From Prescription to

Payment:

Becoming a Pharmacy

Technician Insurance

Specialist Chapter 1

1

© 2010 The McGraw-Hill Companies, Inc. All rights reserved.

Key Terms

• Accounts receivable

(A/R)

• Adjudication

• Benefits

• Billing cycle

• Coinsurance

• EDI (electronic data

interchange)

• Electronic

prescribing (eRx)

• Explanation of

benefits (EOB)

• Formulary

• Health plan

• Insurance payers

• Copayment

• Deductible

Chapter 1

2

Key Terms (Continued)

• Managed care

• Managed care

organization (MCO)

• Maximum benefit

limit

• Medical insurance

• Medically necessary

• Noncovered

(excluded) services

• Pharmacy benefit

• Pharmacy claim

• Pharmacy

management (PM)

system

• Pharmacy technician

insurance specialist

• Point of sale (POS)

• Policyholder

Chapter 1

3

Key Terms (Continued)

• Preferred drug list

• Premium

• Prescription drug

list (PDL)

• Providers

• Remittance advice

(RA)

Chapter 1

4

The Importance of Pharmacy

Benefits

•

In an average year Americans spend

around $180 billion on outpatient

prescription medications

• Pharmacy insurance technician specialists

fill many vital roles in the field:

• Collecting payment for prescriptions

• Interacting with patients, physicians,

and health insurance companies

• Processing prescriptions

Chapter 1

5

Medical Insurance Basics

•

•

Medical insurance is an agreement

between a person, known as a

policyholder , and health plan (or

insurance payer)

People purchase medical insurance to be

able to afford the expenses of medical care,

such as preventative care and medications

and treatments for sicknesses, accidents,

and injuries

Chapter 1

6

Medical Insurance Basics (Cont.)

•

The Insurance Contract

• The policyholder pays a premium to the

health plan

• In exchange, the health plan provides

benefits for medical services

• These services include care provided by

hospitals, physicians, etc.

• Benefits usually start once the

policyholder has met their deductible

Chapter 1

7

Medical Insurance Basics (Cont.)

•

Medically Necessary

• Described by The Health Association of

America as “medical treatment that is

appropriate and rendered in

accordance with generally accepted

standards of medical practice”

• Consists of medical procedures and

medications that are considered

necessary

Chapter 1

8

Medical Insurance Basics (Cont.)

•

Covered Services

• Pharmacy benefits usually cover a

selection of prescription medications

• A plan’s prescription drug list (or

preferred drug list) contains a

formulary, listing the covered drugs

• Noncovered (excluded) Services

• Medical services not covered as part of

a health plan

Chapter 1

9

Medical Insurance Basics (Cont.)

•

Health Plan Limitations

• A maximum benefit limit places a

monetary coverage limit on particular

services for the duration of the plan

• Beneficiaries may be required to choose

from a list of physicians and hospitals

• Various specialists’ services and

hospital benefits may not be covered

Chapter 1

10

Medical Insurance Plans

•

Indemnity Plans

• The type of most medical insurance

policies in the United States in the past

• The plan policy lists the covered

services and amounts that will be paid

• Coinsurance, a payment by the

beneficiary for a percentage of the

medical costs, is often required

Chapter 1

11

Medical Insurance Plans (Cont.)

•

Managed Care Plans

• Designed to supervise medical care to

provide needed services in the most

appropriate, cost-effective setting

• Managed care organizations establish

links among providers, patients, and

payers

• Patients are often required to make a

copayment, usually a small fixed fee

Chapter 1

12

Sources of Medical Insurance

•

Private Plans

• Offer a variety of types of medical

insurance coverage

• Most enrollees are part of a group

contract, which are bought by

employers or other organizations

• Private insurance can be purchased for

people not belonging to any groups

Chapter 1

13

Sources of Medical Insurance

(Cont.)

•

Government Programs

• Medicare – federal health plan for most

citizens aged sixty-five and over, people

with disabilities, end-stage renal disease

(ESRD), and dependent widows

• Medicaid – designed for low-income

people; cosponsored by federal and

state governments

Chapter 1

14

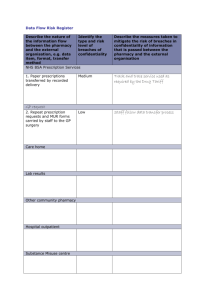

The Pharmacy Billing Cycle

•

•

•

•

•

•

•

Step 1: Receipt of Prescription

Step 2: Patient Interview

Step 3: Filling of Prescription

Step 4: Pharmacy Claim Transmittal

Step 5: Payer Adjudication

Step 6: Point-of-Sale Patient Payment

Step 7: Calculation of Payer Claim

Balance

Chapter 1

15

The Pharmacy Billing Cycle

(Cont.)

•

•

•

Step 8: Accounts Receivable Follow-Up

Step 9: Payment Processing

Step 10: Collections and Problem

Resolution

Chapter 1

16

The Pharmacy Billing Cycle

(Cont.)

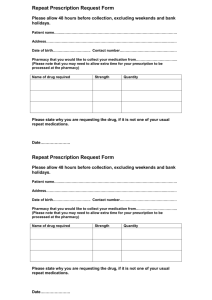

• Step 1: Receipt of Prescription

– First step for a new prescription or a refill

– The pharmacy receives a prescription through

a patient or caregiver in person or by phone,

by a physician or physician representative via

phone or fax, or sometimes through electronic

prescribing

Chapter 1

17

The Pharmacy Billing Cycle

(Cont.)

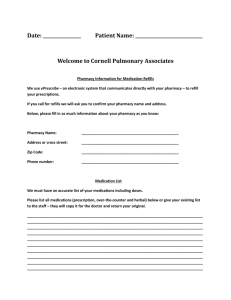

• Step 2: Patient Interview

– The patient (or caregiver) is interviewed to

determine if the patient is a returning or new

customer, and if the patient is covered by a

prescription drug plan

– If prescription benefits are applicable, the

patient’s answers to the appropriate

demographic and health questions is inputted

into a pharmacy management system

Chapter 1

18

The Pharmacy Billing Cycle

(Cont.)

• Step 3: Filling of Prescription

– The assigned pharmacy staff member fills the

prescription order after drug utilization and

drug interactions are reviewed by the

pharmacist

– Medication is filled properly utilizing NDC

numbers

Chapter 1

19

The Pharmacy Billing Cycle

(Cont.)

• Step 4: Pharmacy Claim Transmittal

– A pharmacy claim is sent to the payer to

identify the policyholder, prescriber,

pharmacy, and prescription information for a

payment decision

– Most claims are sent electronically by

electronic data interchange (EDI), although

paper forms are an option too

Chapter 1

20

The Pharmacy Billing Cycle

(Cont.)

• Step 5: Payer Adjudication

– The payer processes the claim to decide if the

drug is covered and being used properly

– The payer uses the benefit plan to calculate

what the patient owes and what the insurance

plan will pay

– Real-time claim adjudication allows the

pharmacy to receive the decision in seconds

Chapter 1

21

The Pharmacy Billing Cycle

(Cont.)

• Step 6: Point-of-Sale Patient Payment

– The pharmacy gives the patient the

prescription and collects the payment via

cash, check, credit card, or debit card

– Pharmacist consultation is offered on drug

administration and the patient signs an

insurance log verifying the prescription was

received

Chapter 1

22

The Pharmacy Billing Cycle

(Cont.)

• Step 7: Calculation of Payer Claim

Balance

– The payer begins internal processing of the

claim for payment to the pharmacy

– The patient’s payment is subtracted from the

total payer-specified payment, and the payer

then owes the pharmacy this amount

– The remaining balance is recorded by the

pharmacy as accounts receivable

Chapter 1

23

The Pharmacy Billing Cycle

(Cont.)

• Step 8: Accounts Receivable Follow-Up

– Most balances due are paid thirty to sixty days

after the date of service

– Pharmacy technician insurance specialists

follow up on the balances due from payers

– Accounts receivable is collected as rapidly as

possible to provide funds for the continued

operation of the pharmacy practice

Chapter 1

24

The Pharmacy Billing Cycle

(Cont.)

• Step 9: Payment Processing

– Most payments are made electronically into

the pharmacy’s bank account, or by check in

a single transaction

– A remittance advice (or explanation of

benefits) is sent to the pharmacy showing the

claim details, which is checked to verify it is

correct through the process of reconciliation

Chapter 1

25

The Pharmacy Billing Cycle

(Cont.)

• Step 10: Collections and Problem

Resolution

– In some cases there will be payment problems,

potentially from the payer or patient

– Pharmacy technician insurance specialists

follow up uncollected sums, track down and

solve problems, and work to ensure maximum

appropriate payment for the pharmacy

practice

Chapter 1

26

Procedures, Communication, and

Information Technology in the

Pharmacy Billing Cycle

•

Each step of the pharmacy billing cycle

has three parts:

1. Following procedures

2. Communicating effectively

3. Using information technology

Chapter 1

27

Following Procedures

•

Administrative Duties

• Entering data and updating patients’

records

• Compliance

• Securing computer files from

unauthorized viewers

• In most pharmacies, policy and procedure

manuals are available that describe how to

perform major duties

Chapter 1

28

Using Information Technology

•

•

Computer hardware and software

information systems are in use in the

pharmacy every day, making pharmacies

more efficient and productive

Information must be inputted carefully

and correctly in order for programs to

function properly

Chapter 1

29

Communicating Effectively

•

•

•

Good communication is as important as

knowing specific codes and regulations

A pleasant tone, friendly attitude, and

helpful manner increases customer

satisfaction

Conversations between pharmacy staff

must be brief and effective

Chapter 1

30

Effects of Pharmacy Claim Errors

•

Errors Result in Problems

• Lower Payment or Denied/Delayed

Claims – incorrect coding causes claim

denials and payment delays

• Disruption of Other Work – time spent

correcting errors can effect all

pharmacy staff and slow operations

• Problematic Customer Relations –

pharmacy staff may have to spend time

handling complaints and inquiries

Chapter 1

31