Financial Accounting & Threshold Concepts: Ignoring Articulation in

advertisement

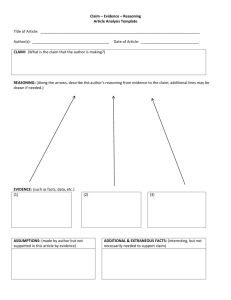

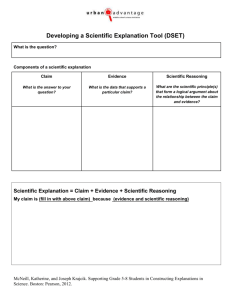

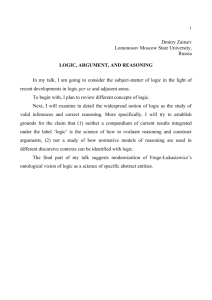

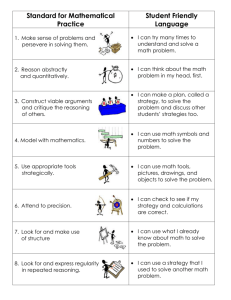

Financial Accounting & Threshold Concepts: Ignoring Articulation in Favor of the Bottom Line Kim Lyons UW-La Crosse Special thanks to OPID and the UW-La Crosse Provost’s office for their support of this project “A threshold concept can be considered as akin to a portal, opening up a new and previously inaccessible way of thinking about something. It represents a transformed way of understanding, or interpreting, or viewing something without which the learner cannot progress.” Meyer, J. & Land, R. (2006). Overcoming Barriers to Student Understanding: Threshold Concepts and Troublesome Knowledge. New York: Routledge. Threshold Concepts Moving from • Memorized rules, content, and processes To • Understanding the interrelatedness and impact of reporting alternatives The Greater Threshold for Accounting Students In the first few weeks of an Accounting Principles I course students learn • The accounting equation and components of financial statements • Financial statements are connected or “articulated” • Key figures in one financial statement are affected by changes in another • Financial information should be viewed in relative terms Basic Model: Articulation As students move through the financial accounting course sequence, are they better able to • Identify the accounting equation • Identify as true a conceptual description of the accounting equation • Apply the threshold concept by recognizing changes in income relative to the accounting equation Research Questions Using 5 multiple choice questions, I asked a cross-section of Principles I (N = 106), Intermediate I (N = 44), and Advanced (N = 44) Financial Accounting students to: • (1) Identify the accounting equation • (2) Identify a conceptual description of the accounting equation as a true statement among alternatives • (3-5) Apply the threshold concept to choose between two companies for investment • (3-5) Explain the reasoning behind their investment choices Research Design • Improved ability to identify, describe, and apply the model at higher levels of the financial course sequence • Smaller numbers of students in higher level courses making less optimal choices for the same reasons as students in lower level courses What I Expected Concept questions included the following Question Design Question Design Application questions were constructed to include an optimal answer choice when the data was viewed in context Open-ended explanations were coded to reveal thought processes separately from answer choices • (0) Unrelated reasoning • (1) Application of the threshold concept • (2) Focused or narrow thinking (net income, assets, liabilities, equity, company size, or cash) Question Design Statistical analysis revealed • Ability to apply the model at higher levels of the financial course sequence improved • Making the optimal choice was not independent of reasoning on all three questions for all three groups • Students who exhibited poor reasoning were clustered into groups, but not as expected Analysis and Results Principles students focus on net income and assets Intermediate students focus on debt Significant Differences in Reasoning Principles I to Intermediate Intermediate students focus on equity and company size Advanced students focus on debt Significant Differences in Reasoning Intermediate to Advanced Question 1: Correctly identify the accounting equation ACC221 (N = 106) 96% Question 2: Conceptual description of the accounting equation ACC321 (N = 44) 95% ACC221 (N = 106) 9% ACC421 (N = 44) 95% ACC321 (N = 44) 57% ACC421 (N = 44) 57% • Advanced students were no more likely than intermediate students to identify the conceptual description • These results imply that students at higher levels are applying concepts more appropriately, even while they may not understand the model they are using • The conceptual definition is counterintuitive or confusing Conceptual Questions