CCP services for securities lending

advertisement

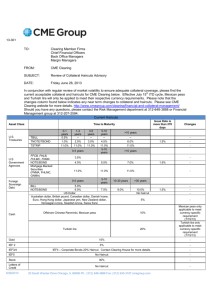

Eurex Clearing Lending CCP Overview on the CCP service for securities lending December 2015 Eurex Clearing Lending CCP December 2015 Content • What services does Eurex Clearing provide? • Why is the Lending CCP beneficial for you? • What is the Lending CCP service offering? • What is required to participate in the Lending CCP? • How to get in contact? 2 www.eurexclearing.com Eurex Clearing Lending CCP December 2015 Eurex Clearing offers central counterparty services for multiple asset classes across multiple markets Market participants Eurex Exchange (Derivatives) EurexOTC (IRS) Frankfurt Stock Exchange Irish Stock Exchange (Equities, ETFs) (Equities) Eurex Bonds Eurex Repo (Bonds, Basis) (Repo, GC Pooling) Securities Lending Eurex Clearing Central Securities Depositories International Central Securities Depositories • Eurex Clearing is part of Eurex Group, which is a full subsidiary of Deutsche Boerse Group and has one of the strongest rating profiles of financial market infrastructure providers in the world; S&P rates Deutsche Boerse Group with AA. • Eurex Clearing is licensed as a credit institution under the supervision of the German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht, BaFin). • Eurex Clearing is an approved QCCP; the national competent authority BaFin approved Eurex Clearing as in accordance with the European Market Infrastructure Regulation (EMIR) effective 10 April 2014. • Eurex Clearing is fully compliant with CPMI and IOSCO Recommendations for CCPs. 3 www.eurexclearing.com Eurex Clearing Lending CCP December 2015 Lending CCP’s unique service offering benefits the securities lending marketplace Simplifies your multiple counterparty credit structure to a single CCP relation for all novated loans • Improved distribution for borrowers and lenders with restrictive counterparty parameters • Maintains bilateral trading relationships Transparent and standardized risk management & default procedures • Lending CCP guarantees the return of the loan and collateral securities • Offers protection from counterparty default Beneficial regulatory capital requirements • Capital costs reduced for CCP loans Operational efficiency by CCP-managed post-trade services • Settlement flows controlled by CCP (based on Power of Attorney) • Lending CCP operates as the ‘golden source’ for loan valuation and centralized billing Membership structure for Lenders allows for Agency and Principal roles • Specific Lender License supports the Agent Lender / Beneficial Owner relationship; utilizes a ‘pledge model’ for non-cash collateral – Beneficial Owners do not pay margin for the related transactions • Lenders can act as Principal using either a Direct or General Clearing Membership 4 www.eurexclearing.com Eurex Clearing Lending CCP December 2015 Lending CCP delivers a combined platform to connect bilateral and electronic markets Securities lending market participants Bilateral market (OTC) Electronic securities lending trading platforms EquiLend*, Pirum Real-Time Service Eurex Repo-SecLend Market Eurex Clearing Lending CCP Central Securities Depositories International Central Securities Depositories Clearstream Banking Frankfurt Euroclear BE, FR, NL SIX SIS Clearstream Banking Luxembourg Euroclear Bank *EquiLend planned start date in March 2016 5 www.eurexclearing.com Eurex Clearing Lending CCP December 2015 Lending CCP serves the key elements of the securities lending market Transactions • Bilateral transactions (OTC) • Electronic markets Markets • Bonds – European corporate & government bonds • Equities – coverage of key European markets • Exchange Traded Funds (ETFs) Collateral • Loans against cash collateral • Loans against non-cash collateral - bonds & equities Tri-party • Clearstream Banking Luxembourg collateral agents • Euroclear Bank Post-trade functionality • Loan Deliveries, Mark-to-Marks, Re-rates, Recalls, Returns, Buy-ins • Corporate Actions, dividend payments • Automated billing (lending fees & rebates) 6 www.eurexclearing.com Eurex Clearing Lending CCP December 2015 Lending CCP operates an integrated solution for your securities lending transactions Lending CCP System Trade management Position management • Loan capture • Buy-ins • Loan validation • Corporate Actions • Loan novation • Rebate / lending fees • Loan confirmation • Clearing fees • Loan recalls • Reporting • Loan returns • Loan re-rates Delivery management • Instruction of securities deliveries (on behalf) • Instruction of cash payments (on behalf) • Fee settlement (Rebate / Lending Fees) • Information on settlement results Risk management • • Procedure to control collateral compared to risk exposure Collection and release of cash and non-cash collateral Collateral management • Daily mark-to-market • Intraday calculation of margin requirements • Margin requirements consider deposited principal collateral 7 www.eurexclearing.com Eurex Clearing Lending CCP December 2015 Lending CCP incorporates STP trade-flow for your securities lending activity Loan negotiation Trading Lender Loan information Flow Provider* Real-time trade validation Loan information Borrower Clearing Membership Clearing Member Data transmission Eurex Clearing Clearing Clearing Member Settlement Payment bank Clearing Membership Cash Validation Novation Confirmation Loan life-cycle management Non-cash Principal Collateral Tri-party agent Equities CSD Bonds Loan securities ICSD *Flow Provider used as the entry channel from market participants to Eurex Clearing e.g. for New loan transactions, Re-rates, Recalls, Returns etc. 8 www.eurexclearing.com Eurex Clearing Lending CCP December 2015 Lending CCP’s Specific Lender License supports the Beneficial Owner’s role and Agent Lender relationship Agent Lender Loan negotiation Borrower Loan securities Beneficial Owner Non-cash Principal Collateral Specific Lender License Key: Loan securities Eurex Clearing Non-cash Principal Collateral Clearing Member Margin Collateral Pledge to Lender Pledge to the CCP Transfer of Title Beneficial Owner maintains business relationship with Agent Lender • Agent Lender continues to arrange loans for CCP eligible transactions • Operational links with flow provider and CCP maintained by Agent Lender • Agent Lender reports loans and collateral through existing reporting set Beneficial Owner uses an approved Specific Lender License with a distinctive CCP membership • No requirement to clear through a General Clearing Member • No requirement to pay margin • No default fund contribution Dedicated requirements for Specific Lender License • Supervised financial sector entity located within the EU, Switzerland, USA* and other selected countries • Permission to perform securities lending business • Pre-requisite is collateral pledge model with Tri-party Collateral Agent *Pending legal analysis 9 www.eurexclearing.com Eurex Clearing Lending CCP December 2015 Lending CCP incorporates a Tri-party collateral process for the management of your non-cash collateral Lender Clearing Member CCP Reporting Eurex Clearing Borrower Reporting Clearing Member Tri-party agreement* Collateral Receiver Lender Tri-party a/c Collateral Giver Collateral Giver & Receiver Transfer of Title or Pledge CCP Tri-party a/c Transfer of Title Borrower Tri-party a/c Integrated and enhanced collateral management • Exposure management undertaken by Lending CCP • Lender eligibility profiles (bonds & equities) maintained by Lending CCP and Tri-party collateral agent • Borrower substitutions of Principal Collateral undertaken by Tri-party collateral agent • Tri-party collateral agents ensures substitution of Principal Collateral prior to Corporate Actions • Re-use of Principal Collateral within the regulations of Tri-party collateral agent (for transfer of title) *Borrower, Lender and the CCP make use of the same Tri-party Collateral Agent e.g. Clearstream Banking Luxembourg or Euroclear Bank 10 www.eurexclearing.com Eurex Clearing Lending CCP December 2015 Lending CCP includes an integrated solution for Corporate Action processing on novated transactions Management of Corporate Actions Mandatory Voluntary Cash Distributions • Automatic processing of compensation payments based on the payment rate as agreed in the loan transaction Distributions with Options • Automatic distribution of Rights processed as an opening of a new Rights loan • Lender can recall the Rights to execute/sell; non-recalled/returned Rights will be automatically cash settled at the end of the subscription period Securities Distributions • Automatic distribution of stock dividends and bonus shares processed as an opening of a new loan or an update to the existing loan Mandatory Reorganizations • Automatic nominal and/or ISIN changes processed as an opening of a new loan or an update to the existing loan; Squeezeout/Redemptions/Liquidations lead to closing of the loan and an automatic cash settlement Voluntary Reorganizations • Corporate Action CCP Transformation* function allows market participants to arrange for all types of voluntary corporate actions bilaterally while keeping the loan within the CCP • Eurex Clearing’s Graphical User Interface** allows Borrowers and Lenders to electronically communicate, agree and transmit the expected outturn instructions towards Eurex Clearing • Dispute Resolution Committee provides independent deliberation on disputed voluntary corporate actions *Transformation via Pirum Real-time Service; ** GUI via Eurex Clearing web portal www.eurexclearing.com 11 Eurex Clearing Lending CCP December 2015 Summary of the Lending CCP’s participation and set-up requirements Clearing Membership - Securities Lending license • Clearing Conditions of Eurex Clearing - Chapter IX Clearing of Securities Lending Transactions • ‘Full’ clearing membership (GCM/DCM) or Specific Lender License for Beneficial Owners Technical connectivity to Lending CCP flow provider & reporting infrastructure • Eurex Repo-SecLend Market and/or Pirum Real-Time Service • Eurex Clearing Common Report Engine Securities accounts for loan securities at (I)CSDs • Equities - Clearstream Banking Frankfurt, Euroclear Belgium/France/Netherlands (ESES) and/or SIX SIS • Fixed income - Clearstream Banking Luxembourg or Euroclear Bank Cash accounts for loan related activities • Cash accounts for fee/rebate and compensation payments (CHF, EUR, USD) Collateral accounts for Principal Collateral • Cash accounts for EUR and USD for cash collateral (EUR, USD) • Tri-party collateral profile/account at Clearstream Banking Luxembourg and/or Euroclear Bank for non-cash collateral Collateral accounts for Margin Collateral • Cash accounts (CHF, GBP, EUR, USD) for additional margin payments and/or • Pledge securities account at Clearstream Banking Frankfurt, Clearstream Banking Luxembourg or SIX SIS 12 www.eurexclearing.com Eurex Clearing Lending CCP December 2015 Eurex Clearing continues to advance its Lending CCP for the securities lending market Lending CCP service offering: Asset classes Flow Providers Cash, Bonds, Equities & Exchange Traded Funds EquiLend*, Eurex Repo-SecLend Market & Pirum Real-Time Service Loan securities Settlement locations European fixed income: Government bonds Supranational bonds Regional bonds Local government bonds Corporate bonds ICSD: Equities: Belgium France Germany Netherlands Switzerland CSD: ESES / Euroclear Belgium ESES / Euroclear France Clearstream Banking Frankfurt ESES / Euroclear Netherlands SIX SIS Exchange Traded Funds: Replicated ETFs CSD: Clearstream Banking Frankfurt Non-cash Principal Collateral Tri-party Collateral Agents Bonds, equities & ETFs Clearstream Banking Luxembourg & Euroclear Bank Cash Principal Collateral Payment locations EUR USD TARGET2 account Payment banks Clearstream Banking Luxembourg & Euroclear Bank *EquiLend planned start date in March 2016 13 www.eurexclearing.com Eurex Clearing Lending CCP December 2015 Lending CCP information Contact Frankfurt Paris Efthimia Kefalea Thomas Wißbach Ebru Ciaravino T +49 (0) 69 2111 7275 M +49 (0) 172 299 0628 T +49 (0) 69 2111 7992 M +49 (0) 172 619 9850 T +33 (0) 155 27 6768 M +33 (0) 685 93 1333 efthimia.kefalea@eurexclearing.com thomas.wissbach@eurexclearing.com ebru.ciaravino@eurexclearing.com London USA Gerard Denham Jonathan Lombardo Tim Gits T +44 (0) 207 862 7634 M +44 (0) 787 688 5276 T +44 (0) 207 862 7559 M +44 (0) 746 915 8310 T +1 312 544 1091 M +1 312 929 8588 gerard.denham@eurexclearing.com jonathan.lombardo@eurexclearing.com tim.gits@eurexclearing.com Connect Web Twitter www.eurexclearing.com @EurexGroup E-mail LinkedIn LendingCCP@eurexclearing.com www.linkedin.com/company/eurex 14 www.eurexclearing.com Eurex Clearing Lending CCP December 2015 © Eurex 2015 Deutsche Börse AG (DBAG), Clearstream Banking AG (Clearstream), Eurex Frankfurt AG, Eurex Clearing AG (Eurex Clearing) as well as Eurex Bonds GmbH (Eurex Bonds) and Eurex Repo GmbH (Eurex Repo) are corporate entities and are registered under German law. Eurex Zürich AG is a corporate entity and is registered under Swiss law. Clearstream Banking S.A. is a corporate entity and is registered under Luxembourg law. U.S. Exchange Holdings, Inc. and International Securities Exchange Holdings, Inc. (ISE) are corporate entities and are registered under U.S. American law. Eurex Frankfurt AG (Eurex) is the administrating and operating institution of Eurex Deutschland. Eurex Deutschland and Eurex Zürich AG are in the following referred to as the “Eurex Exchanges”. All intellectual property, proprietary and other rights and interests in this publication and the subject matter hereof (other than certain trademarks and service marks listed below) are owned by DBAG and its affiliates and subsidiaries including, without limitation, all patent, registered design, copyright, trademark and service mark rights. While reasonable care has been taken in the preparation of this publication to provide details that are accurate and not misleading at the time of publication DBAG, Clearstream, Eurex, Eurex Clearing, Eurex Bonds, Eurex Repo as well as the Eurex Exchanges and their respective servants and agents (a) do not make any representations or warranties regarding the information contained herein, whether express or implied, including without limitation any implied warranty of merchantability or fitness for a particular purpose or any warranty with respect to the accuracy, correctness, quality, completeness or timeliness of such information, and (b) shall not be responsible or liable for any third party’s use of any information contained herein under any circumstances, including, without limitation, in connection with actual trading or otherwise or for any errors or omissions contained in this publication. This publication is published for information purposes only and shall not constitute investment advice respectively does not constitute an offer, solicitation or recommendation to acquire or dispose of any investment or to engage in any other transaction. This publication is not intended for solicitation purposes but only for use as general information. All descriptions, examples and calculations contained in this publication are for illustrative purposes only. Eurex and Eurex Clearing offer services directly to members of the Eurex exchanges respectively to clearing members of Eurex Clearing. Those who desire to trade any products available on the Eurex market or who desire to offer and sell any such products to others or who desire to possess a clearing license of Eurex Clearing in order to participate in the clearing process provided by Eurex Clearing, should consider legal and regulatory requirements of those jurisdictions relevant to them, as well as the risks associated with such products, before doing so.Eurex derivatives are currently not available for offer, sale or trading in the United States or by United States persons (other than EURO STOXX 50® Index Futures, EURO STOXX 50® ex Financials Index Futures, EURO STOXX® Select Dividend 30 Index Futures, EURO STOXX® Index Futures, EURO STOXX® Large/Mid/Small Index Futures, STOXX® Europe 50 Index Futures, STOXX® Europe 600 Index Futures, STOXX® Europe 600 Banks/Industrial Goods & Services/Insurance/Media/Travel & Leisure/Utilities Futures, STOXX® Europe Large/Mid/Small 200 Index Futures, Dow Jones Global Titans 50 IndexSM Futures (EUR & USD), DAX®/MDAX®/TecDAX® Futures, SMIM® Futures, SLI Swiss Leader Index® Futures, MSCI World/Europe/ Europe Value/Europe Growth/Emerging Markets/Emerging Markets Latin America/Emerging Markets EMEA/Emerging Markets Asia/China Free/India/Japan/Malaysia/South Africa/Thailand/AC Asia Pacific ex Japan Index Futures, TA-25 Index Futures, Daily Futures on TAIEX Futures, VSTOXX® Futures, Gold and Silver Futures as well as Eurex agriculture, property and interest rate derivatives). Trademarks and Service Marks Buxl®, DAX®, DivDAX®, eb.rexx®, Eurex®, Eurex Bonds®, Eurex Repo®, Eurex Strategy WizardSM, Euro GC Pooling®, FDAX®, FWB®, GC Pooling®,,GCPI®, MDAX®, ODAX®, SDAX®, TecDAX®, USD GC Pooling®, VDAX®, VDAX-NEW ® and Xetra® are registered trademarks of DBAG. All MSCI indexes are service marks and the exclusive property of MSCI Barra. ATX®, ATX® five, CECE® and RDX® are registered trademarks of Vienna Stock Exchange AG. IPD® UK Annual All Property Index is a registered trademark of Investment Property Databank Ltd. IPD and has been licensed for the use by Eurex for derivatives. SLI®, SMI® and SMIM® are registered trademarks of SIX Swiss Exchange AG. The STOXX® indexes, the data included therein and the trademarks used in the index names are the intellectual property of STOXX Limited and/or its licensors Eurex derivatives based on the STOXX® indexes are in no way sponsored, endorsed, sold or promoted by STOXX and its licensors and neither STOXX nor its licensors shall have any liability with respect thereto. .Dow Jones, Dow Jones Global Titans 50 Index SM and Dow Jones Sector Titans IndexesSM are service marks of Dow Jones & Company, Inc. All derivatives based on these indexes are not sponsored, endorsed, sold or promoted by Dow Jones & Company, Inc. Dow Jones & Company, Inc. does not make any representation regarding the advisability of trading or of investing in such products. Bloomberg Commodity IndexSM and any related sub-indexes are service marks of Bloomberg L.P. All references to London Gold and Silver Fixing prices are used with the permission of The London Gold Market Fixing Limited as well as The London Silver Market Fixing Limited, which for the avoidance of doubt has no involvement with and accepts no responsibility whatsoever for the underlying product to which the Fixing prices may be referenced. PCS® and Property Claim Services® are registered trademarks of ISO Services, Inc. Korea Exchange, KRX, KOSPI and KOSPI 200 are registered trademarks of Korea Exchange Inc. Taiwan Futures Exchange and TAIFEX are registered trademarks of Taiwan Futures Exchange Corporation. Taiwan Stock Exchange, TWSE and TAIEX are the registered trademarks of Taiwan Stock Exchange Corporation. BSE and SENSEX are trademarks/service marks of Bombay Stock Exchange (BSE) and all rights accruing from the same, statutory or otherwise, wholly vest with BSE. Any violation of the above would constitute an offence under the laws of India and international treaties governing the same. The names of other companies and third party products may be trademarks or service marks of their respective owners. 15 www.eurexclearing.com