An Analysis - Global Initiative for Fiscal Transparency

Fiscal Transparency in OGP Countries, and the

Implementation of OGP Commitments: An Analysis

Murray Petrie

Lead Technical Advisor - GIFT petrie@fiscaltransparency.net

GIFT-OGP Fiscal Openness Working Group Meeting

Mexico City - 29 October, 2015

#FiscalTransparency

Fiscal Transparency in OGP Countries, and the

Implementation of OGP Commitments: An Analysis

Overview

1.

How transparent are budgets in OGP countries?

2.

What fiscal transparency commitments did countries make in their OGP Action

Plans?

3.

How well have the commitments been implemented?

4.

How ambitious were the fiscal transparency commitments?

5.

Some notable commitments and practices.

6.

What steps to increase fiscal transparency and participation should countries include in their Action Plans?

2

Fiscal Transparency in OGP Countries, and the

Implementation of OGP Commitments: An Analysis

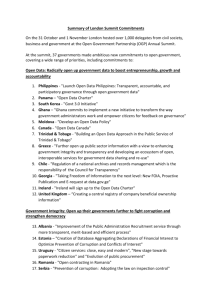

Figure 1: Distribution of Absolute Changes in OBI Scores of OGP members first survey - 2015

Figure 1: Distribution of Absolute Changes in OBI Scores of OGP members from each country's first survey to 2015 OBI n = 46

6

5

4

3

8

7

2

1

0

(-20)-(-16) (-15)-(-11) (-10)-(-6) (-5)-(-1) 0 1-5 6-10 11-15

Absolute Change in OBI Score

16-20 21-25 26-30 31-35 36-40

3

Fiscal Transparency in OGP Countries, and the

Implementation of OGP Commitments: An Analysis

Outstanding examples of increase in OBI score in OGP member countries 2006-2015

• In Africa: Malawi +37; Liberia +35;

• In the Americas: Honduras +31; Dominican Republic +39; El Salvador +25;

• In Asia: Mongolia +33; Azerbaijan +21; Indonesia +17;

• In Europe: Georgia +32; Tunisia +31; Bulgaria +18; Albania +13; Croatia +11.

•

Many of the gains came from governments publishing documents previously only available within government

4

Fiscal Transparency in OGP Countries, and the

Implementation of OGP Commitments: An Analysis

Increases between 2012 and 2015 surveys

• Biggest increase by OGP member was Tunisia, +31 points: published Executive’s

Budget Proposal and Citizens Budget.

• Romania (+28) and the Dominican Republic (+22) both saw substantial improvements by improving comprehensiveness of Executive’s Budget Proposal.

• Peru, the Philippines, Sierra Leone, Italy, Malawi, Georgia, and El Salvador all improved by 10 points or more.

5

Fiscal Transparency in OGP Countries, and the

Implementation of OGP Commitments: An Analysis

Notable reductions in fiscal transparency

• In Europe: Macedonia -19; Ukraine -16; Bosnia and Herzegovina -7.

• OGP members that do not meet the minimum eligibility criteria for OGP membership (publication of the budget and audit report): o Asia: none o Europe: Tunisia o Americas: El Salvador o Africa: Liberia

6

Fiscal Transparency in OGP Countries, and the

Implementation of OGP Commitments: An Analysis

Overall weak performance and slow rate of increase in fiscal transparency in OGP countries

• In 2015 OBS, 29 of the 47 OGP countries included in the OBS (62%) score 60 or below on the OBI.

o OBI rates this as providing insufficient budget information to the public.

Four of those countries provide minimal budget information, the second lowest category in the OBI.

• The average increase 2012-2015 only +2 on the OBI o Similar to but lower than the +3 average improvement for all countries in the

OBS.

7

Fiscal Transparency in OGP Countries, and the

Implementation of OGP Commitments: An Analysis

What types of FT commitments did OGP countries make?

• Most commitments under GIFT High Level Principle 3:

‘The public should be presented with high quality financial and non-financial information on past, present, and forecast fiscal activities, performance, fiscal risks

, and public assets and liabilities….’ Focus is on flows rather than stocks.

• Many commitments on public participation (HLP 10).

• Few commitments on legislative oversight (HLP 8); on macro-fiscal policy (HLP 2); or on a citizen right to fiscal information (HLP 1).

• For further details of FT commitments see http://fiscaltransparency.net/2014/02/comparing-ogp-country-commitments-onfiscal-transparency/

8

Fiscal Transparency in OGP Countries, and the

Implementation of OGP Commitments: An Analysis

How well have OGP countries implemented their commitments?

• This analysis uses data in the first 51 Independent Reporting Mechanism (IRM)

Progress Reports

• Two sources: o A GIFT background paper for FOWG, analysing implementation of all the commitments in the 51 Action Plans by country and region, and implementation of just the FT commitments in those Plans, based on data extracted by GIFT from the 51 IRM Executive Summaries o A paper by Foti (IRM program manager) on the implementation of all the commitments in the 43 Action Plans.

9

Fiscal Transparency in OGP Countries, and the

Implementation of OGP Commitments: An Analysis

Foti’s* analysis of NAP implementation

• Analysis of all 948 commitments in the first 41 IRM Reports by Foti* concludes that: o 41% of commitments were new rather than pre-existing.

o 24% were of potentially transformative impact.

o Some NAPs contain high levels of ‘filler’ – commitments not clearly relevant to OGP, or assessed as having little or no impact. Problem worse in cohort 2 compared to cohort 1.

o Cohort 1 countries had much stronger rates of implementation of commitments than cohort 2 countries.

o Cohort 1 countries also had much lower count of commitments of unclear relevance to OGP (1% v 22%).

*

‘Lessons for OGP from the first 43 IRM reports’ by Joesph Foti with Leny Kouang, publication forthcoming.

10

Fiscal Transparency in OGP Countries, and the

Implementation of OGP Commitments: An Analysis

Weak performance in public consultation

• Fewer than half of OGP members met the letter of the OGP requirements for consultation in development and implementation of their NAPs.

• More than half of all member countries thus risk being found in breach of their OGP commitments.

11

Fiscal Transparency in OGP Countries, and the

Implementation of OGP Commitments: An Analysis

Identifying FT commitments in Action Plans

• Commitments were coded as FT commitments where they related to any aspect of taxation, borrowing, spending, investment and management of public resources, including delivery of public services.

• Covers policy design, implementation, review

• Includes: any public participation in the above

• Excludes: general references to public participation, or RTI, or open data, that do not specifically refer to FT

12

Fiscal Transparency in OGP Countries, and the

Implementation of OGP Commitments: An Analysis

Overview of FT commitments in NAPs

• A total of 378 FT commitments identified, in 48 out of these 51 Action Plans. This is

33% of the total commitments in these Plans.

• The definition of a commitment varies widely within and across Action Plans, reducing the comparability of data on commitments.

• There is a very wide range in the proportion of fiscal transparency commitments to total commitments in Action Plans, from 0% (Chile, Panama, Romania) to 100%

(Guatemala).

13

Implementation of FT commitments

Fiscal Transparency in OGP Countries, and the

Implementation of OGP Commitments: An Analysis

14

Fiscal Transparency in OGP Countries, and the

Implementation of OGP Commitments: An Analysis

Notable country FT reforms

• Of those countries with more than 5 FT commitments, notable progress in implementation of FT commitments was made by: o Croatia

– 12 out of 16 commitments completed or substantially completed o Mexico

– 12 out of 17 o Brazil

– 10 out of 10 o Indonesia – 10 out of 11 o Moldova – 8 out of 14 o The Philippines

– 8 out of 16

15

Fiscal Transparency in OGP Countries, and the

Implementation of OGP Commitments: An Analysis

OGP Star Commitments

• A star commitment is defined by the OGP as a commitment that combines three elements: o clear relevance to OGP goals o assessed as likely to be moderate to high impact o Has been substantially completed or completed.

• Introduced after the IRM reports for cohort 1 countries had been completed.

• There are 74 star commitments relating to FT.

• Star commitments make up 20% of all FT commitments.

16

Fiscal Transparency in OGP Countries, and the

Implementation of OGP Commitments: An Analysis

Table 4: Number of FT Commitments in Action Plans rated as Star Commitments

Country

Croatia

Honduras

Moldova

Colombia

Dominican Republic

Ghana (sub-commitments)

Jordan

Bulgaria

Italy

Tanzania

Denmark

Latvia

Uruguay

Liberia

Others*

2

2

2

16

3

3

3

2

4

4

11

6

6

5

5

17

Fiscal Transparency in OGP Countries, and the

Implementation of OGP Commitments: An Analysis

Some notable commitments (1)

• EITI: commitments in around a dozen countries to join, implement, strengthen participation, publicise reports

• Guatemala: join the Construction Sector Transparency Initiative (CoST)

• Finland: promote participatory budgeting

• Ghana: consult on, pass, and raise public awareness of a Fiscal Responsibility Act; prepare guidelines for deepening CSO participation in planning and budgetary processes;

• Draft new or stronger PFM Laws in Bulgaria and Azerbaijan

• Commitments to strengthen procurement in many countries e.g. Indonesia, the

Philippines

• GFMIS reforms in the Philippines, Honduras, and Dominican Rep. (latter also introduced a Treasury Single Account)

• Indonesia: publish local level health and education budgets

18

Fiscal Transparency in OGP Countries, and the

Implementation of OGP Commitments: An Analysis

Some notable commitments (2)

• Armenia: introduce internal audit across government; and program budgeting

• Israel: publish executive’s budget proposal

• Tanzania: publish grants to local governments

• Greece: publish taxpayers in arrears

• Indonesia: Publish tax and customs administration performance information and

Annual Report

• Honduras: update and disseminate the PEFA assessment

• IATI initiatives in a number of donor countries

19

Fiscal Transparency in OGP Countries, and the

Implementation of OGP Commitments: An Analysis

Some innovative commitments

• The Philippines: create a People’s Budget interactive web site; and institutionalize social audits

• Dominican Rep: publish data on public complaints at the level of individual government agencies; introduce a balanced scorecard on implementation of the national development strategy

• Honduras: create a portal devoted to fiscal education

• Peru: improve mechanisms for public consultation on budget preparation, approval, implementation and reporting

• Kenya: increase the country’s score on the OBI

20

Fiscal Transparency in OGP Countries, and the

Implementation of OGP Commitments: An Analysis

What steps to increase FT should countries include in their next Action Plans?: Disclosure

• First, OGP member governments should publish documents already produced within government: o 4 countries produce a Pre-Budget Statement but do not publish it; 4 others publish it too late.

o 2 countries publish a Citizen’s Budget but too late.

o 4 countries produce but do not publish a Mid-Year Review.

o 1 country produces but does not publish a year-end report and another does not publish the audit report;

2 countries publish these documents too late.

21

Fiscal Transparency in OGP Countries, and the

Implementation of OGP Commitments: An Analysis

Next steps in disclosure (2)

• Other reports not currently produced, but which would take relatively effort, are a

Citizens’ Budget (not published in 12 OGP members), and a mid-year report (not produced in 21 OGP members).

• OGP members that have gone backwards on fiscal transparency in recent years should give priority to decisively reversing this trend.

• The 4 countries that do not meet minimum fiscal transparency standards for OGP should do so by publishing the Audit Report.

22

Fiscal Transparency in OGP Countries, and the

Implementation of OGP Commitments: An Analysis

Next steps in public participation

• Governments, legislatures and Supreme Audit Institutions should increase opportunities for public engagement in fiscal policy throughout the budget cycle and across all stages of fiscal policy design and implementation: o The annual budget cycle (8 documents).

o Fiscal policy reviews and new policy initiatives outside the annual budget cycle

(revenues, expenditures, financing, asset, liability management).

o The design and delivery of public services. o The planning, appraisal & implementation of public investment projects.

23

Fiscal Transparency in OGP Countries, and the

Implementation of OGP Commitments: An Analysis

Principles of public participation

• GIFT High Level Principle 10: public participation in fiscal policy is a right of citizens.

• GIFT has developed a set of Principles of Public Participation in Fiscal Policy

(consultation paper is on our web site).

• Principles stress that public engagement needs to be open, inclusive, timely, wellinformed, meaningful, on-going, and complementary to existing accountability mechanisms.

24

Fiscal Transparency in OGP Countries, and the

Implementation of OGP Commitments: An Analysis

Next steps in strengthening oversight

• Countries should give early priority to: o Strengthening legislative oversight.

o Opening up legislative committee budget hearings to the public.

o Strengthening SAI independence and resourcing o Introducing social auditing.

25

Fiscal Transparency in OGP Countries, and the

Implementation of OGP Commitments: An Analysis

Improving the way in which commitments are specified

• Countries should pay much more attention to the specification of commitments in their Action Plans, using SMART criteria: o specific, measureable, achievable, relevant, and time bound

• The Philippines first Action Plan and the second UK Plan provide some good examples.

• Each commitment should demonstrate specifically how it advances open government.

• Group similar activities together in logically sequenced steps with timelines

26

Fiscal Transparency in OGP Countries, and the

Implementation of OGP Commitments: An Analysis

A poorly-specified commitment

• Commitment: ‘…plans to launch a web site where citizens can find information on the national budget and report information they may have on the actual expenditure of government funds.’

Commitment is not specific on the types of budget information, nor the types of information that citizens might report.

Not possible to see how commitment builds on current information availability, nor how success will be measured.

No reference to a time frame.

27

Fiscal Transparency in OGP Countries, and the

Implementation of OGP Commitments: An Analysis

A well-specified commitment

‘…commits to publish data on government subsidies to elementary and junior high schools and to publish health expenditures and budgets at every community hospital in

497 regions…’

Commitment is specific and measureable

– although not time bound.

28

Fiscal Transparency in OGP Countries, and the

Implementation of OGP Commitments: An Analysis

A results-focused commitment

‘Improve the management of public resources by increasing the country’s ranking in the Open Budget Index from providing ‘limited information’ to providing ‘significant information.’

Very specific and measureable: the expressions ‘limited information’ and ‘significant information’ correspond to bands on the OBI (scores of 41-60 and 61-80 respectively) although it lacks a time dimension

29

Fiscal Transparency in OGP Countries, and the

Implementation of OGP Commitments: An Analysis

Recommended consultation practices

• Designation of a lead agency responsible for each commitment.

• Publication of the names of specific CSOs who are working with government on each commitment.

• Countries need to follow much more closely the OGP process requirements for public consultation in the design and implementation of their Action Plans.

• Go beyond traditional civil society consultation models towards institutionalising systematic, on-going and meaningful dialogue with non-government actors and the public.

30

Fiscal Transparency in OGP Countries, and the

Implementation of OGP Commitments: An Analysis

In conclusion

• DGIFT stands ready to assist countries with the design and implementation of fiscal transparency initiatives, whether they are current members of OGP or are nonmembers, by: o Providing a platform for peer to peer sharing and learning e.g. on fiscal transparency portals, and on publishing in open data formats.

o Offering access to good practices, tools, technical expertise; o Supporting OGP members to develop more ambitious commitments; o Motivating additional governments to join OGP; o Developing new norms and sources of guidance e.g. on how governments, legislatures and SAIs should encourage and facilitate public participation in fiscal policy.

31

Fiscal Transparency in OGP Countries, and the

Implementation of OGP Commitments: An Analysis

Selected references

Fiscal Transparency in OGP Countries, and the Implementation of OGP Commitments:

An Analysis. Background Paper for the FOWG Meeting in Bali, 6 May 2014.

Fiscal Openness Working Group London Workshop Background Paper: http://fiscaltransparency.net/2013/11/ogp-gift-fowg-background-paper/

Fiscal Openness Working Group 2014 Work Plan: http://fiscaltransparency.net/2014/03/fowg-2014-workplan/

GIFT Expanded High Level Principles: http://fiscaltransparency.net/2013/07/expandedhigh-level-principles-on-fiscal-transparency/

32

Engage with us: fiscaltransparency.net