0TAXB_Supplement

advertisement

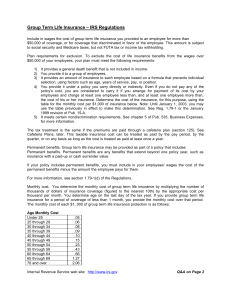

Supplement to 2015 McBride/Nellen Federal and California Update for Businesses & Estates 2015 TAXB Supplement NOTE – This document continues to be updated through early January 2016. You might want to just use it online rather than print it. Also, links are live. Table of Contents 2015 TAXB Supplement ............................................................................................................... 1 Chapter 1: 2015 New Law ........................................................................................... 2 Congress Ends File and Suspend Practice .............................................................................. 2 Chapter 2: Expiring Tax Provisions and 2016 Inflation Adjustment Amounts ................................................................................................................................. 3 Chapter 3: Affordable Care Act (ACA) Impact on Business ...................... 3 Chapter 4: Credits ........................................................................................................... 3 Chapter 5: Partnerships and LLCs .......................................................................... 3 Chapter 6: C Corporations........................................................................................... 3 Cal Pure Pistachios, Inc., No. CV 14-5237-DMG (CD CA, 4/10/15) - Corporate Estimated Tax Payments Where $0 Tax In Prior Year ........................................................................... 3 Schedules UTP and M-3 ........................................................................................................... 6 Chapter 7: State of California and Multistate................................................... 6 ABLE Accounts ......................................................................................................................... 6 FTB Information and Phone Directory .................................................................................. 7 2015 Letters to Assessors .......................................................................................................... 7 Property Tax Forms List .......................................................................................................... 7 Equipment and Fixtures Factors for 2016 .............................................................................. 7 Multistate Tax Data Reports.................................................................................................... 7 Chapter 8: Accounting Methods and Section 199 .......................................... 8 Notice 2015-82 (11/24/15) – Increase in De Minimis Safe Harbor Expensing Amount for Taxpayers without AFS ............................................................................................................ 8 Rev. Proc. 2015-56 - Restaurant and Retail Improvement Safe Harbor Method............... 9 Stine, LLC, No. 2:13-03224 (WD LA, 1/27/15) - Placed In Service ..................................... 10 City Line Candy & Tobacco Corp - Measuring Gross Receipts for the Small Retailer Exception of §263A ................................................................................................................. 12 Greiner, No. 13-520T (Fed Cls., 7/22/15) - Is Change from Ordinary Income To Capital Gain a Method Changes? ....................................................................................................... 13 Chapter 9: S Corporations ......................................................................................... 15 2015 TAXB Supplement Page 1 Supplement to 2015 McBride/Nellen Federal and California Update for Businesses & Estates Chapter 10: Worker Classification and Payroll Tax .................................... 15 CCA 201522004 (IRS, 5/29/15) - Late Payment Penalties Are Not Wages For Employment Tax Purposes .................................................................................................... 15 IRS Seeking Information From PEOs for the Voluntary Certification Program ............ 17 SBSE 04-1115-0073 - New Exam Procedure for Substitute For Returns .......................... 18 Chapter 11: Income Taxation of Trusts and Estates ................................. 18 Chapter 12: Estate, Gift, and GST Tax ............................................................... 18 Chapter 13: Tax Exempt Organizations ............................................................. 18 Gamehearts - Gaming Found Not to Qualify for 501(c)(3) Status ...................................... 18 Parks and Parks Foundation, 145 TC No. 12 (11/17/16) - Private Foundation Liable for §4945 Excise Tax For Radio Messages.................................................................................. 19 Chapter 14: International Tax ................................................................................. 20 Notice 2015-79 - Inversion Guidance .................................................................................... 20 IRS Upgrades, Enhances FATCA Registration System ...................................................... 21 Chapter 15: Looking Forward .................................................................................. 21 Chapter 1: 2015 New Law Congress Ends File and Suspend Practice P.L. 114-74 (11/2/15), Bipartisan Budget Act of 2015, that most notably for tax purposes includes new partnership audit procedures, also includes some Social Security Changes. Per the Congressional Research Service summary: “Subtitle C--Protecting Social Security Benefits (Sec. 831) Provisions in the Social Security Act related to deemed filing, dual entitlement, and benefit suspension are amended to prevent individuals from obtaining larger benefits than Congress intended. (Sec. 832) In making an initial determination of disability, the SSA must make every reasonable effort to ensure that a qualified physician, psychiatrist, or psychologist has completed the medical portion of the case review. (Sec. 833) Specified payroll tax revenues are reallocated to the Disability Insurance Trust Fund to pay benefits until 2022. (Sec. 834) The SSA may verify certain financial information when an individual requests a waiver of an overpayment because they are without fault and unable to repay the funds.” The provision at Act Sec. 831 is described as “closure of unintended loopholes.” It amends 202(r) of the Social Security Act by removing paragraphs (1) and (2) and inserting new (1) and (2), effective for individuals who reach age 62 in any year after 2015. It also adds new paragraph 2015 TAXB Supplement Page 2 Supplement to 2015 McBride/Nellen Federal and California Update for Businesses & Estates (z) on voluntary suspension, effective for requests for benefit suspension submitted beginning at least 180 days after 11/2/15. It ends the ability some couples have had and used where one spouse files for benefits and then suspends them to claim later. This practice can allow a spousal benefit to the other spouse that is greater than that spouse would get on their own. Meanwhile, the suspended account continues to grow in terms of eventual benefit that can be obtain (when the suspension ends). The SSA has a description of suspending retirement benefits at https://www.ssa.gov/planners/retire/suspend.html. Chapter 2: Expiring Tax Provisions and 2016 Inflation Adjustment Amounts Chapter 3: Affordable Care Act (ACA) Impact on Business Chapter 4: Credits Chapter 5: Partnerships and LLCs Chapter 6: C Corporations Cal Pure Pistachios, Inc., No. CV 14-5237-DMG (CD CA, 4/10/15) - Corporate Estimated Tax Payments Where $0 Tax In Prior Year Cal Pure Pistachios, Inc., No. CV 14-5237-DMG (CD CA, 4/10/15) – CPP’s return for the year ended 8/31/08 showed $0 tax due. CPP’s interpretation of estimated tax rule of 6655(d) was that it owed no estimated taxes for the year ended 8/31/09 and made none. The IRS assessed an estimated tax penalty for that year of $94,672, plus interest. Section 6655(d)(1)(B) provides: (d) Amount of required installments. For purposes of this section— (1) Amount 2015 TAXB Supplement Page 3 Supplement to 2015 McBride/Nellen Federal and California Update for Businesses & Estates (A) In general. Except as otherwise provided in this section, the amount of any required installment shall be 25 percent of the required annual payment. (B) Required annual payment. Except as otherwise provided in this subsection, the term “required annual payment” means the lesser of— (i)100 percent of the tax shown on the return for the taxable year (or, if no return is filed, 100 percent of the tax for such year), or (ii)100 percent of the tax shown on the return of the corporation for the preceding taxable year. Clause (ii) shall not apply if the preceding taxable year was not a taxable year of 12 months, or the corporation did not file a return for such preceding taxable year showing a liability for tax. As summarized by the District Court: “In essence, the parties disagree as to whether "$0.00" in tax indicates "no liability" for tax or a liability of $0.00.” That is, the IRS argues that (B)(ii) does not apply to CPP because there was no tax shown on the prior year return. Per the IRS, $0 tax indicates no liability for tax. The IRS also supported its position by rules applicable to S corporations and individuals. As summarized by the court: “Congress's omission of the requirement that an S corporation file a tax return for the preceding taxable year "showing a liability for tax" in section 6655(g)(4)(D) and the absence of such requirement for individuals under section 6655(d)(1)(B)(ii) indicate that "Congress intended that the requirements have a separate and special significance for C corporations, such as plaintiff."” CPP argued that “liability for tax” has always included “zero” as a possibility. However the court found these assertions to be unsupported. Per the court: “Even without looking to the legislative intent of the statute, a mere functional reading of the language in Section 6655(d)(1)(B) is itself illuminating as to how to interpret $0.00 in tax. … Section 6655(d)(1)(B) plainly states that clause (ii) is inapplicable where a corporation did not file a return for the preceding taxable year showing a liability for tax. Plaintiff attempts to skirt the exception to the safe harbor by arguing that filing a tax return reflecting "$0.00" in liability is somehow distinguishable from not filing a return showing a liability for tax. The Court sees no distinction between the two. Plaintiff filed a 2008 tax return showing zero liability for tax- whether zero is expressed as "$0.00," "0," "N/A," "nada," "zilch," or through the absence of filing, the result is the same: Plaintiff did not file a return showing a tax liability. Plaintiff's interpretation of the statutory language finds no support in basic rules of statutory construction or in case law. If corporations that claimed no tax liability in a prior year could take advantage of the safe harbor provision by simply filing a return stating "$0" rather than not filing a return at all, they would all have an option to pay nothing, as opposed to what they actually owe for the current taxable year. "[S]tatutory interpretations which would produce absurd results are to be avoided."…” CPP also noted that the $95,000 penalty was “irrational and arbitrary,” noting that had it paid $1 in tax for 2008, it would owe no penalty for 2009. The court noted though that the IRS interpretation was “entitled to considerable deference” The court also stated that the tax law “sometimes presents harsh results” but that “does not negate the fact that the law must be enforced as written by Congress.” 2015 TAXB Supplement Page 4 Supplement to 2015 McBride/Nellen Federal and California Update for Businesses & Estates Observations: The language of 6655 for corporate estimated tax payments is not identical to that of 6654 for estimated tax payments of individuals. The language regarding the amount of required installments is similar: § 6654 - Failure by individual to pay estimated income tax (d) Amount of required installments. For purposes of this section— (1) Amount § 6655 - Failure by corporation to pay estimated income tax (d) Amount of required installments. For purposes of this section— (1) Amount (A) In general. Except as provided in paragraph (2), the amount of any required installment shall be 25 percent of the required annual payment. (A) In general. Except as otherwise provided in this section, the amount of any required installment shall be 25 percent of the required annual payment. (B) Required annual payment. For purposes of subparagraph (A), the term “required annual payment” means the lesser of— (B) Required annual payment. Except as otherwise provided in this subsection, the term “required annual payment” means the lesser of— (i) 90 percent of the tax shown on the return for the taxable year (or, if no return is filed, 90 percent of the tax for such year), or (ii) 100 percent of the tax shown on the return of the individual for the preceding taxable year. Clause (ii) shall not apply if the preceding taxable year was not a taxable year of 12 months or if the individual did not file a return for such preceding taxable year. (i)100 percent of the tax shown on the return for the taxable year (or, if no return is filed, 100 percent of the tax for such year), or (ii)100 percent of the tax shown on the return of the corporation for the preceding taxable year. Clause (ii) shall not apply if the preceding taxable year was not a taxable year of 12 months, or the corporation did not file a return for such preceding taxable year showing a liability for tax. Section 6654(e) provides: (2) Where no tax liability for preceding taxable year. No addition to tax shall be imposed under subsection (a) for any taxable year if— (A) the preceding taxable year was a taxable year of 12 months, (B) the individual did not have any liability for tax for the preceding taxable year, and 2015 TAXB Supplement Page 5 Supplement to 2015 McBride/Nellen Federal and California Update for Businesses & Estates (C) the individual was a citizen or resident of the United States throughout the preceding taxable year. Thus, §6654 specifically refers to a situation where the individual “did not have any liability for tax” in the prior year. This statement is not included in §6655. The IRS website on estimated taxes further stresses: Pub 542, Corporations, stresses that if using the prior year return approach to determine estimated taxes, the “return must have shown a positive tax liability (not zero).” [pages 6 – 7] Schedules UTP and M-3 In October, the IRS released a 52-page report through Tax Notes entitled, Schedule M-3 Profiles of Schedule UTP Filers by IRC Section Cited. A few observations: 1. For 2012 forms, only about 5% of businesses with over $10 million of assets file Schedule UTP (about 2,200 taxpayers). This represents about 58% of the total assets of the set of large taxpayers. 2. For 2011 and 2012 UTP schedules, the top two IRC provisions listed were the research credit (§41) and transfer pricing (§482). Chapter 7: State of California and Multistate ABLE Accounts SB 324 (Chapter 796, 10/11/15) – Enables creation of ABLE accounts as specified in IRC 529A, enacted in 2014. Provisions include one account per individual, only California residents may 2015 TAXB Supplement Page 6 Supplement to 2015 McBride/Nellen Federal and California Update for Businesses & Estates create accounts, and contributions must be in cash. The changes to the corporate law for ABLE accounts was enacted by AB 449 (Chapter 774, 10/11/15). FTB Information and Phone Directory FTB Pub 1240 includes the practitioner hotline numbers and the phone directory of many FTB offices and activities. 2015 Letters to Assessors The complete list can be found at http://www.boe.ca.gov/proptaxes/2015.htm. Property Tax Forms List http://www.boe.ca.gov/proptaxes/pdf/lta15006.pdf Equipment and Fixtures Factors for 2016 See BOE Letter to Assessors, No. 2015/053 (11/25/15) and links to Assessors’ Handbook Section 581. Multistate Tax Data Reports 1. Council on State Taxation (COST) – In October, COST released its annual report prepared by EY, Total State and Local Business Taxes: State-by-State Estimates for Fiscal Year 2014. Findings include: a. Businesses paid 2.2% more state and local tax in FY2014 ($688 billion) compared to FY2013. b. On average, businesses taxes equal about 4.6% of private sector gross state product, with the range among the states from 3.4% to 11.5%. c. For California, businesses paid 34.7% of state taxes and 51.6% of local taxes. d. As with prior years, businesses pay more in tax relative to the benefits they get from the states. Per cost, “businesses paid $3.35 for every dollar of government spending benefiting businesses, on average, assuming that education spending does not benefit local businesses.” 2. Tax Foundation 2016 State Business Tax Climate Index – The Tax Foundation released its annual study of state business climates on 11/17/15. California ranked 48 followed by New York at 49th and New Jersey at 50th. The top ranked states in order were Wyoming, South Dakota, Alaska, Florida and Nevada. California does rank higher (13th ) in terms of property tax. Observations: The details of the approach and focus of these types of studies needs to be evaluated before relying on them for any business decisions or legislative changes. For example, while the Tax Foundation rates Alaska high, the COST report finds that 2015 TAXB Supplement Page 7 Supplement to 2015 McBride/Nellen Federal and California Update for Businesses & Estates businesses pay 92.2% of the taxes in Alaska. Also, differences may exist based on the industry, size or form of the business. For example, California has a generous research tax credit which might cause it to rank higher for a tech company. Chapter 8: Accounting Methods and Section 199 Notice 2015-82 (11/24/15) – Increase in De Minimis Safe Harbor Expensing Amount for Taxpayers without AFS NON-AFS DE MINIMIS DOLLAR AMOUNT CHANGE STARTING FOR 2016! On 11/24/15, the IRS issued Notice 2015-82 and an information release (IR-2015-133 (11/24/15)) announcing that the $500 de minimis safe harbor threshold under §1.263(a)-1(f) for taxpayers without an applicable financial statement (AFS), would be raised to $2,500 effective for tax years beginning on or after 1/1/16. This change is in response to the IRS request for comments in February 2015 (Rev. Proc. 2015-20) on whether the threshold should be raised. The IRS stated that it received over 150 comment letters with requests to raise the $500 threshold. Suggestions for the new figure ranged from $750 to $100,000. The notice includes the following statement about “Audit Protection”: “For taxable years beginning before January 1, 2016, the IRS will not raise upon examination the issue of whether a taxpayer without an AFS can utilize the de minimis safe harbor provided in § 1.263(a)-1(f)(1)(ii) for an amount not to exceed $2,500 per invoice (or per item as substantiated by invoice) if the taxpayer otherwise satisfies the requirements of § 1.263(a)-1(f)(1)(ii). Moreover, if the taxpayer’s use of the de minimis safe harbor provided in § 1.263(a)-1(f)(1)(ii) is an issue under consideration in examination, appeals, or before the U.S. Tax Court in a taxable year that begins after December 31, 2011, and ends before January 1, 2016, the issue relates to the qualification under the safe harbor of an amount (or amounts) that does not exceed $2,500 per invoice (or per item as substantiated by invoice), and the taxpayer otherwise satisfies the requirements of § 1.263(a)-1(f)(1)(ii), then the IRS will not further pursue the issue.” Observations: The likely reason for a prospective effective date is that the accounting policy has to be in place at the start of the tax year so it would be too late to change that for 2015. The “audit protection” statement likely pertains to a situation where a taxpayer without an AFS has a book policy to expense items greater than $500. If this treatment clearly reflects income and was properly adopted, it should be ok for tax purposes. Such a taxpayer would still want to make the safe harbor election as that would “guarantee” that expensed amounts up to $500 could be expensed. With the raising of the dollar amount, such taxpayer might be protected up to $2,500 (or less depending on what the taxpayer’s accounting policy is). To take advantage of the higher expensing/safe harbor amount for 2016, the accounting procedures must be in place by the start of the tax year. Where there is no AFS, there is no requirement for a written book policy (but it would be a good idea). 2015 TAXB Supplement Page 8 Supplement to 2015 McBride/Nellen Federal and California Update for Businesses & Estates Rev. Proc. 2015-56 - Restaurant and Retail Improvement Safe Harbor Method Per the IRS (11/19/15): “Revenue Procedure 2015-56 provides certain taxpayers engaged in the trade or business of operating a retail establishment or a restaurant with a safe harbor method of accounting for determining whether expenditures paid or incurred to remodel or refresh a qualified building (as defined in section 4.02) are deductible under § 162(a) of the Internal Revenue Code (Code), must be capitalized as improvements under § 263(a), or must be capitalized as the costs of property produced by the taxpayer for use in its trade or business under § 263A. This revenue procedure also provides procedures for obtaining automatic consent to change to the safe harbor method of accounting permitted by this revenue procedure.” Example from the revenue procedure: 2015 TAXB Supplement Page 9 Supplement to 2015 McBride/Nellen Federal and California Update for Businesses & Estates Stine, LLC, No. 2:13-03224 (WD LA, 1/27/15) - Placed In Service Stine, LLC, No. 2:13-03224 (WD LA, 1/27/15) – S is a retailer selling home building supplies and materials. For 2008, S claimed Go Zone bonus (50%) depreciation for two buildings it constructed. This large deduction created an NOL which S carried back to 2003, 2004 and 2005. The IRS disallowed the 2008 depreciation on the basis that the building was not placed in service in that year. The resulting deficiency was about $2.1 million. 2015 TAXB Supplement Page 10 Supplement to 2015 McBride/Nellen Federal and California Update for Businesses & Estates Certificates of occupancy were issued in 2008, but did not allow the public to enter the buildings yet. S argued that the structures “were substantially complete, the buildings were then ready and available for their intended use – to store and house equipment, racks, shelving and merchandise.” IRS argued that the structures were not placed in service in 2008 because they were not open for business. One argument raised by the IRS – matching, was shot down by the court. The court noted that the purpose of this bonus depreciation was to stimulate investment, not match expenses against revenues. The court next examined relevant regulations and rulings. Per “Treas. Reg. § 1.167(a)-10(b) provides that the depreciation period for an asset begins when the asset, in this case, the building, is "place in service." "Placed in service" is defined as follows: Property is first placed in service when first placed in a condition or state of readiness and availability for a specifically assigned function, whether in a trade or business, in the production of income, in a tax-exempt activity, or in a personal activity. . . . In the case of a building which is intended to house machinery and equipment and which is constructed, reconstructed, or erected by or for the taxpayer and for the taxpayer's use, the building will ordinarily be placed in service on the date such construction, reconstruction or erection is substantially complete and the building is in a condition or state of readiness and availability. Thus, for example, in the case of a factory building, such readiness and availability shall be determined without regard to whether the machinery or equipment which the building houses, or is intended to house, has been placed in service. However, in an appropriate case, as for example where the building is essentially an item of machinery or equipment, or the use of the building is so closely related to the use of the machinery or equipment that it clearly can be expected to be replaced or retired when the property it initially houses is replaced or retired, the determination of readiness or availability of the building shall be made by taking into account the readiness and availability of such machinery or equipment. . . .” Relevant case law used by the court: Sealy Power, Ltd., 46 F.3d 382 (5th Cir. 1995) – the court held that a power plant facility should be viewed as a single property rather than various interdependent components. The Stine court found this case inapplicable as it did not involve a retail facility. Piggly Wiggly Southern, Inc., 84 T.C. 739 (1985) – the Stine court found this case inapplicable as it involved equipment rather than a building. Brown, 2013 WL 6244549, *10 (Tax. Ct. 2013) – involved a plane and insufficient evidence from the taxpayer. The court found that the plane was not placed in service because some of its components that enabled the plane to be used for its intended purpose were not yet placed in service. The Stine court found this case not useful because of continued litigation with respect to it. Valley Natural Fuels, T.C. Memo. 1991-341 – this case distinguished a building from equipment in application of the placed in service test. 2015 TAXB Supplement Page 11 Supplement to 2015 McBride/Nellen Federal and California Update for Businesses & Estates Williams, T.C. Memo 1987-308 – held that a building was placed in service when refurbishing work was complete and not when it was open for business. The court held for the taxpayer because the property was ready for service in a finished condition. Per the court, the structures “were fully functional to house and secure shelving, racks and merchandise.” Also, the government did not support its theory with any law and “during oral arguments, the government candidly admitted, that no such authority currently exists.” Per the court: “whether a building is open for business is of no moment; rather the building is placed in service when it is substantially complete meaning in a condition of readiness and availability to perform the function for which it was built — in this instance to house and secure racks, shelving and merchandise. The court finds that the Walker and Broussard buildings were placed in service prior to December 31, 2008 fully qualifying the taxpayer to take advantage of the "Go Zone" bonus depreciation allowance.” City Line Candy & Tobacco Corp - Measuring Gross Receipts for the Small Retailer Exception of §263A City Line Candy & Tobacco Corp, No. 14-3793-ag (2nd Cir, 9/30/15), aff’g 141 TC 414 (2013) – The IRS and Tax Court found that City Lin’s gross receipts should include the stamp tax is part of gross receipts. The Second Circuit agreed with the Tax Court. Reasons included: a. City Line includes the tax in its gross receipts for financial reporting purposes and did not provide a good reason why tax treatment should differ. b. Reg. 1.263A-3(b)(2)(ii) lists items that can be excluded from gross receipts but does not note taxes. City Line argued that taxes are mentioned at Reg. 1.263A-3(b)(2)(ii)(F) to exclude receipts from an activity other than a business or activity not engaged in for profit. The court stated that the stamp tax is a key part of City Line’s business. City Line opted to be a licensed stamping agent rather than a wholesaler. In addition, City Line receives a commission for the stamping services under New York law. c. City Line’s argument that the tax falls on the customer fails because there is no authority for such exclusion and New York law provides that both the reseller and customers are liable for the tax. Thus, the court determined that City Line was subject to §263A. The next issue was whether the stamp cost was deductible or capitalizable as an indirect cost of reselling. The court rejected all of City Line’s arguments for expensing. Per the court: “City Line offers three arguments for treating its stamp costs as deductible, which contradict each other and fail independently. City Line first suggests that the stamps were actually a direct cost. Even if that were true, it would not change the outcome, since direct costs must also be capitalized. I.R.C. § 263A(a)(2)(A). Alternatively, City Line argues that the stamps qualify as a deductible selling expense. See Treas. Reg. § 1.263A-1(e)(3)(iii)(A). But "the regulations specifically list [taxes] as" an example "`of indirect costs that must be capitalized to the extent they are properly allocable to . . . property acquired for resale.'" Robinson Knife, 600 F.3d at 129 (quoting Treas. Reg. § 1.263A-1(e)(3)(ii)). To accept City Line's contention "would effectively read the word [`tax'] out of the relevant regulation." Id. 2015 TAXB Supplement Page 12 Supplement to 2015 McBride/Nellen Federal and California Update for Businesses & Estates Finally, City Line argues that Robinson Knife permits the deduction of indirect costs tied directly to sales. Robinson Knife interpreted §1.263A-1 as including two limitations on the requirement that indirect costs be capitalized. First, the case requires capitalization only of costs that are a "but-for cause" of the taxpayer's production or sales activity. Robinson Knife, 600 F.3d at 131-32. This causation test is easily satisfied here, since City Line's cigarette sales would have been illegal but for the stamps, and the Tax Court found that City Line's stamping activity was an integral part of its resale activity. Second, Robinson Knife permitted the deduction of costs that "are (1) calculated as a percentage of sales revenue from certain inventory, and (2) incurred only upon sale of such inventory." Id. at 129.[4] City Line's situation fails the second prong. Under New York law, City Line became liable for the cigarette tax as soon as it offered the cigarettes for sale, not when it sold them.[5] Accepting City Line's reading would permit it to take an immediate deduction for costs associated with future sales—precisely the kind of temporal mismatch § 263A seeks to avoid.” Greiner, No. 13-520T (Fed Cls., 7/22/15) - Is Change from Ordinary Income To Capital Gain a Method Changes? The answer is “yes” if the issue really involves how transactions are reported (open versus closed transaction) and the overall income is the same, but the amount reported per year varies under the two treatments (methods). Mr. and Mrs. Greiner (G) reported ordinary income (compensation) on their 2008 and 2009 returns. They later filed amended returns changing that income to capital gain income (from sale of a capital asset), seeking a refund of about $4.7 million, plus interest. Mr. G was president of a company. His compensation package included stock options. The company was acquired (merged) and these options were vested and then cancelled. G was allowed to a one-time cash payment (cash election) or a lower one-time cash payment less the “strike price, plus a contractual ‘earn-out’ right” over nine years (earn-out election). G selected the earn-out option. He received $10 million for his one million shares, plus the right to a pro rata share of future earn-outs that were contingent. The company (Boston Scientific) reported the cash on G’s 2004 Form W-2. The value of the earn-out right was not reported. BS viewed the later payments as income when received by the employee. The tax consequences were not clear for all of this. The companies told the employees the following: “Although Advanced Bionics and Boston Scientific intend to treat all of the amounts paid to holders who elect the Earn Out Consideration as compensation, there are other alternative treatments that could apply. The Option holders who exchange their options in the Merger for the Earn Out Consideration should consult their own tax advisors regarding the specific federal, state, local and foreign tax consequences to them of the Merger.” The court described the delayed reporting as an “open transaction approach, which taxpayers may use when it is not possible to determine with ‘fair certainty’ the fair market value of a contract for future payments of money.” G received earn-out payments as follows, which were reported in G’s W-2: 2005 $0 2015 TAXB Supplement Page 13 Supplement to 2015 McBride/Nellen Federal and California Update for Businesses & Estates 2006 $6.6 million 2007 $4.6 million In 2008, litigation was settled and basically the companies were de-merged and the earn-out payments ended. The parties would receive his “pro rata portion of the earn-out buyout consideration.” Mr. G’s portion, paid in February 2008 was $15 million and the 2009 share was $11.6 million. These amounts were reported on W-2. The rationale for amending the 2008 and 2009 returns was that the earn-out right should have been viewed as receipt of a capital asset. G’s argument as described by the court: “ascertained the fair market value of the earn-out right in 2004, reported it that year as ordinary compensation income, and been immediately taxed on it. … After doing so, they would have held a “capital asset” as broadly defined in Code §1221. …. Subsequent earn-out payments in 2006 and 2007 would still have been taxable as ordinary income (after a return of basis). …. However, the 2008 and 2009 final payments—originally reported as ordinary compensation income—allegedly should have been reported as long-term capital gain. Id. The Greiners claimed that these final payments were entitled to different treatment because they purportedly resulted from the sale or exchange of a capital asset— specifically, Boston Scientific’s early “earn-out buy-out.” …. The claimed refunds were the difference between the taxes originally paid at higher ordinary income rates, and the taxes allegedly owed under the lower preferential long-term capital gain rates.” The arguments of the IRS and the court’s responses: (1) The change is a change in method of accounting for which the Gs did not obtain permission to make. The court reviews guidance on what is a change in method and then focuses on the closed versus open transaction noting that case law had held that changing from cost recovery method of reporting gain to a completed transaction method was a change in method of accounting. Per the court: “In 2004, the Greiners faced a choice: (1) report their earn-out income as payments that were actually received under the open transaction principles of Burnet v. Logan, 283 U.S. 404 (1931); or (2) report earn-out income under the normal closed transaction rule by estimating and reporting the fair market value of the earn-out right they received in 2004 (purportedly $10 million per plaintiffs’ amended returns), see I.R.C. § 83(a). Def.’s Mem. 13. Consistent with Boston Scientific and Advanced Bionics’ intention to include the payments as deductible expenses only when those payments were actually made, the Greiners chose the first option—open transaction. Id. at 13–14; see Compl. ¶ 12. They did not report an estimated fair market value of the earn-out right in 2004, but rather reported income associated with the earn-out right only when and as the cash was received in later years: first $6,579,031 in 2006; then $4,628,596 in 2007; then $15,062,420 in 2008; and finally $11,592,809 in 2009. Def.’s Mem. 14. Moreover, the Greiners maintained this approach in their bookkeeping over a period of six years (tax years 2004–2009), and manifested it by abstaining from reporting in 2004 and affirmatively reporting in 2006, 2007, 2008, and 2009. See id. As explained above, the hallmark of a method of accounting is the timing of income or deduction of a material item for reporting, and in this case the open transaction approach plainly directed the timing of income on the Greiners’ tax returns. As such, the open transaction approach 2015 TAXB Supplement Page 14 Supplement to 2015 McBride/Nellen Federal and California Update for Businesses & Estates was a method of accounting. Having adopted that approach in 2004, the Greiners were obligated to maintain it absent the IRS’s consent to a change. See I.R.C. §446(e).” The court also noted that G’s proposed closed transaction approach is a method of accounting. “Under the closed approach, the Greiners would have reported ordinary income equal to an estimated fair market value of the earn-out right in 2004 (purportedly $10 million), even though no cash was actually received at that time. In turn, the 2006 earn-out payment ($6,579,031) would have been entirely a return of basis against the $10 million. The 2007 earn-out payment would have been a return of basis in part ($3,420,969), plus ordinary income in part ($1,207,627). The 2008 and 2009 payments (respectively, $15,062,420 and $11,592,809) would have been ordinary income or capital gain. The hallmark of this closed transaction method of accounting is, like the open transaction method, the timing of income generated by the earn-out right.” The court notes that the amount of income reported under the open versus closed transaction approach is different each year, yet the total from 2004 – 2009 is the same. The court did not agree that G met any exception to treatment as a method of accounting requiring permission to change. (2) The change in accounting violates the “duty of consistency” doctrine. The court did not need to address this issue because of its finding that the G’s were attempting to improperly change a method of accounting. (3) There can be no capital gain because there was no “sale or exchange” of a “capital asset.” No need to address (see 2 above). Chapter 9: S Corporations Chapter 10: Worker Classification and Payroll Tax CCA 201522004 (IRS, 5/29/15) - Late Payment Penalties Are Not Wages For Employment Tax Purposes CCA 201522004 (5/29/15) – X Corporation was assessed late payment penalties under California Labor Code §203 because it failed to issue paychecks by the required due date. Per 203: “(a) If an employer willfully fails to pay, without abatement or reduction, in accordance with Sections 201, 201.3, 201.5, 201.9, 202, and 205.5, any wages of an employee who is discharged or who quits, the wages of the employee shall continue as a penalty from the due date thereof at the same rate until paid or until an action therefor is commenced; but the wages shall not continue for more than 30 days. An employee who secretes or absents himself or herself to avoid payment to him or her, or who refuses to receive the payment when fully tendered to him or her, including any penalty then 2015 TAXB Supplement Page 15 Supplement to 2015 McBride/Nellen Federal and California Update for Businesses & Estates accrued under this section, is not entitled to any benefit under this section for the time during which he or she so avoids payment. (b) Suit may be filed for these penalties at any time before the expiration of the statute of limitations on an action for the wages from which the penalties arise.” The IRS also relied on information from the California Department of Industrial Relations website on assessment of the penalty. Per the website, there is no need to show that the employer intended not to pay, just that the employer was aware of non-payment and that action was within the control of the employer. If there is a “good faith dispute” on whether wages are owed, the penalty does not apply. The IRS noted that per the Supreme Court of California: “Section 203 is not designed to compensate employees for work performed. Instead, it is intended to encourage employers to pay final wages on time, and to punish employers who fail to do so. In other words, it is the employers’ action (or inaction) that gives rise to section 203 penalties. The vested interest in unpaid wages, on the other hand, arises out of the employees’ action, i.e., their labor. Until awarded by a relevant body, employees have no comparable vested interest in section 203 penalties. We thus hold section 203 penalties cannot be recovered as restitution under the UCL.” The IRS reviewed Sections 3101, 3111, 3121 and 3402 and related regulations to determine if the penalty met the definition of “wages.” It also referred to the US Supreme Court’s decision in Quality Stores, 415 U.S. ___ (2014) where the Court referred to the “broad definition of wages” for FICA purposes as including “all remuneration for employment,” in finding that severance payments were wages. The IRS found that late payment penalty to be different from severance pay because it was due to a failure by the employer rather than work of the employee. Per the IRS, the penalty “also does not satisfy the definition of wages in Rev. Rul. 2004-110 because the penalty is not part of the terms and conditions of employment, but a separate statutorily imposed penalty.” “The late payment penalty is similar to the liquidated damages in Rev. Rul. 72-268 that were held not to be wages for employment tax purposes. The late payment penalty is a statutorilyimposed penalty for employer misconduct that is additional to the employee’s wages. The penalty varies in amount based on the extent of the employer’s misconduct (i.e., the number of days that the employer fails to pay the wages after the due date) rather than the level of services performed by the employee, and is not a substitute for the employer’s liability for the payment of wages. Based on Rev. Rul. 72- 268, we conclude that the payment of the late payment penalty is not wages for federal employment tax purposes.” The IRS cautions that its holding for the Section 203 late penalty payment is limited to that penalty. “Specifically, it does not apply to the meal and rest period payments made under California Labor Code Section 226.7. Under that provision, if an employer fails to provide an employee a meal period or rest period in accordance with State requirements, the employer must pay the employee one additional hour of pay at the employee’s regular rate of compensation for each day that the meal or rest period is not provided. Because the meal and rest period payments are essentially additional compensation for the employee performing additional services during the period when the meal and rest periods should have been provided, it appears those payments would be wages for federal employment tax purposes.” 2015 TAXB Supplement Page 16 Supplement to 2015 McBride/Nellen Federal and California Update for Businesses & Estates Observations: California law includes many requirements for employers including required information for pay stubs, payment of employee expenses, sick pay, pay equity, and much more. Many of these rules are explained at the website of the California Department of Industrial Relations. Following are excerpts from this department’s website on the “waiting time penalty”: that was the subject of the IRS CCA summarized above. “Q. Seven days ago I gave my employer notice that I was quitting on Friday, which I did. I did not receive my final paycheck on that day, and on the following Monday called my former employer to find out when I would be paid. He informed me that my check was available and that I could come in and pick it up, and I told him I would do so. I purposely did not pickup my check until 10 days later, which was 13 days after I quit. Am I entitled to the waiting time penalty?” “A. Yes, you are entitled to the waiting time penalty in the amount of three days' wages. In this situation, since you gave your employer at least 72 hours prior notice that you were quitting and quit on the date you said you would, the employer's obligation is to pay you all of your unpaid wages at the time of quitting. Labor Code Section 202 Since tender of payment of the final wages stops the penalty from accruing (in this case "tender of payment" is your former employer's informing you on the Monday following your quit that your check was available, and your telling him that you would pickup it up), you are entitled to only three days' wages worth of penalty.” “You are not entitled to 13 days' wages worth of penalty because you purposely avoided picking up your check for ten days after you were informed it was available. Labor Code Section 203 provides that "An employee who secretes or absents himself or herself to avoid payment to him or her, or who refuses to receive the payment when fully tendered to him or her...is not entitled to any benefit...for the time during which he or she so avoids payment..."” Example of penalty computation: “A security guard is discharged on Friday, July 12, 2002, and not paid all of her earned wages due until Monday, July 22, 2002, ten days later. She regularly worked 35 hours per week, Monday through Friday, and was making $8.00 per hour at the time of her termination. Daily Rate of Pay Calculation 35 hours/week 5 days/week = 7 hours/day 7 hours/day x $8.00/hour = $56.00/day (daily rate of pay) Waiting Time Penalty Calculation 10 days, the number of days between the date the employer was obligated to pay the employee, July 12, 2002, and July 22, 2002, the date she is paid all of her wages. (See Labor Code Section 201, discharge of employee; immediate payment) 10 days x $56.00/day = $560.00 waiting time penalty.” IRS Seeking Information From PEOs for the Voluntary Certification Program Per the IRS (11/17/15): The IRS is requesting information “about current professional employer organization practices in an effort to streamline the implementation of a new federal program.” 2015 TAXB Supplement Page 17 Supplement to 2015 McBride/Nellen Federal and California Update for Businesses & Estates Per the IRS: “Under legislation enacted last December, the IRS must establish a voluntary certification program for professional employer organizations (PEOs). The law requires them to meet a number of requirements, including certain bond and independent financial review requirements. The IRS has been working to determine the procedures and information system changes necessary to implement the new law and plans to begin accepting applications for PEO certification on July 1, 2016. Currently, PEOs are subject to licensing, registration and other requirements in many states. In addition, there are private assurance organizations that offer PEOs accreditation if they satisfy certain requirements. The IRS is requesting information related to these state requirements and accreditation programs. Specific topics of interest include covered employees, financial audit practices, verification of payroll tax obligations, and working capital and net worth requirements. The IRS will also welcome for further consideration information on other industry practices. Further details on the specific topics and the process for submitting information are in the full text of the request for information. The deadline for submissions is Jan. 8, 2016.” SBSE 04-1115-0073 - New Exam Procedure for Substitute For Returns In SB/SE memo SBSE 04-1115-0073 (11/4/15), a new procedure and form was announced for substitute for return employment tax returns under IRC 6020(b). The new Form 13496-A, IRC Section 6020(b) Certifications for Employment Tax Returns applies to “examiners working nonfiled returns where a signed return has not been received prior to the conclusion of the examination.” Chapter 11: Income Taxation of Trusts and Estates Chapter 12: Estate, Gift, and GST Tax Chapter 13: Tax Exempt Organizations Gamehearts - Gaming Found Not to Qualify for 501(c)(3) Status Gamehearts, A Montana Nonprofit Corp, TC Memo 2015-218 (11/16/15) – G is a nonprofit corporation organized in Montana. Per its bylaws, it serves a community and civil welfare purpose to promote “adult sobriety and the general welfare of citizens of” Montana. G filed Form 1023, Application for Recognition of Exemption Under Section 501(c)(3) in July 2010. Per 2015 TAXB Supplement Page 18 Supplement to 2015 McBride/Nellen Federal and California Update for Businesses & Estates information included on this form, G provides alternative entertainment to adults to promote sobriety. Playing games is intended as an alternative to going to a bar. G also stated it promoted “decision making and problem solving abilities by teaching and promoting educational and strategic games and activities” via card and miniature tabletop games. The form also noted that G “also helps boost the overall market shares of the industry by introducing new and motivated players into the environment” such that they might purchase gaming materials. G offers tutorials on how to play the games, as well as “organized play.” G is “dependent on donations from the gaming community.” In letters to the IRS following the submission of the Form 1023, G’s president, Mr. Glick noted that G provided free services to the poor and distressed. He also noted that the games offered by G are the same as offered in the for-profit gaming industry and donations included “surplus bulk leftover” items from the for-profit gaming industry. As noted in the case, G’s offerings were not attractive to individuals “who could afford for-profit gaming alternatives.” The IRS denied tax-exempt status for G on the basis that it did not benefit a charitable class, it had nonexempt activities (selling games) that were more significant than the exempt activities and it failed Reg. 1.501(c)(3)-1(d) “because it did not limit activities to addicts with low income.” The court agreed with the IRS that G did not qualify for tax-exempt status. The basis for this finding is that G was not organized and operated exclusively for tax-exempt purposes. IRS contended that G offered gaming to anyone over 18 and sober, thus not limiting activities to a “charitable class.” G countered that it did not compete with the for-profit gaming industry because its gaming activities were not competitive with that industry. The court found that G “’operated exclusively’ for one or more exempt purposes. Gaming in an alcohol-free environment may provide a therapeutic outlet to recovering addicts, and community-minded sobriety may benefit the community as a whole, but the question of tax exemption turns on whether there is a single substantial nonexempt purpose, notwithstanding the importance of the exempt purpose. … While it may be laudable, in the light of the administrative record in this case promotion of sober recreation is insufficient justification here for tax-exempt status under a statute that must be construed strictly. The decisive factor here is that the form of recreation offered as therapy also is offered by for-profit entities, and GameHearts even emphasized, in its application for tax exemption, that it would introduce new participants to that for-profit recreational market and “boost the overall market shares of the industry”. We also note that GameHearts received contributions of surplus materials from the industry. While GameHearts itself does not profit from the recreation it offers and could not offer recreational gaming experiences that would compete in the for-profit recreational gaming markets, we conclude nonetheless, consistent with our holdings in Schoger Found. and Wayne Baseball, that recreation is a significant purpose, in addition to the therapy provided, because of the inherently commercial nature of the recreation and the ties to the for-profit recreational gaming industry.” Parks and Parks Foundation, 145 TC No. 12 (11/17/16) - Private Foundation Liable for §4945 Excise Tax For Radio Messages 2015 TAXB Supplement Page 19 Supplement to 2015 McBride/Nellen Federal and California Update for Businesses & Estates Parks and Parks Foundation, 145 TC No. 12 (11/17/15) – The tax under §4945, Taxes on taxable expenditures, is a 20% on the foundation and 5% on the foundation manager. Per the court’s summary of this 108 page opinion: “PF is a corporation exempt from income tax under I.R.C. sec. 501(c)(3) and classified as a private foundation under I.R.C. sec. 509(a). P is a foundation manager of PF as defined in I.R.C. sec. 4946(b). During its taxable years ended Nov. 30, 1997 through 2000, PF made cumulative expenditures of $639,073 to produce and broadcast 30- and 60-second radio messages. As a foundation manager, P agreed to the making of the expenditures. R determined that the foregoing expenditures were “attempts to influence legislation and/or the opinion of the general public” and therefore taxable expenditures, rendering PF and P liable for excise taxes under I.R.C. sec. 4945(a)(1) and (2), respectively. R further determined that because the taxable expenditures were not timely corrected, PF and P were also liable for excise taxes under I.R.C. sec. 4945(b)(1) and (2), respectively.” “Held: Pursuant to the regulations interpreting I.R.C. sec. 4945(e), a communication refers to a ballot measure if it either refers to the measure by name or, without naming it, employs terms widely used in connection with the measure or describes the content or effect of the measure. Held, further, PF’s expenditures for the radio messages were taxable expenditures under I.R.C. sec. 4945(d)(1) or (5) to the extent redetermined herein; consequently PF is liable for excise taxes under I.R.C. sec. 4945(a)(1) to the extent redetermined herein. Held, further, P is liable for excise taxes under I.R.C. sec. 4945(a)(2) to the extent redetermined herein. Held, further, PF and P are liable for excise taxes under I.R.C. sec. 4945(b)(1) and (2), respectively, to the extent redetermined herein. Held, further, the application of I.R.C. sec. 4945 and the regulations thereunder to PF and P does not violate the First Amendment to the U.S. Constitution, and the regulations are not unconstitutionally vague.” Chapter 14: International Tax Notice 2015-79 - Inversion Guidance Per the IRS (11/19/15): “Notice 2015-79 describes regulations that the Treasury Department and the IRS intend to issue that will address transactions that are structured to avoid the purposes of section 7874 by i. requiring the foreign acquiring corporation to be a tax resident in the relevant foreign country in order to have substantial business activities in the relevant foreign country; ii. disregarding certain stock of the foreign acquiring corporation in “third-country” transactions; and 2015 TAXB Supplement Page 20 Supplement to 2015 McBride/Nellen Federal and California Update for Businesses & Estates iii. clarifying the definition of nonqualified property for purposes of disregarding certain stock of the foreign acquiring corporation. Notice 2015-79 also describes regulations that the Treasury Department and the IRS intend to issue that will address certain post-inversion tax avoidance transactions by defining inversion gain for purposes of section 7874 to include certain income or gain recognized by an expatriated entity from an indirect transfer or license of property and providing for aggregate treatment of certain transfers or licenses of property by foreign partnerships for purposes of determining inversion gain; and requiring an exchanging shareholder to recognize all of the gain realized upon an exchange of stock of a controlled foreign corporation (CFC), without regard to the amount of the CFC’s undistributed earnings and profits, if the transaction terminates the status of the foreign subsidiary as a CFC or substantially dilutes the interest of a United States shareholder in the CFC.” IRS Upgrades, Enhances FATCA Registration System Per IR-2015-131 (11/23/15) – the upgrade allows “sponsoring entities to register their sponsored entities to obtain a global intermediary identification number. The upgraded system also will allow users to update their information, download registration tables and change their financial institution type. The upgrade also includes an updated jurisdiction list.” The IRS notes that over “170,000 financial institutions worldwide have registered with the IRS. These financial institutions are located in more than 200 jurisdictions. … FATCA requires certain sponsored entities (including those covered by an IGA) to have their own Global Intermediary Identification Number (GIIN) for FATCA reporting and withholding purposes by Dec. 31, 2016. To facilitate this requirement, the FATCA Online Registration System will now enable sponsoring entities to add their sponsored entities and, if applicable, sponsored subsidiary branches. These entities can be added either individually or by submitting a file containing information for multiple entities.” Chapter 15: Looking Forward 2015 TAXB Supplement Page 21