Quantitative Analysis for Marketing

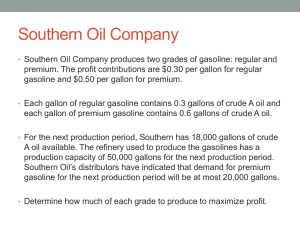

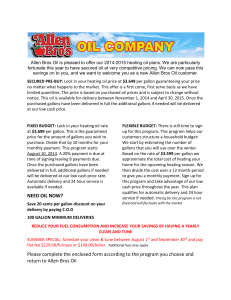

advertisement

University of Washington EMBA Program Regional 20 Conquistador Beer Suggested Solution October 10, 2003 Approach to the Problem • Calculate a Demand Forecast for the Company. Then calculate Break Even Volume and compare them. • Demand Forecast = Industry Demand * Market Share for Conquistador Beer • BEV = Fixed Costs / (Price – Variable Costs) Calculation of Industry Demand • Method 1: Uses Tables A and B. Per capita beer consumption * population Population Per Capita Beer Consumption (gallons)** Industry Demand in 2003 91000 33.1 gallons 3.02 million gallons Based on 63600 Population Over Age 21 49.6 gallons 3.15 million gallons Based on Entire Population **Assumes straight line growth. Calculation of Industry Demand • Method 2: Uses Table E. “Taxes Paid Approach” Taxes Paid (at $.105/ gallon) Gallons Consumed 1999 $234,200 2.23 million 2000 $253,650 2.41 million Assuming a straight line growth, demand will be 3.07 million gallons in 2003. Market Share Projection • Market Share Estimates are available in Study C. We estimate 23% market share in 2003. Demand Forecast = 23% * 3.1 million gallons =713,000 gallons Investments • The investments given in the case (Table A) fail to include estimates of cash and accounts receivable. Table F provides an estimate of the percentage of total assets needed at 16.3% $1,589,000 / (1-.163) = $1,898,447 Fixed Cash Flows (Annual) • The case (Table B) does not include: – Salary expense and benefits. Estimate that 10% of total compensation is in the form of incentives, and 30% is in non-salary benefits. $425,000/(1-.1)*(1/(1-.3)) = $674,603 – Advertising. Assume cost is 3% of sales 713,000*.03*$6.40 = $136,896 (note: price will be discussed later) – Debt retirement / interest. Assume 20 year loan at 8%. Larry borrows $1,548,000 ($1,898,447 - $350,000 that he invests). Recurring payment of $155,526 per year – Travel and other related expenses: $40,000/year Fixed Cash Flows (Annual) Depreciation is not a cash flow, and therefore should not be included. The revised fixed costs are as follows: Utilities and Telephone Insurance Property Taxes Marketing / Co-op Advertising Debt Retirement and Interest Payments Travel and Related Expenses $46,000 $112,000 $18,000 $136,896 $155,526 $40,000 TOTAL $1,183,025 Unit Contribution Price can be estimated using Exhibit I. We assume that Conquistador is a premium beer, and can sell at a wholesale price equal to the average price of the top three beers listed ($3.61 for a 6-pack). This translates into $6.40 / gallon (128 ounces per gallon, 12 ounces per beer). In addition, kegs will be sold at a rate of 1/3 the gallons of bottles and cans. Price for kegs is 45% of bottle/can price. Unit Contribution Classification Revenue Weight Wholesale Cost Wholesale / Gallon Price / Gallon Bottles / Cans 3.0 $5.14** $6.4 Keg 1.0 $2.31 $2.88 $4.43 $5.52 Weighted Average **The wholesale cost is calculated by multiplying the cost of goods sold (which from Exhibit F is 80.3% of sales) by the price per gallon. Unit contribution is therefore $1.09 ($5.52 - $4.43) Break Even Volume BEV = Fixed Costs / Unit Contribution = $1,183,025 / $1.09 = 1,087,900 gallons Our demand forecast was 713,000 gallons. We will most likely not break even. Larry should probably not invest in this business!! Total Research Required… Exhibits C,E,F, and I for a total cost of $3,350 And $4,150 left over!