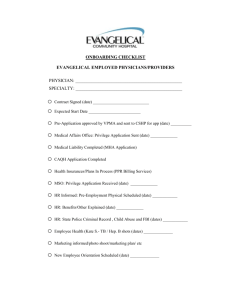

Presentation - Alston & Bird LLP

advertisement

Group Practice Requirements & Advantages Under the Stark Law Rob Stone, Esq. Alston + Bird Presentation for Georgia Hospital Association January 30, 2009 Presentation Objectives • Understand requirements necessary to qualify as a Group Practice under Stark. • Understand the special rules related to a group practice compensating its owners and employees – Profit Sharing – Productivity Bonuses • Understand the In-Office Ancillary Services Exception, including its requirements, limitations and relationship to the Group Practice definition. 1 Why bother qualifying as a Group Practice? • Meeting the definition of a group practice allows the practice to: (1) Take advantage of special compensation rules for its physicians: • A group practice is allowed to share profits with its member physicians. • A group practice is allowed to pay certain productivity bonuses to its member physicians. (2) Take advantage of the “In-Office Ancillary” exception to Stark. 2 Why bother qualifying as a Group Practice? • The Anti-Kickback Statute safe harbor for “investments in group practices” specifically cross references the Stark Law definitions of Group Practice and In-Office Ancillary Services. – In order for a physician-owner of a group practice to fit within the AKS safe harbor, the practice must qualify as a “group practice” under Stark. (Recent OIG Advisory Opinion 08-24) 3 Group Practice Requirements In order to qualify as a Group Practice under Stark, an entity must meet all of the following requirements. • Single legal entity • Physicians – minimum of two who are either owners or employees of the group (as opposed to independent contractors) • Range of Care • “Substantially All” Test • Expenses & Income • Unified Business • Volume/Value of Referrals • Physician/Patient Encounters 4 Single legal entity • The practice must consist of a single legal entity (e.g. P.C., LLC, NFP corporation, faculty practice plan) • Operating primarily for purpose of being a physician group practice (a hospital may not be a group practice) • May be organized by any party or parties (including physicians, health care facilities or others) • May be owned (in whole or part) by another practice organization, so long as it is no longer functioning as a group practice. 5 “Substantially All” Test • Substantially all (i.e. at least 75%) of the total patient care services of the group practice members, must be furnished through the group and billed under the group’s billing number • Patient care services means: (i) total time each member spends on patient care services, as documented by any reasonable means; or (ii) any alternative measure that is reasonable, fixed in advance, uniformly applied, verifiable and documented. • Data used to calculate compliance must be made available to Secretary of HHS upon request. • HPSA Exception for the Substantially All test • Start-up period (reasonable, good faith effort at compliance) • Admitting new members (12 month grace period) 6 Other Requirements – Part I • Physicians: At least 2 physicians who are “members of the group” (i.e. either employees or direct/indirect owners) – Per CMS guidance, solo practitioners may also take advantage of the benefits of group practice. • Range of Care: Each employed or owner physician (not including independent contractor physicians) must furnish substantially the full range of patient care services that the physician routinely furnishes through the group practice. • Expenses & Income: Overhead expenses and income must be distributed according to methods determined before receipt of payment. 7 Other Requirements – Part II • Unified Business: Centralized decision making, consolidated billing, accounting and financial reporting • Volume/Value of Referrals: Except for special rules on bonuses and profit sharing, no compensation to physicians based on volume/value of referrals. • Physician/Patient Encounters: Members (owners/employees) of the group must personally conduct no less than 75% of the physician-patient encounters of the practice. 8 Special Rules for Productivity Bonuses & Profit Sharing • A “physician in a group practice” (which includes employees, owners, and some independent contractors) may be paid – A share of overall profits of the group; – A productivity bonus based on services that he or she has personally performed (including services “incident to”) • Neither of the above may be determined in any manner that is directly related to volume or value of referrals of DHS by the physician. 9 Profit Sharing • Division of overall profits must be done in a “reasonable and verifiable” manner that does not directly relate to volume or value of referrals of DHS. • Overall profits means group’s entire profits derived from DHS, or profits derived by any component of the practice consisting of at least 5 physicians. • Share of the profits will be deemed not to relate directly to volume/value in the following situations: – Per capita division; – DHS revenues are distributed based on distribution of group’s non-DHS revenues; or – Revenues from DHS are less than 5% of group’s total revenues and allocated portion of the DHS revenues constitute 5% or less of individual physician’s total compensation. 10 Productivity Bonus • Productivity bonus should be calculated in a “reasonable and verifiable” manner not directly related to volume/value of physician’s referrals of DHS. • A bonus will be deemed not directly related to volume/value if: – Based on physicians total patient encounters or RVU’s (including “incident to”); – Based on allocation of physician’s compensation attributable to services that are not DHS; or – Revenues derived from DHS are less than 5% of group’s total revenues and the allocated portion of the revenues to each physician represent 5% or less of that physician’s total compensation from the group. 11 In-Office Ancillary Services Exception (IOAS) • Creates a Stark exception for most DHS services (only furnishing certain DME is protected under IOAS) • In order for a particular service to qualify for the IOAS exception (allowing a physician to make a referral for that service to an entity with which the physician has a financial arrangement), the service must meet all of the following requirements: – Be performed by certain individuals; – Be performed in certain locations; and – Billed by certain person or entity. 12 In-Office Ancillary Services Exception (IOAS) • Examples of common In-Office Ancillary services include: – X-ray machine (owned/leased by group and colocated with the group practice) – Lab services (owned/leased by group and colocated with the group practice) – Prescription drugs provided to patients of the group – Physical Therapy/Occupational Therapy – Certain DME (crutches, walkers, folding manual wheelchairs, infusion pumps, glucose monitors) 13 IOAS – Performed By • The DHS must be performed personally by: (1) the referring physician; (2) a physician who is a member of the same group practice as the referring physician; or (3) an individual who is supervised by the referring physician or supervised by another physician in the same group practice as the referring physician. 14 IOAS Supervision Requirement • CMS has stated that the supervision requirements of the IOAS exception are equivalent to whatever supervision requirements Medicare has for billing the service. • Note that a group’s independent contractors who meet the following criteria are allowed to provide supervision under the IOAS exception: – – – – Direct contract between the physician and the group; Treating group’s patients; On group’s premises; Have properly reassigned their claims to the group. 15 IOAS – Location Requirement “Same Building” • The service must be furnished in one of the following locations: – Option I - the “same building” in which: • • (i) The referring physician (or his or her group) has an office that is normally open to the physician’s (or group’s) patients for medical services at least 35 hours per week; and (ii) the referring physician (or one or more members of that physician’s group) regularly practice medicine and furnishes physician services at least 30 hours per week (these 30 hours must include services unrelated to DHS payable by a government or private payer). 16 IOAS – Location Requirement “Same Building” – cont’d • “Same building,” Option II: • • • The patient receiving the DHS service usually receives physician services from the physician or members of the group, the referring physician (or group) owns or rents an office that is normally open to the physician’s (or group’s) patients at least 8 hours per week; and the referring physician regularly practices medicine and furnishes physician services to patients at least 6 hours per week (these 6 hours must include some physician service unrelated to DHS payable by government or private payor). 17 IOAS – Location Requirement “Same Building” – cont’d • “Same building,” Option III: • • • The referring physician is present and orders the DHS during a patient visit on the premises; the referring physician (or group) owns or rents an office that is normally open to the physician’s (or group’s) patients for medical services at least 8 hours per week; and the referring physician (or group) regularly practices medicine and furnishes physician services to patients at least 6 hours per week (which must include physician services unrelated to DHS payable by government or private payer). 18 IOAS – Location Requirement “Same Building” – cont’d • • For all options, the “same building” means a structure (or combination of structures) that share a single street address as assigned by the Postal Service. Excluding all exterior spaces (lawns, courtyards, driveways, parking lots) and mobile vehicles, vans or trailers. 19 IOAS – Location Requirement “Centralized Building” • Alternatively, the DHS may be performed at a “Centralized Building,” which is defined as: – – – – All or part of a building (including a mobile vehicle, van, or trailer); That is owned or leased on a full-time basis (24/7) for a term of not less than 6 months, by a group practice; and Used exclusively by the group practice. Note: a group may have more than one Centralized Building. 20 IOAS – Billing Requirement • The service must be billed by one of the following: – The physician performing or supervising the service; – The group practice of which the performing or supervising physician is a member under a billing number assigned to the group practice; – The group practice if the supervising physician is a “physician in the group practice” under a billing number assigned to the group practice (this includes some independent contractor physicians providing medical care to patients of the group) 21 IOAS – Billing Requirement • The service must be billed by one of the following (continued): – An entity that is wholly owned by the performing or supervising physician or by that physician’s group practice under the entity’s own billing number or under a billing number assigned to the physician or group practice; or – An independent third party billing company acting as an agent of the physician, group practice or entity under a billing number assigned to the physician, group, or entity. 22 In-Office Ancillary Exception • DME Limitations – The In-Office Ancillary Exception is available for certain, limited DME, including canes, crutches, walkers, and folding manual wheelchairs, infusion pumps and blood glucose monitors, if they meet certain additional conditions. – To qualify, the group practice must also qualify as a Medicare certified DME supplier. • Special Rules for Home Care Physicians – For a physician who primarily treats patients in their private homes, the “same building” requirements are met if the referring physician (or qualified nurse or tech accompanying the physician) provides the DHS contemporaneously with a physician service that is not a DHS. 23 Differences Between Qualifying as a Group Practice and the IOAS Exception • Meeting the Group Practice requirements allows a group of affiliated physicians to share revenue in ways that might otherwise be prohibited. It also allows a group to take advantage of the IOAS exception. • The IOAS exception describes a set of services which are not subject to the Stark law restrictions. It allows physicians to refer for these services (that would otherwise be considered DHS) to entities (i.e. a Group Practice) with which the physician has a financial relationship (either ownership or employment). 24 Additional Issues • Ownership and Corporate Structure of a Group Practice • Employment by a hospital versus formation of a group practice. • Use of Independent Contractors • Use of Mobile Facilities • Leasing of Equipment/Space • Pharmaceuticals • Shared Space Arrangements 25 Ownership and Corporate Structure of a Group Practice • Under the “single legal entity” requirement, the group practice entity may be legally organized by any party or parties, including physicians, health care facilities or others. • However, it must be formed primarily for the purpose of being a physician group practice (this excludes hospitals from meeting the group practice requirements. 26 Ownership and Corporate Structure of a Group Practice – Cont’d • Examples of corporate structures cited affirmatively by CMS: – Partnership between physicians; – Partnership between physician and another party; – LLC (must have at least 2 physicians as owners and/or employees) – Single legal entity owned by physicians through their individual P.C.’s – Joint venture with or without physician ownership (if it employees at least 2 physicians). 27 Implications of Direct Employment by Hospital or Health Care Facility • Physicians employed by a hospital cannot qualify as a group practice. • These physicians cannot receive share of profits generated from the hospital’s DHS services. • Under the Stark Employment Exception, these physicians may receive productivity bonuses for services personally performed (but not under the group practice rules). 28 Implications of Employment via Subsidiary of Hospital • Subsidiary may qualify as a group practice. • Physicians can receive share of profits generated from DHS services that are performed in compliance with the IOAS exception (but not DHS services conducted by the hospital). • In either case, physicians may receive productivity bonuses for services personally performed (this is included in the Stark employment exception). 29 “Physician in the group practice” (e.g. Independent Contractors) • Requirements for an independent contractor to be considered a “physician in the group practice:” – Has a contract directly with the practice; – To provide services to the practice’s patients in the practice’s facilities; – Except for productivity bonuses or profit shares, does not receive compensation based on volume/value of referrals; – Services are billed by the group under a contract that complies with the reassignment rules. – Phase III commentary indicates concern about use of independent contractors in centralized buildings. 30 “Physician in the group practice” (e.g. Independent Contractors) • Are not included in the 2 or more physicians test. • Are not included in the “range of care” or “substantially all” requirements. • Are not factored in to the 75% physician/patient encounter requirement. • Are allowed to receive productivity bonuses or profit shares. • May be allowed to make referrals to the group for DHS under the IOAS or personal services exceptions (assuming the relevant requirements are met). • Under the IOAS exception, allowed to provide requisite supervision of DHS services that are referred by another physician in the group. 31 Mobile Facilities • “Centralized Building” includes a mobile vehicle, van or trailer that is owned or leased on a full-time basis . • Nothing in the group practice or IOAS exception prohibits physicians or group practices from – Purchasing the technical component of mobile services (see the purchased diagnostic testing rules); – Arranging for a mobile provider to treat patients at the physician or group’s office (as long as the arrangement fits an exception) • Note: the rural provider ownership exception may apply to protect some ownership interests in mobile facilities. 32 Leases • Part-time leases for centralized buildings are not allowed. – Group practices may lease or sublease DHS facility space (including mobile units) to or from other group practices or solo practitioners on a part-time basis – but DHS provided to patients of a part time lessee will not fit the IOAS exception. • Nothing in these rules prohibit a physician or group practice from leasing equipment that is used in the performance of DHS. 33 Outpatient Prescription Drugs • DHS is “furnished” where the service is performed or where an item is dispensed to a patient in a manner sufficient to meet applicable Medicare payment rules. • As a result, outpatient prescription drugs (which are considered DHS under Stark) that are dispensed in the group practice’s facilities (either same or centralized building) may be covered by the IOAS exception. 34 Shared Space Arrangements • Under the “same building” requirement of the IOAS, shared facilities are allowed, to the extent they comply with the other IOAS requirements (supervision, location and billing). • Per Stark III, “a physician sharing a DHS facility in the same building must control the facility and the staffing at the time the DHS is furnished to the patient. . . . As a practical matter, this likely necessitates a block lease arrangement for the space and equipment used to provide the DHS” (emphasis added). • Per use fee arrangements are frowned on by the Stark III commentary. 35 Group Practice Requirements & Advantages Under the Stark Law Rob Stone, Esq. Alston + Bird Presentation for Georgia Hospital Association January 30, 2009 36