MACROECONOMICS

advertisement

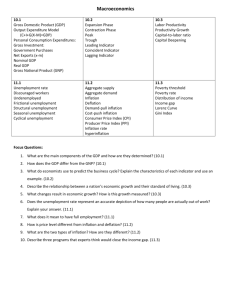

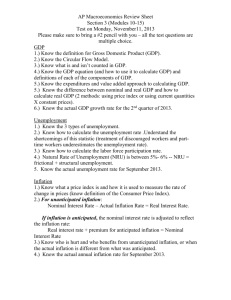

MACROECONOMICS UNIT OF ANALYSIS ECONOMY AS A WHOLE VARIABLES OF INTEREST OUTPUT PRODUCTIVITY INFLATION UNEMPLOYMENT METHOD OF ANALYSIS ECONOMIC MODELING ECONOMIC MODELING • HYPOTHESIS – Relationship of interest • Level of sales and the price • THEORETICAL FORMULATION – Mathematical relationship • Quantity sold = f (price) = constant – coefficient*Price • -EMPIRICAL ANALYSIS – ESTIMATION -EXPERIMENTAL ANALYSIS -THEORETICAL FORMULATION ONLY ATTENDANCE IN CLASS AS MODEL • Hypothesis – Penalty for missing a class leads to increased attendance • Theoretical formulation – Attendance (A) is a function of many factors • Attendance penalty (X) • Alternative uses of time, and other costs of being in class (difficult to measure and identify, as they differ from student to student) • Quality of lectures (Q) • % of the students in the class majoring in Economics (E) – A=f(X,Q,E)=constant+a*X+b*Q+c*E • A – an endogenous to the model variable • X,Q,E – exogenous to the model variables • Next stage is either empirical or experimental Example II – Modeling Demand (another microeconomic model) • Quantity = f (Price, other relevant factors) • Consider demand for gasoline at a gas station, other relevant factors will include – Population density/car ownership rate – Fuel efficiency of an average car in the area – State of public transit in the area – Proximity of another gas station – Price charged by a competing gas station – ….and many many more…. Modeling Demand • Assume that we can only observe the price charged by the competitor: Pc (Note: assumptions simplify the reality, but reduce applicability) • Hypothesis – Quantity sold = constant – a*Price + b*Pc • Quantity sold is determined by the model (endogenous) • Price, Pc are inserted into the model (exogenously given) • a, b represent the effects of Price and Pc on Quantity sold; these are the research objectives • Signs on a and b are also part of the hypothesis. a is assumed to be negative because of the law of demand, while b is positive due to the substitution, but this is not always known in advance. model • Simplification of reality and limitations of the model • Analysis of relationships • Dynamically changing society and the need for evolution of economic thought – From Adam Smith to Karl Marx to John Keynes Measuring Economic Activity • OUTPUT • EMPLOYMENT • INFLATION MEASURING OUTPUT • Gross Domestic Product the total market value of all final goods and services produced by factors of production located within a nation’s borders over a period of time (usually one year) • Gross National Product the total market value of all final goods and services produced by factors of production owned by a nation over a period of time (usually one year) Output • Measuring production – – – – Time period (flow vs. stock) Final goods and services (value added) Market prices Defining an economy (geographical boundaries versus resource ownership) • Gross Domestic Product • Gross National Product • www.bea.gov Table 1.7.5 http://www.bea.gov/bea/dn/nipaweb/TableView.asp?SelectedTable=43&FirstYear=2003&LastYear=2005&Freq=Qtr Main Categories of Expenditures • Consumption • Investment • Government Spending • Imports • Exports National Income Accounts statistics are available online on the website of The US Bureau of Economic Analysis: www.bea.gov % share of expenditures in GDP Personal consumption expenditures Durable goods 2004 70 8.4 Nondurable goods 20.2 Services 41.4 Gross private domestic investment Fixed investment 16.4 16 Nonresidential 10.2 Structures 2.5 Equipment and software 7.7 Residential Change in private inventories Net exports of goods and services Exports 5.7 0.5 -5.3 10 Goods 7 Services 3 Imports 15.3 Goods 12.7 Services Government consumption expenditures and gross investment Federal 2.6 18.9 7.1 National defense 4.7 Non-defense 2.3 State and local 11.8 OUTPUT = INCOME • GNP = GDP + NET PAYMENTS FROM ABROAD (Table 1.7.5) • NNP = GNP – DEPRECIATION • NI = NNP – INDIRECT BUSINESS TAXES • NI represents total payments to nation’s factors of production (profits, rents, wages…). (Table 2.1. Personal Income and Its Disposition) Real versus Nominal i N GDP i 1 PiQi Nominal GDP growth rate = output growth rate + price level growth rate Growth in Nominal vs Real GDP Nominal GDP Real GDP 8.0 7.0 6.0 level of growth 5.0 4.0 3.0 2.0 1.0 0.0 1995 1996 1997 1998 1999 2000 year 2001 2002 2003 2004 Measuring Inflation • CPI, PPI, Core Index, GDP Deflator – Data available on BLS website (www.bls.gov) – Construction of an index “indexed average price” • Characteristics of recent US inflation – Low level – Non-uniform – International effect on the US inflation employment • Labor force and labor force participation • Measuring unemployment – Current Population Survey • Measuring current employment – Survey of businesses Employment data: Bureau of Labor Statistics (www.bls.gov) Statistics for the US economy For March-July 2003 (seasonally adjusted). Source: BLS Emploment values are in 000's Total nonfarm Employment in 000's Total Employment Total Unemployed Civilian Labor Force Labor Force Participation Rate Unemployment Rate March 130084 137348 8445 145793 66.2 April 130062 137687 8786 146473 66.4 May 129986 137487 8998 146485 66.4 June 129914 137738 9358 147096 66.6 July 129870 137478 9062 146540 66.2 0.05792459 0.05998375 0.06142608 0.06361832 0.06183977 Discouraged Worker Phenomenon % Labor Force Participation Rate 1997 67 For the month of January 1998 1999 2000 2001 2002 2003 67.1 66.4 66.3 67.3 67.3 67.2 Real Output and Unemployment • Okun’s Law – Unemployment increase reduction in Real GDP growth – Estimates suggest that a 1% increase in unemployment rate leads to a 2% decline in Real GDP growth rate: Change in Real GDP growth rate = constant – 2 * change in Unemployment rate • 2001-2003: Jobless Recovery? – 2001-2003: unemployment and real GDP increase at the same time Classical Economic Theory • Historical roots of the theory – From Adam Smith’s Invisible Hand to XX century economics • Flexibility of all prices – Price adjustment rather than output adjustment • Economy at the capacity equilibrium – The long-run nature of the model The economy as a self-perpetual system • Spending creates income; income creates means for spending…. The circular flow concept • An important classical assumption: no leakages from the flow: for example, savings immediately translate into investment – Keynes’ Trust Paradox closed economy: Y = C +I +G Output markets C Revenues I Private S Financial market G households Taxes income firms Pub.S Government Wages, profits, rents = Y Input markets Demand for Output • Income identity from the Circular Flow Model: Y=C+I+G • Disposable income (after-tax/transfer PI) = Y – T – (Y-T) = C + S • Consumption function (autonomous, induced) – Consumption is induced by disposable income: C = C(Y-T) – Some consumption may be autonomous to disposable income, and be influenced by other factors (expected future Y, interest rate..) C = a + c (Y-T) • Consumption and Saving are the only allocations of disposable income – MPC, MPS • G, T are policy driven and hence not induced by current income. Demand for output • Investment – Function of real interest rate I(r) – Investment is a decreasing function of the real interest rate (investment is spending by firms on final goods such as capital goods) – The economic measure of the user cost of capital • Interest rate • Economic depreciation Equilibrium in the output market • Production of output (supply) depends on two factors: – Composition of inputs • Physical capital (K) • Labor (L) – State of production technology • Y = F ( K, L ) • Equilibrium in the classical model (long-run, or capacity equilibrium) Y ( K , L ) a(r ) c(Y T ) I (r ) G If the inputs and the state of production technology are fixed, the supply of goods in the economy is limited by its fixed capacity (recall fixed LRAS from 2105) Note that r, the real interest rate, is not yet determined by the model. Interest rate is simply the price of loanable funds, and the Classical model assumes full flexibility of prices, however there is only one interest rate at which the output market will be in an equilibrium – that equilibrium interest rate must be determined in another market. Determining the equilibrium interest rate: the financial market • Real interest rate is the real cost of borrowing (investment). Recall that even if investment is cash financed, interest rate is still the cost of borrowing. • GDP identity: Y = C + I + G I = Y – C – G = S (national savings) – National savings: output – expenditures: Y – C – G • Public savings: T – G – Public savings do not depend on the interest rate • Private savings: (Y-T)-C – If we treat C as NOT a function of the interest rate, then private savings are not affected by the interest rate (Mankiw Textbook) – If we assume that autonomous consumption is a function of the interest rate, and is a decreasing function of the interest rate, then the private savings will be an increasing function of the interest rate Financial market equilibrium r S S, when a(r) I(r) Loanable funds I = (T-G) + [(Y-T) – a – c (Y-T)] = public savings + private savings Weakness of fiscal expansion in the classical world • Equilibrium in the output market 1 Y (a cT I G ) 1 c • Equilibrium in the loanable funds market I = (T-G) + [(Y-T) – a – c (Y-T)] – Any increase in G will be offset by equal drop in I (or I+a, if a(r)) – indirect crowding-out – Any decrease in T will be offset by a drop in I = cT (or I+a, if a(r)) – indirect crowding-out Indirect Crowding-out effect in Fiscal Expansion • Expansionary fiscal policy: • Public Savings decrease r S T-G Investment declines, offsetting Increase in G. I(r) Loanable funds The microeconomics • Determination of factor prices • Marginal productivity – The benefit of hiring an additional worker is the change in the total revenues that results from hiring that worker • Value of the marginal product of labor = wage – Similarly, VMPK=R - cost of capital • Constant returns to scale and zero economic profits • Changes in input ratio and changes in input costs example • Assume the following: • C=100+0.8*(Y-T) • I=1000-100*r • Y=f(L,K)=L^(0.5)*K^(0.5) • L=10000; K=400 • G=T=0 -------------------------------------• What is the equilibrium level of output? • What is the level of national, public, and private savings? • What is the equilibrium interest rate? -------------------------------------• Set G=T=200 (balanced budget) -------------------------------------• Set =200, T=100 (budget deficit) -------------------------------------• Set G=200, but increase I to I=1100-100r -------------------------------------• Set G=T=0, original I function, but C=100-10r+0.8*(Y) money • Functions – Medium of exchange – definition of money – Unit of account – Store of value • Historical forms of money – Commodity money • Gold standard: 1880’s-1914; revised standard in post WWII era • Fiat money Supply of Fiat Money • Central Bank and money supply – Open market operations • Expansion • Contraction • Recent history of US OMO – http://www.federalreserve.gov/fomc/fundsrate.htm • For more expanded discussion of money supply read appendix at the end of Chapter 18 (p. 482) Money Market • Real Supply: M/P=f( monetary policy ) • Real Money Demand: Md/P – Transaction demand for money • Function of Y – Opportunity cost of holding M2 assets • Nominal interest rate – Md/P = L( i, Y ) = k Y – a i M/P - supply i Md/P M-balances Quantity Theory of Money • Transaction need for money – Price*Number of Transactions • Money Supply (Quantity of Money): M • Transaction Velocity of Money: V • Quantity equation (transaction): M*V=P*T --------------------------------------------------------• Income Velocity of Money • Quantity equation (income): M*V=GDP Deflator * Real GDP demand for money and quantity theory of money • Money demand: Md – Transaction based: function of nominal GDP (PY): Md=PkY • PY=Md(1/k) V (income velocity) = (1/k) – Real Money Demand: Md/P=kY • Real money balances • In equilibrium real money demand (Md/P) must equal real money supply (M/P) – M/P = k Y M(V=1/k)=PY inflation • Quantity of money equation: MV = PY inflation %P %M %V %Y • Assumption of constant velocity of money – Inflation • Money supply growth – Russia in the 90’s, Germany in the 20’s • Drop in productive capacity (output) • Monetary Rule – Money supply growth = real GDP growth Money neutrality • Classical economic theory: – Changes in money supply have no impact on real economic variables: output, real wages, relative prices… Inflation and nominal rates • Fisher Equation: – Nominal rate = real rate + inflation • For past arraignments: observed inflation – ex post real interest rate • For forward looking: expected inflation – ex ante real interest rate determination • Real Money Demand: – Md/P = L ( i , Y ) = L ( r + exp infl , Y ) • Expectation of future inflation can affect current money demand Seigniorage or Inflationary Tax • Printing money as source of government revenue – Main source of hyper inflation – Dollarization Costs of inflation • Expected (and unexpected) inflation – Menu Costs – Shoe-Leather Costs – Instability in relative prices • Unexpected inflation – Redistribution of wealth – Uncertainty of future inflation and forward looking arraignments Open Economy • Presence of foreign sector – Trade – Investment 2001 data. Source: WDI, WorldBank, 2003 Exports % of Imports % GDP of GDP Austria Belgium Finland France Germany Greece Ireland Italy Luxembourg Netherlands Portugal Spain China Japan Russian Federation Switzerland United Kingdom United States (2004:BEA) 52.21 84.42 40.38 27.91 34.97 .. 52.58 81.09 31.58 26.35 33.07 .. 95.39 28.27 .. 80.49 26.67 .. 65.06 31.63 29.92 59.73 41.24 31.40 25.83 10.44 36.81 45.47 27.12 10.00 23.41 9.81 24.15 41.13 29.28 15.32 Croatia Czech Republic Denmark Iceland Sweden Hungary Latvia Lithuania Poland Exports % Imports % of GDP of GDP 46.72 71.05 45.59 40.48 46.45 60.47 45.52 50.41 29.12 52.77 73.79 39.18 40.95 40.56 62.61 54.19 55.85 33.01 Trade • • • • X – exports m – imports Net Exports: NX = X – m Y = C + I + G + NX – At any given time period a country’s spending need not equal its output • NX<0 a country spends more than it produces, i.e. borrowing • NX>0 a country’s production exceeds its spending, i.e. lending National Savings in Open Economy • • • • NS = Y – C – G = I + NX NX = NS – I Trade balance = net capital flow US BoP (www.bea.gov) – Current Account – Trade – Financial Account – Investment Small Open Economy • Incapable of causing changes in the world’s financial markets, i.e. is a price taker in financial markets, unable to influence the price of loanable internationally funds – interest rate.