Document

advertisement

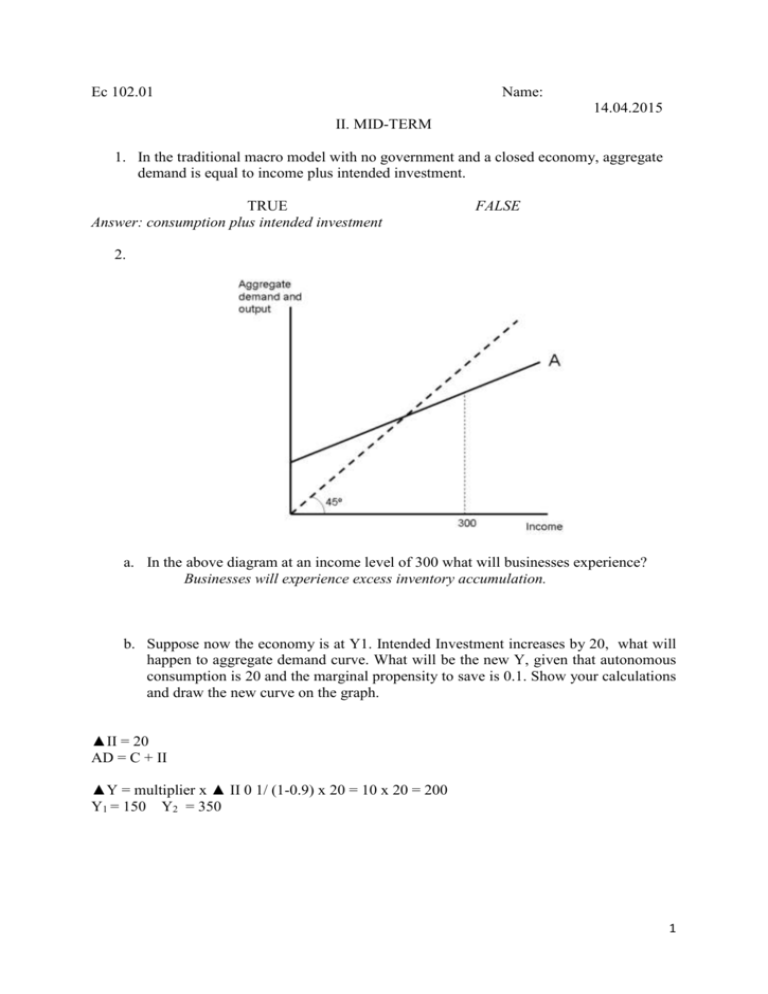

Ec 102.01 Name: 14.04.2015 II. MID-TERM 1. In the traditional macro model with no government and a closed economy, aggregate demand is equal to income plus intended investment. TRUE Answer: consumption plus intended investment FALSE 2. a. In the above diagram at an income level of 300 what will businesses experience? Businesses will experience excess inventory accumulation. b. Suppose now the economy is at Y1. Intended Investment increases by 20, what will happen to aggregate demand curve. What will be the new Y, given that autonomous consumption is 20 and the marginal propensity to save is 0.1. Show your calculations and draw the new curve on the graph. ▲II = 20 AD = C + II ▲Y = multiplier x ▲ II 0 1/ (1-0.9) x 20 = 10 x 20 = 200 Y1 = 150 Y2 = 350 1 3. Persistent unemployment is more likely to occur according to the Classical model than the Keynesian model. TRUE FALSE 4. A growing percentage of foreign debt in Turkey is owed by private businesses. TRUE FALSE 5. Classical economists believe consumption and saving rates are mainly determined by the interest rate while Keynesians believe these vary according to the inflation rate. TRUE FALSE Answer: Classical economists claim that consumption and saving rates are mainly determined by the interest rate while Keynesians argue that these vary according to income levels. 6. Which one of the following statements BEST describes the relationship between interest rates and savings in the Keynesian macroeconomic model? a) Higher interest rates will always encourage higher savings because saving becomes relatively more attractive to people than consuming. b) Higher interest rates will always encourage higher savings because savings is a normal good that becomes relatively cheaper when interest rates rise. c) Higher interest rates will always encourage lower savings because people can reach their financial targets while saving less. d) Higher interest rates will always encourage lower savings because people will anticipate higher inflation rates. e) Higher interest rates may lead to higher or lower savings – the effect is ambiguous. 7. Assuming the total population is 200 million, the labor force is 100 million, and 92 million workers are employed, the unemployment rate is: (show your calculation) a. 4%; b. 6%; c. 8%; d. 10%. e. There’s insufficient data to determine the unemployment rate. 8. Automatic stabilizers: a. lower the multiplier. b. eliminate business cycles. 2 c. involve raising the money supply and reducing government spending during expansions. d. refer to procyclical fiscal policies. 9. A bank has excess reserves of $5,000 and demand deposits of $50,000 when required reserve ratio is 20%. If the reserve ratio is raised to 25% this bank can lend a maximum of a. $1,000. b. $2,000. c. $1,500. d. $2,500. 10. Assume that a closed economy is currently at an equilibrium national income level of $1,000 billion, but the full-employment national income level is $1,200 billion. Assume the government’s budget is currently in balance at $200 billion and the marginal propensity to consume is 0.75 and the tax rate is 0.20. a. the recessionary gap is ______200__________. b. the value of the multiplier is ____4_________. c. aggregate expenditures would have to be (increased/decreased) by _____50____________billion to eliminate the (inflationary/recessionary) gap. 11. The liquidity of an asset refers to the ease with which it can be converted into cash. TRUE FALSE 12. Explain what the classical school predicts will happen when there is a sudden drop in intended investment spending. Show your explanation on a graph. 13. Which of the following factors will not cause a shift in the consumption function (or schedule)? a. Wealth b. Consumer confidence c. Cultural attitudes toward spending and saving d. A change in income e. Changes in the distribution of income 3 14. In the classical model: a. flexible markets will keep the economy at a full-employment level of spending and output. b. both households’ saving activity and firms’ investment activity are quite sensitive to changes in the interest rate. c. adjustments in the interest rates quickly correct any imbalances between saving and investment. d. a sudden fall in investment spending would cause a fall in the interest rate, which would dampen saving and stimulate consumption, quickly returning the economy to full employment. e. all of the above. 15. Ali lost his job during the last recession. What type of unemployment is he experiencing? a. frictional unemployment b. structural unemployment c. cyclical unemployment d. natural unemployment e. seasonal unemployment 16.The automatic stabilization effect of fiscal policy refers to the fact that … a) b) c) d) e) taxes tend to become more progressive during economic expansions. taxes tend to become more regressive during economic expansions. inflation tends to go up during economic expansions. government spending tends to go down during economic expansions. government spending tends to go up during economic expansions. 17. Unlike the Classical economists, Keynes thought that after a sudden fall in investment spending: a. the economy would quickly return to full-employment equilibrium. b. the economy could contract by even more than the initial fall in spending, and get stuck there. c. the market mechanism would automatically pull an economy out of a recession. d. a rise in consumption spending would counteract the fall in investment spending, keeping the economy at full employment. e. None of the above. 18.Suppose in a simple economy with no foreign sector, the mpc equals 0.8. Intended investment spending has suddenly fallen, reducing AD and output to a level that is 100 million below Y* (full employment). a. If the government decided to try to get the economy back to full employment using only an increase in government spending (∆G), by how much would G need to be increased? Multiplier = 1 / (1-0.8) ▲Y = multiplier x ▲G 100 = 5 x ▲G ▲ G = 20 million 4 b. If the government, instead, decided to try to get the economy back to full employment using only a lump-sum tax cut (∆T), how big of a tax cut would be needed? ▲ Y = -mpc (multiplier) x ▲T 100 = - 0.8 x 5 x ▲T ▲T = -25 million c. Alternatively, if the government decided to try to get the economy back to full employment using only an increase in transfers (∆TR), how large would this increase need to be? ▲Y = -0.8 x 5 x ▲TR ▲TR = -25 million c. Which fiscal policy--increasing G, decreasing T, or increasing TR--would do the least amount of damage to the government budget deficit? Increasing G would do the least damage to the deficit. It will raise the deficit by 20 million rather than 25 million. 19. Beril takes a $100 bill he had in his wallet and deposits it into his checking account. Thus, M1 increases by $100. True or false? Explain Why? False, M1 remains unchanged. There has just been a change in the composition of M1, but the size of M1 remains the same. 20.Which one of the following impacts is LEAST likely to occur as a result of expansionary fiscal policy? a) b) c) d) e) An increase in unemployment An increase in inflation An increase in the government debt An increase in aggregate demand An increase in equilibrium output 5