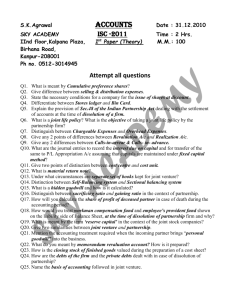

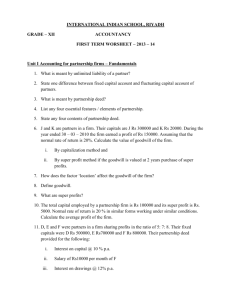

Partnership Accounts

advertisement

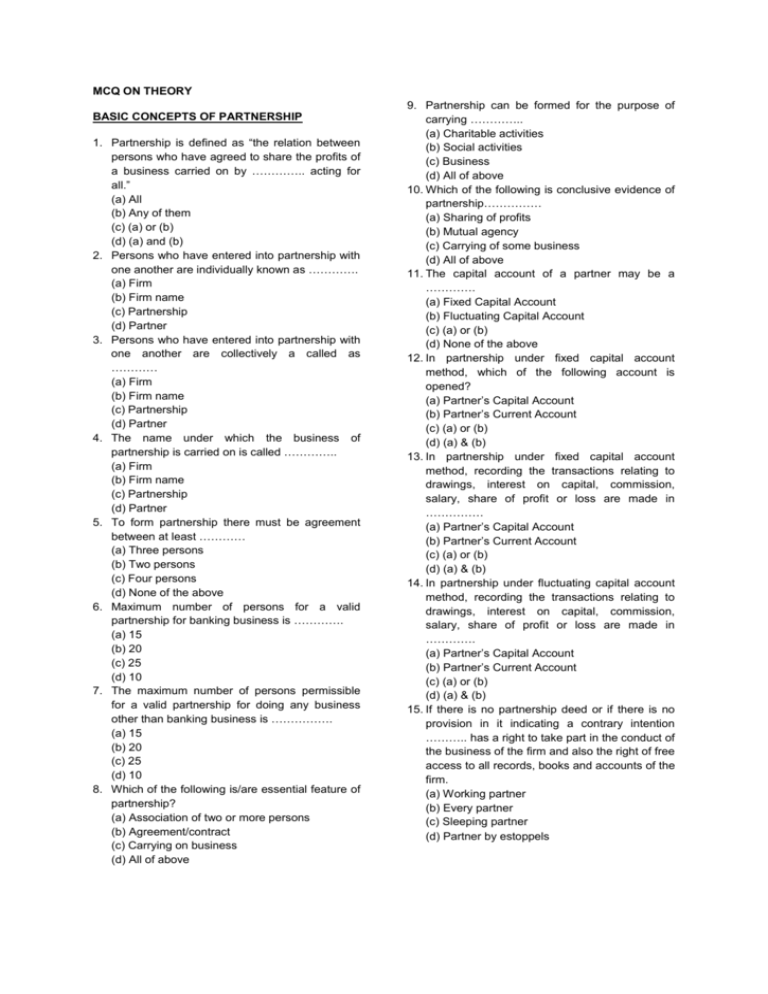

MCQ ON THEORY BASIC CONCEPTS OF PARTNERSHIP 1. Partnership is defined as “the relation between persons who have agreed to share the profits of a business carried on by ………….. acting for all.” (a) All (b) Any of them (c) (a) or (b) (d) (a) and (b) 2. Persons who have entered into partnership with one another are individually known as …………. (a) Firm (b) Firm name (c) Partnership (d) Partner 3. Persons who have entered into partnership with one another are collectively a called as ………… (a) Firm (b) Firm name (c) Partnership (d) Partner 4. The name under which the business of partnership is carried on is called ………….. (a) Firm (b) Firm name (c) Partnership (d) Partner 5. To form partnership there must be agreement between at least ………… (a) Three persons (b) Two persons (c) Four persons (d) None of the above 6. Maximum number of persons for a valid partnership for banking business is …………. (a) 15 (b) 20 (c) 25 (d) 10 7. The maximum number of persons permissible for a valid partnership for doing any business other than banking business is ……………. (a) 15 (b) 20 (c) 25 (d) 10 8. Which of the following is/are essential feature of partnership? (a) Association of two or more persons (b) Agreement/contract (c) Carrying on business (d) All of above 9. Partnership can be formed for the purpose of carrying ………….. (a) Charitable activities (b) Social activities (c) Business (d) All of above 10. Which of the following is conclusive evidence of partnership…………… (a) Sharing of profits (b) Mutual agency (c) Carrying of some business (d) All of above 11. The capital account of a partner may be a …………. (a) Fixed Capital Account (b) Fluctuating Capital Account (c) (a) or (b) (d) None of the above 12. In partnership under fixed capital account method, which of the following account is opened? (a) Partner’s Capital Account (b) Partner’s Current Account (c) (a) or (b) (d) (a) & (b) 13. In partnership under fixed capital account method, recording the transactions relating to drawings, interest on capital, commission, salary, share of profit or loss are made in …………… (a) Partner’s Capital Account (b) Partner’s Current Account (c) (a) or (b) (d) (a) & (b) 14. In partnership under fluctuating capital account method, recording the transactions relating to drawings, interest on capital, commission, salary, share of profit or loss are made in …………. (a) Partner’s Capital Account (b) Partner’s Current Account (c) (a) or (b) (d) (a) & (b) 15. If there is no partnership deed or if there is no provision in it indicating a contrary intention ……….. has a right to take part in the conduct of the business of the firm and also the right of free access to all records, books and accounts of the firm. (a) Working partner (b) Every partner (c) Sleeping partner (d) Partner by estoppels 16. If there is no partnership deed or if there is no provision in it indicating a contrary intention, partners share profits and losses …………. (a) In their capital ratio (b) In their opening capital ratio (c) Equally (d) In last agreed capital ratio 17. If there is no partnership deed or if there is no provision in it indicating a contrary intention and where a partner has advanced any loan to the firm and the agreement provides for interest, but does not specify any rate, the rate shall be ………… (a) 6% p.a. (b) 6% (c) 10% p.a. (d) 12% p.a. 18. If there is no partnership deed or if there is no provision in it indicating a contrary intention, …………. is to be charged on drawings (a) 6% p.a. (b) No interest (c) 12% p.a. (d) 10% p.a. 19. In absence of specific provisions in the partnership deed ……….. salary would be paid to the partners (a) Rs. 10,000 per month (b) Rs. 10,000 per annum (c) Rs. 20,000 per annum (d) No 20. …………….. is a very short duration special purpose partnership entered into by two or more persons jointly to carry out business with a view to earn profit and loss in an agreed ratio. (a) Consignment (b) Partnership at will (c) Implied partnership (d) Joint venture 21. ………… is limited to a specific venture. (a) Express partnership (b) Partnership at will (c) Implied partnership (d) Joint venture 22. The doctrine of implied authority is ………….. to co-ventures whereas it ………….. to partnership. (a) Is applicable, not applicable (b) Not applicable, is applicable (c) Not applicable, not applicable (d) None of the above GOODWILL & VARIOUS METHODS FOR VALUATION OF GOODWILL 23. ………… may be described as the aggregate of those intangible attributes of a business which contribute to its superior earning capacity over a normal return on investment. (a) Image of firm (b) Goodwill (c) Work quality (d) None of the above 24. Which of the following factor generally contribute to the value of goodwill of a firm? (a) Efficiency of management (b) Risk involved in the business (c) Location of the business (d) All of above 25. Which of the following factor generally contribute to the value of goodwill of a firm? (a) Quality of goods sold by the firm (b) Reputation of the owners (c) Risk involved in the business (d) All of above 26. In which of the following case the need for the valuation of goodwill in a firm may arise? (a) Admission of new partner (b) While changing profit sharing ratio (c) Retirement or death of partner (d) All of above 27. Which of the following formula is used to calculate goodwill under simple average profit method? (a) Goodwill = Weighted average profit x No. of year purchase (b) Goodwill = Average profit x No. of year purchase (c) Goodwill = Super profit x No. of years purchases (d) Goodwill = Super profit x Annuity factor 28. Which of the following formula is used to calculate goodwill under super profit method? (a) Goodwill = Weighted average profit x No. of year purchase (b) Goodwill = Average profit x No. of year purchase (c) Goodwill = Super profit x No. of years purchases (d) Any of the above 29. Which of the following formula is used to calculate goodwill under weighted average profit method? (a) Goodwill = Weighted average profit x No. of year purchase (b) Goodwill = Average profit x No. of year purchase (c) Goodwill = Super profit x No. of years purchases (d) Goodwill = Super profit x Annuity factor 30. Which of the following formula is/are used for valuation goodwill under super profit basis? (a) Goodwill = Super profit x No. of years purchases (b) Goodwill = Super Profit x Annuity factor (c) Goodwill = Super profit x 100 Capitalization rate (d) Any of the above INTEREST ON CAPITAL & DRAWINGS 31. Interest on partners capital is chargeable …………. (a) To the extent of available profit (b) Where there is loss (c) Fully chargeable even if profit is not sufficient (d) None of the above 32. When a partner draws a fixed sum at the beginning of each month, interest on total drawings will be equal to interest of ………….. at an agreed rate. (a) 2.5 months (b) 5.5 months (c) 6.5 months (d) 6 months 33. When a partner draws a fixed sum at the middle of each month, interest on total drawings will be equal to interest of ………….. at an agreed rate. (a) 2.5 months (b) 5.5 months (c) 6.5 months (d) 6 months 34. When a partner draws a fixed sum at the end of each month, interest on total drawings will be equal to interest of ..……….. at an agreed rate. (a) 2.5 months (b) 5.5 months (c) 6.5 months (d) 6 months ADMISSION OF PARTNER 35. A new partner can be admitted with the consent of ………………… (a) Any other partner (b) Majority partner (c) All existing partners (d) None of above 36. Scarifying ratio is different between ………. & …………. (a) Old ratio & New ratio (b) Old ratio & Capital ratio (c) New ratio & Capital ratio (d) None of above 37. Reserves created out of profits or balance in Profit and Loss Account at the time of admission of a new partner must be transferred to the capital accounts of the old partners in the ……………. (a) New profit sharing ratio (b) Old profit sharing ratio (c) Scarifying ratio (d) Capital ratio 38. To revalue assets & liabilities on admission, retirement or death of partner ………… is opened. (a) Goodwill Account (b) Suspense Account (c) Adjustment Account (d) Revaluation Account 39. Profit or loss on revaluation is shared among the partners in …………. ratio. (a) Old profit sharing (b) New profit sharing (c) Capita (d) Equal 40. Sometimes, all the partners including the new partner may agree not to alter the book value of assets and liabilities even when they agree to revalue them. In order to record this, …………… is opened. (a) Revaluation Account (b) Memorandum Revaluation Account (c) Goodwill Account (d) Suspense Account 41. The amount that the incoming partner pays for goodwill is known as …………….. (a) Adjusted goodwill (b) Premium for capital (c) Premium for goodwill (d) Hidden goodwill 42. When required amount for premium for goodwill is brought in by new partner and this amount is immediately withdrawn by the old partner, then such premium for goodwill shared by old partner in ………….. (a) New profit sharing ratio (b) Old profit sharing ratio (c) Scarifying ratio (d) Capital ratio 43. When required amount for premium for goodwill is not brought in by new partner, goodwill account is raised in the books of the firm by debiting goodwill account and crediting partners capital account in ……………… (a) New profit sharing ratio (b) Old profit sharing ratio (c) Scarifying ratio (d) Capital ratio 44. When required amount for premium for goodwill is not brought in by new partner, goodwill account is raised in the books of the firm by debiting goodwill account and crediting partners capital account in old profit sharing ratio and written off in ..……….. if it is agreed not show goodwill in the books of the firm OR ALTERNATIVELY premium for goodwill should be adjusted through partners’ capital accounts partner’s capital by debiting new partners share of goodwill to his account and crediting old partners’ capital accounts in ………….. (a) New profit sharing ratio, Scarifying ratio (b) Old profit sharing ratio, Scarifying ratio (c) Scarifying ratio, New profit sharing ratio (d) Capital ratio, New profit sharing ratio 45. Sometime the value of goodwill has to be inferred from the agreement of capitals and profit sharing ratio among the partners, is known as …………. (a) Adjusted goodwill (b) Premium for capital (c) Premium for goodwill (d) Hidden goodwill 46. Guaranteed profit is generally given to ………….. (a) Incoming partner (b) Retiring partner (c) Sub partner (d) All the three 47. When a partner is given guarantee by the other partner, loss on such guarantee will be borne by …………… (a) All the other partners (b) Partnership firm (c) Partner with highest ratio (d) Partner giving guarantee RETIREMENT & DEATH OF PARTNER 48. A partner may retire …………….. (a) With the consent of all the partners (b)In accordance with an express agreement by the partners (c) Where the partnership is at will, by giving notice in writing to all the other partners of his intention to retire (d) Any of the above 49. Gain ratio = …………. Minus ………… (a) Old ratio, New ratio (b) Old ratio, Capital ratio (c) New ratio, Old ratio (d) None of above 50. The amount due to the retiring partner can be made by …………… (a) Lump Sum Payment Method (b) Instalment Payment Method (c) Both (a) & (b) (d) (a) or (b) 51. Before a partner retires, reserves created out of profits or balances in profit and loss account must be transferred to the capital accounts of all the partners in …………… (a) New profit sharing ratio (b) Old profit sharing ratio (c) Scarifying ratio (d) Gain ratio 52. Balance in revaluation account is transferred to old partners in …………… (a) New profit sharing ratio (b) Old profit sharing ratio (c) Scarifying ratio (d) Gain ratio 53. Increase in liability at the time of retirement of partner is ………….. (a) Debited to goodwill account (b) Debited to profit & loss account (c) Debited to revaluation account (d) Credited to revaluation account 54. Decrease in liability at the time of retirement of partner is ………………… (a) Debited to goodwill account (b) Debited to profit & loss account (c) Debited to revaluation account (d) Credited to revaluation account 55. Increase in assets at the time of retirement of partner is ……………. (a) Debited to goodwill account (b) Debited to profit & loss account (c) Debited to revaluation account (d) Credited to revaluation account 56. Decrease in assets at the time of retirement of partner is …………….. (a) Debited to goodwill account (b) Debited to profit & loss account (c) Debited to revaluation account (d) Credited to revaluation account 57. The executors of the deceased partner are entitled to a share of profit earned by the firm from the date of last balance sheet and to the date of death. Which of the entry will be passed for this purpose? (Name of the deceased partner was Mr. X) X A/c To revaluation A/c X A/c To Profit & Loss A/c X A/c To memorandum Revaluation A/c X A/c To Profit & Loss Suspense A/c Dr. Dr. Dr. Dr. DISSOLUTION OF A FIRM 58. Dissolution of partnership between all the partners of firm is called …………. (a) Reconstitution of firm (b) Dissolution of firm name (c) Dissolution of firm (d) Dissolution of partnership 59. A firm is dissolved when …………… (a) The partners of the of the firm decide to dissolve it (b) All the partners or all the partners except one become insolvent (c) The business of the firm is declared illegal (d) All of above 60. A firm is dissolved when ………….. (a) In case partnership at will, a partner gives notice of dissolution (b) The Court orders dissolution of the firm (c) All the partners or all the partners except one become insolvent (d) All of above 61. The Court orders dissolution of the firm in which of the following case? (a) Where a dissolution appears to the Court to be just and equitable (b) Where a business cannot be carried on except at a loss (c) Where there is persistent disregard of partnership agreement by a partner (d) All of above 62. The Court orders dissolution of the firm in which of the following case? (a) Where a partner is guilty of misconduct affecting the business (b) Where a partner suffers from permanent incapacity (c) Where a partner has become of unsound mind (d) All of above 63. In setting the accounts of a firm after dissolution, losses, including deficiencies of capital, shall be paid …………. (a) Out of profits (b) Out of capital (c) By the partners individually in the proportions in which they were entitled to share profits (d) First out of profits, next out of capital, and, lastly, if necessary, by the partners individually in the proportions in which they were entitled to share profits 64. Upon dissolution, the firm’s assets shall be first applied in ……………. (a) In paying the debts of the firm to third parties (b) Payment of partners loan (c) Payment of partners capital (d) Distribution of surplus to partners in profit sharing ratio 65. Upon dissolution, the firm’s assets shall be first applied in paying the debts of the firm o third parties, shall thereafter be applied in …………………… (a) In paying the debts of the firm to third parties (b) Payment of partners loan (c) Payment of partners capital (d) Distribution of surplus to partners in profit sharing ratio 66. Upon dissolution, the firm’s assets shall be first applied in paying the debts of the firm to third parties, shall thereafter be applied in payment of partners loan, shall then be applied in payment of partners capital. (a) In paying the debts of the firm to third parties (b) Payment of partners loan (c) Payment of partners capital (d) Distribution of surplus to partners in profit sharing ratio 67. Upon dissolution, the firm’s assets shall be first applied in paying the debts of the firm to third parties, shall thereafter be applied in payment of partners loan, shall then be applied in payment of partners capital and still surplus remains it should used for ……………. (a) In paying the debts of the firm to third parties (b) Payment of partners loan (c) Payment of partners capital (d) Distribution of surplus to partners in profit sharing ratio 68. Upon dissolution, which is the proper order for application of the firm’s assets? I. Payment of partners loan II. In paying the debts of the firm to third parties III. Distribution of surplus to partners in profit sharing ratio IV Payment of partners capital (a) I, IV, III, II (b) II, I, IV, III (c) II, I, III, IV (d) I, II, III, IV 69. The private property of a partner should be used to …………….. (a) Pay his private debts first (b) If there is any surplus it can be used to pay firm’s liabilities (c) (a) and (b) (d) None of above 70. Firm’s assets should be first used to pay …………… (a) Firm’s liabilities (b) Private liabilities (c) Firm’s liabilities and if surplus remains then it can be used to pay his private liabilities of partner (d) None of above 71. Which of the following is prepared only at the time of dissolution of the firm? (a) Revaluation Account (b) Realization Account (c) Profit & Loss Adjustment Account (d) Any of above 72. Which of the following account’s balance will not be transferred to realization account? (a) Provision for bad debts (b) Debtors Account (c) Building Account (d) Cash & Bank Account 73. The effect of the revaluation of assets and liabilities is recorded in …………… (a) Capital Account (b) Suspense Account (c) Realization Account (d) Revaluation Account 74. In which of the following account, accounting entries are made on the basis of the difference between book value and revalued figures? (a) Capital Account (b) Suspense Account (c) Realization Account (d) Revaluation account 75. In which of the following account, accounting entries are made at the book value of assets and liabilities? (a) Capital Account (b) Suspense Account (c) Realization Account (d) Revaluation account 76. If a partner on his admission pays to the other partner an amount for goodwill (also known as premium) and it is agreed that the partnership would be for a fixed term, then, if the firm is dissolved before the expiry of such a term, the partner will be entitled to a refund of a ratable amount of the premium so paid. However, such a refund cannot be claimed …………… (a) When the firm is dissolved due to the death of a partner (b) When the dissolution takes place mainly due to the misconduct of the partner making the claim (c) Where the dissolution is in pursuance of an agreement that no such refund will be made (d) Any of the above 77. ………….. rule is applicable at the time of any partner becoming insolvent. (a) Garner vs Murray (b) Derry vs Peek (c) Salomon vs A. Salomon & Co. Ltd. (d) Mohiri Bibi vs Dhamodas Ghose 78. Garner Vs Murray Rule requires ………….. (a) That the solvent partners should bear the loss arising due to insolvency of a partner in their last agreed capital ratio (b) That the solvent partners should bring in cash equal to their respective shares of the loss on realization (c) Both (a) & (b) (d) None of above 79. In which of the following case Garner vs Murray rule is not applicable? (a) Only one partner is solvent (b) All partners are insolvent (c) Partnership deed provides for a specific method to be followed in case of insolvency of a partner (d) All of the above 80. When the partners capital accounts are fixed, as per the decision in the Garner vs Murrary case, any loss arising due to the capital deficiency in the insolvent partners’ capital accounts is to be borne by solvent partners in the ratio of ………………… (a) Profit sharing ratio (b) Scarifying ratio (c) Gaining ratio (d) Last agreed capital ratio PRACTICAL MCQ VALUATION OF GOODWILL 81. The profits of last 5 years are Rs. 60,000; Rs. 67,500; Rs. 52,500; Rs. 75,000 & Rs. 60,000. Find the value of goodwill, if it is calculated on average profits of last 5 years on the basis of 3 years of purchase. (a) Rs. 63,750 (b) Rs. 1,91,250 (c) Rs. 1,89,000 (d) Rs. 2,13,750 82. On 1st April 2011 on the admission of a new partner, it is agreed that goodwill of the firm is valued at 3 years purchase of average profits for the last 5 years. The profits for last 5 years have been as follows: Year ended Profit/(loss) 31st March, 2011 16,110 31st March, 2012 11,850 31st March, 2013 8,145 31st March, 2014 (600) 31st March, 2015 12,750 Value of goodwill will be ……………. (a) Rs. 28,953 (b) Rs. 29,673 (c) Rs. 28,673 (d) Rs. 29,953 83. On 1st April 2011on the admission of a new partner, it is agreed that goodwill of the firm is valued at 2 years purchase of weighted average profits for the last 3 years. The profits for last 3 years have been as follows: Year ended Profit Weight 31st March, 2011 45,000 1 31st March, 2012 52,500 2 31st March, 2013 72,000 3 Value of goodwill will be ……………. (a) Rs. 1,22,000 (b) Rs. 2,22,000 (c) Rs. 1,22,222 (d) Rs. 1,20,000 84. Find the goodwill from the following information: Capital employed – Rs. 11,00,000 Rate of normal return – Rs. 10% Future maintainable profit – Rs. 2,00,000 No. of year purchases – 3 years (a) 6,00,000 (b) 2,70,000 (c) 9,00,000 (d) 3,70,000 85. Find the goodwill of the firm using capitalization method from the following information: Total capital employed in the firm Rs.4,80,000 Rate of normal return – 15% Profits for the year Rs. 90,000 (a) Rs. 4,20,000 (b) Rs. 3,11,000 (c) Rs. 1,20,000 (d) Rs. 2,20,000 86. Average profit of a firm is Rs.1,20,000. The rate of capitalization is 12%. Assets and liabilities of the firm are Rs.10,00,000 and Rs. 4,25,000 respectively. (a) 3,25,000 (b) 2,25,000 (c) 5,25,000 (d) 4,25,000 87. A firm of X, Y and Z has a total capital investment of Rs.3,60,000. The firm earned net profit during the last four years as Rs. 56,000, Rs. 64,000, Rs. 96,000 and Rs. 80,000. The fair return on the net capital employed is 15%. Value of goodwill if it is based on 3 years purchased of the average super profits of past four years. (a) Rs. 37,500 (b) Rs. 50,000 (c) Rs. 60,000 (d) Rs. 40,000 88. Find the goodwill from the following information: Capital employed – Rs.8,25,000 Rate of normal return – Rs. 10% Future maintainable profit – Rs. 1,50,000 Annuity factor – Rs. 3.17 (a) 4,75,500 (b) 2,61,525 (c) 3,13,975 (d) 2,13,975 89. The net profits after tax of Z & Co. for the past 5 years are as follows: Year Profit 2007-2008 2,56,000 2008-2009 2,64,000 2009-2010 3,76,000 2010-2011 4,86,000 2011-2012 5,30,500 The capital employed is Rs. 16,00,000. Rate of normal return is 15%. Calculate the value of the goodwill on the basis of annuity method on super-profits basis, taking the present value of an annuity of Rs. 1 for the 4 years at 15% as Rs. 2.855. (a) Rs. 7,65,000 (b) Rs. 8,67,800 (c) Rs. 5,70,000 (d) Rs. 4,06,838 90. The net profits after tax of NZ & Co. for the past 5 years are as follows: Year Profit 2010-2011 20,000 2011-2012 2,61,000 2012-2013 3,12,000 Closing stock for 2011-2012 and 2012-2013 includes the defective items of Rs.22,000 and Rs.62,000 respectively which were considered as having no market value. Calculate goodwill on average profit method. (a) Rs. 2,37,000 (b) Rs. 1,77,000 (c) Rs. 1,37,000 (d) Rs. 1,73,000 91. From the following information calculate the value of goodwill. The adjusted forecast maintainable profit is Rs.40,000, Capital employed is Rs.2,00,000, Normal rate of return is 15%, Capitalization rate is 20%. (a) Rs. 50,000 (b) Rs. 75,000 (c) Rs. 40,000 (d) Rs. 60,000 92. The net profits of a business, after providing for income tax for the last 5 years were: Rs. 80,000, Rs.1,00,000, Rs. 1,20,000, Rs. 1,25,000 and Rs. 2,00,000 respectively. The capital employed in the business is Rs. 10,00,000 and the normal rate of return is 10%. Calculate the value of the goodwill on the basis of the annuity method taking the present value of annuity of Rs. 1 for 5 years at 10% is 3.7907. (a) Rs. 84,768 (b) Rs. 95,768 (c) Rs. 94,768 (d) Rs. 60,000 93. Capital employed by a partnership firm is Rs. 1,00,000. Its average profit is Rs. 20,000. Normal rate of return is 15%. Value of goodwill. (a) 33,333 (b) 30,000 (c) 23,333 (d) 43,667 94. The profits and losses for the last years are: Year Profit/(loss) 2001-2002 ( 20,000) 2002-2003 (5,000) 2003-2004 1,96,000 2004-2005 1,52,000 The average capital employed in the business is Rs. 4,00,000. The rate of interest expected from capital invested is 12%. The remuneration of partners is estimated to be Rs. 2,000 p.m. not charged in the above losses/profits. Calculate the value of goodwill on the basis of 2 years purchase of super profits based on the average of four years. (a) Rs. 18,000 (b) Rs. 17,500 (c) Rs. 17,000 (d) Rs. 16,500 95. H and M are partners in a firm sharing profits and losses in the ratio of 3:2. Their capitals are Rs. 90,000 and Rs. 60,000 respectively. They admit K as a new partner who will get 1/6th share in the profits of the firm. K brings in Rs. 37,500 as his capital. Calculate hidden goodwill? (a) 37,500 (b) 75,000 (c) 56,250 (d) 60,000 NEW PROFIT SHARING RATIO 96. A and B are partner sharing profits and losses in the ratio of 3:2. C is coming as a new partner for 1/3rd share. Calculate new profit sharing ratio among A, B and C. (a) 6:4:5 (b) 5:4:6 (c) 3:2:3 (d) 2:3:3 97. H and M are partners in a firm sharing profits and losses in the ratio of 2:5. They admit K as a new partner who will get 1/6th share in the profits of the firm. Calculate new profit sharing ratio among H, M and k. (a) 10:25:7 (b) 7:25:10 (c) 25:10:7 (d) 10:7:25 98. R & S are in partnership sharing profits and losses in the ratio of 3:2. They take T as a new partner. Calculate the new profit sharing ratio. If T purchases 1/10th share from R. (a) 27:18:5 (b) 28:17:5 (c) 5:4:1 (d) 19:19:12 99. R & S are in partnership sharing profits and losses at the ratio of 3:2. They take T as a new partner. Calculate the new profit sharing ratio. If R & S agree to sacrifice 1/10th share to T in the ratio of 2:3. (a) 27:18:5 (b) 28:17:5 (c) 5:4:1 (d) 19:19:12 100. R & S are in partnership sharing profits and losses in the ratio of 3:2. They take T as a new partner. Calculate the new profit sharing ratio. If T simply gets 1/10th share of profit. (a) 27:18:5 (b) 28:17:5 (c) 5:4:1 (d) 19:19:12 101. A and B are equal partners. They admit C and D as partners with 1/5th and 1/6th share respectively. What is the profit sharing ratio of all the partners? (a) 27:18:5:6 (b) 28:17:5:6 (c) 5:4:5:6 (d) 19:19:12:10 102. A, B and C are partners in a firm sharing profits and losses in the ratio of 4:3:2. B decided to retire from the firm. Calculate the new profit sharing ratio of A and C if B gives his share to A and C in the original ratio of A and C. (a) 7:2 (b) 25:11 (c) 11:7 (d) 2:1 103. A, B and C are partners in a firm sharing profits and losses in the ratio of 4:3:2. B decided to retire from the firm. Calculate the new profit sharing ratio of A and C if B gives his share to A and C in equal proportion. (a) 7:2 (b) 25:11 (c) 11:7 (d) 2:1 104. A, B and C are partners in a firm sharing profits and losses in the ratio of 4:3:2. B decided to retire from the firm. Calculate the new profit sharing ratio of A and C if B gives his share to A and C in the ratio of 3:1. (a) 7:2 (b) 25:11 (c) 11:7 (d) 2:1 105. A, B and C are partners in a firm sharing profits and losses in the ratio of 4:3:2. B decided to retire from the firm. Calculate the new profit sharing ratio of A and C if B gives his share to A only. (a) 7:2 (b) 25:11 (c) 11:7 (d) 7:3 106. A, B and C are partners sharing profits and losses in the ratio of 3:2:1. B retired from the firm. Partners A and C decided to take his share in 3:1 ratio. What is the new ratio of the partners A and C? (a) 3:2 (b) 3:1 (c) 3:7 (d) 2:1 107. N and Z are partners sharing profits and losses in the ratio of 5:3. They admitted S and agreed to give him 3/10th of the profit. What is the new ratio after C’s admission? (a) 34:20:12 (b) 49:22:29 (c) 35:21:24 (d) 35:42:17 108. A and B are partners sharing profits in the ratio of 5:3, they admitted C giving him 3/10th share of profit. If C acquires 1/5 from A and 1/10 from B, new profit sharing ratio will be: (a) 5:6:3 (b) 2:4:6 (c) 18:24:38 (d) 17:11:12 109. A, B & C are partners sharing profits and losses in the ratio of 6:3:3, they agreed to take D into partnership for 1/8th share of profits. Find the new profit sharing ratio. (a) 12:27:36:42 (b) 14:7:7:4 (c) 1:2:3:4 (d) 7:5:3:1 110. A, B and C are partners with profits sharing ratio 4:3:2. B retires. If A & C shares profits of B in 5:3, then find the new profit sharing ratio. (a) 47:25 (b) 17:11 (c) 31:11 (d) 14:21 111. Ram & Rahim partners sharing profits and losses in the ratio of their effective capital. They had Rs.2,00,000 and Rs. 1,20,000 respectively in their capital accounts as on 1 st January 2012. Ram introduced a further capital of Rs. 20,000 on 1st April 2012 and another Rs. 10,000 on 1st July, 2012. On 30th September 2012 Ram withdrew Rs. 80,000. On 1st July 2012, Rahim introduced further capital of Rs. 60,000. Calculate the profit sharing ratio of Ram & Rahim. (a) 4:3 (b) 3:4 (c) 2:3 (d) 3:2 SCARIFYING RATIO 112. A and B are partners sharing profits and losses in the ratio of 3:2 C is coming as a new partner for 1/3rd share. Calculate scarifying ratio between A and B. (a) 6:5 (b) 5:4 (c) 3:2 (d) 2:3 113. A and B are partners sharing profits and losses in the ratio of 5:3. C is coming as a new partner for 1/6th share. Calculate scarifying ratio between A and B. (a) 6:5 (b) 5:3 (c) 3:2 (d) 2:3 114. X and Y are partners sharing profits and losses in the ratio of 5:3. Z is coming as a new partner. New profit sharing ratio among S,Y & Z will be 3:2:1. Calculate scarifying ratio between X and Y. (a) 2:1 (b) 1:3 (c) 3:1 (d) 5:3 115. P and Q are partners sharing profits and losses in the ratio of 11:7. Z is coming as a new partner. New profit sharing ratio among X, Y & Z will be 11:9:5. Calculate scarifying ratio between X and Y. (a) 77:13 (b) 13:77 (c) 11:9 (d) 11:7 116. N and D are in partnership sharing profits and losses equally. They agreed to take G as a partner. New profit sharing ratio of N, D and G becomes 4:2:3. Sacrificing ratio is …………. (a) 1:1 (b) 1:5 (c) 5:1 (d) 4:2 117. A & B are equal partners. They take C as a third partner for 1/3rd profit. Sacrificing ratio is ……………. (a) 1:1 (b) 1:5 (c) 5:1 (d) 4:2 118. A, B & C are equal partners. They decided to take D as a partner. The new profit sharing ratio is 3:3:2:2. Sacrificing ration is …………. (a) 1:1:4 (b) 1:5:4 (c) 5:1:4 (d) 4:2:4 GAINING RATIO 119. A, B and C are partners sharing profits and losses in the ratio of 3:2:1. B retired from the firm. What is the gain ratio of the partners A and C? (a) 3:2 (b) 3:1 (c) 3:7 (d) 2:1 120. X, Y and Z are partners sharing profits and losses in the ratio of 3:2:1. Y retired from the firm. New profit sharing ratio between X & Z is 5:3. What is the gain ratio of the partners X and Z? (a) 3:2 (b) 3:1 (c) 3:7 (d) 3:5 121. A, B and C are partners in a firm sharing profits and losses in the ratio of 4:3:2. B decided to retire from the firm. B gives his share to A and C in the original ratio of A and C. What is the gain ratio? (a) 1:2 (b) 25:11 (c) 11:7 (d) 2:1 122. A, B and C are partners in a firm sharing profits and losses in the ratio of 4:3:2. B decided to retire from the firm. B gives his share to A and C in equal proportion. What is the gain ratio? (a) 7:2 (b) 25:11 (c) 11:7 (d) 1:! 123. A, B and C are partners in a firm sharing profits and losses in the ratio of 4:3:2. B decided to retire from the firm. B gives his share to A and C in ratio of 3:1. What is the gain ratio? (a) 7:2 (b) 3:1 (c) 11:7 (d) 2:1 124. A, B and C are partners in a firm sharing profits and losses in the ratio of 4:3:2. B decided to retire from the firm. B gives his share to A only. What is the gain ratio? (a) 3:(b) - :3 (c) 11:7 (d) 2:1 TREATMENT OF GOODWILL 125. A and B are partners sharing profits and losses in the ratio of 3:2. C is coming as a new partner who pays Rs.25,000 as premium for goodwill. The profit sharing ratio among A, B and C is equal. If premium money is retained in business which of the following journal entry is correct for sharing premium for goodwill? A Capital A/c Dr. B Capital A/c Dr. To Premium for Goodwill A/c 20,000 5,000 Premium for Goodwill A/c Dr. To A Capital A/c To B Capital A/c Premium for Goodwill A/c Dr. To A Capital A/c To B Capital A/c Premium for Goodwill A/c Dr. To A Capital A/c To B Capital A/c 25,000 25,000 5,000 20,000 25,000 20,000 5,000 25,000 15,000 10,000 126. A and B are partners in a firm sharing profits and losses in the ratio of 3:2. C joins the firm for 1/3rd share, and is to pay Rs.20,000 as premium for goodwill but cannot pay anything. As between A and B, they decided to share profits and losses equally. Required journal entry …………… A Capital A/c Dr. B Capital A/c Dr. To Goodwill A/c Goodwill A/c Dr. To A Capital A/c To B Capital A/c Goodwill A/c Dr. To A Capital A/c To B Capital A/c Premium for Goodwill A/c Dr. To A Capital A/c To B Capital A/c 36,000 24,000 60,000 60,000 36,000 24,000 60,000 30,000 30,000 60,000 24,000 36,000 127. A and B are partners in a firm sharing profits and losses in the ratio of 3:2. C joins the firm for 1/3rd share, and is to pay Rs.40,000 as premium for goodwill but cannot pay anything. As between A and B, they decided to share profits and losses equally. Goodwill already appearing in balance sheet is 1,00,000. Required journal entry ……………. A Capital A/c B Capital A/c To Goodwill A/c Goodwill A/c To A Capital A/c To B Capital A/c Dr. Dr. 72,000 48,000 Dr. 1,20,000 1,20,000 72,000 48,000 Goodwill A/c Dr. To A Capital A/c To B Capital A/c Premium for Goodwill A/c Dr. To A Capital A/c To B Capital A/c 20,000 12,000 8,000 20,000 8,000 12,000 128. N and Z are partners in a firm sharing profits and losses in the ratio of 3:2. S joins the firm for 1/3rd share, and is to pay Rs.5,000 as premium for goodwill but cannot pay anything. As between N and Z, they decided to share profits and losses equally. It was agreed that goodwill has to be adjusted through partner’s capital account. Required journal entry ………………. N Capital A/c Z Capital A/c To S A/c S Capital A/c To N Capital A/c To Z Capital A/c Dr. Dr. 4,000 1,000 5,000 Dr. S Capital A/c Dr. To N Capital A/c To Z Capital A/c Premium for Goodwill A/c Dr. To N Capital A/c To Z Capital A/c 5,000 4,000 1,000 5,000 1,000 4,000 20,000 8,000 12,000 129. H and M are partners in a firm sharing profits and losses in the ratio of 3:2. Their capitals are Rs.60,000 and Rs. 40,000 respectively. They admit K as a new partner who will get 1/6th share in the profits of the firm. K brings in Rs. 25,000 as his capital. It was agreed that goodwill has to be adjusted through partner’s capital account. Required journal entry ………… H Capital A/c Dr. M Capital A/c Dr. To K A/c K Capital A/c Dr. To H Capital A/c To M Capital A/c K Capital A/c Dr. To H Capital A/c To M Capital A/c Premium for Goodwill A/c Dr. To H Capital A/c To M Capital A/c 10,000 15,000 25,000 25,000 15,000 10,000 25,000 10,000 15,000 25,000 10,000 15,000 130. A, B & C are in partnership sharing profits and losses in the ratio of 2:2:1. They want to admit D into partnership with 1/5 share. D brings in Rs. 30,000 as capital and Rs.10,000 as premium for goodwill. If premium money is retained in business which of the following journal entry is correct for sharing premium for goodwill? A Capital A/c Dr. B Capital A/c Dr. C Capital A/c Dr. To Premium for Goodwill A/c Premium for Goodwill A/c Dr. To A Capital A/c To B Capital A/c To C Capital A/c Premium for Goodwill A/c Dr. To A Capital A/c To B Capital A/c To C Capital A/c Premium for Goodwill A/c Dr. To A Capital A/c To B Capital A/c To C Capital A/c 4,000 4,000 2,000 10,000 10,000 2,000 4,000 4,000 10,000 4,000 4,000 2,000 10,000 3,000 3,000 4,000 131. A & B are equal partners. They wanted to take C as a third partner and for this purpose goodwill was valued at Rs. 1,20,000. The journal entry for adjustment of value of goodwill through partners’ capital account will be ……………. A Capital A/c Dr. B Capital A/c Dr. To C A/c C Capital A/c Dr. To A Capital A/c To B Capital A/c C Capital A/c Dr. To A Capital A/c To B Capital A/c Premium for Goodwill A/c Dr. To A Capital A/c To B Capital A/c 20,000 20,000 40,000 40,000 20,000 20,000 40,000 15,000 25,000 40,000 20,000 20,000 132. A, B & C are equal partners. They decided to take D who brought in Rs.36,000 as goodwill. The new profit sharing ratio is 3:2:2:2. The journal entry for goodwill will be ……………… A Capital A/c B Capital A/c C Capital A/c To A/c Cash A/c To A Capital A/c To B Capital A/c To C Capital A/c Cash A/c To A Capital A/c To B Capital A/c To C Capital A/c Goodwill A/c To A Capital A/c To B Capital A/c To C Capital A/c Dr. Dr. Dr. 6,000 6,000 24,000 Dr. 36,000 36,000 6,000 6,000 24,000 Dr. 36,000 24,000 6,000 6,000 Dr. 36,000 12,000 12,000 12,000 133. A, B & C are equal partners. C wanted to retire for which value of goodwill is considered as Re.90,000. The necessary journal entry will be: A Capital A/c Dr. B Capital A/c Dr. To C A/c C Capital A/c Dr. To A Capital A/c To B Capital A/c C Capital A/c Dr. To A Capital A/c To B Capital A/c Premium for Goodwill A/c Dr. To A Capital A/c To B Capital A/c 15,000 15,000 30,000 30,000 15,000 15,000 30,000 10,000 20,000 30,000 10,000 20,000 134. A, B and C are equal partners. D is admitted to the firm for one-fourth share. D brings Rs.20,000 capital and Rs.5,000 being half of the premium for goodwill. The value of goodwill of the firm is …………. (a) 20,000 (b) 40,000 (c) 10,000 (d) None of above 135. A and B are partners with capitals of Rs.14,000 and Rs. 28,000 respectively and sharing profits equally. They admitted C as their third partner with 1/4 profits of the firm on the payment of Rs. 16,800. The amount of hidden goodwill is ………… (a) 8,400 (b) 14,000 (c) 11,200 (d) None of the above 136. X and Y share profits and losses in the ratio of 2:1. They take Z as a partner and the new profit sharing ratio becomes 3:2:1. Z brings Rs. 4,500 as premium for goodwill. The full value of goodwill will be ………… (a) 24,000 (b) 27,000 (c) 18,000 (d) 4,500 137. A and B are partners sharing the profit in the ratio of 3:2. They take C as the new partner, who is supposed to bring Rs.25,000 against capital and Rs.10,000 against goodwill. New profit sharing ratio is 1:1:1. C is able to bring Rs. 30,000 only. How this will be treated in the books of the firm. (a) A and B will share goodwill brought by C as Rs.4,000 : Rs. 1,000 (b) Goodwill not brought, will be adjusted to the extent of Rs. 15,000 in old profit sharing ratio. (c) Both (a) & (b) (d) None of above INTEREST ON CAPITAL, INTEREST DRAWINGS, INTEREST ON LOAN ON 138. Z, a partner withdraws the following sums during the year ended 31st March 2011: On 1st May 2010 Rs. 1,000 On 1st August 2010 Rs. 3,000 On 1st January 2011 Rs. 2,000 On 1st March 2011 Rs. 1,000 Calculate interest on his drawing @ 6% p.a (a) Rs. 310 (b) Rs. 210 (c) Rs. 410 (d) Rs. 510 139. On 1st April 2010, A’s capital account showed a balance of Rs. 1,75,000 while B’s capital account showed a balance of Rs. 35,000. In 2010-2011 the firm earned a profit of Rs. 52,500 before adjustment for salary to B amounting to Rs. 10,500 for the year and interest on capital @ 7% per annum. On final distribution of profit in profit sharing ratio of 3:2 A and B will be get share of profit ……………. (a) 10,920 & 16,380 (b) 16,380 & 10,920 (c) 28,630 & 23,870 (d) 25,200 & 16,800 140. N, S and Z are three partners. They withdraws fixed sum of Rs.2,000 per month as follows: N draws at the beginning of each month, S withdraws at the middle of each month and Z withdraws at the end of each month. Rate of interest on drawings is 8% p.a. Interest on drawing for three partners respectively will be ……………….. (a) 87, 80 & 73 (b) 1,040, 960 & 880 (c) 880, 960 & 1,040 (d) 867, 800 & 733 141. N and Z are two partners. During the year N withdraws Rs. 37,000 on 1.5.2012 & Z withdraws Rs. 45,000 on 15.8.2012. Accounts are closed on 31.12.2012. Rate of interest on drawings is 10% p.a. Interest on drawing for two partners respectively will be …………………. (a) 2,775 & 2,063 (b) 2,063 & 2,775 (c) 2,467 & 1,688 (d) 1,688 & 2,467 142. N, S and Z are three partners. They withdraw fixed sum of Rs. 15,000 per quarter as follows: N draws at the beginning of each quarter, S withdraws at the middle of each quarter and Z withdraws at the end of each quarter. Rate of interest on drawings is 12% p.a. Interest on drawing for three partners respectively will be ………….. (a) 11,700, 10,800 & 9,900 (b) 975, 900 & 825 (c) 2,700, 3,600 & 4,500 (d) 4,500, 3,600 & 2,700 143. X & Y are two partners with a capital of Rs. 60,000 & 40,000 respectively. They are allowed interest @ 10% p.a. on capital. Find the interest allowed to X and Y. (a) 2,000 & 3,000 (b) 4,000 & 6,000 (c) 3,000 & 2,000 (d) 6,000 & 4,000 144. A has Rs. 30,000 capital in the beginning of the year and introduces Rs. 10,000 during the year. If rate of interest on capital is 20% p.a., interest on A’s capital is Rs. …………… (a) 7,000 (b) 8,000 (c) 9,000 (d) 10,000 145. R & S are partners with the capital of Rs. 37,500 and Rs. 22,500 respectively. Interest payable on capital is 10% p.a. Find the interest on capital for both the partners when the profits earned by the firm is Rs. 3,600. (a) Rs. 3,750 and Rs. 2,250 (b) Rs. 1,800 and Rs. 1,800 (c) Rs. 2,250 and Rs. 1,350 (d) None of the above 146. X, Y and Z are partners in a firm. Profits before interest on partner’s capital was Rs. 12,000. Y demanded interest @ 15% p.a. on his loan of Rs. 1,60,000. Partnership deed is silent on this point. Calculate the amount of interest payable to Y on his loan. (a) 24,000 (b) 9,600 (c) 12,000 (d) 16,000 147. R & S are partners with the capital of Rs. 2,40,000 and Rs. 1,20,000 respectively. Interest payable on capital is 10% p.a. Profit before interest on partner’s capital was Rs. 12,000. Calculate the interest on capital for both the partners. (a) 12,000 & 6,000 (b) 8,000 & 4,000 (c) 6,000 & 12,000 (d) 10,000 & 5,000 SHARE OF PROFIT 148. According to the partnership deed of A & B, B is entitled to a salary of Rs. 500 per month. Profit sharing ratio is 5:3. During the year the firm earned a profit, before charging salary to B Rs. 25,000. Calculate share of profit of A & B. (a) 13,750 & 8,250 (b) 13,875 & 7,875 (c) 10,000 & 6,000 (d) 11,875 & 7,125 149. A and B start business on 1st January 2009, with capitals of Rs. 30,000 and Rs. 20,000. According to the partnership deed, B is entitled to a salary of Rs. 500 per month and interest is to be allowed on capitals at 6% p.a. Profit sharing ratio is 5:3. During the year the firm earned a profit, before charging salary to B and interest on capital amounting to Rs. 25,000. During the year A withdrew Rs. 8,000 and B withdrew Rs. 10,000 for domestic purposes. Closing balance of partners capital account for A = ? & B = ? (a) 33,800 & 23,200 (b) 23,200 & 33,800 (c) 41,800 & 33,200 (d) 33,200 & 41,800 150. P & Q started business with capital of Rs. 70,000 and Rs. 42,000 on 1st January 2012. Q is entitled to a salary of Rs.560 p.m. Interest is allowed on capitals and is charged on drawings at 6% p.a. Profits are to be in ratio of 3:2. During the middle of the year, P withdrew Rs. 11,200 and Q withdrew Rs. 14,000. The profit for the year before appropriation came to Rs. 42,000. Calculate share of profit of P & Q. (a) 10,470 & 10,470 (b) 12,564 & 8,376 (c) 8,376 & 12,564 (d) 17,590 & 11,726 151. B and M are partners sharing profits and losses in the ratio of 3:2 having the capital of Rs.40,000 and Rs. 25,000 respectively. They are entitled to 9% p.a. interest on capital before distributing the profits. During the year firm earned Rs. 3,900 after allowing interest on capital. Profits apportioned among B and M is …………….. (a) Rs. 2,340 and Rs. 1,560 (b) Rs. 2,340 and Rs. 1,500 (c) Rs. 2,500 and Rs. 1,400 (d) None of the above 152. S and G are partners sharing profits and losses in the ratio of 4:1. M was manager who received the salary of Rs. 1,000 p.m. in addition to a commission of 5% on net profits after charging such commission. Profits for the year is Rs. 1,69,500 before charging salary. Find the total remuneration of M. (a) Rs. 19,500 (b) Rs. 22,000 (c) Rs. 21,750 (d) Rs. 19,000 153. A, B and C had capitals of Rs. 50,000; Rs. 40,000 and Rs. 30,000 respectively for carrying on business in partnership. The firm’s reported profit for the year was Rs. 80,000. Find out the share of profit of each partner after providing interest on an advance by A of Rs. 20,000. (a) 26,267 to each partner (b) 26,267 for two partners & 26,666 for one partner (c) Rs. 30,000 to each partner (d) Rs. 33,333 for A, Rs. 26,667 for B and Rs. 20,000 for C REVALUATION ACCOUNT 154. A and B shares profit and loss equally. They admit C as an equal partner and assets were revalued as follows : Stock at Rs. 20,000 (book value Rs. 12,000); Machinery at Rs. 60,000 (book value Rs.55,000). Find the profit/loss on revaluation to be shared among A, B and C. (a) Profit 6,500 & 6,500 (b) Profit 4,000 & 4,000 (c) Profit 2,500 & 2,500 (d) None of above 155. A and B shares profit and loss equally. They admit C as an equal partner and assets were revalued as follow: Stock at Rs.10,000 (book value Rs.12,000); Machinery at Rs. 50,000 (book value Rs.55,000).Building would be appreciated by 10% (book value Rs. 15,000). Find the profit/loss on revaluation to be shared among A and B. (a) Profit 2,750 & 2,750 (b) Loss 2,750 & 2,750 (c) Profit 2,500 & 2,750 (d) None of above 156. A and B are partners sharing profit in the ratio of 5:3. C was admitted on the following terms: New profit sharing ratio will be 7:5:3 Machinery would be appreciated by 10% (book value Rs. 1,80,000) Building would be depreciated by 6% (book value Rs. 1,50,000) To create provision for bad debts 5% on Debtors of Rs. 40,000 Find the distribution of profit/loss on revaluation between A & B. (a) Profit 4,083 & 2,917 (b) Profit 2,625 & 4,375 (c) Profit 2,917 & 4,083 (d) Profit 4,375 & 2,625 157. X and Y are partners sharing profits in the ratio of 3:2. Z was admitted on the following terms: New profit sharing ratio will be 5:3:2 Machinery would be depreciated by 8% (book value Rs. 1,08,000) Building would be appreciated by 15% (book value Rs. 1,50,000) To create provision for bad debts 5% on Debtors of Rs. 25,000 Unrecorded debtors of Rs. 1,250 would be brought into books Creditors amounting to Rs. 2,750 died and need not to pay anything Find the distribution of profit/loss on revaluation between X & Y. (a) Profit 3,210 & 2,140 (b) Profit 6,150 & 4,340 (c) Profit 1,710 & 1,140 (d) Profit 1,140 & 1,710 158. P, Q & R are three partners sharing profit & loss in 5:3:2 ratio. P retires from the firm. Q & R decided to continue in new ratio 3:2. On the date of retirement stock, sundry debtors and provisions for bad debts stand in the books at Rs. 50,000, 45,000 & 4,500. The partners decided to revalue assets as under: Stock to be reduced to 90%, provisions for bad, debts to be brought to 15%. Find the distribution of profit/loss on revaluation. (a) Loss to be shared by P, Q & R – Rs. 5,875, 3,525 & 2,350 respectively (b) Loss to be shared by Q & R – Rs. 4,350 & 2,900 respectively (c) Loss to be shared by P, Q & R – Rs. 3,625, 2,175 & 1,450 respectively (d) Profit to be shared by P, Q & R – Rs. 5,875, 3,525 & 2,350 respectively CALCULATION OF CAPITAL 159. C was admitted in a firm with 1/4th share of the profits of the firm. C contributes Rs. 37,500 as his capital, A and B are other partners with the profit sharing ratio as 3:2. Find the required capital of A and B, if capital should be in profit sharing ratio taking C’s as base capital: (a) Rs. 67,500 and Rs. 40,000 for A and B respectively. (b) Rs. 67,500 and Rs. 45,000 for A and B respectively (c) Rs. 80,000 and Rs. 52,500 for A and B respectively (d) Rs. 77,500 and Rs. 65,000 for A and B respectively 160. X and Y are partners sharing profits in the ratio 5:3. They admitted Z for 1/5th share of profits, for which he paid Rs. 72,000 against capital and Rs. 36,000 against goodwill. Find the capital balances for each partner taking Z’s capital as base capital. (a) Rs. 1,80,000, Rs. 72,000 and Rs. 72,000 (b) Rs. 1,80,000, Rs. 72,000 and Rs. 1,08,000 (c) Rs. 1,80,000, Rs. 1,08,000 and Rs. 72,000 (d) Rs. 1,80,000, Rs. 1,08,000 and Rs. 1,08,000 161. A and B are partners sharing profits and losses in the ratio of 3:2 (A’s Capital is Rs.30,000 and B’s Capital is Rs.15,000). They admitted C and agreed to give 1/5th share of profits to him. How much C should bring in towards his capital? (a) Rs. 9,000 (b) Rs. 12,000 (c) Rs. 14,500 (d) Rs. 11,250 DISSOLUTION OF FIRM 162. K and A are partners in a firm. They share profits and losses in the ratio of 4:1. They decided to dissolve the firm. K Capital – Rs.1,60,000, A Capital- Rs. 1,00,000, Total assets – Rs. 3,95,000, Total liabilities – Rs. 1,35,000. On dissolution assets realized Rs. 4,25,000 & liabilities settled at Rs. 1,10,000. Net profit or loss on realization = (a) Profit 3,15,000 (b) Loss 80,000 (c) Loss 55,000 (d) Profit 55,000 163. K and A are partners in a firm. They share profits and losses in the ratio of 4:1. They decided to dissolve the firm. K Capital – Rs. 1,60,000, A Capital – Rs. 1,00,000, Total assets – Rs. 3,95,000, Total liabilities – Rs. 1,35,000. On dissolution assets realized Rs.3,50,000 & liabilities including unrecorded liability settled at Rs. 1,50,000. Net profit or loss on realization = (a) Profit 30,000 (b) Loss 60,000 (c) Profit 60,000 (d) Loss 30,000 164. A, B & C are partners firm. Their capital balances were: A – Rs. 24,000, B – Rs. 8,000, C – Rs. 4,000. Their current balances were: A – Rs. 10,800 (Cr.), B – Rs. 2,000 (Dr.), C – Rs. 6,000 (Dr.). C become insolvent and could not meet his liability to the firm so partners decided to dissolve the firm. Realization loss came to Rs. 31,200. Amount to be paid/(receivable) to/from A & B on final settlement should be Rs. …………… & Rs. ………….. (Apply Garner vs Murray principle) (a) 25,500 & 2,900 (b) 15,100 & (7,500) (c) 2,900 & 25,500 (d) 45,200 & 18,400 Question No. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. Answers (c) (d) (a) (b) (b) (d) (b) (d) (c) (b) (c) (d) (b) (a) (b) (c) 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. 35. 36. 37. 38. 39. 40. 41. 42. 43. 44. 45. 46. 47. 48. 49. 50. 51. 52. 53. 54. 55. 56. 57. 58. 59. 60. 61. 62. 63. 64. 65. 66. 67. 68. 69. 70. 71. 72. 73. 74. 75. 76. 77. 78. 79. 80. (a) (b) (d) (d) (d) (b) (b) (d) (d) (d) (b) (c) (a) (d) (a) (c) (d) (b) (c) (a) (b) (d) (a) (b) (c) (c) (b) (a) (d) (a) (d) (d) (c) (d) (b) (b) (c) (c) (d) (c) (d) (c) (d) (d) (d) (d) (d) (a) (b) (c) (d) (b) (c) (c) (b) (d) (d) (d) (c) (d) (a) (c) (d) (d) 81. 82. 83. 84. 85. 86. 87. 88. 89. 90. 91. 92. 93. 94. 95. 96. 97. 98. 99. 100. 101. 102. 103. 104. 105. 106. 107. 108. 109. 110. 111. 112. 113. 114. 115. 116. 117. 118. 119. 120. 121. 122. 123. 124. 125. 126. 127. 128. 129. 130. 131. 132. 133. 134. 135. 136. 137. 138. 139. 140. 141. 142. 143. 144. (c) (a) (a) (b) (c) (d) (c) (d) (d) (b) (a) (c) (a) (b) (a) (a) (a) (c) (b) (a) (d) (d) (c) (b) (a) (b) (c) (d) (b) (a) (a) (c) (b) (c) (a) (b) (a) (a) (b) (d) (d) (d) (b) (a) (c) (b) (c) (c) (b) (c) (b) (d) (a) (b) (a) (b) (c) (b) (b) (b) (c) (d) (d) (a) 145. 146. 147. 148. 149. 150. 151. 152. 153. 154. 155. 156. 157. 158. 159. 160. 161. 162. 163. 164. (c) (b) (b) (d) (a) (d) (a) (a) (b) (a) (b) (d) (b) (c) (b) (c) (d) (d) (b) (a)