Burda & Wyplosz

MACROECONOMICS

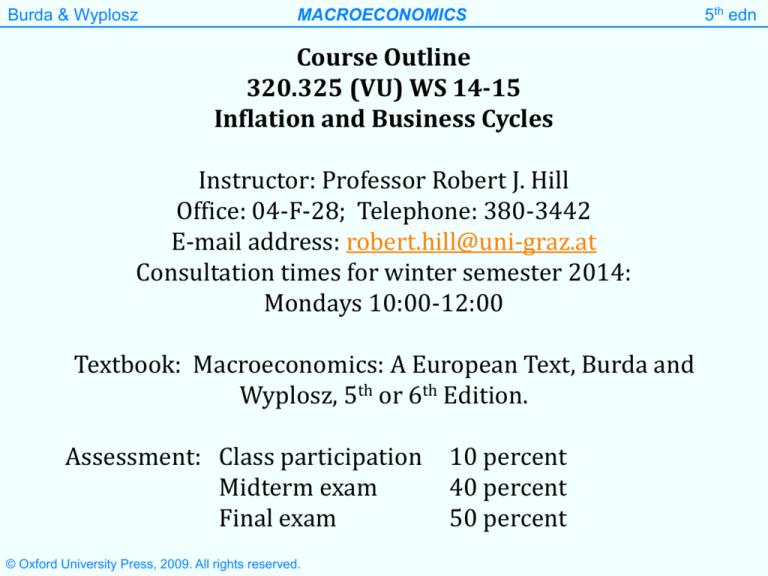

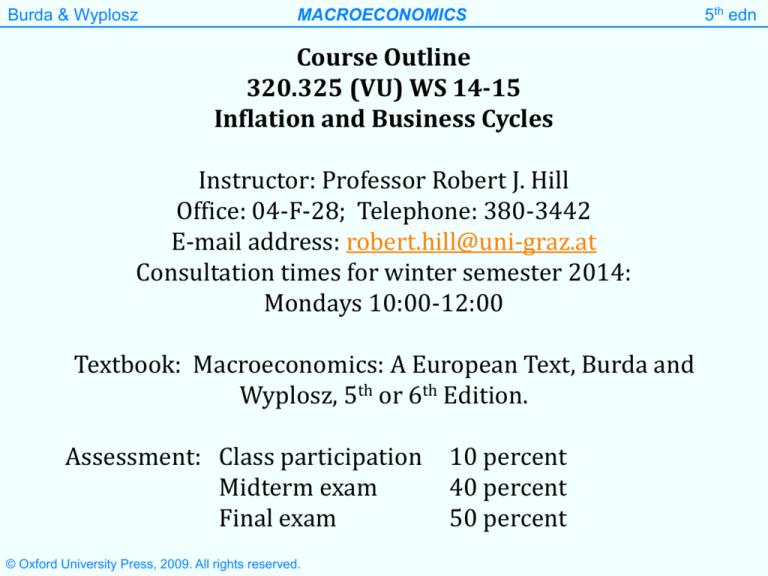

Course Outline

320.325 (VU) WS 14-15

Inflation and Business Cycles

Instructor: Professor Robert J. Hill

Office: 04-F-28; Telephone: 380-3442

E-mail address: robert.hill@uni-graz.at

Consultation times for winter semester 2014:

Mondays 10:00-12:00

Textbook: Macroeconomics: A European Text, Burda and

Wyplosz, 5th or 6th Edition.

Assessment: Class participation

Midterm exam

Final exam

© Oxford University Press, 2009. All rights reserved.

10 percent

40 percent

50 percent

5th edn

Burda & Wyplosz

MACROECONOMICS

5th edn

Provisional Lecture Schedule

Week 1 – (29 October 2014) – Lecture on Chapter 12

Week 2 – (5 November 2014) – Tutorial covering material

from Chapter 12

Week 3 – (12 November 2014) – Lecture on Chapter 13

Week 4 – (19 November 2014) – Tutorial covering material

from Chapter 13

Week 5 – (26 November 2014) – Lecture on Chapter 14

2

© Oxford University Press, 2009. All rights reserved.

Burda & Wyplosz

MACROECONOMICS

5th edn

Week 6 – (3 December 2014) – Tutorial covering material

from Chapter 14

Week 7 – (10 December 2014) – Midterm Exam

Week 8 – (17 December 2014) – Lecture on Chapter 15

Week 9 – (7 January 2015) – Tutorial covering material

from Chapter 15

Week 10 – (14 January 2014) – Lecture on Chapters 16

and 17

3

© Oxford University Press, 2009. All rights reserved.

Burda & Wyplosz

MACROECONOMICS 5/e

Week 11 – (21 January 2015) – Tutorial covering material

from Chapters 16 and 17

Week 12 – (22 January 2015) – Lecture and tutorial

covering material from Chapter 18

Week 13 – (28 January 2015) – Final Exam

4

Burda & Wyplosz

MACROECONOMICS

Lecture 1

Chapter 12

Output, Employment,

and Inflation

© Oxford University Press, 2009. All rights reserved.

5th edn

Burda & Wyplosz

MACROECONOMICS 5/e

Figure 12.01

From the short to the long run

One-off increase in

the money supply

M

M

Short-run: prices are

sticky, output responds

to change in demand

Y

Y

P

Neoclassical long-run:

change in money results

in no change in output,

only a change in the

price level.

P

Time

© Oxford University Press, 2009. All rights reserved.

6

Burda & Wyplosz

MACROECONOMICS 5/e

An increase in the real money supply pushes down the

equilibrium interest rate in the money market for any given

level of Y, thus shifting the LM curve to the right. The fall in

the interest rate causes investment and hence equilibrium

Y to rise.

7

Burda & Wyplosz

MACROECONOMICS 5/e

Figure 12.04

Phillips curves: The UK, 1888-1975 and

a 16-country average, 1921-1973*

16 country average

Inflation rate (%)

UK

Unemployment rate (%)

© Oxford University Press, 2009. All rights reserved.

Unemployment rate (%)

8

*Excluding 1939-1949

Burda & Wyplosz

MACROECONOMICS 5/e

Figure 12.03

Inflation

Stylized Phillips curve

The tradeoff: reducing

inflation from the high level

at A to the lower inflation at

B comes at a cost in an

increase in unemployment.

A

B

Unemployment

Phillips curve

9

© Oxford University Press, 2009. All rights reserved.

Burda & Wyplosz

MACROECONOMICS 5/e

Figure 12.03

Stylized Phillips curve in algebra

Inflation

b U U

Phillips curve in point-slope form

U

(a) Phillips curve

Unemployment

10

© Oxford University Press, 2009. All rights reserved.

Burda & Wyplosz

MACROECONOMICS 5/e

Why might a trade off exist between inflation π and

unemployment U?

Suppose workers expect inflation to be at the level .

They take this into account when they negotiate wage rises

for the next period.

If the actual rate of inflation π is lower than , then real

wages are higher than expected.

This causes firms to cut output and fire some of their

employees.

The fall in inflation therefore causes unemployment to rise.

Similarly, unemployment falls when inflation rises.

11

Burda & Wyplosz

MACROECONOMICS 5/e

Phillips curve plots inflation against unemployment

(π – ) = –b(U – Ū)

Okun‘s law plots unemployment against output

U – Ū = -h(Y – Ỹ)/Ỹ

Aggregate supply curve plots inflation against output

(π – ) = g(Y – Ỹ)/Ỹ

12

Burda & Wyplosz

MACROECONOMICS 5/e

12.3.2 Okun’s Law and a supply curve interpretation

Okun’s Law is the relatively stable empirical relationship

U U h Y Y Y

where 0<h<1

There are two reasons why h<1:

(i) The labour force expands in booms and declines in

recessions

(ii) Firms tend to hoard labour in recessions

13

Burda & Wyplosz

MACROECONOMICS 5/e

Figure 12.05

Output gaps and unemployment in Germany

(1966-2007)

4

3

2

1

0

-1

-2

-3

Output gap

-4

Unemployment gap

-5

1966 1970 1974 1978 1982 1986 1990 1994 1998 2002 2006

© Oxford University Press, 2009. All rights reserved.

14

Burda & Wyplosz

MACROECONOMICS 5/e

Figure 12.06

Okun’s Law

Ygap

Ugap

U U

Ugap

U

Y Y

h

Y

h

U U Y Y

Y

j

Y

Output

U U j Y Y

Okun's Law in point-slope form

15

© Oxford University Press, 2009. All rights reserved.

Burda & Wyplosz

MACROECONOMICS 5/e

Figure 12.07

Phillips curve + Okun’s law = Aggregate Supply

b U U

Phillips curve in point-slope form

U U j Y Y

Okun's law in point-slope form

b j Y Y b j Y Y Y

g

a

Y

Ygap

Aggregate supply curve

© Oxford University Press, 2009. All rights reserved.

Note: the product of two negative slopes

became a positive slope!

16

Burda & Wyplosz

MACROECONOMICS 5/e

Figure 12.07

g Y Y

b U U

Aggregate supply curve

Inflation

Inflation

Simple Phillips curve

U

Unemployment

(a) Phillips curve

Y Output

(b) Aggregate supply

17

© Oxford University Press, 2009. All rights reserved.

Burda & Wyplosz

MACROECONOMICS 5/e

Figure 12.09

Phillips curves: Recent experience

Euroland and the UK

Euroland (1970-2007)

UK (1960-2007)

18

© Oxford University Press, 2009. All rights reserved.

Source: OECD

Burda & Wyplosz

MACROECONOMICS 5/e

Figure 12.08

Inflation

Inflation

The long run

U

(a) Phillips curve

Unemployment

Y

Output

(b) Aggregate supply

19

© Oxford University Press, 2009. All rights reserved.

Burda & Wyplosz

MACROECONOMICS 5/e

The Phillips Curve in the 1970s

In the 1970s many countries experienced stagflation. This

is not consistent with the Phillips curve? Why did this happen?

The underlying rate of inflation and the natural rate of

unemployment Ū in the Phillips curve are endogenous (i.e.,

they can change over time).

Hence the Phillips curve shifts over time.

Here we focus on factors that can cause the underlying rate

of inflation to change over time.

Factors that can change the underlying rate of unemployment Ū will be briefly mentioned in the concluding section.

20

Burda & Wyplosz

MACROECONOMICS 5/e

Deriving the Phillips Curve from First Principles

To understand the behaviour of the Phillips curve in the

1970s it is useful to derive it from the interaction between

two markups:

(i) the price markup

θ is the price mark-up on labour costs charged by firms

(ii) wage markup.

γ is the wage mark-up on expected prices obtained by

workers

This approach shows us how is determined and why it

varies over time.

21

Burda & Wyplosz

MACROECONOMICS 5/e

The price mark-up θ on labour costs charged by firms is

calculated as follows:

Labour productivity = Y/L

L/Y = unit labour requirements

W = the wage per worker

WL/Y = W/(Y/L) = nominal unit labour costs

(i.e., the labour cost of producing one unit of output).

.

It is now assumed that firms set prices by marking-up nominal

unit labour costs by a proportion θ:

W

WL

P 1

1

Y

Y L

22

Burda & Wyplosz

MACROECONOMICS 5/e

Wage negotiations will set a nominal wage W compatible

with an expected real wage target W/Pe.

W

Y

Y

sL 1 sL

e

P

L decomposes L

share of

productivity

paid to labour

actual wage

share into two

components

The parameter γ can be positive or negative. It allows

for a deviation from the “normal” or historical share of

labour productivity that will be paid to labour.

23

Burda & Wyplosz

MACROECONOMICS 5/e

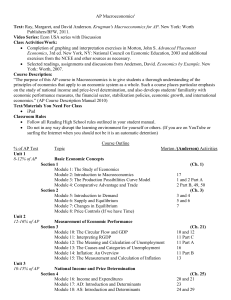

Table 12.01

Wage share of value added by country and selected

industries, 2001 (%)

Total

economy

Belgium

Manufacturing

Chemicals

Basic metal

industries

Wholesale/

retail trade

56.6

64.5

53.9

78.3

56.7

50.1

54.6

46.0

60.0

43.6

Germany

58.2

74.1

69.0

75.3

63.9

Denmark

60.1

64.5

40.4

54.1

67.9

Spain

53.1

67.3

59.7

73.3

44.5

Italy

43.7

54.6

51.9

61.6

32.6

Japan

52.6

56.1

36.3

60.9

60.2

Netherlands

56.0

59.9

45.9

78.4

60.0

Poland

49.8

61.0

n.a.

n.a.

26.1

United States

58.7

66.0

49.5

70.6

55.6

Czech Republic

a

a

a

a

2000

Source: OECD, National Accounts, Volume II

24

© Oxford University Press, 2009. All rights reserved.

Burda & Wyplosz

MACROECONOMICS 5/e

Rewriting the last equation we have:

WL

1 sL P e

Y

Substituting this wage equation into the price markup

equation, we get a relationship between the markup

factors, normal labour share, and expected price and

the actual price level.

P 1 1 sL P

e

25

Burda & Wyplosz

MACROECONOMICS 5/e

Now take logs of this equation in the current and previous

period:

ln P ln 1 ln 1 ln sL ln P e ln sL ln P e

ln P1 ln 1 1 ln 1 1 ln sL ln Pe1 1 1 ln sL ln Pe1

Subtract the second line from the first:

ln P ln P1 1 1 ln P e ln Pe1

mark-up

subtract and add

P1 here

mark-up ln P e ln P1 ln P1 ln Pe1

e

price level surprise

last period

26

Burda & Wyplosz

MACROECONOMICS 5/e

The following approximation is used on the previous

slide:

ln(1+x) ≈ x (where x is small).

It follows that

ln P – ln P-1 = ln(P/P-1) ≈ (P/P-1) –1 = (P – P-1)/P-1 = π

where x = (P/P-1)-1.

27

Burda

& Wyplosz

MACROECONOMICS 5/e

The last term in the equation below will on average be zero

(assuming rational expectations).

mark-up e ln P1 ln Pe1

price level surprise

last period

π = Δmark-up +

(*)

where denotes the underlying rate of inflation, which

combines forward looking expectations and backward

looking adaption to the last price level surprise.

It should be the case that γ rises when the economy is

booming (i.e., when Y>Ỹ and U < Ū), and falls when the

economy is in recession (i.e., when Y<Ỹ and U > Ū).

It is not clear how θ varies over the business cycle.

28

Burda & Wyplosz

MACROECONOMICS 5/e

Overall, we can reasonably assume that

Δmark-up > 0 when Y>Ỹ and U < Ū

Δmark-up < 0 when Y<Ỹ and U > Ū.

As an approximation, we can go further and assume that

the aggregate mark-up evolves as follows over the

business cycle:

Δmark-up = a(Y-Ỹ) = -b(U-Ū).

(**)

Substituting the mark-up equation (*) into (**), we obtain

that

29

Burda & Wyplosz

MACROECONOMICS 5/e

a Y Y b U U

AS

(***)

"expectations" augmented

Phillips Curve

This is what is referred to as the expectations augmented

Phillips curve.

The key difference between this and the original Phillips

curve is that the parameter is now time dependent

and defined as follows:

= πe + price level surprise last period

Hence the Phillips curve, as graphed in U-π space, shifts

around over time as πe changes.

30

Burda & Wyplosz

MACROECONOMICS 5/e

Modelling the Impact of Supply Shocks

Supply shocks, such as a rise in the price of oil, impact on

the aggregate supply curve and Phillips curve as follows:

actual

underlying

inflation

a Y Y s

cycle

shock

b U U s

In other words, supply shocks cause both the aggregate

supply curve and Phillips curve to shift upwards by the

amount of the shock s.

31

Burda & Wyplosz

MACROECONOMICS 5/e

Figure 12.11

Augmented Phillips and aggregate supply curves

Inflation

Inflation

AS

B

A

U

(a) Phillips curve

B

Unemployment

AS

A

Y

Output

(b) Aggregate supply

32

© Oxford University Press, 2009. All rights reserved.

Burda & Wyplosz

MACROECONOMICS 5/e

Figure 12.10

Oil price in euros, 1952-2007

180

(Index = 100 in 2000)

160

140

120

100

80

60

40

20

0

1952

1962

1972

1982

1992

2002

33

© Oxford University Press, 2009. All rights reserved.

Source: OECD

Burda & Wyplosz

MACROECONOMICS 5/e

Table 12.02

Equilibrium (i.e., natural) unemployment rates

Austria

1970

1980

1990

2000

2008

1970

1980

1990

2000

2008

Belgium Switzerland Germany

1.5

1.8

4.3

5.0

4.9

N/A

5.9

7.3

7.6

7.2

N/A

0.6

1.7

2.2

2.2

3.3

4.4

6.9

7.3

7.1

Hungary

Ireland

Italy

Japan

N/A

N/A

N/A

7.5

5.3

N/A

10.9

14.4

6.6

5.0

4.3

5.4

8.8

9.4

7.2

2.4

1.6

2.8

3.6

3.9

Denmark

Spain

Finland

France

UK

N/A

5.1

6.8

4.8

4.5

N/A

6.4

14.5

12.4

8.5

4.6

4.0

4.8

9.8

8.0

N/A

6.1

9.4

9.5

8.5

2.7

4.1

8.0

5.6

5.3

Portugal

Sweden

US

N/A

6.5

4.5

4.1

4.8

1.5

1.9

2.2

4.8

4.8

5.5

6.5

5.8

5.0

4.6

Netherlands Norway

N/A

4.3

7.5

4.5

3.2

1.6

1.9

3.9

3.8

4.1

The natural rate of unemployment rose in most countries in the 1970s and

then gradually decreased again in the 1990s.

34

© Oxford University Press, 2009. All rights reserved.

Source: OECD

Burda & Wyplosz

MACROECONOMICS 5/e

Figure 12.12

Suppose initially inflation equals underlying inflation.

Inflation

Long run AS

Inflation

Long run

1

A

U

(a) Phillips curve

Short run

Phillips

curve

Unemployment

Short

run

AS

1

A

Y

Output

(b) Aggregate supply

35

© Oxford University Press, 2009. All rights reserved.

Burda & Wyplosz

MACROECONOMICS 5/e

Figure 12.12

-Short-run trade-off between u and p:

Suppose aggregate demand rises (say due to the government implementing an

expansionary monetary policy)

2

1

Long run AS

Inflation

Inflation

Long run

B

A

U

(a) Phillips curve

Short run

Phillips

curve

Unemployment

2

1

B

A

Y

Short

run

AS

Output

(b) Aggregate supply

36

© Oxford University Press, 2009. All rights reserved.

Burda & Wyplosz

MACROECONOMICS 5/e

Figure 12.12

At B, inflation is not equal to underlying inflation.

Underlying inflation will adjust.

2

1

Long run AS

Inflation

Inflation

Long run

B

A

U

(a) Phillips curve

Short run

Phillips

curve

Unemployment

2

1

B

A

Y

Short

run

AS

Output

(b) Aggregate supply

37

© Oxford University Press, 2009. All rights reserved.

Burda & Wyplosz

MACROECONOMICS 5/e

Figure 12.12

As underlying inflation catches up with experience, the

Phillips curve and AS will shift.

2

1

Long run AS

Inflation

Inflation

Long run

B

A

U

(a) Phillips curve

Short run

Phillips

curves

Unemployment

2

1

B

A

Y

Short

run

AS

Output

(b) Aggregate supply

38

© Oxford University Press, 2009. All rights reserved.

Burda & Wyplosz

MACROECONOMICS 5/e

Figure 12.12

A move along “invisible” AD curve through B and C

Long run AS

Inflation

Inflation

Long run

C

2

1

B

A

U

(a) Phillips curve

Short run

Phillips

curves

Unemployment

C

2

1

B

A

Y

Short

run

AS

Output

(b) Aggregate supply

39

© Oxford University Press, 2009. All rights reserved.

Burda & Wyplosz

MACROECONOMICS 5/e

Figure 12.12

No stable long run tradeoff between unemployment and

inflation. End up at Z.

C

2

1

B

Long run AS

Z

Inflation

Inflation

Long run

A

U

(a) Phillips curve

Short run

Phillips

curves

Unemployment

Z

C

2

1

B

A

Y

Short

run

AS

Output

(b) Aggregate supply

40

© Oxford University Press, 2009. All rights reserved.

Burda & Wyplosz

MACROECONOMICS 5/e

Conclusion

The big rightward shift of the short-run Phillips curve in the

1970s and early 1980s can be explained by a combination of

the following:

(i) A negative supply shock caused by the rise in the price of

oil triggered a series of rises in the underlying rate of

inflation. Rises in oil costs caused firms to raise prices

which in turn caused workers to demand higher wages,

which caused firms to further raise prices, etc.

(ii) Attempts by governments to exploit the Phillips curve

and trade-off higher inflation in return for lower

unemployment.

(iii) A rise in the natural rate of unemployment (due to oilshock induced changes in economic structure and

hysteresis).

41