Day 4_Session 4 - Closing and liquidating your business

advertisement

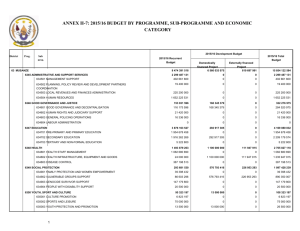

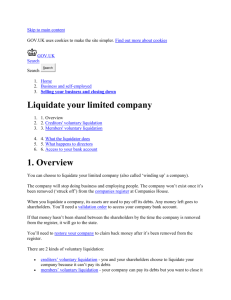

Closing and liquidating your business Know your exist strategies! Financed by Financed by Supported by Supported by Implemented in cooperation with Implemented in cooperation with Closing and liquidating your business.....not an easy decision to make! If you have accumulated business debts and are worried you will never be able to repay them, it might be time to sell the business's assets, pay off its debts as best you can, and move on. Or the court appointed trustee will do it for you! You might also close down your business because you want to retire, in case of sickness etc. Financed by Supported by Implemented in cooperation with Some advice when closing a business 1. Decide to close a business If you are a sole proprietor you can decide by yourself to close the shop. If you work in partnership, be sure to work together with your partner or any other organizational guidelines you have. 2. Get expert advice Closing a business is a delicate multi-step process. It is highly recommended that you find professional help. Expert advice may come from lawyers, accountants, tax experts, bankers, and the tax authorities. 3. Cancel registrations, permits, licenses, and business names To protect your finances and reputation, ensure that you cancel all licenses and permits that you will no longer need. If you have registered under an assumed, or trade name, other than your own name then you can cancel that business name registration with your local authorities 4.Comply with employment and labor laws Pay respect to paying due salaries, unused employee’s vacations, obeying firing procedures. Also, bare in mind if law says something about advance notice of closing prior to the decision. Financed by Supported by Implemented in cooperation with Some advice when closing a business –cont’d 5.Resolve financial obligations Taxes and other duties will have to be paid. 6. Business debts Notify all lenders and creditors of your plans to dissolve the business and settle remaining debt. If you are unable to pay your debts, you may want to consider filing for bankruptcy. Contact the business associates to whom you owe payment, or who owe payment to you. It’s a good idea to discuss with your accountant, attorney, and insurers to ensure that you have everything accounted for. 7. Close Accounts Do not forget to close out your business bank account and cancel your business credit cards. 8. Maintain records You may be legally required to maintain records, particularly tax and employment records, even after your business has closed. A smart guideline for keeping records ranges anywhere from 3 to 10 years. Financed by Supported by Implemented in cooperation with The usual methods of closing business Solvent company or temporary insolvent Liquidating Selling Long-term insolvent company, usually in blockade Bankruptcy Financed by Supported by Implemented in cooperation with Liquidating your company Financed by Supported by Implemented in cooperation with General info on liquidating company Liquidating a company is an alternative when it has enough assets to cover debts It may be done by the owner’s of the company or by the court appointed liquidator The reasons for liquidation can be various, but the important thing is that the company is solvent enough to cover all the existing debts Financed by Supported by Implemented in cooperation with General steps in liquidating company 1. Make formal decision about liquidation 2. Identify all business assets to liquidate 3. Identify the costs of liquidating business 4. Sell business assets 5. Prepare necessary financial statements and other documents 6. Liquidate company in court Financed by Supported by Implemented in cooperation with Make formal decision about liquidation - Dependent upon the country’s legislative, a company’s owners should formally declare liquidation process on their statutory bodies - Owner’s should also appoint liquidators or liquidator independent person or one of the owners (sometimes all of them!) - Owner’s have strong influence in the whole process but the liquidator is legally in charge Financed by Supported by Implemented in cooperation with Identify all business assets to liquidate Make a list of the tangible (computers, vehicles, land, property, machines etc.) and intangible (accounts receivables and payables, security deposits etc.) assets your business owns, Used factoring in case of inability to collect accounts receivables; if possible negotiate repaying the debt with your creditors – hire a lawyer to do that for you If something is left after settling all debts, the owner’s share it amongst themselves Financed by Supported by Implemented in cooperation with Identify the costs of liquidating business On top of existing business costs that should be settled from the existing assets, do not forget the costs of liquidating process E.g. Lawyers, accountants, organization of auctions, advertising sale of assets, possible taxes and other fees that are to be paid regardless of the liquidating process – do a careful calculation! Financed by Supported by Implemented in cooperation with Sell business assets There are different ways to sell your assets, dependent on the country’s law or best practice cases Potential ways to sell your assets: - Existing creditors - Auctions - Ads in newspapers, internet selling sites etc. Financed by Supported by Implemented in cooperation with Prepare necessary financial documents Ask your legal authorities which documents you must deliver to the various government authorities (court, tax office) Example of documents are: Financial statements (Beginning and End of Liquidation), Tax-reports In some cases the court will ask for all of your business documentation, stamps etc. to be deliverd to them in order for liquidation to be finalized Financed by Supported by Implemented in cooperation with Liquidate company in court In general, the juridical bodies such as trade courts etc. make a final decision about the cessation of existence of your company. Financed by Supported by Implemented in cooperation with Selling your business Financed by Supported by Implemented in cooperation with General info on selling your business In order to sell your business you must first find a buyer. Willingness to buy your business will be influenced by its profitability, assets, liabilities, and general market conditions. In general, if you have a profitable business with assets higher than liabilities, you should have no problem finding a buyer. If your business has been losing money for some time and has debts higher than assets, or if the market conditions are not favourable you may have difficulty in finding a buyer. Financed by Supported by Implemented in cooperation with Pros and cons of selling your business PROs CONs You can get higher price for your entire You may have problems in finding business than for just particular assets in liquidation Your buyer can get possible tax deductions (country dependent) It is usually simpler procedure than liquidating For a buyer it would be cheaper to buy your existing business than to start one from the scratch Financed by Supported by buyer – especially if your business is in debt or not profitable If you have a personal liability for business debts, this is not eliminated if you sell your business - you will still have to repay it yourself if you do not agree with buyer otherwise Implemented in cooperation with 3 stages of determining whether to buy your business – buyer’s point of view 1st stage - Due dilligence – The method to background check on your business (financial statements up to 5 years back, tax returns, contracts and other legal matters), - Buyer talks to you as the owner, your banker, customers, suppliers etc. - Buyer also determines why do you sell your business (nonprofitable, debt, retirement, sickness etc.) Financed by Supported by Implemented in cooperation with Cont’d 2nd stage – Valuing the business - Determining fair value of the firm by using one of the most common methods: 1. Asset-based valuation – Liquidation valuation – how much a company is worth by looking at tangible assets, their rate of recovery and liabilities that need to be paid 2. Market-comparable valuation - looks at the actual market prices of recently sold firms similar to the one being valued Financed by Supported by Implemented in cooperation with Cont’d 3rd stage – Negotiating and Closing the Deal - The purchase price of a business is determined by negotiation between buyer and seller. The calculated value serves as the estimate in negotiations, and it is advisable to sign a deal and negotiate fine nuances using a lawyer, as the independent third party. Financed by Supported by Implemented in cooperation with Ways to sell your business Sale to strategic buyers Sale to financial buyers Financed by Supported by Implemented in cooperation with Strategic buyer - The value of the business comes not only from financial valuation but also from the potential synergy or strategic fit the new business might bring. - If the potential buyer is a competitor - the acquisition might provide long-term competitive advantages (e.g. lower cost of production or higher product quality) and the buyer may be willing to pay a premium for the company. Financed by Supported by Implemented in cooperation with Financial buyer Look at your firm through financial value and potential cash generator – if you consider your firm as “your baby” and you care for your employees, the financial buyers might be a problem! Why? Financial buyer will usually restructure by cutting costs and firing people to increase sales (fastest way)! Usual method is to finance debt used to buy company with selling of assets of the firm! Financed by Supported by Implemented in cooperation with Bankruptcy Financed by Supported by Implemented in cooperation with General info on bankruptcy Bankruptcy is declared over a company which is insolvent for longer period of time (or business account is blocked) and is not able to cover all the debts from company’s own assets The bankruptcy trustee (government or court appointed) takes over the entire liquidation process, and pays all the creditors from the entire bankruptcy mass according to their priority The procedure is much more complex and owner’s do not have any control over it Financed by Supported by Implemented in cooperation with General steps in bankruptcy procedure 1. 2. 3. 4. 5. Financed by Creditors or owner(s) file for bankruptcy by a court procedure Bankruptcy trustee is appointed by the court Company’s assets is liquidated (bankruptcy mass) and sold to pay creditors – universality principle = all assets sold to repay all debts Creditors are paid according to priority (determined by country’s laws) Bankruptcy trustee files reports to bankruptcy judge on which suggestion a procedure is legaly concluded by the court verdict Supported by Implemented in cooperation with