Budgeting, Grants Management & Cost Allocation

advertisement

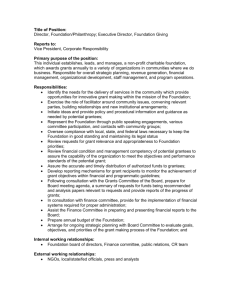

North Carolina Community Health Center Association March 3, 2011 Michael Holton Manager Michael.Holton@mcgladrey.com Budgeting, Grants Management, and Cost Allocation Michael Holton Manager RSM McGladrey, Inc. 919-571-3266 Michael.Holton@RSMI.Com Session Goals GOALS To enhance participants’ knowledge of the grant requirements of community health centers from federal, state and other funding agencies. - Grant Revenue Contract Revenue The Session Will Discuss Issues Related to: - Budgeting, Maximization of Grant Funding, and Reporting / Filing Issues DHHS GRANT REVENUE CYCLE Budget UDS FSR NGA Establishing a Grant File Each health center should establish, maintain and, as necessary (at a minimum, on a yearly basis), update a centrally located corporate file in which the health center stores documents related to compliance with all grant requirements - Application and Notice of Grant Award (NGA) - HRSA/BPHC correspondence, including responses to special conditions and letters from the project officer and/or grants management - HRSA Performance Review, JCAHO, other site review reports - Financial Status Report (FSRs) - Semi-annual Reports (SARs) - Audit reports Establishing a Grant File Institutional file, that includes – - Grant-related laws, regulations and policies • • • • • • Grant enabling statute: Section 330 of the Public Health Service Act (42 USC 254b), as amended by Public Law 107-251 (October 26, 2002) DHHS line item appropriations Program specific regulations: 42 CFR Part 51c (community health centers) and 42 C.F.R. Part 56 (migrant health centers) DHHS administrative regulations: 45 C.F.R. Part 74, incorporating OMB Circulars A-110 (as set forth in 2 CFR Part 215) and A-122 OMB Circular A-133 – Federal Audit Guidance PHS policies (e.g., PHS Grants Policy Statement) Establishing a Grant File Applicable PINs and PALs - PIN #2004-22: Service Area Competition (project renewal) - PIN #2004-19: Non-competing Continuation (budget renewal) - PIN #2002-01: Unified NGA for Health Center Cluster Programs - PIN #2002-07: Scope of Project Policy - PIN #98-23: Health Center Program Expectations - PINs #97-27 & 98-24: Affiliation Policies - PAL #2005-03: Accreditation Initiative Establishing a Grant File Applicable PINs and PALs (cont.) - PIN #2002-18: Creating a Financial Recovery Plan - PIN #95-15: Application of Federal Cost Principles - PIN #95-02: Payment of Membership Dues to Professional Organizations - PIN #94-34: Guidance Regarding the Implementation of 1992 Amendments to Sections 329 and 330 of the Public Health Service Act - PAL #99-14: Community Centers – A Review of Literature Website: www.bphc.hrsa.gov/pinspals Establishing a Grant File Institutional file (cont.) - Other Federal, State and local laws Documents related to the internal operations of the health center • Articles of Incorporation • Bylaws • Mission statement and internal policies and procedures • Terms and conditions of agreements between health center and third parties Your Key Federal Players Establish a Meaningful and Working Relationship Key Federal Contacts • Program issues: • Assigned HRSA Project Officer • Budget Information and other Grants Management requirements • Assigned Grants Management Specialist • Refer to attachment pages of the Notice of Grant Award Project Officer The Project Officer, in most cases, serves as the first point of contact • Has Federal program oversight responsibilities of the HRSA grant • Reviews and make recommendations on continued Federal support • Clarifies program guidance and program expectations Grants Management Specialist The assigned Grants Management Specialist, working in conjunction with the Project Officer, serves as the business management contact for the grant • Reviews and make recommendations on continued federal support • Clarifies grants regulations and requirements • Monitors compliance with grant requirements and releases conditions of award • Issues Notices of Grant Award Single Grant Application Grant Application Budgeting SINGLE GRANT APPLICATION – BUDGETING Preparation of Budget(s): - Departmental Organization-Wide Justification of Budget Items (revenue and expenses) Preparation of Budget Forms: - BPHC Funding Request Summary Standard Form 424A Income Analysis Format Personnel by Position and BPHC Program SINGLE GRANT APPLICATION – BUDGETING Staffing Budget: - Consider: Current Payroll Register New Program or Site Expansion - Need Salary Cost and FTE Detail Provider Versus Non-Provider Staff - Staffing Assists in the Budgeting of Various Expenses and Visits SINGLE GRANT APPLICATION – BUDGETING Sample Staffing Budget Employee Name Dr. Steven Smith Dr. Bob Scott Peggy Sue John Cooper Marie Ryan John Schwartz Steve Johnson Caroline Hudson Total Position Internist Internist Nurse Prac. Cashier Data Process. Executive Dir. Controller Accountant FTE 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 Salary $100,000 110,000 75,000 22,000 25,000 125,000 75,000 35,000 $567,000 SINGLE GRANT APPLICATION – BUDGETING Calculation of Projected Visits Employee Dr. S. Smith Dr. Bob Scott Peggy Sue Total Visits Position Internist Internist Nurse Prac. FTE 1.00 1.00 1.00 Estimated Productivity 3,950 3,950 2,600 Budgeted Visits 3,950 3,950 2,600 10,500 SINGLE GRANT APPLICATION – BUDGETING Expenditures: Review Prior Year Audited Financial Statements Review First 6 Months’ Internal Financial Statement Base Expenditures on First 6 Months’ Financial Statement: - Compare to Prior Year for Major Differences Reconcile - Increase or Decrease Appropriate Cost Due to Visit Volume Variance - Increase or Decrease Due to Unit Cost Differences SINGLE GRANT APPLICATION – BUDGETING Budgeting of Expenditures Salaries Fringe benefits Supplies Rent Interest = = = = = Staffing Plan (FTEs) Percent of Salaries and Wages Based on Visits Based on Current Leases Based on Current Loan Payments SINGLE GRANT APPLICATION – BUDGETING Budgeting of Expenditures Salaries Fringe Benefits (25%) Supplies ($10 per visit) Rent Interest Other Total Expenses = = = = = = $ 567,000 141,750 105,000 75,000 50,000 203,240 $1,141,990 SINGLE GRANT APPLICATION – BUDGETING 10,500 Visits Payor % # Visits Rate Coll. % Revenues MCD 20 2,100 $60 95% $119,700 MCD# 20 2,100 *** 100% 105,592 MCR 15 1,575 $75 100% 118,440 S/P* 35 3,675 Var 50% 27,563 OTP** 10 1,050 Var 50% 26,250 100% 10,500 #Managed Care Capitation Revenue *Average collection $7.50 ** Average collection $25.00 ***Based on projected member months and capitation rate $397,545 BUDGETING SUMMARY Projected Revenue DHHS Grant $494,426 Program Income 397,545 Contract Services Interest Income 237,195 4,180 Miscellaneous Total Revenue 8,644 $1,141,990 BUDGET SUMMARY Projected Expenses Total Projected Expenses $1,141,990 Excess of Projected Expenses Over Projected Revenue $ 0*** *** CHCs must always submit a balanced budget when submitting a grant application. SINGLE GRANT APPLICATION – BUDGETING Make Certain the Budget Balances!!!!!! - Review Patient Revenue Factors Review Staffing BE CONSERVATIVE WHEN PROJECTING PATIENT SERVICES REVENUE!!!! (If overly aggressive projections are used, an unobligated balance (UOB) of Federal funds could result when the FSR is filed) Accessing Federal Funds • Payments for grants award by HRSA are made through the Division of Payment Management. Division of Payment Management P. O. Box 6021 Rockville, MD 20852 (301) 443-1661 http://www.dpm.psc.gov/Default.aspx Accessing Federal Funds • Important reminders • Only draw down funds to be expended in a 72-hour period. Manage your Account!! • Need to request Password for SmartLink access • Absent restrictions for high risk grantees, draw downs can either be advances or reimbursement. • Federal funds should be placed in an interest bearing account. The first $250 of interest earned may retained. • PMS Application Support Group = 877-614-5533 Financial and Program Management DHHS Administrative Regulations and Requirements 45 CFR Part 74 - Transactions/activities conducted by nonprofit grantees (including health centers) that are paid for in whole or in part by Federal funds are subject to administrative requirements in 45 CFR Part 74, incorporating – • OMB Circular A-110 (as set forth in 2 CFR Part 215) – Administrative standards • OMB Circular A-122 – Cost principles Financial Management System The financial management system must be able to control, account for, and document the use of funds including expenditures - General ledger and accounting records Systems to control cash collections and flow Systems to document revenues, and accounts receivable and payable Internal control system and related policies and procedures (including determination of reasonableness, allocability and allowability) Written procedures to minimize time elapsed between draw down and use of grant funds Financial Management System The financial management system should be capable of generating monthly financial reports and statements - Budget comparative – monthly and yearly - Productivity analyses - Cost center allocations Federal Cost Principles Allowability: to be allowable, costs must meet the criteria set forth in OMB Circular A-122 - Reasonable: “[A] cost is reasonable if, in its nature and amount, it does not exceed that which would be incurred by a prudent person under the circumstances prevailing at the time the decision was made to incur the costs” - Conform to the limitations and exclusions regarding particular cost items - Be adequately documented - Be treated consistent under generally accepted accounting principles (GAAP) and the grantee’s policies and procedures Federal Cost Principles Allocability: costs are allocable to a Federal grant if they – - Are allocated to a grant/project based on the relative benefits received by that project - Are treated consistent to similar costs - Are incurred specifically for an award - Benefit the grant and can be distributed proportionately - Are necessary to the overall operation even if there is no direct relationship to a particular cost objective Federal Cost Principles Costs borne, in whole or in part, by the Section 330 grant are “project costs” and subject to Federal cost principles Federal cost principles (and procurement standards) do not apply to expenditures of program income and nongrant funds, so long as they are consistent with Section 330 purposes and there is sufficient program income and non-grant funds to cover unallowable costs - (PIN #95-15) Specific problem areas include lobbying, fundraising, reserves, travel and entertainment Federal Cost Principles Total project costs = allowable direct costs incident to grant activities plus the allocable portion of indirect costs, less any applicable credits Direct costs - Costs identified specifically with a particular final cost objective Indirect costs - Costs incurred for common or joint objectives and that cannot be readily identified with a particular cost objective (e.g., facilities, administration) Federal Cost Principles DHHS-approved indirect cost rate - Cost principles require grantees with multiple sources of funding or lines of business outside of the Section 330 scope to consider utilizing an indirect cost approach, otherwise it is hard to justify cost allocation of overhead and staff to the various sources - DHHS approved indirect cost rates assign an approved percentage of overhead/staff to each source of funding - May require substantial communications with auditors to agree on certain fundamental principles of allocation - Division of Cost Allocation – Apply for indirect cost rate Federal Cost Principles Even if a grantee does not need a DHHSapproved indirect cost rate, the grantee will need an allocation system if it is involved in activities that it wants to keep separate from the health center project Federal Cost Principles Time allocation - For employees working on multiple projects, salary and benefit charges should be allocated to each project based on the proportion of time expended - Unless assigned to specific management or professional staff, the time of clerical employees should be allocated based on either the volume or type of work performed, or, if all projects generate similar volume/type of work, based on total project expenditures Real Property and Equipment Grantees must maintain financial records, supporting documents, statistical records and all other records pertaining to the expenditure of grant funds to purchase real property/equipment for a period of 3 years after the final disposition of the asset Real Property and Equipment Grantees must maintain records for equipment acquired or improved with grant funds that – - Adequately describe the equipment Identify the equipment by serial, model or other ID number Identify it by source, including award number Note whether title vests in grantee or government Provide the acquisition date and cost Set forth information that can be used to calculate the Federal share Federal reversionary interest Real Property and Equipment Equipment records (cont.) - Identify the equipment’s location and condition and the reporting date Provide the unit acquisition cost Provide the ultimate disposition data, including date of disposal, sale price, method to determine fair market value At least every two years, the grantee must inventory its equipment and reconcile results with prior inventories Record Keeping and Reporting Obligations Financial and Programmatic Records General record-keeping requirements - Grantees are responsible for monitoring and oversight of all activities supported (in whole or in part) by Federal funds - Grantees must submit to DHHS financial and programmatic records and reports pertaining (directly or indirectly) to the grant-supported project, in such form and the frequency as prescribed by DHHS Financial and Programmatic Records Retention - Financial records, supporting documents, statistical records and all other records pertaining to the grantsupported project should be retained for 3 years (or other period required by applicable law) from the date of submission of final report - If an audit, litigation, or other action involving the records is started before the end of the appropriate retention period, the records should be maintained until the end of the appropriate retention period or until the audit, litigation, or other action is completed, whichever is later Financial and Programmatic Records Access - For as long as records are retained, DHHS, the Comptroller General, or any of their duly authorized representatives has the right to • Timely and unrestricted access to records, reports, books, documents, and papers pertaining to the grantsupported project, as may be necessary for audit, examination, excerpt, transcription, and copy purposes • Timely and reasonable access to the grantee’s personnel for the purpose of interview and discussion related to the documents Federal Audit Requirements Audit requirements - If total Federal expenditures are greater than $500,000, must complete an annual audit in accordance with the requirements of OMB Circular A-133 and the most current compliance supplement for health centers - Costs of performing the audit can be charged to the Federal grant, unless the audit is deficient and rejected by the government - Due 9 months after the end of fiscal year or 30 days after receipt from the auditor, whichever is earlier - Preferably, the audit will result in an unqualified opinion with the following characteristics: gross charges exceed billable expenses, acceptable financial ratios, and minimal (or no) material audit findings Federal Audit Requirements Scope of the audit - Determination that financial statements are presented fairly in all material respects in conformity with GAAP - Review of internal controls over Federal programs to support a determination of a low level of risk for major programs - Determination as to whether the grantee has complied with applicable laws, regulations and provisions of grant agreements that could have a direct and material effect on Federal programs Federal Audit Requirements Auditors are precluded from performing both A-133 audit and providing certain non-audit management consulting services, including – - Implementing accounting systems Determining account balances Developing internal control systems Establishing capitalization criteria Processing payroll Posting of transactions Evaluating assets Designing or implementing IT systems Performing actuarial studies Reporting Requirements Financial reporting requirements - Federal Financial Report (FFR – SF425) (replaces the SF 272 PSC Federal cash transactions report and SF269 Financial Status Report) • • Old SF 272 PSC 1. Monitors the timing of cash advances and disbursements 2. Submitted quarterly, within 45 days of the end of the quarter Old SF 269 FSR 1. Reports the status of grant fund expenditures 2. Submitted annually, within 90 days after the budget period ends What is the Federal Financial Report (FFR)? The FFR, also known as SF-425/SF425A, combines and replaces both the Federal Cash Transactions Report (PSC/SF-272) and the Financial Status Report (SF-269) into a single electronic report Certain federal agencies are required to transition to using the FFR beginning with 1st Quarter Fiscal Year 2010 Reports (Quarter 1: October 1–December 31, 2009) Until further notice, the FSR-269 will not be accessible for HHS Grantees through the FFR HHS Grantees PSC 272 Submit through PMS FSR-269 Submit through EHB What is the Federal Financial Report (FFR)? The Office of Management and Budget (OMB) is facilitating the Federal Grant Reporting Process by requiring all federal grantees to transition to the FFR Key Concepts: - Financial Status Report (SF-269): statement of expenditures sent to the grantor contract Federal Cash Transactions Report (PSC/SF 272): report of cumulative expenditures on multiple budgets Financial Status Report Cash Transaction Report Federal Financial Report How will the FFR affect Health Centers’ Current Reporting Requirements? Non HHS Grantees HHS Grantees Report Cash Transactions the Payment Management System’s (PMS) website using the automated FFR Cash Transaction Report Should continue to use the SF269/SF-269A to report expenditures through 3/31/2010 on HRSA’s EHB Transition to FFR (SF425) on HRSA’s EHB beginning 4/1/2010 for the FSR The Electronic 272 System will no longer be available Reports are due 30 days after reporting period has ended Beginning January 4, 2010, grantees will not be permitted to file cash transactions using PSC-272 Cash Transactions Reports for the quarter ending on December 31, 2009 and beyond must use the new FFR in PMS Reports are due 30 days after reporting period has ended The Financial Status Report will now be provided through the FFR What Are the Changes Included in the FFR? Health and Human Services (HHS) will advise the Office of Management & Budget (OMB) how the FSR will be incorporated into the FFR for HHS grantees Eventually, OMB anticipates the FFR to become identical for all programs Total Recipient Share required: must now report on the cumulative recipient share and disbursements of the grant funds based on the amounts entered in the approved budgets The New Federal Financial Report Process The filling requirements remain the same as for filing the PSC-272 in FFR The filing requirements remain the same as indicated in the Terms and Conditions of the Notice of Grant Awards (NGA) for the FSR A FFR attachment will be used for reporting multiple grants The FFR establishes government-wide standards for reporting periods & due dates - Reporting period end dates must fall on the end of a calendar quarter Reports are due 30 days after reporting period end date instead of 45 days Accessing and Completing the FFR To submit the FFR, you must access the Division of Payment Management Website (DPM) at http://www.dpm.psc.gov. Select Payment System and Login - If you are a current PMS user, you will continue to have the same user permissions for the FFR Cash Transaction Report as you did for the Electronic 272 System. If you are not a current PMS User but had used the Electronic 272 System, on Jan. 4, 2010, DPM sent an email to you with a temporary username and password, as well as instructions to access the FFR Cash Transaction Report Accessing and Completing the FFR Once you enter your account number, you must choose either 1) the Federal Cash Transaction Report or 2) the Financial Status Report. - Note : if you choose the Financial Status Report, it will be “grayed out” for HHS Grantees There is also a selection for reporting FFR interest income. The assumption is that you will report any interest earned above $250.00 per grant period, per grant. Certain information will be pre-populated on the report, i.e., the federal agency, recipient organization, DUNS number, the grant period. Check to be sure information is accurate. There is a separate area for reporting on multiple grants on a FFR attachment screen. Must now verify cumulative disbursements for each active grant (since the inception of the grant). FFR –Transactions Section 10a. –10c. o You will report these values to PMS o Fields will be disabled in the EHBs Accessing and Completing the FFR If you have disbursements on inactive grants, you will need to enter the disbursement amount. If inactive grants show on your account, and there will be no more activity on them, you should delete them from the FFR. Once disbursements have been completed, the FFR will populate fields showing cash receipts and cash disbursements. You must enter an amount in the “cash on hand” field. Once the report is complete and ready to be Certified, the authorized certifier must log into the FFR, scroll to the bottom of the page and complete steps 1-5 You will have the ability to print, save and/or view the report once it is certified. Recommend that a copy be saved for your records. Suggestions for FFR Reporting Have a separate, interest-bearing checking account for each federal award: Draw downs and expenditures are easily traced for each grant. There is no co-mingling of grant funds that may be for different purposes, and it is easier to determine interest earned on the federal funds. The FFR report can be completed simply by gathering the bank statements on each federal grant account, which will show receipts and disbursements activity. Keep copies of each quarterly report Keep a log of draw-downs for each grant, including a perpetual log on the 330 grant - Resources & References for the FFR Division of Payment Management: - http://www.dpm.psc.gov/ http://www.dpm.psc.gov/grant_recipient/ffr_info_hhs.asp x Grants.gov: http://www.grants.gov/ Recipient Instructions for completing the FFR in the Payment Management System (PMS) Always contact your grant specialist or your payment management account representative for any questions or concerns Federal Financial Report (Formerly the FSR) Key Definitions • Program Income – Patient Services Revenue and State, local and other assistance. • Patient Services Revenue - The amount of fees, premiums, and third party reimbursements accrued from center operations during the budget period, after adjustments for uncollectibles. • State, Local, and Other assistance - all resources for the approved project that are NOT: – Fees, premiums and third party reimbursement, or – Section 330 Federal financial assistance. Financial Status Report Determination of Outlays • Start with: Accrual based expenses, reconciled to audited financial statements. • Minus: All non-cash outlays (depreciation, bad debt, etc.). • Plus: Fixed asset additions (less proceeds from long term debt) and payments of long-term debt obligations. – Only capital lease and loan payments for capital expenditures can be included in total outlays. • Plus: Establishment of Reserves • Equals = Total Outlays Financial Status Report The “Order of Spending” for CHC Grant Awards is: 1. Program Income: a) Patient Services Revenue b) State, Local and Other Dollars: – Contracts – Contributions – Miscellaneous – Donated 2. Federal Grant (up to amount recognized) 3. Current Program Income Over Budget FFR Transactions – By Field Line 10 d. Federal funds authorized Populated from EHBs e. Federal share of expenditures Previously reported = pre-populated f. Federal share of unliquidated obligations Enter cumulative value g. Total Federal share EHBs will calculate value h. Unobligated balance of Fed funds EHBs will calculate value i. Total recipient share required Previously reported – pre-populated j. Recipient share of expenditures Previously reported = pre-populated k. Remaining recipient share to be provided EHBs will calculate values l. Total Federal program income earned Enter cumulative value only (last column) m. Program income expended – deduction alt n. Program income expended – addition alt o. Unexpended program income Enter cumulative value only (last column) Enter cumulative value only (last column) Enter cumulative value only (last column) Federal Financial Report Financial Status Report Budget: Grant Program Income $ 494,426 647,564 $ 1,141,990 Actual: Grant Program Income Total Revenue Outlays Surplus $ 494,426 740,574 1,235,000 1,150,000 $ 85,000 Financial Status Report Example: Order of Spending: Program Income, Up to Budget Federal Grant Current Program Income Over Budget Excess Program Income ($740,574 - $647,564 - $8,010) 647,564 494,426 8,010 $1,150,000 $85,000 Federal Financial Report Example Federal Financial Report Example Federal Expenditures and Unobligated Balance I. Previously Reported Line # Description 10 d. 10 e. 10 f. 10 g. 10 h. Total Federal funds authorized Federal share of expenditures Federal share of unliquidated obligations Total Federal share (sum of lines e and f) Unobligated balance of Federal funds (line d minus g) Recipient Share 10 i. Total recipient share required 10 j. Recipient share of expenditures 10 k. Remianing recipient share to be provided (line I minus j) Program Income 10 l. Total Federal program income earned 10 m. Program income expended in accordance with the deduction alternative 10 n. Program income expended in accordance with the addition alternative 10. o Unexpended program income (line l minus line m or line n) II. This Period 494,426 494,426 III. Cumulative 494,426 494,426 494,426 0 494,426 0 0 0 0 0 0 0 740,574 0 740,574 0 647,564 647,564 85,000 85,000 Lines i, j and k are for reporting on cost sharing or matching requirements, only. When Health Centers report on the FFR, lines i., j., and k. should remain blank. Financial Status Report Scenarios Budgeted Revenue CHC 1 Federal grant State, Local & Other Patient Revenue Total Budget Actual Revenue Federal grant State, Local & Other Patient Revenue Total Revenue CHC 2 CHC 3 CHC4 $ 1,200,000 1,800,000 4,500,000 $7,500,000 $1,200,000 1,800,000 4,500,000 $7,500,000 $ 1,200,000 1,800,000 4,500,000 $7,500,000 $ 1,200,000 1,800,000 4,500,000 7,500,000 $1,200,000 1,800,000 4,500,000 $7,500,000 $1,200,000 1,700,000 4,600,000 $7,500,000 $1,200,000 2,000,000 5,000,000 $8,200,000 $1,200,000 1,900,000 4,600,000 $7,700,000 ($7,300,000) ($7,900,000) ($7,400,000) $6,300,000 1,000,000 --$7,300,000 $6,300,000 1,200,000 400,000 $7,900,000 $6,300,000 1,100,000 --$7,400,000 --$200,000 $200,000 $300,000 ---$300,000 Total Outlays ($7,400,000) Order of Dollars Spent 1) Program income $6,300,000 2) Federal grant 1,100,000 3) Program income above budget --Total Expenditures $7,400,000 Unspent Dollars Excess Program Income --Unobligated Federal Grants $100,000 Total Unspent Dollars $100,000 $200,000 100,000 $300,000 Any Questions???