FIN 1010 Student Learning Guide

advertisement

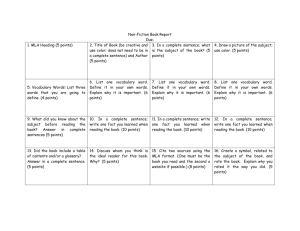

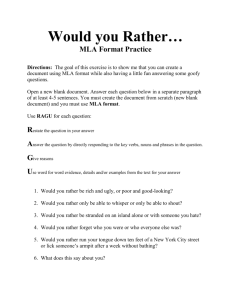

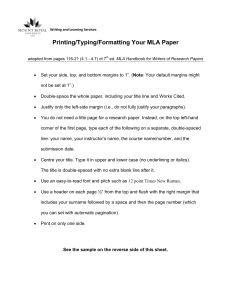

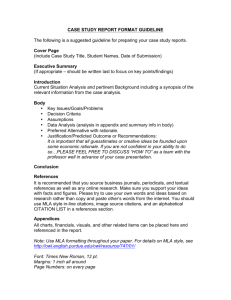

Career and Technology Studies Student Learning Guide FIN 1010: Personal Financial Information Submitted by: Crystal Jiang Ed 3601 ~ 2~ Why take this course? Most of you don’t see financial life skills as relevant to you in school and don’t have the experience to apply financial learning in your lives. This course involves a great amount of hands-on interactive activities which allows you to learn financial life skills in a meaningful and practical way. What do you need to know before you start? There are no prerequisites to this course. Have the curiosity about personal finance. Find the value of this course to your real-life experience. ~ 3~ What will you know and be able to do when you finish? Describe aspects of the lifestyle you envision for your future. Understand how personal needs and wants affect budgeting and financial planning. Able to take income and expenses into a personal budget. Calculate simple and annual interest and total savings Describe how credit and debit could affect you transition from secondary school. Describe different forms of insurance. Choose an investment portfolio suited to you. ~ 4~ When should your work be done? This course requires approximately 23-25 hours of work in and out of classroom, excluding quizzes. When in-class time allowed for the activities is up, you need to arrange your own time to complete them by deadline. How will your grade be determined? 7 assignments (45%) 3 mini-projects (35%) 6 quizzes (20%) ~ 5~ Which resources may you use? Most handouts and templates will be provided to you by the teacher in class. Glossary of financial terms provided by your teacher A Financial Consumer Agency of Canada site, “The Money Belt”: http://www.themoneybelt.ca/home-accueil-eng.asp you will need to register a student account for “The City” program. Other particular websites provided in the activities. Various internet sites in consultation with your teacher ~ 6~ Activities Your Future Lifestyle: 1. Goal setting(assignment) Needs and Wants: 1. Proposition paper on media and wants(project) Income, Expenses and Budget 1. Monthly budget (assignment) Savings and Banking: 1. Savings calculation(assignment) 2. Research on Savings accounts, GICs, and Canada Savings Bonds (project) Credit and Debit 1. The cost of borrowing(assignment) 2. Credit-related frauds presentation (project) Insurance 1. My insurance needs (assignment) Investing 1. Sample investments (assignment) 2. My investment portfolio(assignment) Note: There are 6 quizzes, one at the end of each topic, except for the first topic. ~ 7~ Topic 1: Your Future Life-Style Goal-setting assignment (1 hour, 4% of assignments grade): Creating your educational and career goals, 2 aimed at your future career (MUST include financial aspects, for example salary or worth of house you will own), and 2 aimed at your education to prepare you to meet your career goals. Use the S.M.A.R.T. Goals structure and requirements. S- Specific: A specific goal has a much greater chance of being accomplished than a general goal. To set a specific goal you should consider the following six “W” questions: Who (who’s involved), What, Where, Which (requirements and constraints), Why (purpose or benefits of accomplishing the goal) M- Measurable: establish concrete criteria for measuring progress toward the attainment of each goal you set. A-Attainable: figure out ways or strategies you can make them come true. R- Realistic: a goal must represent an objective toward which you are both willing and able to work. T- Timely: your goal should be grounded within a time frame. Typed up using font style and size easy to read. No extra marks are assigned for decoration. ~ 8~ Topic 2: Needs and Wants Paper on media and “wants” (4 hours, 10% of projects grade): Write a paper which debates and supports the proposition that media advertising promotes a culture of “wants” rather than “needs”. Use the internet, magazines, newspapers, television and radio broadcasts as your research medium. The paper must be composed of an introduction, at least 1 body paragraph, and a conclusion Length of the paper should be 3-4 pages, font size:12, font style: Times New Roman, double spaced. Cite any internet, magazine, and newspaper sources you have used, use MLA style (refer to the following website for standard MLA format): http://www.mcgill.ca/files/library/mla.pdf ~ 9~ Topic 3: Income, Expenses and Budget Monthly budget (2-3hours, 6% of assignments grade): Part 1 (5pts) Choose a career that you would like to pursue once you are done school and on your own finally. Find the salary for this position. Career title:______________ Salary:________________ Part 2: (10pts) Calculate what your gross pay would look like if you were paid weekly, bi-weekly, and monthly. Show your calculations. Weekly___________ Bi-weekly___________ Monthly__________ Now choose a pay period. How often would you like to receive a paycheck? ___________ Part 3: (20pts) Complete your monthly budget. Your budget must include accommodations, bills, food, entertainment, transportation, as well as anything else you might spend your hard-earned money on during the month. Note: If you make more than $80,000 per year you MUST buy a NEW car If you make between $30,000 and $79,000 you MUST buy a used car If you make less than $30,000 you MUST buy a bus pass All bills must be researched, a research log (next page) is provided, you must explain your research by including the website where your information was retrieved from. Don’t forget to budget for 5% GST on bills such as groceries, phone, utilities, clothing, etc. ~ 10~ EXPENSES Housing Mortgage or rent Internet Phone Cell phone Electricity Cable Water Other Transportation Vehicle Payment Bus/Taxi Fare Insurance & Registration Gas Maintenance Other Food Groceries Dining Out Other Personal Care Medical Hair/Nails Clothing Dry-cleaning Health Club Organization Dues/Fees Entertainment Videos/DVDs Movies Concerts Sporting Events Live Theatre Other COST WEBSITE REFERENCE Part 4: (10pts) You are going to turn your gross income into net income by taking into considerations of the deductions that would be taken out of your gross income each pay period. ~ 11~ Consider the following and re-evaluate your monthly living expenses. Monthly Income ______________ EI Contributions (1.73% of your gross monthly income)_____________ CPP Contribution (4.95% of your gross monthly income)____________ Income tax (15% of your gross monthly income)______________ Net Monthly Income (amount after deductions) ______________ Can you still afford your monthly living expenses? ____________ Are there any adjustments that you are willing to make not that you are not making as much money as you had originally budgeted for? Explain in detail. Total Expense Layout: Gross Monthly Income Housing Transportation Food Personal Care Taxes & Deductions Entertainment Net Monthly Income Deduct reasonable expenses if your budget ended up with a deficit. Figure out the new budget. Extended questions (Bonus up to 3pts): If your monthly budget ended up with a surplus, what are you going to do with it? How might your budget change if this was a budget for the month of August? December? ~ 12~ Topic 4: Savings and Banking Savings Calculation (1-2 hours, 6% of assignments grade): Savings add up when you follow a regular savings plan. Calculate the answers to the problems below. Show the steps needed to arrive at your answers on a separate piece of paper. OR if you choose to use an electronic spreadsheet for your calculations, make sure you show the formulas used at each step. 1. If you put $250 into an investment that paid 5% simple interest each year, how much interest would you earn in five years? What would your savings be worth at the end of 5 years? Year 1 Year 2 Year 3 Year 4 Year 5 Investment Interest Total 2. If you put $250 into an investment that paid 5% compound interest each year, how much interest would you earn in five years? What would your savings be worth at the end of 5 years? Year 1 Year 2 Year 3 Year 4 Year 5 Investment Interest Total 3. If you put $240 each year into an investment that paid 5% compound interest each year, how much interest would you earn in 5 years? What would your savings be worth at the end of 5 years? Carry over Annual Contribution Subtotal Interest Total Year 1 $0 $240 Year 2 Year 3 Year 4 Year 5 4. Look for the monthly net income from the “Monthly Budget” assignment, ~ 13~ the income after the CPP, EI, and income tax are deducted. Take the monthly net income and multiply it by 12 to get the annual net income (goes in the Annual Contribution row). Calculate the total amount you would have if you saved 5% compound interest each year. Repeat the calculations for 10% and 15% of your income. Carry over Annual Contribution (5%) Subtotal Interest Total Carry over Annual Contribution (10%) Subtotal Interest Total Carry over Annual Contribution (15%) Subtotal Interest Total Year 1 $0 Year 2 Year 3 Year 4 Year 5 Year 1 $0 Year 2 Year 3 Year 4 Year 5 Year 1 $0 Year 2 Year 3 Year 4 Year 5 ~ 14~ Research on savings accounts, GICs, and Canada Savings Bonds (4hours, 10% of projects grade): Write a report to evaluate and compare and contrast the following three methods of saving: savings accounts, GICs, and Canada Savings. Use trusted web resources to research the features, advantages, and disadvantages of each method. Include at least 3 web sources. Email your teacher the web sources you decide to use in order to get permission of using the sites, make sure you do this before you start writing the report. Length of the report should be about 2-3 pages (max 3 pages), font size:12, font style: Times New Roman. Must include subheadings. Use MLA citation style (refer to the following website for standard MLA format): http://www.mcgill.ca/files/library/mla.pdf ~ 15~ Topic 5: Credit and Debit Cost of Borrowing (1 hour, 6% of assignments grade): So you found a good deal and made a purchase. Should you pay cash or use credit card? When you use your credit card, the cost depends on when you’ll pay it off, and what the interest rate is. Unless you pay before the due date, credit adds cost. Use the example below to calculate how much it costs to use credit: You are starting university and want a laptop computer. You find one for $200 off the regular price – with taxes, it’s $1,498, just below your credit card limit. You have the money in a savings account, but you decide to put the computer on your credit card so you can use your savings for other purchases. When the statement arrives, you don’t have enough to money to pay it, so you make the minimum payment – 10% of the balance owing, $149.80. You don’t pay for the computer for three more months, except for the minimum payment each month. 1. If the annual percentage rate (APR) on your card is 18.9%, what’s the true cost of the computer when it’s fully paid? (Hint: work out the monthly interest rate, calculate the added interest, and subtract the payments each month. Use an electronic spreadsheet if you choose, but provide the formulas used on the side). Month 1 Month 2 Month 3 Month 4 Balance Interest at 1.58% per month (18.9% per year divided by 12 months) Subtotal (balance +interest) Minimum Payment (10% of balance) New Balance Owing (Subtotal less payment) ~ 16~ 2. Calculate the cost of the sum of the items on your credit card statement, using the interest rate showing on the statement. Assume that you make only the minimum payments for 3 months. Final payment (final balance) Total (final payment + minimum payments + all interest payments Note: you can find a variety of credit card calculators on the web such as the one on FCAC website (for consumers, interactive tools section – http://fcac-acfc.gc.ca/iTools-iOutilsCreditCardCalculator-eng.aspx) OR Credit Canada website (www.creditcanada.com/debtCalc.asp) ~ 17~ Credit-related frauds (4 hours including presentation, 15% of projects grade): In groups of 3, group members will be assigned by your teacher. Prepare a short presentation using PowerPoint on a type of credit fraud or scam assigned by your teacher (eg: fraudulent statements, pay check loans, excessive interest rates, phishing, identity theft, etc.). Each group will be assigned with a different type of fraud or scam. Present your topic focus to class, and it should be no longer than 15 minutes (leave about 5 minutes for questions) Try to fit as many key points as you can into the 10mins show! Content of the presentation should include: what the fraud is, how it occurs, where do they occur? And how to avoid them? Make the slide show as appealing and interesting as possible. ~ 18~ Topic 6: Insurance My insurance needs (2 hours, 8% of assignments grade): What types of insurance do you need once you graduate from high school and start living on your own (living with parents is not an option for the purpose of this assignment). You can start by listing the properties you may own in the future, such as car, apartment, house, etc. Depending on the types of properties you own, the types of insurance you choose varies, also, depending on the values of your properties, the insurance policies may vary. Use the sample insurance policies (example of one on the next page) provided, other sample policies will be handed out during class, and remember to pick the ones that best suit your personal needs, consider your monthly net income from the “Monthly Budget” assignment to see whether your budget allows such insurance policies. (Hint: multiply net income by 12 months to more easily compare with annual insurance expenses) Provide a 4-5 sentences rationale for each insurance policy you pick. ~ 19~ Safety Insurance Residential Insurance Policy This policy insures you against risks of direct physical loss or damage to the property described in the contract terms. Damage caused by any of the following is not covered unless included as an additional option: Earthquake, snowslide, landslide or earth movement Windstorm, hail, snow or sleet Flood, surface water, waves, tides, ice or waterborne objects Water backup or seepage from sewer, septic tank, eavestroughs or group water. This policy does not cover any of the following: Motor vehicles, except the contents thereof Watercraft, outboard motors, motorcycles, bicycles or parts thereof Money, jewelry, precious stones or furs Plants, animals, birds or fish Property owned by a tenant or damage caused by a tenant. This policy is effective for 1 year from the date listed in the contract terms. Premiums on this policy are payable at the amount of specified in the contract terms. You must inform us of any material change in the conditions that this policy is based on. This policy is void and of no effect if you fail to inform us of any material change within 30 days of the change, or if you have misrepresented any material fact. Contract Terms Policy number: 7549-293-0012 Policy type: H5 advantage home Construction; Occupancy; homeowner Effective date: mm/DD/YYYY Annual premium: $508.00 Deductible amount; $500.00 Type of coverage: Comprehensive, Replacement value Additional options: earthquake coverage, sewer backup/water damage, electronic data equipment Property coverage: $229,000.00 Contents coverage: $145,000.00 Liability coverage: $1,000,000.00 ~ 20~ Topic 7: Investing Sample investments (1 hour, 7% of assignments grade): Fill in the blanks to describe the characteristics of each types of investments. As an example, the first one is completed for you. Types of investments will be investigated as a class. You might also want to consult trusted internet sources for further information on these kinds of investments. 1. Canada Savings Bonds, Premium Series Issued and guaranteed by the Government of Canada Bonds are guaranteed to pay 1.75% in the first year, 1.90% in the second year, 2.05% in the third year May be cashed in at any bank in Canada for face value plus interest to date. Type of investment: Liquidity: Fixed income (bond) High (cashable at any bank) Risk rating: Expected return: Very low (guaranteed by gov.) Low (1.5%-2.5% per year) 2. Midas Bank Savings Account Savings account in a Canadian bank Pays interest compounded monthly, at an annual rate of 0.7% on the first $5000, and 1.25% on amounts over $5000 Includes 10 free banking transactions per month Type of investment: Liquidity: Risk rating: Expected return: 3. Moka-Cola Shares Shares in a new company formed to produce a new coffee-flavored cola drink. Shares are listed on a public stock exchange, but don’t trade often. Brokers charge a commission of 2% to trade the shares. The company believes that it can challenge the cola giants with its patented formula for extracting coffee flavor and adding it to carbonated beverages. The company plans to pay no dividends, but will invest any income it receives in expanding production and distribution. The company projects that will double in size at east every 2 years. ~ 21~ Type of investment: Liquidity: Risk rating: Expected return: 4. Global Entertainment Products Shares Shares in the largest entertainment products company in the world, with annual sales of $9.5 billion. Shares are traded on several major stock exchanges around the world. Brokers charge a commission of 2% to trade the shares. The company brings out new products every week to compete with smaller rivals. The company pays dividends four times a year, but keeps enough of its profits to pay for new product development and to buy other smaller companies from time to time Type of investment: Liquidity: Risk rating: Expected return: 5. Ethical Fun Mutual Fund Units Units in a fund that invests in companies that manufacture toys and games following strict ethical and environmental standards. Fund managers believe that ethical toys will be a profitable retail sector that will pay steady dividends and grow at a rate of 10% to 15% per year Fund managers charge an annual fee equal to 3% of the funds they’re managing. Fund charges a fee of 3% when investors sell their units Type of investment: Liquidity: Risk rating: Expected return: 6. Technical Tests Mutual Fund Units Units in a fund that invests in very new technologies before they have a proven market. Fund is new and has not been offered publicly before, but fund managers are known to analyze risks carefully before they invest. Fund brochures say that it is very risky, but could increase in value rapidly if the new technology it supports becomes profitable. Fund managers charge an annual fee equal to 5% of the funds they’re managing. ~ 22~ Fund charges a sales fee of 5% when investors sell their units. Type of investment: Liquidity: Risk rating: Expected return: 7. Government of Canada 90-day Treasury Bills An investment in government securities that can be cashed in for their full face value in 90 days. Rather than paying interest, these treasury bills are sold for $995 today and can be cashed in 90 days from now for $1,000 (equivalent to a bit more than 2% per year). Can be sold through any bank or investment dealer in Canada for their market value on the date of sale. Type of investment: Liquidity; Risk rating: Expected return; 8. Maple Petroleum Company Bonds Issued by a private company with large oil and gas holdings in northern Canada, and long-term contracts to supply petroleum products to customers in the United States. The company pay interest quarterly, calculated at a rate of 5.5% per year. Bonds are non-redeemable for five years, but because the company is well established and has a good financial record, the bonds can be traded through investment dealers. Type of investment: Liquidity; Risk rating: Expected return; ~ 23~ My investment portfolio (3 hours, 8% of assignments grade): Complete the financial risk self- assessment at: http://www.bankatfirstnational.com/Financial%20Self-Assessment%20Worksh eet.pdf Total up your score, and find which type of investor you are, then take a close look at the investing model for your type. Now that you have a general idea of the structure of your investment portfolio. Imagine that you have $25,000 to invest. List the types of investments you would choose for your portfolio and the amount of each investment you would choose. You can choose any types of investments you can find in the “Sample Investments” assignment. Use the form below to describe your choices. Investment Amount Invested Expected Return Risk Liquidity Reason choosing it Now discuss with your parents or another adult your choice of investments and any revisions they would recommend. Write a summary of your discussion (5-6 sentences long). ~ 24~ Rubrics Goal-setting assignment: 2 Satisfactory The goals fail to incorporate financial components and the elements of the SMART goals requirements. Poorly worded. 3 Good The goals contain financial component but lack certain elements of the SMART goals requirements. Good effort. 4 Excellent The goals contain financial components and cover all the elements of the SMART goals requirements. Thoroughly worded, and easy to understand. ~ 25~ Proposition paper on media and wants: Criteria Content Clarity and correctness of the writing Citation 1-2 Poor Hardly supports the idea that media influences wants. There is no central theme. 3-4 Good The main idea is clear, but needs more information to strengthen the support. Ideas of the paper are mostly(not all) relevant. It is difficult for The writing is the reader to generally understand clear, but what the writer unnecessary is trying to words are express. occasionally Paper contains used. spelling and Some grammatical mistakes in errors as well grammar and as improper spelling, punctuation. and/or punctuation exist. References References are not cited in are in MLA MLA style. style but with some errors. 5 Excellent Proposition is very powerfully demonstrated. Ideas are in-depth and without being redundant. Weightings The writing is clear and concise. There are no(or very few mistakes in grammar, spelling and/or punctuation. X5 Accurately adheres to MLA style. X5 X 10 Total_____________ ~ 26~ Research on savings accounts, GICs, and Canada Savings Bonds: Criteria 1-2 Poor 3-4 Good 5 Excellent Weight X10 ings Content Paper lacks features, advantages and/or disadvantages Very vaguely describes the saving methods. Paper includes all components (features, advantages, and disadvantages). More information is needed to more thoroughly describe the saving methods. Paper includes all components(featu res, advantages, and disadvantages) Descriptions of the saving methods are in-depth without being redundant. Clarity and correctness of the writing It is difficult for the reader to understand what the writer is trying to express. Paper contains spelling and grammatical errors as well as improper punctuation. The writing is generally clear, but unnecessary words are occasionally used. Some mistakes in grammar and spelling, and/or punctuation exist. The writing is clear and concise. There are no(or very few mistakes in grammar, spelling and/or punctuation. X5 Citation References are not cited in MLA style. References are in MLA style but with some errors. Accurately adheres to MLA style. X5 Total_______________ ~ 27~ Credit-related frauds presentation: Criteria 3 Satisfactory Student is uncomfortable Subject Knowledge with information and is able to answer only the rudimentary questions, and fails to elaborate. Student occasionally Uses visual aids that Rarely support the presentation Student’s voice is low. Verbal Techniques Audience members have difficulty Hearing presentation Visual 4 Good 5 Excellent Student is at ease and answers most questions with explanations and some elaboration. Student’s visual aids relate to the presentation Student X5 demonstrates full knowledge by answering all questions with explanations and elaboration Student’s visual X2 aids explain and reinforce the presentation Student uses a X5 clear voice. All audience members can hear presentation Student’s voice is clear. Most audience members can hear presentation Weightings Total:____________