Production - Faculty Directory | Berkeley-Haas

advertisement

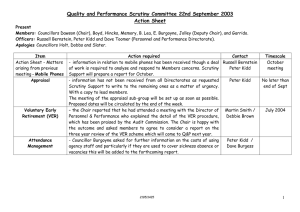

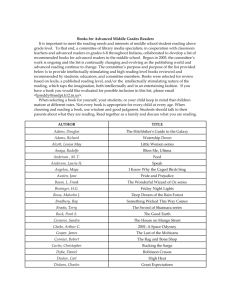

Business-to-Business Marketing Haas School of Business UC Berkeley Fall 2008 Week 2 Zsolt Katona 1 Where we stand • Week 1 – – • Week 2 – – – • Introduction to B2B and Industrat Decision 1 R&D and Market Research in Industrat Surprise Decision 2 Week 3 – – Pricing Strategies in Industrial Markets Room and Haas, Signode case discussions 2 Industrat Stock Prices 3 R&D in Industrat Internal Transactions Production Dept. Finance Dept. R&D Dept. Manufact. Costs Inventory Holding Costs R&D Expendditure Sales Dept. Sales force Expenditure Technical Dept. Technical Support Commissions Corporate Marketing Dept. Corporate Communication Expenses Marketing = Profit Center 4 Feasible Ranges of Physical Characteristics Min - Max KOREX 1 2 3 4 Resistance Suspension Frequency Density (W ) (MSc) (KHz) (MGC) LOMEX 1 2 3 4 Convexity Conductivity Purity Max. Energy (DE) (MSc) (%) (MW) - 5 Korex Technologies Max. S U S P E N S I O N Min. Min. Tech. limit RESISTANCE Max. 6 Korex Technologies Max. S U S P E (MSc) N S I O N Min. Min. Tech. limit RESISTANCE (0) Max. 7 Technology Research Gestation Period Know How Critical Mass Infrastructure New projects (products) using a technology Minimum number of years Minimum annual investment Additional Investment 8 Research Technology Cumulative investment Years above minimum investment Status Minimum total investment Proposed total investment Minimum annual investment 9 Research Technology Cumulative invest Years above min inv Status Min total invest Prop total invest Min annual invest 1 2 0 0 NO 3351 6702 1117 5500 2 OK 5585 11170 1675 3 4 8000 0 2 0 OK NO 5585 8936 11170 13404 1675 2234 5 13050 3 OK 11170 16755 2234 10 Development Prototype = First Development Project Name Technology Cum Expenditure Status Characteristic 1 Characteristic 2 Characteristic 3 Characteristic 4 Base cost PLIA 5 13050 OK 17 101 43 224 100 11 Research and Development Product Development Period T: Project Specification: • • • • • Period T+1: Message from Development: Project name Technology Budget 4 Physical characteristics Production base cost • Project status • Feasibility of base cost • Additional budget necessary 12 Production Costs Production cost Base cost specified to R&D Cumulative Production 13 Production Costs Production (transfer cost) Shared Cost Actual Base Cost New Base Cost Specified to R&D Experience Transfer Technology Experience Actual Manufacturing Method New Manufacturing Method Cumulative Production 14 Production Costs Production (transfer cost) Actual Base Cost New Base Cost Specified to R&D Actual Manufacturing Method New Manufacturing Method Cumulative Production 15 Development Projects Project name Modify existing KIDU Introduce KIDA Complete Modify KIDU & introduce KIDA PKI33 Retain base cost Incomplete Continue PKI33 (same tech and specs) Tighten base cost Relax base cost Terminate project 16 Brand Modification KIDD KIDD Automatic payment to production department at transfer cost (exceptional loss) KIDD KIDD Period T Product KIDD Period T + 1 KIDD Modified KIDD 17 Loans are available 18 Loans For R&D only, line of credit, equal annual payments interest on outstanding balance 19 Loan Repayment Schedule Loan Length Interest 0 0 0 1900 5 10 4500 5 10 0 0 0 0 0 0 Total zero one two three four 0 0 570 1882 1754 1626 1498 990 0 0 0 0 0 0 0 0 0 0 570 532 494 456 418 0 0 0 0 1350 1260 1170 1080 990 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 five 0 0 0 0 0 0 0 0 0 0 0 six 0 0 0 0 0 0 0 0 0 seven eight nine 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 20 Collaboration Negotiations Only within approved periods Outcome Licensing and/or joint research Terms Royalties: historically 3%, but deregulated now Negotiated annual minimum royalties Other fund transfers Process Written contract and approval (arbitration in case of violation) Implementation Compatible decisions entered by both parties Risk Government invalidates contract in case of antitrust action 21 Market Research Objectives: Understanding Markets Monitoring Identifying threats & opportunities Forecasting Methodology: Market Segmentation: Analysis of Survey Data None, Specified or Statistical Optimum 22 Survey Types • About Supplier (Studies 1 and 2) – Awareness and preference for each supplier by decision maker – Importance of and ratings on technical, commercial aspects and reputation – Ideal Points • About Products (Studies 3,5 and 7,8) – Awareness, preference and market share for each product – Importance and ratings of product attributes – Ideal Points • Buying process (Study 6) – Who is the decision maker? • Market demand and forecast (Studies 4,9) • Competitive Information (Study 16) 23 Perceptual maps 24 Prediction Markets • 1988 Iowa Electronic Market (IEM) – A University of Iowa experiment – Securities traded are linked to outcomes of political elections (e.g. you get $1 is B. Obama wins the presidential) – Does better than polls (75% of the time) • IEM is but one example… – – – – Sports Movies (HSX) Financial and Economic data etc. 25 Examples of Prediction Markets Market Iowa Electronic Market TradeSports Economic Derivatives Status Run by University of Iowa For-profit company Run by Goldman Sachs and Deutsche Bank Newsfutures For-profit company Foresight Exchange Nonprofit research group Hollywood Stock Exchange Owned by Cantor Fitzgerald Focus Typical turnover on an event ($US) Small-scale election markets for US elections. Tens of thousands (limited to $500 positions) Trade in a rich set of political futures, financial contracts, current events, sports and entertainment. Hundreds of Thousands Large-scale financial market trading in the likely outcome of future economic data releases. Hundreds of Millions Political, finance, current events and sports markets. Also technology and pharmaceutical futures for specific clients. Virtual currency redeemable for monthly prizes Political, financial, current events, science and technology events suggested by clients. Virtual currency Success of movies, movie stars, awards, including a related set of complex derivatives and futures. Data used for market research. Virtual currency 26 Predictive performance of the Hollywood Stock Exchange 27 External validity: Saddam security and oil prices. 28 Potential corporate applications • More complex securities – Security pays $1 for each additional percentage point in vote. Market price reflects expected proportion of votes earned. – Security pays according to square of percentage vote. Allows to calculate market’s confidence in estimated proportion of votes earned. – Pay $1 if percentage vote is exactly x, y, z…. – What if a contract is contingent on another event (e.g. contract on oil price if Saddam is in power vs. one contingent on the opposite. Difference tells effect of Saddam’s ousting on oil prices.) • Prediction markets in the enterprise – Variety of contexts (scheduling, product success, technology trends) – Examples: HP, Intel, Siemens, Google, Eli Lilly, Arcelor… – Information generated is confidential so more incentive to create the market. – Will traditional market research disappear then? 29 Surprise • We will run a prediction market • There will be 5 securities (one for each firm) • The winner security pays 100 points at the end, the others pay 0 • Winner: the firm that makes the highest total net marketing contributions in the last three periods • “Alternative stock price” 30 Before we go • faculty.haas.berkeley.edu/zskatona/teaching.html • Industrat teams • Decision deadline: 17:00 (set at startup) 31