Set 16 - Matt Will

advertisement

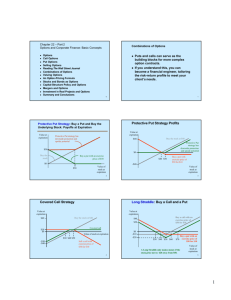

Lecture 16 Components of the Option Price 1 - Underlying stock price 2 - Striking or Exercise price 3 - Volatility of the stock returns (standard deviation of annual returns) 4 - Time to option expiration 5 - Time value of money (discount rate) Black-Scholes Option Pricing Model OC N (d1 ) P N (d 2 ) PV ( EX ) OC N (d1 ) P N (d 2 ) PV ( EX ) OC- Call Option Price P - Stock Price N(d1) - Cumulative normal density function of (d1) PV(EX) - Present Value of Strike or Exercise price N(d2) - Cumulative normal density function of (d2) r - discount rate (90 day comm paper rate or risk free rate) t - time to maturity of option (as % of year) v - volatility - annualized standard deviation of daily returns OC N (d1 ) P N (d 2 ) PV ( EX ) PV ( EX ) EX e e rt rt 1 rt continuous compoundin g discount factor e Black-Scholes Option Pricing Model d1 ln( P EX ) (r v t v2 2 )t N(d1)= d1 ln( P EX ) (r v t d 2 d1 v t v2 2 )t Cumulative Normal Density Function Example - Genentech What is the price of a call option given the following? P = 80 r = 5% v = .4068 EX = 80 t = 180 days / 365 d1 ln( d1 .2297 P EX ) (r v t v2 2 )t N (d1 ) .5908 Example - Genentech What is the price of a call option given the following? P = 80 r = 5% v = .4068 EX = 80 t = 180 days / 365 d 2 d1 v t d 2 .0580 N (d 2 ) 1 .5231 .4769 Example - Genentech What is the price of a call option given the following? P = 80 r = 5% v = .4068 EX = 80 t = 180 days / 365 .5908 80 .4769 (80)e OC N (d1 ) P N (d 2 ) ( EX )e rt OC OC $10.05 (.05)(.5 ) Example What is the price of a call option given the following? P = 36 r = 10% v = .40 EX = 40 t = 90 days / 365 d1 ln( d1 .3070 P EX ) (r v t v2 2 )t N (d1 ) 1 .6206 .3794 .3070 = .3 = .00 = .007 Example What is the price of a call option given the following? P = 36 r = 10% v = .40 EX = 40 t = 90 days / 365 d 2 d1 v t d 2 .5056 N ( d 2 ) 1 .6935 .3065 Example What is the price of a call option given the following? P = 36 r = 10% v = .40 EX = 40 t = 90 days / 365 OC OC rt N ( d1 ) P N ( d 2 ) ( EX )e .3794 36 .3065 ( 40)e (.10)(.2466) OC $1.70 Example What is the price of a call option given the following? P = 36 r = 10% v = .40 EX = 40 t = 90 days / 365 $ 1.70 36 40 41.70 Example What is the price of a call option given the following? P = 41 r = 10% v = .42 EX = 40 t = 30 days / 365 41 (d1) = .422 ln + ( .1 + ) 30/365 40 2 .42 (d1) = .3335 30/365 N(d1) =.6306 Example What is the price of a call option given the following? P = 41 r = 10% v = .42 EX = 40 t = 30 days / 365 41 (d1) = .422 ln + ( .1 + ) 30/365 40 2 .42 (d1) = .3335 30/365 N(d1) =.6306 Example What is the price of a call option given the following? P = 41 r = 10% v = .42 EX = 40 t = 30 days / 365 (d2) = d1 - v (d2) = .2131 N(d2) = .5844 t = .3335 - .42 (.0907) Example What is the price of a call option given the following? P = 41 r = 10% v = .42 EX = 40 t = 30 days / 365 OC = Ps[N(d1)] - S[N(d2)]e-rt OC = 41[.6306] - 40[.5844]e - (.10)(.0822) OC = $ 2.67 Example What is the price of a call option given the following? P = 41 r = 10% v = .42 EX = 40 t = 30 days / 365 $ 1.70 40 41 41.70 Example What is the price of a call option given the following? P = 41 r = 10% v = .42 EX = 40 t = 30 days / 365 Intrinsic Value = 41-40 = 1 Time Premium = 2.67 + 40 - 41 = 1.67 Profit to Date = 2.67 - 1.70 = .94 Due to price shifting faster than decay in time premium Q: How do we lock in a profit? A: Sell the Call $ 1.70 40 41 Q: How do we lock in a profit? A: Sell the Call $ 2.67 $ 1.70 40 41 Q: How do we lock in a profit? A: Sell the Call $ 2.67 $ 0.97 $ 1.70 40 41 Q: How do we lock in a profit? A: Sell the Call $ 2.67 $ 0.97 $ 1.70 40 41 Black-Scholes Op = EX[N(-d2)]e-rt - Ps[N(-d1)] Put-Call Parity (general concept) Put Price = Oc + EX - P - Carrying Cost + D Carrying cost = r x EX x t Call + EXe-rt = Put + Ps Put = Call + EXe-rt - Ps Example What is the price of a call option given the following? P = 41 r = 10% v = .42 EX = 40 t = 30 days / 365 N(-d1) = .3694 N(-d2)= .4156 Black-Scholes Op = EX[N(-d2)]e-rt - Ps[N(-d1)] Op = 40[.4156]e-.10(.0822) - 41[.3694] Op = 1.34 Example What is the price of a call option given the following? P = 41 r = 10% v = .42 EX = 40 t = 30 days / 365 Put-Call Parity Put = Call + EXe-rt - Ps Put = 2.67 + 40e-.10(.0822) - 41 Put = 42.34 - 41 = 1.34 Put-Call Parity & American Puts Ps - EX < Call - Put < Ps - EXe-rt Call + EX - Ps > Put > EXe-rt - Ps + call Example - American Call 2.67 + 40 - 41 > Put > 2.67 + 40e-.10(.0822) - 41 1.67 > Put > 1.34 With Dividends, simply add the PV of dividends