presentation

advertisement

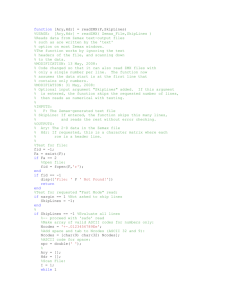

How To Measure Anything: Finding the Value of ‘Intangibles’ in Business Copyright HDR 2007 dwhubbard@hubbardresearch.com 1 How to Measure Anything • It started 12 years ago… • I conducted over 60 major risk/return analysis projects so far that included a variety of “impossible” measurements • I found such a high need for measuring difficult things that I decided I had to write a book • The book was released in July 2007 with the publisher John Wiley & Sons • This is a “sneak preview” of many of the methods in the book Copyright HDR 2007 dwhubbard@hubbardresearch.com 2 How To Measure Anything • “I love this book. Douglas Hubbard helps us create a path to know the answer to almost any question, in business, in science or in life.” Peter Tippett, Ph.D., M.D. Chief Technology Officer at CyberTrust and inventor of the first antivirus software • “Doug Hubbard has provided an easy-to-read, demystifying explanation of how managers can inform themselves to make less risky, more profitable business decisions.” Peter Schay, EVP and COO of The Advisory Council • “As a reader you soon realize that actually everything can be measured while learning how to measure only what matters. This book cuts through conventional clichés and business rhetoric and it offers practical steps to using measurements as a tool for better decision making.” Ray Gilbert, EVP Lucent • “This book is remarkable in it's range of measurement applications and it's clarity of style. A must read for every professional who has ever exclaimed ‘Sure, that concept is important but can we measure it?’” Dr. Jack Stenner, CEO and co-founder of MetaMetrics, Inc. Copyright HDR 2007 dwhubbard@hubbardresearch.com 3 A Few Examples • IT – – – – – – Risk of IT The value of better information The value of better security The Risk of obsolescence The value of productivity when headcount is not reduced The value of infrastructure • Business – Market forecasts – The risk/return of expanding operations – Business valuations for venture capital • Military – Forecasting fuel for Marines in the battlefield – Measuring the effectiveness of combat training to reduce roadside bomb/IED casualties Copyright HDR 2007 dwhubbard@hubbardresearch.com 4 Does Your Model Consider… 1. 2. 3. 4. Research shows most subject matter experts are statistically overconfident. If you don’t account for this, you will underestimate risk in every model you make. Most Monte Carlo models are created with little or no empirical measures of any kind. If a model includes the results of empirical measurements, its usually not the measures the are the “high payoff” measures. There is a way to make tradeoff’s between higher risk/higher return investments and lower risk/lower return investments that result in an optimal portfolio. The final deliverable in most Monte Carlos is a histogram – not a risk/return optimized recommendation. @RISK can support anything we are talking about! Copyright HDR 2007 dwhubbard@hubbardresearch.com 5 Three Illusions of Intangibles (The “howtomeasureanything.com” approach) • The perceived impossibility of measurement is an illusion caused by not understanding: – the Concept of measurement – the Object of measurement – the Methods of measurement • See my “Everything is Measurable” article in CIO Magazine (go to “articles” link on www.hubbardresearch.com Copyright HDR 2007 dwhubbard@hubbardresearch.com 6 The Approach • • • • Model what you know now Compute the value of additional information Where economically justified, conduct observations that reduce uncertainty Update the model and optimize the decision Copyright HDR 2007 dwhubbard@hubbardresearch.com 7 Uncertainty, Risk & Measurement • • Measuring Uncertainty, Risk and the Value of Information are closely related concepts, important measurements themselves, and precursors to most other measurements The “Measurement Theory” definition of measurement: “A measurement is an observation that results in information (reduction of uncertainty) about a quantity.” Copyright HDR 2007 dwhubbard@hubbardresearch.com 8 Calibrated Estimates • Decades of studies show that most managers are statistically “overconfident” when assessing their own uncertainty – Studies showed that bookies were great at assessing odds subjectively, while doctors were terrible • Studies also show that measuring your own uncertainty about a quantity is a general skill that can be taught with a measurable improvement • Training can “calibrate” people so that of all the times they say they are 90% confident, they will be right 90% of the time Copyright HDR 2007 dwhubbard@hubbardresearch.com 9 Calibrated Estimates: Ranges Calibrated probability assessment results from various studies Group Harvard MBAs Chemical Co. Employees Chemical Co. Employees Computer Co. Managers Computer Co. Managers AIE Seminar (before training) AIE Seminar (some training) Subject General Trivia General Industry Company-Specific General Business Company-Specific General Trivia & IT General Trivia & IT 90% Confidence Interval % Correct (target 90%) 40% 50% 48% 17% 36% 50% 80% Copyright HDR 2006 dwhubbard@hubbardresearch.com 10 Calibration Results 73% of people who go through calibration training achieve calibration The remaining 27% seem “stuck” in overconfidence – for these we use “calibration factors” to adjust all ranges or we seek confirmation from calibrated persons – Fortunately, they are not usually the persons relied on for most estimates Percent within expected 90% confidence interval • • 100% 90% 80% Target 60% 40% 20% 0% Test 1 Test 2 Test 3 Test 4 Test 5* 0% 0% 7% 38% 55% Copyright HDR 2006 dwhubbard@hubbardresearch.com % finished on this test 11 1997 Calibration Experiment • • In January 1997, I conducted a calibration training experiment with 16 IT Industry Analysts and 16 CIO’s to test if calibrated people were better at putting odds on uncertain future events. The analysts were calibrated and all 32 subjects were asked To Predict 20 IT Industry events Example: Steve Jobs will be CEO of Apple again, by Aug 8, 1997 - True or False? Are you 50%, 60%...90%, 100% confident? 100% 17 Percent Correct • 90% 45 80% 70% “Ideal” Confidence 21 Statistical Error 65 68 60% Giga Clients 152 21 75 71 65 58 Giga Analysts 50% 40% 99 # of Responses 25 30% 50% 60% 70% 80% 90% 100% Assessed Chance Of Being Correct Source: Hubbard Decision Research Copyright HDR 2007 dwhubbard@hubbardresearch.com 12 The Value of Information z z z EVI p(ri ) max V1, j p( j | ri ), V2 , j p( j | ri ),... Vl , j p( j | ri ), EV * i 1 j 1 j 1 j 1 k The formula for the value of information has been around for almost 60 years. It is widely used in many parts of industry and government as part of the “decision analysis” methods – but still mostly unheard of in the parts of business where it might do the most good. What it means: 1. Information reduces uncertainty 2. Reduced uncertainty improves decisions 3. Improved decisions have observable consequences with measurable value Copyright HDR 2007 dwhubbard@hubbardresearch.com 13 The EOL Method • • • • • • • The simplest approach computes the change in “Expected Opportunity Loss” “Opportunity Loss” is the loss (compared to the alternative) if it turns out you made the wrong decision Expected Opportunity Loss (EOL) is the cost of being wrong times the chance of being wrong The reduction in EOL from more information is the value of the information. In the case of perfect information (if that were possible) the value of information is equal to the EOL. Simple Binary Example: You are about to make a $20 million investment to upgrade the equipment in a factory to make a new product. If the new product does well, you save $50 million in manufacturing. If not, you lose (net) $10 million. There is a 20% chance of the new product failing. What’s it worth to have perfect certainty about this investment if that were possible? Answer: 20% x $10 million = $2 million Copyright HDR 2007 dwhubbard@hubbardresearch.com 14 Information Value w/Ranges • • • The value of information is computed a little differently with a distribution, but the same basic concepts apply For each variable, there is a “Threshold” where the investment just breaks even If the threshold is within the range of possible values, then there is a chance that you would make a different decision with better measurements 90% Confidence Interval Threshold 5% tail Mean 5% tail Threshold Probability Copyright HDR 2007 dwhubbard@hubbardresearch.com 15 Normal Distribution Information Value • The “expected value” of the variable is the mean of the range of possible values • A threshold is a point where the value just begins to make some difference in a decision – a breakeven • The expected value is on one side of the threshold • If the true value is on the opposite side of the threshold from the mean then the best decision would have been different then one based on the mean • The “Threshold Probability” is the chance that this variable could have a value that would change the decision Example Threshold: 18% Productivity Improvement Probability that true value is under required threshold: 16.25% 5% 10% 20% 15% Productivity Improvement in Process X Copyright HDR 2007 dwhubbard@hubbardresearch.com 25% 16 Normal Distribution VIA • • • • The curve on the other side of the threshold is divided up into hundreds of “slices” Each slice has an assigned quantity (such as a potential productivity improvement) and a probability of occurrence For each assigned quantity, there is an Opportunity Loss Each slice’s Opportunity Loss is multiplied by probability to compute its Expected Opportunity Loss Example: Productivity Improvement: 15% Opportunity Loss: $1,855,000 Probability: 0.0053% EOL: $98.31 5% 10% 15% 20% 25% Productivity Improvement in Process X Copyright HDR 2007 dwhubbard@hubbardresearch.com 17 Normal Distribution VIA • • • • • Total EOL for all slices equals the EOL for the variable Since EOL=0 with perfect information, then the Expected Value of Perfect Information (EVPI) =sum(EOL’s) Even though perfect information is not usually practical, this method gives us an upper bound for the information value, which can be useful by itself Many of the EVPI’s in a business case will be zero I do this with a macro in Excel but it can also be estimated Total of all EOL’s = $58,989 This is the value of perfect information about the potential productivity improvement 5% 10% 15% 20% 25% Productivity Improvement in Process X Copyright HDR 2007 dwhubbard@hubbardresearch.com 18 Increasing Value & Cost of Info. The value of information levels off while the cost of information accelerates Information value grows fastest at the beginning of information collection Use iterative measurements that err on the side of “small bites” at the steep part of the slope $$$ Dollar Value/Cost • • • Aim for this range EVPI • ENBI EVI • • Maximum ENBI • EVPI – Expected Value of Perfect Information ECI – Expected Cost of Information EVI – Expected Value of Information ENBI – Expected Net Benefit of Information ECI $0 Low accuracy High accuracy Copyright HDR 2007 dwhubbard@hubbardresearch.com 19 The Measurement Inversion • Also, we found that, if anything, fewer measurements were required after the information values were known. Economic Relevance – Costs were measured more than the more uncertain benefits – Small “hard” benefits would be measured more than large “soft” benefits Typical Attention • After the information values for over 4,000 Measurement Attention variables was computed, a pattern emerged. vs. Relevance • The highest value measurements were almost never measured while most measurement effort was spent on less relevant factors See my article “The IT Measurement Inversion” in CIO Magazine (its also on my website at www.hubbardresearch.com under the “articles” link) Copyright HDR 2006 dwhubbard@hubbardresearch.com 20 Next Step: Observations • Now that we know what to measure, we can think of observations that would reduce uncertainty • The value of the information limits what methods we should use, but we have a variety of methods available • Take the “Nike Method”: Just Do It – don’t let imagined difficulties get in the way of starting observations Copyright HDR 2007 dwhubbard@hubbardresearch.com 21 Some Useful Suggestions for Making Empirical Observations • • • • • It has been done before You have more data than you think You need less data than you think It is more economical than you think The existence of noise is not a lack of signal “It’s amazing what you can see when you look” Yogi Berra Copyright HDR 2007 dwhubbard@hubbardresearch.com 22 Statistics Goes to War • Several clever sampling methods exist that can measure more with less data than you might think • Examples: estimating the population of fish in the ocean, estimating the number of tanks created by the Germans in WWII, extremely small samples, etc. Copyright HDR 2006 dwhubbard@hubbardresearch.com 23 Measuring to the Threshold Number Sampled Chance the Median is Below the Threshold • Measurements have value usually because there is some point where the quantity makes a difference • Its often much harder to ask “How much is X” than “Is X enough” 2 4 6 8 10 12 14 16 18 20 2 3 4 50% 40% 30% 20% 10% 5% 2% 1% 0.5% 0.2% 0.1% 0 1 5 6 7 8 9 10 Samples Below Threshold Copyright HDR 2007 dwhubbard@hubbardresearch.com 24 Measuring to the threshold 4. Find the value on the vertical axis directly left of the point identified in step 3; this value is the chance the median of the population is below the threshold Chance the Median is Below the Threshold 1. Find the curve beneath the number of samples taken 2 • Number Sampled 4 6 8 10 12 14 16 18 20 50% • 40% 30% 20% 10% 5% 2% 1% 0.5% 3. Follow the curve identified in step 1 until it intersects the vertical dashed line identified in step 2. 0.2% 0.1% 0 1 2 3 4 5 6 7 8 9 10 Samples Below Threshold Use this chart when using small samples to determine the probability that the median of a population is below a defined threshold Example: You want to determine how much time your staff spends on one activity. You sample 12 of them and only two spend less than 1 hour a week at this activity. What is the chance that the median time all staff spend is more than 1 hour per week? Look up 12 on the top row, following the curve until it intersects the “2” line on the bottom row, and look up the number to the left. The answer is just over 1%. 2. Identify the dashed line marked by the number of samples that fell below the threshold The “Math-less” Statistics Table • Measurement is based on observation and most observations are just samples • Reducing your uncertainty with random samples is not made intuitive in most statistics texts • This table makes computing a 90% confidence interval easy Copyright HDR 2006 dwhubbard@hubbardresearch.com 26 The Simplest Method • “Bayesian” methods in statistics use new information to update prior knowledge • Bayesian methods can be even more elaborate that other statistical methods BUT… • It turns out that calibrated people are already mostly “instinctively Bayesian” • The instinctive Bayesian approach: – Assess your initial subjective uncertainty with a calibrated probability – Gather and study new information about the topic (it could be qualitative or even tangentially related) – Give another subjective calibrated probability assessment with this new information • In studies where people were asked to do this, there results were usually not irrational compared to what would be computed with Bayesian statistics – calibrated people do even better Copyright HDR 2007 dwhubbard@hubbardresearch.com 27 Comparison of Methods • Overconfident (Stated uncertainty is lower than rational) Gullible Typical Un-calibrated Expert Stubborn NonBayesian Bayesian Statistics Calibrated Expert Under-confident (Stated uncertainty is higher than rational) • Overly Cautious Vacillating, Indecisive Ignores Prior Knowledge; Emphasizes new data Ignores New data; Emphasizes Prior Knowledge • • Copyright HDR 2007 dwhubbard@hubbardresearch.com Traditional non-Bayesian statistics (what you probably learned in the first semester of stats) assumes you knew nothing prior to the samples you took - this is almost never true in reality Most un-calibrated experts are overconfident and slightly overemphasize new information Calibrated experts are not overconfident, but slightly ignore prior knowledge Bayesian analysis is the perfect balance; neither under- nor over- confident, uses both new and old information 28 Analyzing the Distribution • • How are you assessing the resulting histogram from a Monte Carlo simulation? Is this a “good” distribution or a “bad” one? How would you know? ROI = 0% “Expected” ROI Risk of Negative ROI -25% Probability of Positive ROI 0% 25% 50% 75% 100% 125% Return on Investment (ROI) Copyright HDR 2006 dwhubbard@hubbardresearch.com 29 Quantifying Risk Aversion • • • The simplest element of Harry Markowitz’s Nobel Prize-winning method “Modern Portfolio Theory” is documenting how much risk an investor accepts for a given return. The “Investment Boundary” states how much risk an investor is willing to accept for a given return. For our purposes, we modified Markowitz’s approach a bit. Acceptable Risk/Return Boundary Investment Region Investment Copyright HDR 2007 dwhubbard@hubbardresearch.com 30 Approach Summary Define Decision Model Populate Model with Calibrated Estimates & Measurements Conduct Value of Information Analysis (VIA) Analyze Remaining Risk Calibrate Estimators Measure according to VIA results and update model Optimize Decision Copyright HDR 2007 dwhubbard@hubbardresearch.com 31 Connecting The Dots • • The EPA needed to compute the ROI of the Safe Drinking Water Information System (SDWIS) As with any AIE project, we built a spreadsheet model that connected the expected effects of the system to relevant impacts – in this case public health and its economic value Copyright HDR 2006 dwhubbard@hubbardresearch.com 32 Reactions: Safe Water • “I didn’t think that just defining the problem quantitatively would result in something that eloquent. I wasn’t getting my point across and the AIE approach communicated the benefits much better.” Jeff Bryan, SDWIS Program Chief • “Until [AIE], nobody understood the concept of the value of the information and what to look for. They had to try to measure everything, couldn’t afford it, so opted for nothing… • “Translating software to environmental and health impacts was amazing. I think people were frankly stunned anyone could make that connection… • “The result I found striking was the level of agreement of people with disparate views of what should be done. From my view, where consensus is difficult to achieve, the agreement was striking” Mark Day, Deputy CIO and CTO for the Office of Environmental Information Copyright HDR 2006 dwhubbard@hubbardresearch.com 33 Forecasting Fuel for Battle • The US Marine Corps with the Office of Naval Research needed a better method for forecasting fuel for wartime operations • The VIA showed that the big uncertainty was really supply route conditions, not whether they are engaging the enemy • Consequently, we performed a series of experiments with supply trucks rigged with GPS and fuel-flow meters. Copyright HDR 2006 dwhubbard@hubbardresearch.com 34 Reactions: Fuel for the Marines • “The biggest surprise was that we can save so much fuel. We freed up vehicles because we didn’t have to move as much fuel. For a logistics person that's critical. Now vehicles that moved fuel can move ammunition.“ Luis Torres, Fuel Study Manager, Office of Naval Research • “What surprised me was that [the model] showed most fuel was burned on logistics routes. The study even uncovered that tank operators would not turn tanks off if they didn’t think they could get replacement starters. That’s something that a logistician in a 100 years probably wouldn’t have thought of.” Chief Warrant Officer Terry Kunneman, Bulk Fuel Planning, HQ Marine Corps Copyright HDR 2006 dwhubbard@hubbardresearch.com 35 Final Tips • Learn about calibration, computing information values, and risk/return tradeoffs • You can use the information value calculations within @RISK • Don’t let “exception anxiety” cause you to avoid any observations at all – the existence of noise does not mean the lack of signal • Just do it – you learn about how to measure it by just starting to take some observations Copyright HDR 2007 dwhubbard@hubbardresearch.com 36 Questions? Doug Hubbard Hubbard Decision Research dwhubbard@hubbardresearch.com www.hubbardresearch.com 630 858 2788 Copyright HDR 2007 dwhubbard@hubbardresearch.com 37