Folie 1

advertisement

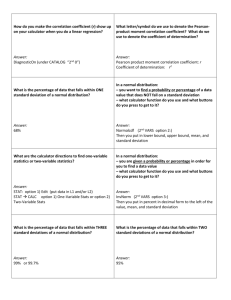

JKU Dissertation Colloquium Economics [3DVWLKS; 239.005] Linz, 23th January 2012 Markus LINDNER COLLECTIVE DOMINANCE BASED ON MARKET SHARING UNDER ARTICLE 102 FEU TREATY THE GAP IN LAW ENFORCEMENT ABSTRACT The Gap in Industrial Economics Classes of Vertical Restriction: Industrial Economics has not yet provided a comprehensive identification strategy for distinguishing general classes of models of collective dominance from models of competition. The paper will provide classes of vertical restrictions to identify collective dominance via “Interdependence by Market Sharing (IbMS)” from competition. The Gap in Law Enforcement: The paper will additionally provide the answer to the question if an law enforcement gap in applying Article 102 FEU Treaty regarding the determination of collective dominance does exists. CHAPTER A CHAPTER A: The Prevailing Literature on Collective Dominance: Is this the whole story “Interdependence by Market Sharing (IbMS)”: IbMS constitutes a collective dominance option that has its coordinated equilibrium based on market sharing. E.g. the firms accept the customers of its competitors thereby avoiding fierce competition. “Interdependence by Price Level (IbPL)”: IbPL constitutes a collective dominance option that has its coordinated equilibrium based on price level. The basic idea of IbPL is that the firms are aware that any attempt to gain market shares by undercutting the prevailing price level would end up by lower price level for all market participants without any change of market shares thereby accepting the prevailing price level. The Gap in Law Enforcement: Misleading legal reasoning has neglected IbMS as a collective dominance option under Article 102 FEU Treaty CHAPTER B CHAPTER B: The Theory of Interdependence by Market Sharing [IbMS] Consensus: The first segment refers to find the consensus for the coordinated equilibrium of customer division. This approach is based on a model to determine critical switching costs under the vertical restriction category EPA tied to conglomerate product to balance price discrimination between customer groups with switching costs for each period of time that are influenced by the firms. Internal Stability (Collective Entity): The second segment refers to collective entity that covers the internal stability of the coordinated equilibrium to divide customers. External Stability (Dominance of Collective Entity - Foreclosure): The third segment refers to foreclosure effect of the collective entity that covers the external stability of the coordinated equilibrium vis-à-vis outside competition. CHAPTER C CHAPTER C: An Empirical Evidence of IbMS Relevant Market: The first part will demonstrate that market delineation by SSNIP-INDIRECT (indirect determination of profitable SSNIP based on demand estimation) is not applicable to determine relevant markets under price discrimination. IbMS-EPA: The second part represents the empirical validation of IbMS and follows the same organizational structure introduced in chapter B. The coordinated equilibrium to divide customers is based on the class of vertical restriction by tying Exclusive Purchasing Agreement (EPA) with a conglomerate product thereby enforcing switching costs and price discrimination between tied and free customer group and giving insights on consumer harm (price discrimination and excessive pricing) by applying this kind of tying contracts beyond the determination of collective dominance. CHAPTER C CONSENSUS: EPA tied to conglomerate product (customer division) Influenced Variables: Price of tied customer group (Price Discrimination) Switching Costs (ccs) Tied Tank t0 trtlt tN Switch New Tank t0 ctied customer group(t) > cfree customer group(t) csccritical=qt tpdexp (ptied – pfree) – cnt (trtlt/ttltnt + (1+i)^trtlt – 1) tN CHAPTER C CONSENSUS: Critical Switching Costs 3,000 2,000 1,000 0 -1,000 -2,000 -3,000 -4,000 -5,000 -6,000 -7,000 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 Undertaking 1 Undertaking 2 Undertaking 3 Undertaking 4 Undertaking 5 Csc CHAPTER C INTERNAL STABILITY: Collective Entity Monitoring Deviation from Customer Division: Monitoring tying contract termination Monitoring breach of tying contract by supply through undertakings Deterrence/Punishment: Apply Arbitral Tribunal of trade association Termination of cooperation contracts Punishment in multimarket contact CHAPTER C EXTERNAL STABILITY: Foreclosure Monitoring Deviation from Customer Division: Monitoring tying contract termination Monitoring breach of tying contract by supply through competitors Deterrence/Punishment: Apply Act against Unfair Practices Punishment in multimarket contact CHAPTER D CHAPTER D: The Gap in Law Enforcement: Are IbMS Cases rare? Industry 1: The first industry is based on the category EPA tied to a conglomerate product, similar to the case in chapter C. Industry 2: The second industry is also based on the category EPA tied to a conglomerate product. The difference to the previous two cases is the interaction between the two collective dominance options IbMS-EPA and IbPL. Industry 3: The third industry is based on the category EPA – Radius Clause. CHAPTER E CHAPTER E: Competition Policy Recommendation IbPL vs IbMS: Chapter E will provide the recommendation to distinguish between the two collective dominance options IbPL and IbMS under Article 102 FEU Treaty. Abolishment of Collective Dominance: Chapter E will provide the recommendation to prohibit the categories (i) EPA tied to conglomerate product and (ii) EPA – radius clause that have per se negative effects on effective competition. OUTLINE CHAPTER A: The Prevailing Literature on Collective Dominance: Is this the whole story? CHAPTER B: The Theory of Interdependence by Market Sharing [IbMS] CHAPTER C: An Empirical Evidence of IbMS CHAPTER D: The Gap in Law Enforcement: Are IbMS Cases rare? CHAPTER E: Competition Policy Recommendation END OF PRESENTATION III