Telecom Industries of Korea and Japan

advertisement

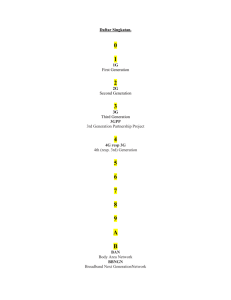

Telecom Industries of Korea and Japan • • • • Brian Toll Greg Zelenka Aaron Cowen Jennifer Barker 1 Outline • • • • • • • Telecom Overview Korean Competitors Japanese Competitors Regulatory in Korea Regulatory in Japan Discussion of Korea Telecom Questions for Korea Telecom 2 Technology Primer • Land Line – Dial-up – ISDN • Broadband – DSL – Cable – LMDS • Wireless – 1G, 2G, 2.5G, 3G 3 Korean Competitors COMPANY LINES OF BUSINESS 2000 REVENUE NOTES SK Telecom Wireless, ISP, broadband via CATV $5 Bn (5,760 bn W), up 34% from 1999 Primarily wireless provider with 54% market share. Korea Telecom (KT) Wireline, wireless, broadband via DSL $11 Bn (12,734 bn W), up 8% from 1999 Primary wireline, DSL provider. Leads broadband at 44% market share. KT Freetel, wireless subsidiary, is #2 with 31% market share. Hanaro Broadband via DSL, LMDS, CATV $260 MM (300 bn W), up 29% from 1999. Second broadband market share at 27%.. Pursuing CDMA 2000 license for 3G. LG Telecom Wireless $ 1.8 Bn (2,058 bn W) Speculation that loss of 3G license will lead to exit of wireless business via sale to KT. Currently #3 wireless carrier with 15% market share. British Telecom 4 contemplation sale of investment. Japanese Competitors COMPANY LINES OF BUSINESS 2000 REVENUE NOTES NTT Wireline, wireless, broadband via DSL $108 Bn NTT maintains wireline domestic monopoly. Wireless division is called Docomo, with 59.1% market share, and is famous for I-mode service. NTT Docomo plans to be first company in world to launch 3G. KDDI International LD, wireless $30.2 Bn Original provider of inter-country long distance. Launched wireless venture called “au”. Japan Telecom Wireless only $14 Bn Called J-phone. Former AT&T investment, sold to Vodafone. 5 Active Regulation - Korea • Multi-ministerial purview (FTC, MOFE, MIC, KCC) – Potential regulatory conflict – Excessive regulation • ‘Dominant player’ regulation – Regulators control rates – Caps on wireless handset subsidies • Other players – File tariffs, but no rate controls – In January 2000, banned handset subsidies 6 Ramifications of Regulation • Geographically – 5 national players in wireless, no regional • Technologically – CDMA standard nationally • Competitively – For wireless, price competition is severe (over 33% drop in 3 years). – Similar technology, similar marketing strategies, no handset subsidies. – 3G postponement announced by SK Telecom. 7 Movement to Passive Regulation- Japan • Ministry of Post and Telecom is single regulatory body in Japan. • NTT Incumbent maintains wireline monopoly. Still very high new phone installation fees. • Late 80’s deregulation with advent of wireless • Increased wireless phone use by removing user deposit system and handset leasing fees (approx $2,700 per user) • Since 1996, MPT exercises no pricing restrictions, which has increased price competition and caused wireless prices to decline by 56% in last 5 years. 8 Ramifications of Regulation • Geographically – NTT DoCoMo dominates, smaller players compete regionally • Technologically – Newer technologies cultivated, or; – Multiple technological standards compete • Competitively – Non-price differentiation based on technological differences and service quality and coverage. – NTT continues to dominate, but faces serious threats as competitors build infrastructure. 9 Korea Telecom • Korean incumbent - $11Bn in revenue. • Local, domestic and int’l long distance, business & data communication services, DSL, cellular service • Virtual monopoly in local services, 85%+ share domestic LD and 60%+ share Int’l LD • Leads broadband at 44% market share. • KT Freetel, wireless subsidiary, is #2 with 31% market share. 10 KT – Responding to Competition • Aggressive Restructuring Area of Restructuring Measures Taken Employee Reduction Reduced by 12,500 to 52,500 employees Disposal of Non-profitable Businesses Sold 9 business Reduction of Branch Offices Reduced to 91 from over 2600 Reduction of Subsidiaries Disposed of 3 subsidiaries and ICO investment • Broadband in 92% Korean Households – KT developing new broadband services 11 Questions for Korea Telecom • What are revenue drivers for 3G in Korea? How much will you spend on 3G and how will you recover this investment? • What marketing techniques are used to attract customers and reduce churn? • How will CLEC industry develop in Korea? • What are the three most important challenges you face in the next 5 years? 12