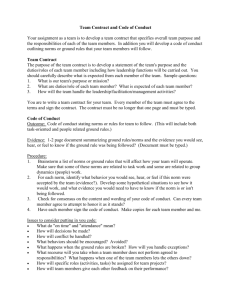

IFRS and Accounting Education: Rules vs. Principles

advertisement

Financial Reporting: Roles of Written and Unwritten Requirements Shyam Sunder Yale School of Management Consultative Committee of the Autorité des Normes Comptables (ANC) Paris, France, June 22, 2011 The Ultimate Man-Bites-Dog News Story • L. Gordon Crovitz column on Information Age in the Wall Street Journal, June 20, 2011 • http://online.wsj.com/article/SB10001424052702303635604576 391802026638250.html • A strange thing happened in Washington earlier this month: After spending two years studying an issue, a federal agency published a 475-page report documenting the problem only to announce that government is not the solution. • • • Internet and Local News Reporting The FCC study, "Information Needs of Communities,” 50 percent drop in state and local news reporting and staffs; internet undermines the advertising-based business model of local newspapers, role of search engines "Just because we have identified a problem does not mean we can solve it," Steven Waldman, the lead researcher for the agency, told me last week. "We did not feel we had to show some big regulatory pot of gold at the end of the rainbow to prove this work had value." Importance of the Problem and Efficacy of Solutions • Is the drop in local news reporting an important matter for a democratic society? • Should we try to find a solution to the problem? • What if we are unable to find a solution that has a reasonable chance of improving the state of affairs? – Wait until we can find a better solution? – Go ahead and do what we can even if we know it is unlikely to solve the problem? Specifics vs. Structure of Problems in Financial Reporting • Most debates on accounting standards (including IFRS) are confined • • • • • • to merits of specific written standards In this narrow debate, we assume that a new or revised written standard will solve the problem We need to go beyond the confines of specific details of standards Roles of written and unwritten standards? Which standards are best left unwritten? What should be the structure of institutions we create to decide this Do we have institutions that do not favor writing new standards? Let us start with examination of some commonly-held beliefs in financial reporting 1. Universal Standards • – – – – Universal written standards of financial reporting applied across time, economies, industries and corporate size and organizational forms best serve the constituent interests Standardization does save costs and effort, (electrical plugs, clothing, cars, street grids, commercial codes) Becomes counterproductive beyond certain limits How do we know where to stop? Rhetoric of universal accounting standards and universal language (Esperanto?) 2. The Static Ideal • There exists a set of written financial reporting standards that, once discovered and implemented, will induce corporations and their auditors to prepare the best attainable financial reports – – Dynamics of the game between managers and standard setters makes any such static ideal all but impossible Standards are only a (small) part of the problem 3. People or Structure • If we select knowledgeable, experienced, self-less, public-spirited, and wise individuals to constitute bodies that devise accounting standards through deliberation and due process, we can improve financial reporting – – Individuals stand where they sit Much emphasis on the quality of individuals, too little attention to the structure of game they are asked to play • 4. Engineering of Standards through Deliberation It is possible to construct or discover better written financial reporting standards through deliberation in properly organized corporate entities (such as the IASB, the FASB, etc.). – – – Assumes that such bodies can know the consequences of their actions No evidence in history to support this proposition Written standards by authoritative bodies have repeatedly failed to yield their stated outcomes 5. Specialization in Setting Standards • Specialist standard setting bodies, standing ready to address new problems, inquiries and requests for clarifications help improve financial reporting – – – – Their existence encourages a new “clarification” game targeted at them They must keep a full agenda (performance) Revenue and budget pressures Over time, their written output must accumulate to a thick rule book 6. What is Good and Bad? • – – – – Standard setters can tell which written standards are better, and why; and what would happen if a rule were left unwritten Little evidence that they know, or can know Cost-of-capital is the result of complex interactions among many factors (including accounting) These influences cannot be sorted out by ex ante analysis Ex post analysis of data to assess the impact on cost of capital may be possible 7. Standards Monopolies • Granting monopoly power in a given jurisdiction to standards written by a given body can help improve corporate financial reporting – Informational disadvantage of a monopoly – No opportunity for experimentation – No opportunity to learn from the experience of alternatives; arrogance – No pressure to do better, or to correct errors • 8. Competition and Race to the Bottom A regime that encourages reporting entities to choose among the standards written by competing organizations (and paying them a royalty for the privilege) induces a “race to the bottom” to devise less demanding standards – Counter examples (Stock exchanges, bond rating services, appliance standards, college accreditation, bank regulation, corporate charters across 50 states in U.S., etc.) 9. Force and Effectiveness • Increase in the power of enforcement behind authoritative standards improves compliance and quality of financial reporting – – – Increased enforcement also increases resources devoted to evasion Draconian punishments do not necessarily induce better behavior Crime, alcohol and drug abuse (recent report on failure of the War on Drugs) • 10. Statutory Approach Dominates Common Law The quasi-statutory approach to setting accounting standards (writing everything down) dominates a common law approach to financial reporting (leave significant parts unwritten, and subject to professional judgment) – – Evidence? Constitution (U.K., U.S., Europe) • 11. Written Standards Dominate Social Norms Written standards backed by power of enforcement work better than unwritten social norms backed only by internal and external informal sanctions – – – – Social norms govern great parts of our lives including many aspects of law Insider trading Guilty beyond reasonable doubt Private commercial codes (cotton, diamond trades) 12. Who defends the middle ground? • The ideal accounting regime would consist of all written standards or all social norms – – Easier to make the extreme cases for standards or norms alone Difficulty of defending the middle ground where both written and unwritten standards may coexist, as they do in many other aspects of life 13. New Problems, New Solutions • Often assumed that financial reporting and governance problems originated in the 20th century – – – History tells us otherwise Governance problems of the East India Company Clive, Hastings, and the Company’s Court of Directors • 14. Financial Reporting is Getting Better – – – – Seventy five years of standardization of financial reports (in U.S.) has helped improve the quality of financial reporting Evidence? Is a thicker rulebook indication of better financial reporting? Perfect correlation between accounting and stock returns? How do we judge if our financial reports are getting better? • 15. Fewer Alternatives, Better Reports Fewer the alternative treatments the reporting entities are allowed to choose from, the better the quality of financial reporting – Fewer alternatives also tie the hands of the management of well-run companies who may wish to signal their confidence, competence and prospects by choosing reporting practices others find difficult to emulate 16. Auditor’s Bargaining Power • Well-specified standards enhance the bargaining power of the auditor vis-à-vis the client – – – Standards also encourage clients to demand: show me the rule Reduced reliance on judgment More detailed the standards, greater the part of accountant’s work that can be replaced by a computer, and lower the value of the service 17. Accounting & Auditing Games • Written standards constrain the tendency of managers, auditors and investment bankers to play accounting and auditing games – On the contrary, they encourage and facilitate game-playing by reducing uncertainty about what is, and is not, acceptable – 3 percent rule for Special Purpose Entities => Enron 18. Individual responsibility • Written financial reporting standards strengthen the individual responsibility of managers, auditors, and investment bankers for fair representation – On the contrary, they undermine individual responsibility for fair representation and the big picture by shifting attention to meeting the letter, not spirit, of the specific provisions and their wording 19. Education • Written standards make it easier to educate better accountants and attract talent to the profession – – Written standards degrade the class room from reasoning and intellectual debate to rote memorization, reinforce street image of accounting as boring and mechanical They make it less attractive to young talent 20. Nothing’s New under the Sun • Have I said something new? – I wish. William T. Baxter (Professor Emeritus, LSE), made many of these arguments over half-a-century ago (“Recommendations on Accounting Theory” in Baxter and Davidson, Studies in Accounting Theory, 1st edition). Beware of Consensus • A different perspective • You would be left behind if you do not follow the crowd • Washington Consensus • Accounting Consensus—five main elements Accounting Consensus 1 • The standards developed should be confined to principles, and not become detailed rules – Nobody can tell which is which – IFRS vs. FAS, yet plans to adopt FAS wholesale – Fair values: principle or rhetorical device Accounting Consensus 2 • A single set of high quality written standards of financial reporting applied to all companies (at least the publicly traded ones) in the world will improve financial reporting by making financial reports more comparable, and thus assist investors and other users of financial statements make better decisions – – – – All prefer high quality, but what is it (Joyce et al. Principles-comparability contradiction Accounting for research & development costs (FAS 2) Evidence that accounting standards help investors or managers make better decisions? Accounting Consensus 3 • The best way to develop such standards is to create a single deliberative corporate body consisting of appropriate experts with a proper governance structure and legally assured funding, functioning under the oversight of statutory regulatory authorities such as the SEC and the EC – – – – – – Difficulty of assessing proposed standards Even simple engineering design need field trials Complexity of social institutions, risk of getting boxed into a wrong standards Division of simplicity and complexity between strategy and institutions Ecosystem view of financial reporting system Competition with no tax revenues Accounting Consensus 4 • To this end, the operations of the FASB and the IASB should be gradually merged into one corporate body and one set of standards to be called IFRS – From social norms to uniform written standards – Effect of uniformity of education, research and profession – Compare accounting education to education for other professions Accounting Consensus 5 • This single set of standards should be practiced in the U.S., EC, and elsewhere, and the U.S. educational system should prepare itself to integrate IFRS into its curricula so U.S. graduates will be able to prepare, use, and audit financial reports based on IFRS – Educational consequences an afterthought at best – Effect of expansion of written standards on classroom discourse – Educational capacity: chance to shift to general principles of accounting – Place of accounting in the university: medicine or plumbing The Problem of Setting Efficient Standards Criteria • • Generation of alternatives • Evaluation of alternatives • Complex interactions among accounting, capital and labor markets • Facilitation of evolution of accounting norms • Balancing statutory and common law • Balancing adjustment speed and errors • No substitute for personal responsibility • The nanny does not know, but can help How Can the Nanny Help? • Government, quasi-government or private sector bodies can play a positive role in evolution of norms of accounting through oversight – – – – No monopoly jurisdiction Competition with alternatives (royalties) Opportunity to experiment Co-existence of multiple sets of standards for different clienteles— diversity essential to evolution – Excel conversion workbooks (high R-square) – Personal responsibility for fair representation – Accounting Court: guilty beyond reasonable doubt In Contrast to IASB (FASB) Command & Control View • To develop accounting standards: – – – – – A single set (monopoly?) Of high quality (what does that mean?) Understandable (to who?) Enforceable (stick, not norms) Global (no clientele or diversity) • Are we ready for an alternative mind set about financial reporting? • • • • • • • • Whither Accounting: Windows™ or Open Systems Comfort vs. choice Uniformity and stagnation vs. dynamic change Predictability vs. some disorder High prices or the advantages of technological progress Financial reporting as an eco-system or a machine (garden or a building) Huxley or Hayek Nanny or personal responsibility Role of accounting researchers/professors? Concluding Remarks • In the preface to his Dictionary, Johnson wrote about his “fortuitous and unguided excursions into… the boundless chaos of a living speech.” • Can authoritative uniform written standards without collaboration with (unwritten) social norms bring a semblance of order to the chaos to financial reporting? • After seven decades of incessant efforts, the answer stares us in the face Thank You. Shyam.sunder@yale.edu www.som.yale.edu\faculty\sunder