Arkansas Budget and Appropriation Process

advertisement

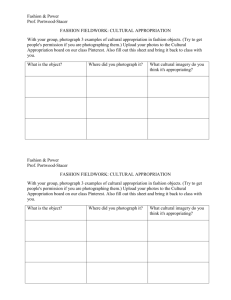

Arkansas Budget and Appropriation Process Bureau of Legislative Research, 2008 The Budget Process Preparation Review/Revise Authorization Funding THE BUDGET PROCESS Preparation The Preparation Phase Budget Calendar The State Fiscal Year Begins on July 1 and Ends on June 30. A Biennial Period or Biennium is a two year period that usually begins July 1 of the oddnumbered year and ends June 30 of the next odd-numbered year. Regular Session Budget Calendar Jun Budget Requests Prepared Executive Review ALC/JBC Hearings Official Revenue Forecast Session Convenes Joint Budget Meetings Legislature Adjourns Operating Budgets Prepared Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Fiscal Legislative Session • On November 4, 2008 Arkansas voters approved a proposed constitutional amendment that becomes effective January 1, 2009 that in-part provides: • The General Assembly shall meet every year • The General Assembly shall meet in Regular Session on the second Monday in January • Beginning in 2010, the General Assembly shall meet in Fiscal Session on the second Monday in February • A bill other than an appropriation bill may be considered in a Fiscal Session if two-thirds (2/3) of the members of each house of the General Assembly approve consideration of the bill Fiscal Legislative Session • A Regular biennial session shall not exceed sixty (60) calendar days unless extended by a two-thirds (2/3) vote of the members of each house of the General Assembly and shall not exceed seventy-five days (75) days in duration, unless extended by a three-fourths (3/4) vote of the members of each house of the General Assembly • A Fiscal Session shall not exceed thirty (30) calendar days in duration, except that by a vote of three-fourths (3/4) of the members of each house of the General Assembly a Fiscal Session may be extended one (1) time by no more than fifteen (15) calendar days. • No appropriation made by the General Assembly after December 31, 2008 shall be for a longer period than one (1) fiscal year • In making appropriations for any fiscal year the General Assembly shall first pass the General Appropriation Bill The Preparation Phase Budget Requests A Budget Request Commitment Item Format Title Regular Salaries No. Positions Personal Svs Match Operating Expenses Conf Fee & Travel Capital Outlay Prof. Fees & Services Advertising Total FUNDING Fund Balances General Revenue Special Revenue Federal Funds Total Funding Actual $200,000 12 42,000 665,000 58,776 123,241 Budgeted $352,000 16 73,920 541,530 60,000 101,000 Base $361,856 16 75,990 529,604 60,000 - Total $486,856 22 102,240 728,354 78,000 300,000 82,150 - 71,550 - 71,550 - 171,550 300,000 $1,171,167 $1,200,000 $1,099,000 $2,167,000 $2,100,000 400,000 37,000 $1,365,833 474,000 50,000 $689,833 474,000 61,000 $2,537,000 $1,889,833 $1,224,833 $689,833 474,000 61,000 $1,224,833 The Preparation Phase Roles In Budget Preparation “In state budgeting, gubernatorial leadership is a dominant consideration.” (Changing State Budgeting: S. Kenneth Howard, 1973) Roles in Budget Preparation Phase Governor/DFA • Set Policy for Agency Requests • Forecast State Revenue • Recommend Budget to ALC/JBC • Recommend Added Revenues as Needed Roles in Budget Preparation Phase 83 Members Legislative Council / Joint Budget • Consider Agency Requests & Governor’s Recommendation • Recommend Budgets to General Assembly • Recommend State Employee Salary Levels • Have Bills Prepared for Introduction Roles in Budget Preparation Phase Joint Budget Committee 56 Members • Consider ALC/JBC Recommendations • Consider Governor’s Revisions and New Programs • Consider MemberSponsored Bills • Recommend Fiscal Bills and Pay Levels to General Assembly • Prepare Revenue Stabilization Amendment Legislature “Legislators get caught spending inordinate amounts of time trying to save relatively trifling sums.” (Changing State Budgeting: S. Kenneth Howard, 1973) THE BUDGET PROCESS Authorization AN APPROPRIATION GIVES THE AGENCY THE AUTHORITY TO SPEND MONEY IF AND WHEN IT BECOMES AVAILABLE. = The Authorization Phase The Constitutional Requirements Constitutional Restrictions 1 Year Limit on Appropriations Single Subject General Appropriation Bill must "embrace nothing but appropriations for the ordinary expenses of the executive, legislative and judicial departments of the state” & be passed first Appropriations must be in dollars and cents Appropriations (except for education, highways, and debt of the state) must be approved by 3/4 affirmative vote The Authorization Phase Types of Appropriation Bills Introduced Appropriation Bills 1600 1496 1400 1200 1163 1000 922 800 691 600 528 400 200 1326 309 348 370 429 475 0 1987 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 Types of Appropriation Bills • Regular Agency Operating Appropriation – 1-year period – Effective July 1 • Supplemental Appropriation – Effective before July 1 & usually immediately – Usually adds to an existing authority – State Funds usually come from an Accumulated Surplus or recovered Fund Balances • Construction – State Funds usually from General Improvement Fund (Surplus & Interest Earnings) • Reappropriations – Allows the Agency to spend the balance of an appropriation provided by another General Assembly. – Not new authority to spend – Usually for old construction projects The Authorization Phase Elements of an Appropriation Bill WHO? FROM WHERE? SECTION 2. APPROPRIATION - OPERATIONS. There is hereby appropriated, to the Abstracters' Board of Examiners, to be payable from the Abstracters' Examining Board Fund, for personal services and operating expenses of the Abstracters' Board of Examiners for the 2008-09 fiscal year, the following: ITEM NO. (01) REGULAR SALARIES (02) PERSONAL SERVICES MATCHING (03) MAINT. & GEN. OPERATION (A) OPER. EXPENSE (B) CONF. & TRAVEL (C) PROF. FEES (D) CAP. OUTLAY (E) DATA PROC. TOTAL AMOUNT APPROPRIATED HOW MUCH? FISCAL YEAR 2008-2009 $ 20,193 8,264 $ 2,567 0 0 0 0 31,024 FOR WHAT? The Authorization Phase FROM WHERE? The Budget Process Funding TOTAL STATE REVENUE FY 2008 General Revenue $ 5,618,456,330 Special Revenue 1,691,902,903 Cash Funds 3,748,891,979 Federal Funds 4,246,431,485 Trust & Other Non Revenue 2,732,221,175 TOTAL STATE REVENUE $18,037,903,873 TOTAL STATE REVENUE – 2008 $18 Billion Trust & Other Non Revenue General Revenue 15% 31% Special 10% Federal 24% Cash 21% GENERAL REVENUE - 2008 $5.6 Billion Luxury Other 3% Insurance 1% 2% Income Taxes 56% Sales/Use 38% SPECIAL REVENUES - 2008 $ 1.7 Billion Property Tax Game & Fish Relief 5% 14% Other 35% Highway Users 37% Natural Finance Resources 3% 6% SPENDING IS LIMITED BY THE AVAILABLE APPROPRIATION OR THE AVAILABLE MONEY - WHICHEVER IS LESS! A Program must have both an appropriation and a means of getting money to it. If one or the other is missing, the program cannot exist. Three Methods of Funding Available •DEDICATED SOURCE •GENERAL IMPROVEMENT FUND •REVENUE STABILIZATION LAW Three Methods of Funding Available •DEDICATED SOURCE The Constitution says “…no moneys arising from a tax levied for one purpose shall be used for any other purpose.” DEDICATED SOURCES OF FUNDS •State Dedicated Tax or Fee (Special Revenue) •Federal Grant-in-Aid •Cash Funds •Trust Funds •Non-revenue Receipts Tobacco Settlement Cash Holding Fund Healthy Century Trust Fund (First $100 Million + Interest+ Unneeded Funds in Debt Service Fund) Tobacco Settlement Debt Service Fund ($5 million/year) UAMS Biosciences $2.2 M ASU Biosciences $1.8 M School of Public Health $1 M Tobacco Settlement Program Fund (Remainder of 2001 after Healthy Century Transfer and remainder after Debt Service Fund Transfer Thereafter) 31.6% 15.8 22.8% Prevention and Cessation Program Account Targeted State Needs Program Account 29.8 22% Delta AHEC Interest Arkansas Biosciences Institute Program Account 33% School of Public Health Interest Interest Medicaid Expansion Program Account Interest Interest Tobacco Commission Fund 22% Center on Aging; 23% Minority Health Initiative Three Methods of Funding Available •DEDICATED SOURCE •GENERAL IMPROVEMENT FUND $500.0 General Improvement Fund Income and Authorized Funding Income Authorized Funding Millions $400.0 $300.0 $200.0 $100.0 $1991- 1993- 1995- 1997- 1999- 2001- 2003- 2005- 200793 95 97 99 01 03 05 07 09 Three Methods of Funding Available •DEDICATED SOURCE •GENERAL IMPROVEMENT FUND •REVENUE STABILIZATION LAW ACT 311 of 1945 The Revenue Stabilization Law Revenue Stabilization Law Revenue Flow The Budget Process Review/Revise CAUTION!!! “...since the practice of review and advice violates the separation of powers doctrine, [it] is unconstitutional.” CHAFFIN v. ARK. GAME & FISH COMM'N, 296 Ark. 431 (1988) Legislative Council SubCommittees •Contracts •Methods of Finance •Leases REVIEW •Budget Adjustments •Misc. Federal Grants PEER •Interagency Contracts Rules & Regulations RULES & REGULATIONS •Special Entry Rates •Titles & Grade Changes •Personnel Policy Changes •Pay Plan PERSONNEL •Lawsuits Against the State •Out-of-Court Settlements LITIGATION •Approved Claims Against the State •Appealed Claims CLAIMS REVIEW •Correctional Institutions •Other State Institutions •Purchased Institutional Services CHARITABLE, PENAL & CORRECTIONAL INSTITUTIONS The Budget Process Preparation Review/Revise Authorization Funding Arkansas Budget and Appropriation Process Bureau of Legislative Research, 2008