Ch02 Fin Statements

advertisement

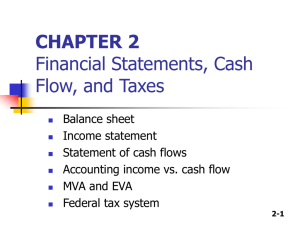

Chapter 02 Financial Statements Determinants of Intrinsic Value: Calculating FCF Sales revenues − Operating costs and taxes − Required investments in operating capital Free cash flow (FCF) Value = = FCF1 FCF2 FCF∞ ... + + + (1 + WACC)1 (1 + WACC)2 (1 + WACC)∞ Weighted average cost of capital (WACC) Market interest rates Cost of debt Firm’s debt/equity mix Market risk aversion Cost of equity Firm’s business risk 2 Financial Statements Balance Sheet Financial Management - Reza Masri 4 Balance Sheet Financial Management - Reza Masri 5 Balance Sheet The basic principles to read Balance Sheet are: LIQUIDITY: Promptness with which assets are expected time to be converted into cash REPAYING PERIOD: Time within which obligations are expected to be satisfied Financial Management - Reza Masri 6 Balance Sheet Financial Management - Reza Masri 7 Balance Sheet Financial Management - Reza Masri 8 Balance Sheet Financial Management - Reza Masri 9 Balance Sheet Financial Management - Reza Masri 10 Balance Sheet • • A snapshot of financial position on the last day of a period Snapshot changes as position changes: B/S may look different at different times of a period MicroDrive Inc. December 31 Balance Sheets (in millions of dollars) 2010 2009 Assets Cash and equivalents $10 $15 Short-term investments $0 $65 Accounts receivable $375 $315 Inventories $615 $415 Total current assets $1.000 $810 Net plant and equipment $1.000 $870 Total assets $2.000 $1.680 Liabilities and equity Accounts payable Notes payable Accruals Total current liabilities Long-term bonds Total debt Preferred stock (400,000 shares) Common stock (50,000,000 shares) Retained earnings Total common equity Total liabilities and equity Asset: things that company owns, listed in “liquidity” order Financial Management - Reza Masri 2010 2009 $60 $110 $140 $310 $754 $1.064 $40 $130 $766 $896 $2.000 $30 $60 $130 $220 $580 $800 $40 $130 $710 $840 $1.680 Liabilities & Equity: claims against company’s value, listed in the “maturity” order 11 Income Statement Financial Management - Reza Masri 12 Income Statement Financial Management - Reza Masri 13 Income Statement Financial Management - Reza Masri 14 Income Statement A basic principle to read Income Statement: DEDUCTING PRINCIPLE To deduct progressively costs from revenues following the production- sales cycle Goals: To show different margins Financial Management - Reza Masri 15 Income Statement Financial Management - Reza Masri 16 Income Statement Financial Management - Reza Masri 17 Income Statement Financial Management - Reza Masri 18 Income Statement Financial Management - Reza Masri 19 Income Statement Financial Management - Reza Masri 20 Income Statement • Reflects financial performance during a period MicroDrive Income Statements for Years Ending December 31 (in millions of dollars) 2010 INCOME STATEMENT Net sales Operating costs except depreciation Earnings before interest, taxes, deprn, and amortization (EBITDA)* Depreciation Earnings before interest and taxes (EBIT) Less interest Earnings before taxes (EBT) Taxes Net Income before preferred dividends Preferred dividends Net Income available to common stockholders Common dividends Addition to retained earnings 2009 $3.000,0 $2.850,0 $2.616,2 $2.497,0 $383,8 $353,0 $100,0 $90,0 $283,8 $263,0 $88,0 $60,0 $195,8 $203,0 $78,3 $81,2 $117,5 $121,8 $4,0 $4,0 $113,5 $117,8 $57,5 $56,0 $53,0 $64,8 *MicroDrive has no amortization charges. Financial Management - Reza Masri 21 Statement of Retained Earnings MicroDrive Statement of Retained Earnings (in millions of dollars) Balance of Retained Earnings, Dec. 31, 2009 Add: Net Income, 2010 Less: Dividends to common stockholders Balance of Retained Earnings, Dec. 31, 2010 Financial Management - Reza Masri $710,0 $113,5 -$57,5 $766,0 22 Statement of Cash Flows Financial Management - Reza Masri 23 Statement of Cash Flows Net Cash Flow = Net Income – Noncash Revenues + Noncash Charges MicroDrive Statement of Cash Flows for Years Ending Dec. 31 (in millions of dollars) Operating Activities Net Income before preferred dividends Noncash adjustments Depreciation and amortization Due to changes in working capital Increase in accounts receivable Increase in inventories Increase in accounts payable Increase in accruals Net cash provided by operating activities ($60,0) ($200,0) $30,0 $10,0 ($2,5) Long-term investing activities Cash used to acquire fixed assets ($230,0) $117,5 $100,0 Financing Activities Sale of short-term investments Increase in notes payable Increase in bonds Payment of common and preferred dividends Net cash provided by financing activities $65,0 $50,0 $174,0 ($61,5) $227,5 Net change in cash and equivilents Cash and securities at beginning of the year ($5,0) $15,0 Cash and securities at end of the year $10,0 Financial Management - Reza Masri 24 What are the five uses of FCF? 1. Pay interest on debt. 2. Pay back principal on debt. 3. Pay dividends. 4. Buy back stock. 5. Buy nonoperating assets (e.g., marketable securities, investments in other companies, etc.) 25 Determining Free Cash Flow (FCF) Operating Cash Flow – Investment in Operating Capital NOPAT (Net Operating Profit After Taxes) Amount of profit a company would generate if it had no debt and held no financial assets Take out impacts of financing & investing decisions to have pure measure of operating performance NOPAT = EBIT(1-Tax Rate) Financial Management - Reza Masri 26 Free Cash Flows (FCF) Cash flows can not be maintained over time unless depreciated fixed assets are replaced, so management is not completely free to use net cash flows. Free Cash Flows is the cash flow actually available for distribution to investors after the company has made all the investments in fixed assets and working capital necessary to sustain ongoing operation NOPAT = EBIT(1-Tax Rate) FCF = NOPAT – Net investment in operating capital Gross Investment = Net Investment + Depreciation FCF = (NOPAT + Depreciation) – Gross Investment in operating capital Financial Management - Reza Masri 27 Operating Capital Total net operating capital = Net operating working capital + Operating long term assets Net operating working capital = Operating current asset – Operating current liabilities Net operating working capital = (Cash + Accounts Receivable + Inventories) - (Accounts Payable + Accruals) Financial Management - Reza Masri 28 Free Cash Flows (FCF) - MicroDrive Illustration EBIT (1-Tax Rate) NOPAT 283,8 0,6 170,28 2010 Cash Accounts Receivable Investories Operating Current Assets minus Accounts Payable Accruals Operating Current Liabilities Net Operating Working Capital plus Operating Long Term Assets Total Net Operating Capital Net Investment in Opr Capital NOPAT Net Investment 170,28 345 (-) FCF (175) 2009 10 375 615 1.000 15 315 415 745 60 140 200 800 30 130 160 585 1.000 1.800 345 870 1.455 Financial Management - Reza Masri 29 Return on Invested Capital ROIC = NOPAT Operating Capital MicroDrive Illustration ROIC = 170.3 0.0946 1,800 Financial Management - Reza Masri 30 Market Value Added (MVA) To incorporate stock prices in the analysis as the primary goal of management is to maximize the firm’s value, hence the outstanding shares times stock price Measures the effects of managerial actions since the inception of the company MVA = Market Value of Stock – Equity capital supplied = (shares o/s)(stock price) – Total Common Equity Financial Management - Reza Masri 31 Economic Value Added (EVA) Focuses on managerial effectiveness in a given year EVA = Net Operating Profit After Taxes (NOPAT) - After-tax dollar cost of capital used to support operations = EBIT(1-Tax Rate) – (operating capital)(WACC) EVA = (Operating capital)(ROIC – WACC) Financial Management - Reza Masri 32 MVA & EVA - Illustration 2010 MVA = = = 2010 MVA = 2009 MVA = MVA = 2010 EVA 2010 EVA 2009 EVA 2009 EVA x x $1.150 # of shares 50 - Total common equity $896 $896 x x $1.300 # of shares 50 - Total common equity $840 $840 $254 = = 2009 Stock price $23,00 Stock price $26,00 $460 = = = = NOPAT $170,3 $170,3 -$27,7 - Operating Capital x $1.800 x $198,0 Weighted average cost of capital 11% = = = = NOPAT $157,8 $157,8 $0,7 - Operating Capital x $1.455 x $157,1 Weighted average cost of capital 11% Financial Management - Reza Masri 33