Class PPT

advertisement

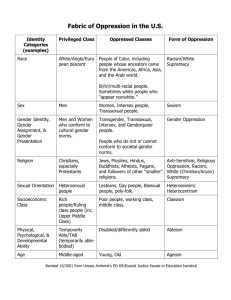

Corporations: A Contemporary Approach Chapter 16 Public Shareholder Activism Slide 1 of 65 Nicolas Delille, “Oppression” (2013) Module X – Close Corporations Chapter 30 Oppression in CHC • Nature of dissension / oppression Bar exam Corporate practice Law profession Citizen of world – Freeze out techniques – Traditional corporate rules • Fiduciary duties – Equal opportunity – Court balancing – Traditional duties (BJR) • Oppression statutes – – – – Reasonable expectations Whose expectations? and when? Remedy: buyout or dissolution Meaning of “fair value” • Oppression in LLC: corporate or contract? Corporations: A Contemporary Approach Chapter 30 Oppression in CHC Slide 2 of 36 Close Corporations What if agreement -• deviates from model? • does not comply with statute? • is unfair? • is incomplete (no liquidity)? Corporations: A Contemporary Approach Chapter 30 Oppression in CHC Slide 3 of 36 Compare models Partnership Model Corporate Model Equal rights Share profits (accounting) Dissolve (liquidate) Majority control Dividends (BJR) Liquid - sell into market Minority shareholder Majority shareholders Close Corporation Corporations: A Contemporary Approach Chapter 30 Oppression in CHC Slide 4 of 36 Freeze-out How can majority • take advantage of minority? • get rid of minority? Minority shareholder Majority shareholders Close Corporation Corporations: A Contemporary Approach Chapter 30 Oppression in CHC Slide 5 of 36 Two freeze-outs … (two results) Corporations: A Contemporary Approach Chapter 30 Oppression in CHC Slide 6 of 36 Freeze-outs Wilkes v. Springside Nursing Home (Mass 1976) Minority shareholder Majority shareholders Close Corporation Corporations: A Contemporary Approach Chapter 30 Oppression in CHC Slide 7 of 36 Wilkes v. Springside Nursing Home (Mass 1976) "... when stockholders in a close corporation bring suit against the majority alleging a breach of the strict good faith duty ... it must be asked whether the controlling group can demonstrate a legitimate business purpose for its action .... the controlling group ... must have some room to maneuver in establishing the business policy of the corporation ..." "When an asserted business purpose for their action is advanced by the majority, .... we think it open to minority to demonstrate that the same legitimate objective could have been achieved through an alternative course of action less harmful to the minority's interest ".. our courts must weigh the legitimate business purpose, if any, against the practicality of a less harmful alternative...." Corporations: A Contemporary Approach Chapter 30 Oppression in CHC Slide 8 of 36 Freeze-outs Minority shareholder Majority shareholders Nixon v. Blackwell (Del 1993) Close Corporation Corporations: A Contemporary Approach Chapter 30 Oppression in CHC Slide 9 of 36 Nixon v. Blackwell (Del 1993) "... stockholders need not always be treated equally for all purposes ... To say that fiduciary principles require equal treatment is to beg the question whether investors would contract for equal or even equivalent treatment ....." "... the minority stockholders were not (a) employees of the Corporation, (b) entitled to share in the ESOP, (c) qualified for key man insurance, or (d) protected by specific provisions in a stockholders' agreement. "The directors' actions following Mr. Barton's death are consistent with his plan. An ESOP is normally established for employees" Corporations: A Contemporary Approach Chapter 30 Oppression in CHC What does “entire fairness” apply to? Slide 10 of 36 1. In a partnership, a partner who wants out: a. Can withdraw and get pro rata cash b. Must get partners’ approval c. Must have agreement to be paid for ownership interest 2. In a CHC, a shareholder who wants out: a. Can withdraw and get pro rata cash for shares b. Must have buyout K c. Is stuck 3. In CHC in MA, a mistreated minority Sh… a. Gets judicial balancing b. Gets buyout option c. Gets only BJR 4. In a CHC in MA, a minority sh excluded from share tx… a. Gets equal treatment b. Must show unfairness c. Gets only BJR 5. In CHC in DE, minority sh… a. Gets equal treatment if majority deals in shares b. Gets judicial balancing c. Gets BJR 6. In a CHC, minority Shs… a. Should get p-ship rights b. Should get only corporate rights c. Should get hybrid rights, given lack of liquidity Answers: Corporations: A Contemporary Approach Chapter 30 Oppression in CHC Slide 11 of 59 What “liquidity” rule for CHC? Sam incorporates a family business. Eventually he retires and gives equal shares to his two daughters – Anna and Bertha. Bertha wants to move to the big city. Can she get her money? Corporations: A Contemporary Approach Chapter 30 Oppression in CHC Slide 12 of 36 Partnership Any shareholder can withdraw and demand payment of her fair share. • Heatherington & Dooley: mandatory buyout right (no opt-out). • Create market for full CHC stock by legislative fiat. Corporations: A Contemporary Approach Modified Any shareholder who is denied her reasonable expectations can withdraw and get paid. • Need not formalize understanding • Close corporation = incorporated partnership!! Chapter 30 Oppression in CHC Corporation No easy out / only majority can set dividends or get $$ on withdrawal. • No partner-like rights unless negotiated. • “Corporation is corporation is corporation.” Slide 13 of 36 Enter legislature (stage left) … Corporations: A Contemporary Approach Chapter 30 Oppression in CHC Slide 14 of 36 MBCA § 14.30 Grounds for judicial dissolution. The [court] may dissolve a corporation: (2) In a proceeding by a shareholder if it is established that (ii) the directors or those in control of the corporation have acted, are acting, or will act in a manner that is illegal, oppressive or fraudulent ... Corporations: A Contemporary Approach Chapter 30 Oppression in CHC Noscitur a sociis Slide 15 of 36 Meaning of “Oppression” Minority Perspective Majority Perspective Role control / financial “Expectations” Change over time Control prerogatives Clarity of “deal” “Harsh, bad faith” Minority shareholder Majority shareholders Close Corporation Corporations: A Contemporary Approach Chapter 30 Oppression in CHC Slide 16 of 36 In re Kemp & Beatley (NY 1984) Chief Judge Cooke: "A shareholder who reasonably expected that ownership in the corporation would entitle him or her to a job, a share of corporate earnings, a place in corporate management, or some other form of security, would be oppressed in a very real sense when others in the corporation seek to defeat those expectations and there exists no effective means of salvaging the investment.“ Corporations: A Contemporary Approach Chapter 30 Oppression in CHC Slide 17 of 36 Distinguish In re Kemp & Beatley (NY 1984) • Long-time Eees (regular “bonuses”) • Longtime mgmt / financial rights • Remedy: buyout Bonavita v. Carbo (NJ Super 1996) • Widow of retired Eee (family member) • No mgmt / limited financial rights • Remedy: buyout Nixon v. Blackwell (Del 1993) • Non-Eee family members • Structural limits on liquidity rights • Remedy: none Corporations: A Contemporary Approach Chapter 30 Oppression in CHC Prof. Doug Moll, University of Houston Slide 18 of 36 NC approach … Corporations: A Contemporary Approach Chapter 30 Oppression in CHC Slide 19 of 36 NC Bus Corp Act § 55-14-30 Grounds for judicial dissolution. The superior court may dissolve a corporation: (2) In a proceeding by a shareholder if it is established that (ii) liquidation is reasonably necessary for the protection of the rights or interests of the complaining shareholder; ... Corporations: A Contemporary Approach Chapter 30 Oppression in CHC Meiselman v. Meiselman (NC 1982) Slide 20 of 36 Remedies … Corporations: A Contemporary Approach Chapter 30 Oppression in CHC Slide 21 of 36 In re Kemp & Beatley (NY 1984) Chief Judge Cooke: "A court has broad latitude in fashioning alternative relief, but when .... there has been a complete deterioration of relations between the parties, a court should not hesitate to order dissolution. "Every order of dissolution, however, must be conditioned upon permitting any shareholder of the corporation to elect to purchase the complaining shareholder's stock at fair value. See NY BCL § 1118(a)." Corporations: A Contemporary Approach Chapter 30 Oppression in CHC Francisco Goya Tres de Mayo (1814) Slide 22 of 36 Brodie v. Jordan (Mass 2006) “The defendants interfered with the plaintiff’s reasonable expectations by excluding her from decision-making, denying her access to company information, hindering her ability to sell her shares. The defendants were the only ones receiving any financial benefit from the corporation. “The remedy should neither grant the minority a windfall nor excessively penalize the majority. [Buyout ordered by trial court] placed the plaintiff in a significant better position than she would have enjoyed absent the wrongdoing. Money damages will be the appropriate remedy. Corporations: A Contemporary Approach Chapter 30 Oppression in CHC Slide 23 of 36 “Oppression” cases 1960-76 1984-85 1990-2000 No relief 27 (50.0%) 4 (10.8%) 55 (36.9%) Dissolution order 16 (29.6%) 10 (27.0%) 42 (28.2%) Buyout order 3 ( 5.6%) 20 (54.1%) 42 (28.2%) Other relief 8 (14.8%) 3 ( 8.1%) 10 (6.7%) TOTAL 54 (100%) 37 (100%) 149 (100%) 3.4 18.5 13.5 Cases/year Corporations: A Contemporary Approach Chapter 30 Oppression in CHC Slide 24 of 36 Meaning of “fair value” … Corporations: A Contemporary Approach Chapter 30 Oppression in CHC Slide 25 of 36 MBCA § 14.34 Election to Purchase in Lieu of Dissolution (a) In a proceeding under 14.30(2) to dissolve a [close corporation] ... the corporation may elect or ... one or more shareholders may elect to purchase all shares owned by the petitioning shareholder at the fair value of the shares. (b) An election to purchase ... may be filed with the court at any time within 90 days after the filing of the petition under 14.30(2) .... (d) If the parties are unable to reach an agreement [as to fair value within 60 days after the election], the court ... shall determine fair value ... (e) ... the court shall enter an order directing the purchase ... as the court deems appropriate, which may include payment of the purchase price in installments ... and any additional costs, fees, and expenses as may have been awarded ... Corporations: A Contemporary Approach Chapter 30 Oppression in CHC Slide 26 of 36 Hypothetical Remember Justin (40%), Kathy (40%) and Lorenzo (20%). Kathy and Lorenzo kick Justin out. He petitions for involuntary dissolution. Kathy and Lorenzo then ask the court for a a buyout order. After a failed negotiation, the court must fix “fair value”. What is “fair value” of minority shares? • Pro rata value of “going concern” enterprise value? • Subject to discounts? – “lack of control” – “lack of marketability” Corporations: A Contemporary Approach Chapter 30 Oppression in CHC Slide 27 of 36 Enterprise value (100%) Corporations: A Contemporary Approach $10.0 Chapter 30 Oppression in CHC Slide 28 of 36 Enterprise value (100%) $4.0 Corporations: A Contemporary Approach Pro rata value (40%) Chapter 30 Oppression in CHC Slide 29 of 36 Enterprise value (100%) Lack of control (30% discount) Pro rata value (40%) $2.8 Corporations: A Contemporary Approach Chapter 30 Oppression in CHC Slide 30 of 36 Enterprise value (100%) Lack of control (30% discount) Lack of marketability (30% discount) Pro rata value (40%) $1.6 Corporations: A Contemporary Approach Chapter 30 Oppression in CHC Slide 31 of 36 Minority shares • “Fair market value” • “Fair value” Enterprise value Corporations: A Contemporary Approach Control discount Marketability discount Chapter 30 Oppression in CHC Pro rata value Slide 32 of 36 1. In a CHC, a minority Shs can seek involuntary dissolution: a. When shareholders fail to elect a new board b. When directors disagree on business policy c. When control Shs are oppressive 2. In a CHC, a minority Sh who has a lousy buyout contract: a. Can petition for dissolution if terms are unfair b. Is stuck with contract 3. In CHC, involuntary dissolution will be granted … a. When minority’s expectations are frustrated b. When course of dealing has not been followed c. Only if majority in bad faith 4. In a CHC, involuntary dissolution … a. Has effect of terminating business b. Forces business assets to be sold c. Usually leads to buyout 5. In CHC, buyout orders … a. Are not allowed by statute, only dissolution available b. Are allowed by statute, if minority proves oppression c. Are an elective “out” for control group 6. In a CHC, “fair value” … a. Is pro rata “enterprise value” b. Is generally same as FMV c. Is generally subject to minority discounts Answers: Corporations: A Contemporary Approach Chapter 30 Oppression in CHC Slide 33 of 59 Minority protection spreads to LLCs … Corporations: A Contemporary Approach Chapter 30 Oppression in CHC Slide 34 of 36 Haley v. Talcott (Del Ch 2004) Haley (50%) / Talcott (50%) Judicial dissolution Exit agreement (corporate statute) (LLC statute) Corporations: A Contemporary Approach Chapter 30 Oppression in CHC Slide 35 of 36 Haley v. Talcott (Del Ch 2004) It is inequitable to force Haley to use the exit mechanism [in the parties’ operating agreement]. Haley would be left liable for the debt of any entity over which he has no further control. With no reasonable exit mechanism [despite the contractual “fair value” provision in LLC operating agreement] I find that Haley is entitled to judicial dissolution [under the Delaware two-shareholder corporate dissolution statute]. Corporations: A Contemporary Approach Chapter 30 Oppression in CHC Vice Chancellor Leo Strine Slide 36 of 36 The end Corporations: A Contemporary Approach Chapter 30 Oppression in CHC Slide 37 of 36 Bonavita v. Corbo (NJ Super 1996) New Jersey Superior Court: "... Alan Corbo will continue to make decisions which are in his best interests (and those of his family) and ignore the wishes, needs and the best interests of the shareholders. “ "... Regardless of whether defendants’ action might otherwise be termed “wrongful” or “illegal” there is no question that defendants’ conduct has destroyed any reasonable expectations that plaintiff may have enjoyed respecting her stock interests. …. Defendants’ actions do indeed constitute “oppression”. Corporations: A Contemporary Approach Chapter 30 Oppression in CHC Slide 38 of 36