minimize the loss AIA confidential and proprietary information. Not for distribution. CHAPTER 18 18.1.2 : Checking Coverage Notice of loss received Preliminary check valid claim exists Claim Form/ Accident Report Form AIA confidential and proprietary information. Not for distribution. CHAPTER 18 18.1.2 : Checking Coverage Conditions for a Valid Claim Is the policy in force? Has premium been paid? Is the loss caused by an insured peril? Is the subject matter affected by the loss the same as that insured under the policy? Has notice of loss been given without undue delay? AIA confidential and proprietary information. Not for distribution. CHAPTER 18 18.1.4 : Investigation of The Claim A small claim will usually be paid on the basis of documents submitted by the claimant Advice is sought from loss adjustors in setting large and complicated claims Claim investigation involves ascertaining:* The validity of a claim * The amount of loss AIA confidential and proprietary information. Not for distribution. CHAPTER 18 18.1.5 :Ascertaining the Amount of Loss Property damage or loss claims: Proof of the value of lost items or estimates of repair, replacement or reinstatement. Liability claims: Subjection of negotiation between the insurer and the person who has suffered injury or property damage AIA confidential and proprietary information. Not for distribution. CHAPTER 18 Part B : Claims Procedure 18.1.6 :Ascertain Subrogation rights & Contribution Duties Notice of loss received Preliminary check valid claim exists Claim Form/ Accident Report Form Investigation of the Claim Ascertaining the amount of loss Ascertain Subrogation rights & Contribution Duties AIA confidential and proprietary information. Not for distribution. CHAPTER 18 : CLAIMS Part C : Claim Document The documents required vary with the type and nature of the claim. Fire Insurance Photographs Technician report (where applicable) Purchase invoices, repair bills, sales record and other related documents Police report (where damage is extensive) Fire brigade report (where damage is extensive) AIA confidential and proprietary information. Not for distribution. CHAPTER 18 : CLAIMS Part D : Settlement of Claims Methods of Settling a Claim Cash-payment of claim by cheque, or Repair Replacement Reinstatement AIA confidential and proprietary information. Not for distribution. CHAPTER 18 : CLAIMS Part F :Repudiation of Liability by Insurers Repudiation of liability is based on several grounds: There was no loss or damage as reported; The loss or damage for which a claim has been made was not caused by a peril or was excluded by the policy; or The policy has been rendered void as a result of a breach in condition (implied / express) or warranty AIA confidential and proprietary information. Not for distribution. CHAPTER 18 : CLAIMS Part G :Average When under-insurance exists, the policy is subject to average Amount Payable = Sum Insured Value of property x Amount of Loss The principle of average is therefore applied to penalise the insured who has underinsured his property AIA confidential and proprietary information. Not for distribution. CHAPTER 18 : CLAIMS Part H :Claims Settlement Agreement Most motor insurers subscribe to a claim settlement agreement known as the “Knock-For-Knock” Agreement The participating insurers agree to pay the cost of repairing their own comprehensively insured cars regardless of who is to blame AIA confidential and proprietary information. Not for distribution. CHAPTER 18 Advantages of the “Knock-For-Knock” Agreement Enable motor insurers to speed up settlement of claims and reduce legal and administration expenses Disadvantage of the “Knock-For-Knock” Agreement Withdrawal of policyholder’s NCD upon settlement of any claim Normally, the policyholder will claim against the negligent motorist’s insurer and thereby retain his NCD AIA confidential and proprietary information. Not for distribution. CHAPTER 18 : CLAIMS Part I :Disputes •Disputes may involve one of the two issues: the question of whether the insurer is liable; or the quantum of loss, if the insurer is liable •Dispute is resolved through the following channels:- Negotiation Litigation Arbitration Insurance Mediation Bureau AIA confidential and proprietary information. Not for distribution. CHAPTER 18 : CLAIMS Part J :Post-Settlement Action Terminate the policy; or Reduce the sum insured, and reinstate if requested by insured, in which event new terms and conditions may be imposed AIA confidential and proprietary information. Not for distribution. CHAPTER 18 Part J :Post-Settlement Action 18.9.1 : Terminate Policy a total loss arising under the policy; or the full sum insured under the policy; or a capital sum benefit under a personal accident policy; or any claim under a fidelity guarantee policy AIA confidential and proprietary information. Not for distribution. CHAPTER 18 Part J :Post-Settlement Action 18.9.2 : Reduce Sum Insured and Reinstate, if requested 18.9.3: Impose New Terms and Conditions AIA confidential and proprietary information. Not for distribution. CHAPTER 19 PRACTICE OF GENERAL INSURANCE : POLICY FORMS AIA confidential and proprietary information. Not for distribution. CHAPTER 19 : POLICY FORMS What information can we obtain from Policy Forms? AIA confidential and proprietary information. Not for distribution. CHAPTER 19 : POLICY FORMS PART A : OVERVIEW • Fire Policy • Private Motor Car Policy AIA confidential and proprietary information. Not for distribution. CHAPTER 19 : POLICY FORMS 19.1 FIRE POLICY • Heading • Recital Clause • Operative Clause • Conditions • Exclusion • Schedule • Attestation AIA confidential and proprietary information. Not for distribution. CHAPTER 19 : POLICY FORMS 19.1 FIRE POLICY Heading • Consists of the Company’s name and address Recital Clause • Insured has proposed to the company • Proposal and declaration is basis of contract • Insured has paid or agreed to pay premium AIA confidential and proprietary information. Not for distribution. CHAPTER 19 : POLICY FORMS 19.1 FIRE POLICY Operative Clause • Coverage • Payment of loss • Compliance of condition • Option to pay cash, repair, reinstate or replace • Maximum liability of the company AIA confidential and proprietary information. Not for distribution. CHAPTER 19 : POLICY FORMS 19.1 FIRE POLICY Condition • Misrepresentation • Premium Payment • Other insurance • Fall or displacement of building • Unoccupancy • Refund of premium AIA confidential and proprietary information. Not for distribution. CHAPTER 19 : POLICY FORMS 19.1 FIRE POLICY Condition • Notification of loss • Fire Brigade charges etc • Subrogation • Fraudulent Claim • Average clause • Reinstatement of sum insured • Arbitration AIA confidential and proprietary information. Not for distribution. CHAPTER 19 : POLICY FORMS 19.1 FIRE POLICY Exclusion • Theft during or after fire, War, Pollution • Burning of property by public authority • Subterranean fire, Convulsion of nature • Bush fire, Explosion (except domestic use) • Precious stone, work of art, drawing, stamps • Spontaneous fermentation, combustion AIA confidential and proprietary information. Not for distribution. CHAPTER 19 : POLICY FORMS 19.1 FIRE POLICY Reasons for Exclusion • Cover by other appropriate policy • Further inquiry on the risk • Additional premium is necessary • The risk is uninsurable AIA confidential and proprietary information. Not for distribution. CHAPTER 19 : POLICY FORMS 19.1 FIRE POLICY Schedule • Name of insurer • Name and address of insured • Business/Occupation • Location of property insured • Period of insurance, premium & sum insured • Endorsement and warranties Attestation • This has the effect of binding insurer AIA confidential and proprietary information. Not for distribution. CHAPTER 19 : POLICY FORMS 19.2 PRIVATE MOTOR CAR POLICY • Heading • Recital Clause/Preamble • Operative Clause • General Exclusion • Conditions • Schedule • Attestation AIA confidential and proprietary information. Not for distribution. CHAPTER 19 : POLICY FORMS 19.2 PRIVATE MOTOR CAR POLICY Operative Clause • Section I: Loss or damage • Section II: Liability to 3rd Party • Section III: Medical Insurance • Section IV: Accidents to Insured AIA confidential and proprietary information. Not for distribution. CHAPTER 19 : POLICY FORMS 19.2 PRIVATE MOTOR CAR POLICY Operative Clause Section I: Loss or damage • Accidental collision or overturning • Fire or lightning, house breaking or theft • Malicious act • Direct sea route or whilst in transit AIA confidential and proprietary information. Not for distribution. CHAPTER 19 : POLICY FORMS 19.2 PRIVATE MOTOR CAR POLICY Operative Clause Section I: Exclusion • Consequential loss, depreciation • Mechanical breakdown • Act of cheating • Criminal breach of trust AIA confidential and proprietary information. Not for distribution. CHAPTER 19 : POLICY FORMS 19.2 PRIVATE MOTOR CAR POLICY Operative Clause Section II: Liability to 3rd Party • Death or bodily injury to 3rd party • Damage to property belonging to 3rd party AIA confidential and proprietary information. Not for distribution. CHAPTER 19 : POLICY FORMS 19.2 PRIVATE MOTOR CAR POLICY Operative Clause Section III: Medical Insurance • Bodily injury sustained by insured or driver Section IV: Accidents to Insured • Bodily injury sustained by insured AIA confidential and proprietary information. Not for distribution. CHAPTER 20 PRACTICE OF GENERAL INSURANCE: ETHICS AND CODE OF CONDUCT AIA confidential and proprietary information. Not for distribution. CHAPTER 20 : ETHICS AND CODE OF CONDUCT What are the good Ethics and Code of Conduct? AIA confidential and proprietary information. Not for distribution. CHAPTER 20 : ETHICS AND CODE OF CONDUCT OVERVIEW • The Essential of Inter-Company Agreement on General Insurance Business • Commission • Cash-Before-Cover • Guidelines on Claim Settlement Practices AIA confidential and proprietary information. Not for distribution. CHAPTER 20 : ETHICS AND CODE OF CONDUCT 20.1: ICAGIB (Objectives) • Promote and protect the interests of the general insurance industry • Regulate and control the conduct of every person transacting general insurance business • Monitor tariffs, commissions & remuneration AIA confidential and proprietary information. Not for distribution. CHAPTER 20 : ETHICS AND CODE OF CONDUCT 20.1.1: Dealings with Agents • Authorized agents • Restriction on payment • Compliance with regulations • Scope of agency • Suspension and Cancellation • Information AIA confidential and proprietary information. Not for distribution. CHAPTER 20 : ETHICS AND CODE OF CONDUCT 20.1.5: General Insurance Business for All Intermediaries (Exclude Insurance Broker) • General sales principles • Factors to be observed when explaining contract • Disclosure of underwriting information • Accounts and financial aspect • Documentation, existing policyholder and claim AIA confidential and proprietary information. Not for distribution. CHAPTER 20 : ETHICS AND CODE OF CONDUCT 20.1.5(a): General Sales Principles • Make prior appointment • Identify own self • Recommend policy suitable to needs • Recommend other specialist when necessary • Treat all information by prospect confidential AIA confidential and proprietary information. Not for distribution. CHAPTER 20 : ETHICS AND CODE OF CONDUCT 20.1.5(b): Explaining A Contract • Identify insurance company • Explain all essential provision • Draw attention to exclusion/restriction 20.1.5(c): Disclosure of Underwriting Information • Proposal forms are fully & accurately completed • All answers are prospect’s own responsibility AIA confidential and proprietary information. Not for distribution. CHAPTER 20 : ETHICS AND CODE OF CONDUCT 20.1.5(d): Accounts and Financial Aspect • Keep proper account • Distinguish premium from other payment • Remit money collected 20.1.5(e-g): Documentation, Policyholder & Claim • Provide all documentation to policyholder • Render appropriate after sales service • Inform insurer immediately should claim arise AIA confidential and proprietary information. Not for distribution. CHAPTER 20 : ETHICS AND CODE OF CONDUCT 20.2: Commission • No discount or rebate is allowed 20.3: Cash Before Cover • Part XV Regulation 65 of the Insurance Regulation 1996 provides that an insurer or its insurance agent shall not assume motor policy unless the premium has been paid AIA confidential and proprietary information. Not for distribution. CHAPTER 20 : ETHICS AND CODE OF CONDUCT 20.4: GUIDELINES ON CLAIMS SETTLEMENT Part I: Deal with claims other than motor - Claim procedure - Disclosure of material fact Part II: Deal with motor insurance claims - Own damage - Theft - 3rd Party AIA confidential and proprietary information. Not for distribution. - Total loss - Subrogation Thank You AIA confidential and proprietary information. Not for distribution.