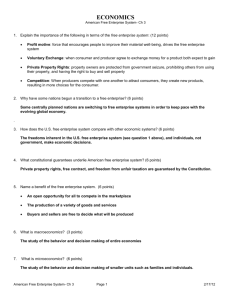

Chapter 12

C HAPTER 12

Bell Work: Grab workbooks from back put in workbook, complete warm-ups on pages

109 and 110

C HAPTER 12.1

“What does the GDP show about the nation’s economy?”

Objectives to know

How GDP is calculated

Difference b/t nominal and real GDP

Limitations of GDP

Factors that influence GDP

Other output/income measures

Key Terms (3)

http://www.pearsonsuccessnet.com/snpapp/iText/prod ucts/0-13-369833-

5/Flash/Ch12/Econ_OnlineLectureNotes_ch12_s1.swf

I NTRODUCTION

What does the Gross Domestic Product (GDP) show about the nation’s economy?

GDP measures the amount of money brought into a nation in a single year through the selling of that nation’s goods and services

GDP is a measurement of how well a nation’s economy is doing for a particular year.

High GDP means nation is doing well

Low GDP means nation is doing poorly

N ATION I NCOME A CCOUNTING

Economists use a system called national income accounting to monitor the U.S. economy

They collect microeconomic statistics, which the govt. uses to determine economic policies

M/I data economists analyze is Gross Domestic

Product (GDP)

Dollar value of all final goods and services produced w/in country’s borders in a year

W HAT IS GDP

Tracks exchanges of money

Need to understand which are/are not included

Included

• Cash value of all goods/services sold

• Goods/services offered to consumers

• American or Foreign companies producing in U.S.

Excluded

• Cost of producing all goods/services

• Intermediate goods used to produce others goods/services

• American Companies producing overseas

A PPROACHES : R EAD S ECTIONS

Expenditure

One method used to calculate GDP

Estimate annual expenditures on 4 categories of final goods/services

Consumer goods

Business goods/services

Govt. goods/services

Net Exports

Income

Adding up all the incomes in the economy

Rationale is that a sale of final good/service minus the cost of production represents income for that firms owners/employees

N OMINAL VS R EAL GDP: R EAD S ECTION

Helps understand current conditions of GDP

Nominal GDP is measured in current prices

Calculated by using the current year’s prices to calculate the current years output

Problem: Doesn’t account for rise in prices

May show increase in GDP when output is still same

Real GDP

GDP expressed in constant, unchanging prices

Determine a year to set base prices so they can see a

“true” change in GDP

Figure 12.3 311

L IMITATIONS OF GDP

Doesn’t take into account some economic activities or aspects of life.

Nonmarket activities: GDP doesn’t measure goods/services people make/do themselves

Underground Economy: GDP doesn’t account for “black market” or people paid w/out taxes

Negative externalities: unintended side effects, like pollution, not subtracted from GDP

Quality of Life: GDP doesn’t necessarily represent quality of life

O THER OUTPUT AND INCOME M EASURE

In addition to GDP, there are other ways to measure economy

I NFLUENCES ON GDP

Aggregate Supply

Total amount of goods/services available at all possible price levels

In a nation’s economy, as the prices of most goods/services change, the price level changes and firms respond by changing their output

As price level rises, real GDP, or aggregate supply rises

As prices fall, so does real GDP

I NFLUENCES ON GDP

Aggregate Demand

Amount of goods/services that will be purchased at all possible price levels

As prices move up/down individuals/firms change how much they buy--- in the opposite direction of aggregate supply

Any shift in aggregate supply or aggregate demand will have an impact on real GDP and price level

Aggregate supply/demand represent supply/demand on a national level.

They show what happens to GDP and prices when aggregate supply/demand shifts.

Figure 12.5

L ESSON C LOSING

“Exit Card”: Identify/Explain which is/isn’t part of GDP

Restaurant meal

Chair manufactured in Mexico by U.S. company

Childcare provided by parent

Bike made by European company in U.S.

Childcare provided by Daycare center

Selling of 3-year old used truck

Item made this year, but not sold yet

Workbook pages

111, 16, and 19: Quiz done for tomorrow

Visual Glossary: GDP

Action Graphs: Measurements and Agg. S & D

12.2: B ELL W ORK

Workbook pages

111, 16, and 19: Quiz done for tomorrow

Visual Glossary: GDP

Action Graphs: Measurements and Agg. S & D

12.2

“What factors affect phases of a business cycle?”

Objectives to know

Phases of business cycle

4 key factors that keep business cycle going

How economists forecast fluctuations in cycle

Impact of business cycles in U.S. history

Key Terms(2)

http://www.pearsonsuccessnet.com/snpapp/iText/prod ucts/0-13-369833-

5/Flash/Ch12/Econ_OnlineLectureNotes_ch12_s2.swf

I NTRODUCTION

What factors affect the phases of a business cycle?

Periods of economic growth

Periods of economic decline

Business investments

Interest Rates and Credit

Consumer expectations

External Shocks

P HASES OF A B USINESS C YCLE

Business cycles are made up of major changes in real GDP above or below normal levels

Consists of four phases

Expansion

Rise in real GDP, jobs abundant, unemployment low, businesses prosper

Peak

When GDP stops rising, reaches height of expansion

Contractions

Falling GDP; usually less output and higher unemployment

3 Types

Recession: long contraction (16-18 mnths)

Depression: Really long recession, high UE and output

Stagflation: Decline in real GDP w/rise in prices (inflation)

4 F ACTORS FOR B USINESS CYCLE

Business cycles are affected by 4 main economic variables

Business Investment

When expanding, investments increase

Keeps increasing GDP, maintaining expansion

When firms cut spending, decreases GDP

Interest Rates/Credit

Consumers often us credit to buy new things

If interest rates on goods rise, less likely to buy

Same is true for businesses deciding whether or not to buy new equipment or make large investments

4 F ACTORS FOR B USINESS CYCLE

Consumer Expectations

If people expect economy to contract they may reduce spending, pulling down GDP

High consumer confidence may lead people to buy more goods; pushes up GDP

External Shocks

Negative external shocks can have a great effect on business, causing GDP to decline

Country in War w/ heavy investments by banks/businesses

Positive External shocks can lead to increase in nations wealth

Like oil discovery or a great growing season

F ORECASTING B USINESS C YCLES

To predict the next phase of a cycle, forecasters must anticipate movements of real GDP before the occur

Economists use leading indicators to help them

Stock market is one leading indicator

Today it will turn downward sharply before recession

Conference Board: keeps index of 10 strong indicators

Stocks, interest rates, and capital goods purchases

None are altogether reliable

I MPACT OF C YCLES IN U.S. H ISTORY

Great Depression

Changed beliefs that a declining economy would recover on own.

Led economists to belief that modern market economies could fall into long-lasting contractions

Economy didn’t recover until WWII

Declining GDP/High unemployment were 2 major signs of the Great Depression

Pic on pg. 320

What year did GD hit its Trough?

1933

How long did it take GDP to return to pre-depression peak?

4 years

I MPACT OF C YCLES IN U.S. H ISTORY

OPEC Embargo

In 1970s, U.S. experienced an external shock when the price of gasoline and heating fuels skyrocketed as a result of the OPEC embargo on oil shipped to U.S.

U.S. economy also experienced a recession in the early 80s and another brief one in 1991

Attacks of 9/11 led to another sharp drop in consumer spending in many service industries

B USINESS C YCLE TODAY

Economy became slow in 2001

Surged in late 2003

Growth slowed again as a result of high gas prices in 2006

Sub-Prime mortgage crisis caused further decline in

2007

Stock market decline in 2008 appeared to be bringing country into another recession

L ESSON C LOSING

“Exit Card”

Draw the business cycle with “hypothetical” peaks and troughs from the 1980s to now

Homework

Workbook pages: 112, 25, 27

Video

How economy works

Tracking a business Cycle

If any of you would like a “jump” on the Ch.12

Project go ahead. Its on Sharepoint! Under the

“announcements”

C HAPTER 12 S ECTION 3

BW: Section 2 Quiz

Video

How economy works

Tracking a business Cycle

C HAPTER 12 S ECTION 3

“How does the economy grow?”

Objectives to learn

How economic growth is measured

What capital deepening is and how it contributes to economic growth

Analyze how saving and investment are related to economic growth

Impact of population growth, government, and foreign trade on economic growth

Causes and impact of technological progress

Key Terms (1)

http://www.pearsonsuccessnet.com/snpapp/iText/prod ucts/0-13-369833-

5/Flash/Ch12/Econ_OnlineLectureNotes_ch12_s3.swf

I NTRODUCTION

How does the economy grow?

The economy grows through

Increase in capital deepening

Higher savings rate

Population that grows along w/capital growth

Government intervention

Technological Progress

M EASURING E CONOMIC G ROWTH

Basic measure is the % change in Real GDP over a period of time

Economists prefer a measuring system that takes population growth into account

GDP per capita is used then instead

Example: Imagine there are 2 families both living on

$60,000/yr

Family 1: 5 in family, Family 2: 3 in family

Which family has a higher standard of living?

GDP measures standard of living, not quality

GDP also tells us nothing about output distributed across population

In general, nations w/high GDP per capita experience greater Quality of life; even though it tells us little about individuals other than a starting point

Watch Action Graph

W HAT IS C APITAL

D EEPENING ?

Nation w/large amount of physical capital will experience economic growth

CD is process of increasing amount of capital/worker.

One of most important sources for econ. growth

S AVING AND I NVESTING

Amnt of $$ people save increases, then more investment funds are there for businesses

Funds can be used for capital investment and expand stock of capitol in business sector

Link to Cap.Deepening?

Provides more funds for financial institutions to invest

E FFECTS ON E CONOMIC G ROWTH

Population Growth

High pop. Growth w/supply of capital same = less capital per worker

Opposite of capital deepening, lower standards of living

Low pop. Growth and expanding capital = greater capital deepening

Government (Taxes)

Raising Taxes

People have less money, reduce savings

Reduces money for investment

HOWEVER

If Govt. invests revenue in public goods this will increase investment

Results in capital deepening

E FFECTS ON E CONOMIC G ROWTH

Foreign Trade

Can result in a trade deficit

Value of goods a country imports is higher than exported

If imports consist of investment type goods, running a trade deficit can help capital deepening

If funds are used for long-term investments, Capital

Deepening can offset negatives of a trade deficit by helping generate economic growth

Popcorn Read Foreign Trade: pg. 327

T ECHNICAL P ROGRESS

Key source for Economic

Growth

Can result from new scientific knowledge, inventions, and production methods

Measuring technological progress can be done by determining how much growth in output comes from increases in capitol and how much comes from increases in labor

Any remaining growth in output comes from technological progress

Causes

Scientific Research

Innovation

Scale of Market

Larger markets provide more incentives for innovation

Education and Experience

Natural Resources

Increases need for new technology

Read Case Study: pg.329

L ESSON C LOSING

Watch Case Study Video

Watch Essential Question Video

Answer Questions for Quiz…… fill in workbook

F RIDAY

Project Work

This is your Project Grade for Ch.12

Go to http://www.econedlink.org/lessons/index.php?lesson=904&p age=student

Or just go to share-point and choose the site.

Follow directions

Print off results….

May work w/partner but need to print off separate results