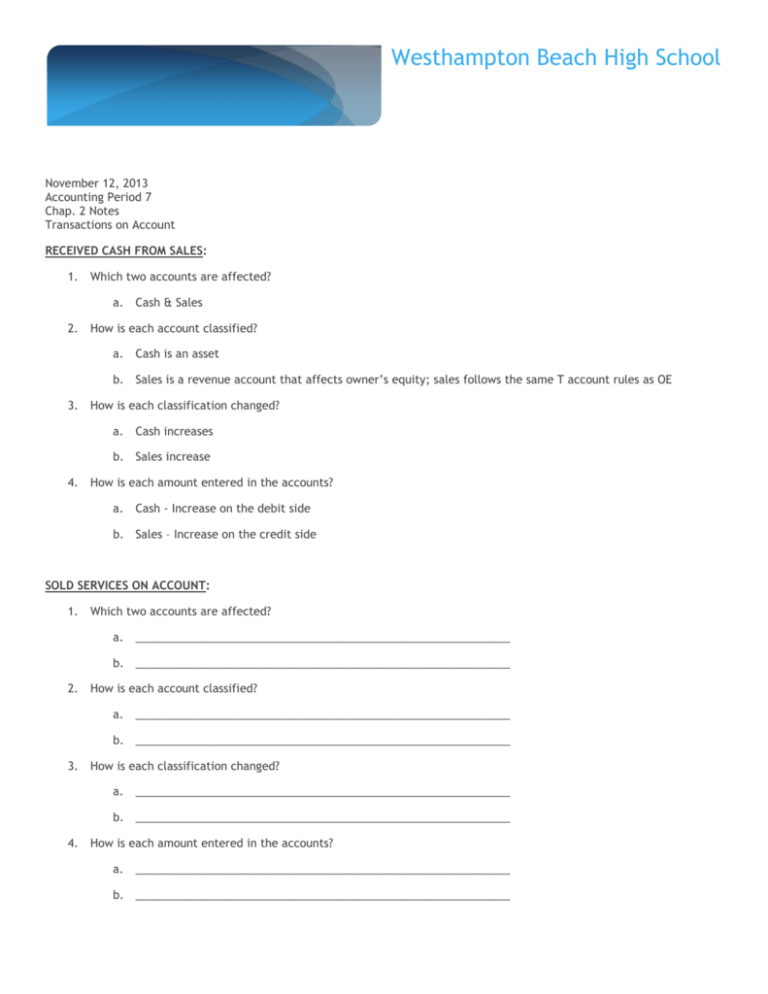

Chap 2 student notes - Westhampton Beach School District

advertisement

Westhampton Beach High School November 12, 2013 Accounting Period 7 Chap. 2 Notes Transactions on Account RECEIVED CASH FROM SALES: 1. Which two accounts are affected? a. Cash & Sales 2. How is each account classified? a. Cash is an asset b. Sales is a revenue account that affects owner’s equity; sales follows the same T account rules as OE 3. How is each classification changed? a. Cash increases b. Sales increase 4. How is each amount entered in the accounts? a. Cash - Increase on the debit side b. Sales – Increase on the credit side SOLD SERVICES ON ACCOUNT: 1. Which two accounts are affected? a. ____________________________________________________________ b. ____________________________________________________________ 2. How is each account classified? a. ____________________________________________________________ b. ____________________________________________________________ 3. How is each classification changed? a. ____________________________________________________________ b. ____________________________________________________________ 4. How is each amount entered in the accounts? a. ____________________________________________________________ b. ____________________________________________________________ 2 PAID CASH FOR AN EXPENSE: 1. Which three accounts are affected? a. ____________________________________________________________ b. ____________________________________________________________ c. 2. ____________________________________________________________ How is each account classified? a. ____________________________________________________________ b. ____________________________________________________________ c. 3. ____________________________________________________________ How is each classification changed? a. ____________________________________________________________ b. ____________________________________________________________ c. 4. ____________________________________________________________ How is each amount entered in the accounts? a. ____________________________________________________________ b. ____________________________________________________________ c. ____________________________________________________________ RECEIVED CASH ON ACCOUNT: 1. Which two accounts are affected? a. ____________________________________________________________ b. ____________________________________________________________ 2. How is each account classified? a. ____________________________________________________________ b. ____________________________________________________________ 3. How is each classification changed? a. ____________________________________________________________ b. ____________________________________________________________ 4. How is each amount entered in the accounts? a. ____________________________________________________________ b. ____________________________________________________________ 3 PAID CASH TO OWNER FOR PERSONAL USE: 1. Which three accounts are affected? a. ____________________________________________________________ b. ____________________________________________________________ c. 2. ____________________________________________________________ How is each account classified? a. ____________________________________________________________ b. ____________________________________________________________ c. 3. ____________________________________________________________ How is each classification changed? a. ____________________________________________________________ b. ____________________________________________________________ c. 4. ____________________________________________________________ How is each amount entered in the accounts? a. ____________________________________________________________ b. ____________________________________________________________ c. ____________________________________________________________ Audit Your Understanding: 1. What three accounts are affected when a business pays cash for a cell phone bill? 2. What two accounts are affected when a business sells services on account? 3. What two accounts are affected when a business receives cash on account? 4. Is the drawing account increased on the debit side or credit side? 5. Are revenue accounts increased on the debit side or credit side? Work Together: T accounts are given. Use the chart of accounts below for Jensen Cleaning Service to complete the T accounts. Prepare T accounts for each transaction, recording the account title, the debit and credit side of each account, the normal balance and how the transaction affects the account. Transactions: March 11. Sold services on account to Johannes Erickson, $125.00 March 13. Received cash from sales, $260.00 March 14. Paid cash for telephone bill, $54.00 4 March 16. Received cash on account from Johannes Erickson, $125.00 March 19. Paid cash to owner for a withdrawal of equity, $200.00