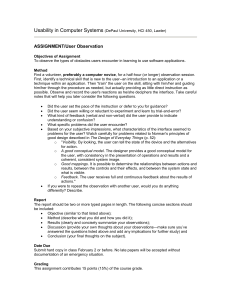

Free Sample - Buy Test banks and Solution Manuals

advertisement