Debit and Credit (Using “T” Accounts)

advertisement

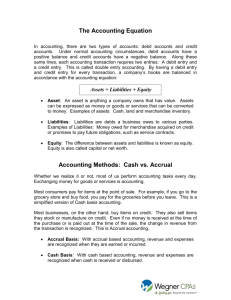

Debit and Credit (Using “T” Accounts) Chapter 2 Analyzing Transactions into Debit and Credit Parts DO NOW: In your notebook What do you know about debits and credits? The Accounting Equation – It’s really not efficient http://www.youtube.com/watch?v=PEXulul11 dE Let’s Break the Accounting Equation Down Assets = Liabilities + Owner’s Equity Remember how we named OE transactions as Investment, Withdrawal, Revenue and Expense The owner gave her own cash to the business for the business to use We increased cash We increased Owner’s Equity, because the owner has a right to that money We called it INVESTMENT The owner took money out of the business to pay for something for herself– not business related We decreased cash We decreased Owner’s Equity, because this $ wasn’t there for her to have the right to it We called it Withdrawal Let’s Break the Accounting Equation Down Assets = Liabilities + Owner’s Equity Remember how we named OE transactions as Investment, Withdrawal, Revenue and Expense A sale occurs We increased either cash or accounts receivable We increased Owner’s Equity, because the owner has a right to that money received or coming in We called it REVENUE OR We pay cash for a service (telephone bill, repairs, rent) that isn’t an asset We decrease cash We decrease Owner’s Equity, because the owner is losing the rights to the cash We called it EXPENSE Let’s Break the Accounting Equation Down Assets = Liabilities + Owner’s Equity Remember how we named OE transactions as Revenue and Expense? Let’s practice some of these: Paid cash for charity: Sold services for cash: Sold services to customer On account: Paid cash for cleaning service to clean office: Decrease cash (asset), decrease Capital (OE) Expense Increase cash (asset) Increase Capital (OE) Revenue Increase accounts receivable (asset), Increase Capital (OE) Revenue Decrease cash (asset) Decrese Capital (OE) Expense The Expanded Accounting Equation Assets = Liabilities + Owner’s Equity Assets = Liabilities + Investment – Withdrawal + Revenue - Expense (Capital) Accounting Terms T account – Temporary account; an accounting device used to analyze transactions Debit – an amount recorded on the left side of the T account Credit – an amount recorded on the right side of the T account T Account and Debits and Credits: The Increase-Decrease Secret http://www.youtube.com/watch?v=DfX_mbbB sYo – WITT The Accounting Equation Using T Accounts Debits & Credits http://www.youtube.com/watch?v=99LTqkxz BpA Learning on the closet door REVIEW IN PRINT Textbook pages 28, 29, and 30 Increases and Decreases for the “T” Account Two sides of an account are used to record increases and decreases to that account. Any Asset Debit side increases (Left side and normal balance) Credit decreases (Right side) Any Liability and OE Debit side decreases (left side) Credit side increases (right side and normal balance) Account Balances Normal Balance – The side of the account that increases Assets – – On the left side of the T Have normal debit balances Liabilities and OE – On the right side of the T – Have normal credit balances Work Together WP p. 21 Textbook p. 31 Work Together WP p. 22 Textbook p. 31 USE THE STEPS! Debit/Credit Dance http://www.youtube.com/watch?v=j71Kmxv7s mk TRANSACTION ANALYSIS Step by step – – Which accounts are affected? How is each account classified? – How is each classification changes? – Asset, liability, or owner’s equity account Increase or decrease How is each amount entered in the accounts? Debit or credit side Received cash from owner as an investment $5000 1. Which accounts are affected? – 2. How is each account classified? – – Cash is an asset Capital is an OE 3. How is each classification changed? – – Cash and Capital Assets: increase OE: Increase 4. How is each amount entered in accounts? – Assets increase on the debit side – Debit the asset account cash OE increase on the credit side Credit the OE account capital Paid cash for supplies 1. Which accounts are affected? – 2. How is each account classified? – – Supplies is an Asset Cash is an Asset 3. How is each classification changed? – – Supplies and Cash One asset (supplies): increase One asset (cash): decrease 4. How is each amount entered in accounts? – Assets increase on the debit side – Debit the asset account supplies Assets decrease on the credit side Credit the asset account cash $275.00 Paid cash for insurance 1. Which accounts are affected? – 2. How is each account classified? – – Prepaid insurance is an Asset Cash is an Asset 3. How is each classification changed? – – Prepaid insurance and cash One asset (prepaid insurance): increase One asset (cash): decrease 4. How is each amount entered in accounts? – Assets increase on the debit side – Debit the asset account prepaid insurance Assets decrease on the credit side Credit the asset account cash $1,200 Bought supplies on account 1. Which accounts are affected? – 2. How is each account classified? – – Supplies is an Asset Accounts Payable is a Liability 3. How is each classification changed? – – Supplies and Accounts Payable (Supply Depot) Assets: increase Liabilities: increase 4. How is each amount entered in accounts? – Assets increase on the debit side – Debit the asset account supplies Liabilities increase on the credit side Credit the liability account Accounts payable $500 Paid cash on account 1. Which accounts are affected? – 2. How is each account classified? – – Cash is an Asset Accounts Payable is a Liability 3. How is each classification changed? – – Cash and Accounts Payable (Supply Depot) Assets: decrease Liabilities: decrease 4. How is each amount entered in accounts? – Assets decrease on the credit side – Credit the asset account cash Liabilities decrease on the debit side debit the liability account Accounts payable $300 Practice Work Together – WP p.23 – Textbook p. 27 HOMEWORK: Study Guide 2: WP p. 17 Study Guide Part Three: WP p. 19, #’s 1 – 8 On Your Own – WP p. 24 – Textbook p. 37` Analyzing Trasactions: OE Accts Receive cash from sales 1. Which accounts are affected? – 2. How is each account classified? – – Cash is an asset Sales is an OE (revenue) 3. How is each classification changed? – – Cash and Sales Assets: increase OE: Increase 4. How is each amount entered in accounts? – Assets increase on the debit side – Debit the asset account cash OE increase on the credit side Credit the revenue account sales $295 Sold services on account 1. Which accounts are affected? – 2. How is each account classified? – – AR is an asset Sales is an revenue account that affects OE 3. How is each classification changed? – – Accounts receivable and Sales Assets: increase OE: Increase 4. How is each amount entered in accounts? – Assets increase on the debit side – Debit the asset account AR OE increase on the credit side Credit the revenue account sales (OE) $350 Paid cash for an expense 1. Which accounts are affected? – 2. How is each account classified? – – Cash is an asset Rent Exp is an OE 3. How is each classification changed? – – Cash and Rent Expense Assets: decrease OE: decreases 4. How is each amount entered in accounts? – OE decrease on the debit side – Debit the rent expense account Assets decrease on the credit side Credit the asset account cash (Rent) $300 Received cash on account 1. Which accounts are affected? – 2. How is each account classified? – – Cash is an asset AR is an asset 3. How is each classification changed? – – Cash and Accounts receivable Assets: (cash) increase Assets: (AR) decreases 4. How is each amount entered in accounts? – Assets increase on the debit side – Debit the asset account cash Assets decrease on the credit side Credit the asset account AR $200 Paid cash to owner for personal use $125 1. Which accounts are affected? – 2. How is each account classified? – – Cash is an asset Owner Drawing is an OE 3. How is each classification changed? – – Cash and Owner, Drawing Assets: decrease OE: decreases 4. How is each amount entered in accounts? – OE decreases on the debit side – Debit the OE account Owner Drawing Assets decrease on the credit side Credit the asset account cash REVIEW ACTIVITIES – http://www.quia.com/cm/63252.html Quia game matching transactions and vocab