Assignment 1

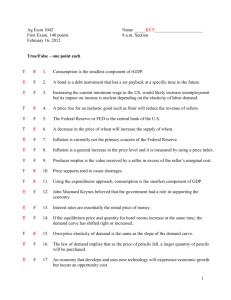

advertisement

Mariela Tinajero MBA 6410 Professor Doris Geide-Stevenson Assignment 1 1. Use chapters 1 and 2 "Global Prospects and Policy Issues" and "Country and Regional Perspectives" from the World Economic Outlook, October 2009 to answer the following questions (cite the appropriate page number and information). a. What were the five fastest growing countries in 2009? List the countries and cite the data based on the tables in your reading. 1. 2. 3. 4. 5. Ethiopia with a 2009 real GDP of 9.9 (pg. 67, Table 2.8) Azerbaijan with a 2009 real GDP of 9.3 (pg.58, Table 2.5) Lebanon with a 2009 real GDP of 9.0 (pg. 65, Table 2.7) Qatar with a 2009 real GDP of 9.0(pg. 65, Table 2.7) China with a 2009 real GDP of 8.7 (pg. 49, Table 2.3) b. Identify all countries that were NOT characterized by a recession in 2009 (based on projections). Explain which data you looked at to determine whether countries are in a recession or not. Cite the data. Australia, Korea, China, India, Indonesia, Thailand, Philippines, Malaysia, Vietnam (pg. 49, Table 2.3), Poland (pg. 54, Table 2.4), Kazakhstan, Belarus, Azerbaijan, Turkmenistan, Uzbekistan, Tajikistan, Kyrgyz Republic (pg. 58, Table 2.5), Argentina, Colombia, Peru, Ecuador, Bolivia, Uruguay (pg. 61, Table 2.6), Islamic Republic of Iran, Saudi Arabia, Algeria, Iraq, Qatar, Sudan, Egypt, Morocco, Syrian Arab Republic, Tunisia, Lebanon, Jordan, Israel (pg. 65, Table 2.7), Nigeria, Equatorial Guinea, Republic of Congo, Mauritius, Swaziland, Cape Verde, Ethiopia, Kenya, Tanzania, Cameroon, Uganda, and Cote d’Ivoire (pg. 67, Table 2.8) As long as the countries real GDP growth rate for 2009 was not negative, in other words they remained positive for 2009 they were not in a recession. Overall their real GPD for 2009 would indicate that they were producing more than before; since recession is exemplified by two or more quarters of real GDP growth rate decline. c. Identify two high-inflation countries and two high unemployment countries. Cite evidence and interpret 'high' as relative to other countries during the same time period. Ethiopia’s consumer prices rose from 25.3 to 36.4 from 2008 to 2009 (pg. 67, Table 2.8); while Uganda’s consumer prices rose from 7.3 to 14.2 from 2008 to 2009 (pg. 67, Table 2.8). These two countries have the highest inflation rate Ethiopia rose 11.1 and Uganda rose 6.9 from 2008 to 2009. Most countries inflation rate tended to lower. Spain with a unemployment rate of 18.0 and the Slovak Republic with and unemployment rate of 12.1 for 2009 have the two highest unemployment rates; relative to the other countries on the table for the same year. (pg. 47, Table 2.2) d. Identify unfamiliar terms that are frequently used in the IMF articles. Simply list 6 -7 terms. Some words I didn’t know or forgot what they meant that I had to look up were fiscal, monetary, commodity, backwardation, contango, albeit, securitization, and multilateral. e. List a number of indicators that point to an economic recovery. Some indicators that may signal economic recovery are the rising demand for oil and rising oil prices, the stability of the money market, the stock market is beginning to go up again, and bank lending is beginning to loosen up again (pg. 3). Some other signals include money being sent to developing economies, credit market is beginning to even, and some inventories are beginning to be restocked (pg.4 -7). f. What is meant by 'fiscal fragilities'? Which countries suffer from these 'fragilities'? Fiscal fragilities are frail situations in a country’s economy due to government spending or policy that may put it at risk for more economic hardship. The US is experiencing this fragility as the economy moves back into the hands of the private sector and due to its government stimulus. Europe in general is going through this same dilemma and its governmental implementation of the euro (pg. 1). In many advanced countries must consider their public debt as it will seem harder to pay off then emerging countries (pg. 19). g. Identify countries that have external surpluses. External surplus is based on the current account balance in this case it will be for 2009. Although China’s external surplus has fallen it still poses a surplus (pg. 5). China’s surplus is at 4.1, and Singapore holds the highest for the Asian region at 19.1 (pg. 49, Table 2.3). The Middle East and North Africa in most part also poses an external surplus, but again this may lower as the region begins to invest in other energy sources (pg. 64). Kuwait holds the highest surplus in that region at 25.8. However, its GDP is in the negative (pg. 65, Table 2.7). Norway’s surplus is the highest for all of Europe which accounts to 13.8, although, Norway’s GDP is negative (pg. 54, Table 2.4). The highest surplus in the Commonwealth of Independent States region is Azerbaijan at 23.6 (pg. 58, Table 2.5), in Latin America it’s Bolivia with 3.5 (pg. 61, Table 2.6), and in Africa it’s Kuwait with 25.8 surplus (pg. 65, Table 2.7). j. Show a demand and supply diagram of the spot market for oil (carefully read through Mankiw's discussion of the pizza market in chapter 1 of the textbook). Indicate the current (April 2010) equilibrium price in this market. Then, read the discussion of the crude oil market. Select one quote from this discussion and graphically illustrate this quote with the help of your demand and supply diagram. Spot Market for Oil 100 90 80 70 60 Price (U.S. dollars per 50 barrel) 40 30 20 10 0 0 10 20 30 40 50 60 70 80 90 100 Quantity (Millions of barrels a day) (pg. 37-38, Figure 1.19 & Table 1.3) Quote - “In the first half of 2009, reported findings of new oil deposits were about 10 billion barrels, the highest rate (annualized) since the late 1990s.” (pg.37) Spot Market for Oil 100 90 80 70 60 Price (U.S. dollars per 50 barrel) 40 30 20 10 0 0 10 20 30 40 50 60 70 Quantity (Millions of barrels a day) 80 90 100