pptx - James River District PTA

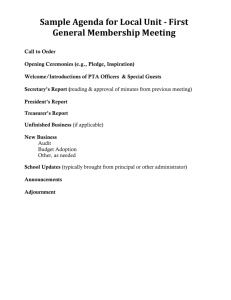

advertisement

Session 302 and 602: The PTA Treasurer Jennifer Young – Treasurer Melissa Nehrbass – Peninsula District Director Virginia PTA 2012 Annual Conference July 13, 2012 In this session we will: • Define the 3-1 rule. • Identify at least 3 responsibilities of a PTA Treasurer. • Have basic knowledge of handling PTA funds. • Identify at least 3 ways to prevent theft/embezzlement. 501(c)(3) Organization • Sales tax exempt - Income tax exempt • Donations by donors are treated as charitable contributions for tax purposes • Must be organized and operate according to the mission set forth in the bylaws: Advocate for the health, education and welfare of all children. • Non-sectarian • Non-commercial • Non-partisan --Cannot engage in political activity --CAN engage in insubstantial amount of lobbying • Resources cannot be used for private benefit Responsibilities • • • • • • Filing forms Developing the budget Staying in the budget Paying bills Depositing income Financial statements and year end report Questions? Forms to File • • • • • Audit Budget IRS Form 990 Membership dues Insurance (bonding, fidelity, and liability) Who completes the Audit? • An auditing committee of at least three – Cannot be signers on the unit’s account(s) • An accountant or person with excellent working knowledge of PTA accounting procedures. When do you Audit? • Before a new treasurer takes over • At the end on each fiscal year – Should be done within a month of year-end What is Audited? • • • • • • • Treasurer’s reports Check book and register Bank statements Deposit slips Receipts Receipt book Previous audit report Audit Report • Oral audit report at the general meeting after executive board approval. • Written audit report given to President, Secretary and Treasurer. • President calls for adoption of the audit report. This is the actual acceptance of the monthly financial reports that have been put on file. – Auditor or auditing committee all sign and date the report at the time it is filled out Questions? IRS Form 990 • All units must file 990, 990-EZ, or 990-N or the e-Postcard by the 15th of the 5th month after the end of fiscal year. • Instructions for filing the 990-EZ will be available at www.vapta.org Units in Good Standing New officer information to the State Office Dues paid by Dec. 1st Bylaws are current Membership Dues Work with the membership chair Membership drives are year ‘round Pay due by Dec. 1st, March 1st, and June 30th ■ Can be remitted at any time Insurance • Check the renewal date of the policy • All treasurers (and officers) should be bonded • R.V. Nuccio offers insurance to PTAs or you can get insurance from any other company Sales Tax Exempt • Application can be found at: – www.vapta.org – LURG (Local Unit Resource Guide • Will need to obtain a 501(c)3 determination letter before applying Budget - Supply Line • Development – How? • • • • Look at actual income and expenses from last year Plan with board what you will add or delete Include line item for training Include some for start up for the following year – Who? • Executive Board (in the bylaws) Budget - Getting it Approved • Present it to the full board • Make approved adjustments • Present it to the general membership for approval Live within the Approved Budget • Only approved expenses can be paid • If an expense is in the budget, it can’t be voted against as the budget has already been approved • Budget changes must be approved by 2/3 vote at a general meeting • Keep track of each line item’s income and expenses. Keeping Track • All income and expenses need to be placed under a line item • If you run a program or have an expense or income every year it should have a line in the budget • Membership dues for the National and State are transfer items - not income • PTA Funds must be kept separate from other accounts The 3-to-1 Rule (IRS) Are you using it to further your purpose/mission? For every fundraising activity, there should be at least three nonfundraising projects/programs aimed at helping parents or children or advocating for school improvements: Fundraiser Gift Wrap Catalog Sales Programs Take Dad to School Day Fall Carnival Reflections Program PTA Fundraising • You don’t need to have a fundraiser • Don’t raise funds, just to raise funds – you should have a purpose for the money • Plan what you want to do then plan how to raise funds to do it • No set amount that you can have, but if you have savings account, it should be earmarked for something Treasurer’s Briefcase what you need to do your job • • • • • • • Copy of bylaws and standing rules Copy of adopted budget Receipt book Check book EIN and Local Unit # Copy of Sale tax exemption certificate Determination of 501(c) 3 non profit status Briefcase cont… • • • • • • Cash Box Zippered Bank Bag(s) Deposit Slips Cash Turned In Form Deposit Form Expense Reimbursement Form Back Files • • • • Audit Reports Three (3) Year’s Budgets Seven (7) Year’s Financial Records Correspondence Banking • Have bank statements sent to the school • Have a non-signer go over the bank statements and initial (now a requirement for most insurance) • Reconcile statements in a timely manner To Protect the Association and the Officers: • • • • Never sign a blank check Never mix PTA money with school money Never open a credit card Never hold PTA money overnight Handling Money • • • • • Try to avoid cash if possible Always have two people count the cash Fill out and sign cash verification form Treasurer counts cash with chair Treasurer gives chair a receipt for cash and keeps a copy • Deposit slip filled out and deposit made Writing Checks • Have up-to-date signature cards on file at bank • Always have two signatures on checks – Married couples and family members should never be on the account together • Never sign a blank check • Get receipts before signing the check Expense Reimbursement • Fill out the expense reimbursement form • Check the receipts • Must be within the budget Paying Bills • • • • Must be approved Need an invoice or receipt Must be done with a PTA Check Must be within the budget guidelines or it needs membership approval IRS Guidelines for Spending • Must fall within three categories: – Educational – Operational – Charitable IRS Guidelines for Expenditures • Educational – Supplement to instruction of students – Education of your members – Reflections – Field trips, assemblies and speakers IRS Guidelines for Expenditures • Operational – Cost of postage and printing – Cost of training your officers at conference, leadership development seminars, district and/or council training – Supplies needed to run your PTA IRS Guidelines for Expenditures • Charitable – Assemblies – Fieldtrips – Celebrations (keep in mind – opportunities that benefit the majority of students) Financial Statements • Provided at each meeting – Balance from last meeting – Plus the itemized income – Less the itemized expenses – Current balance – Budget vs Actual Year End Report • Provided at the end of the fiscal year – List starting balance – Break down expenses by line item – Break down income by line item – State the current balance Checklist - Before Fraud Occurs • Follow proper fund handling procedures • Never sign a blank check • Check insurance policy to see if it requires prosecution in order to recover a loss • Have a written money handling and control policy in your standing rules Warning Signs of Fraud • • • • • Treasurer’s report delayed or non-existent Delayed deposits of cash receipts Missing supporting documents Multiple corrections in the cash book Check bouncing when there should be available funds • Lifestyle or behavior changes of staff or volunteers If Fraud is Suspected DO NOT make accusations! (libel, slander) Determine suspect’s access to other PTA resources Gather facts, documents, and interviews. Identify all accounts involved and consider freezing or closing them Contact your District Director and/or State Treasurer Contact the authorities Contact the insurance company Resources • • • • • Money Matters from National PTA Financial section in VA PTA LURG (Section 4) State Treasurer Leadership Training Conference District and/or Council Training Events For more information contact: Jennifer Young, Treasurer, Virginia PTA 804-852-3285 treasurer@vapta.org www.vapta.org