Chapter 2

advertisement

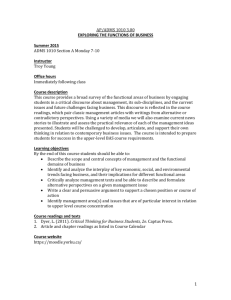

Chapter 14 Multiple-Choice Questions and Answers © Captus Press Inc., 2012 1. Which of the following can never be negative? (a) (b) (c) (d) The real rate of interest The realized rate of return on a bond The holding period return on a stock The standard deviation on the rate of return on a stock (e) The correlation coefficient between two stocks The answer is (d). © Captus Press Inc., 2012 2. If the stock market is efficient, it implies _______. (a) one cannot outperform the market consistently (b) stocks are fairly valued at any point in time (c) the best investment strategy is to buy and hold (d) (a) and (b) only (e) (a), (b), and (c) The answer is (e). © Captus Press Inc., 2012 3. The risk and return trade-off implies _______. (a) (b) (c) (d) (e) the higher the risk of an investment, the higher the expected return the lower the default risk on a bond, the higher the holding period return it is impossible to get rich in the stock market that one must diversify to reduce risk none of the above The answer is (a). © Captus Press Inc., 2012 The following information applies to questions 4 and 5. Lisa Sadowska purchased 100 shares of AMB Inc. one year ago. She paid $11 per share and, at the time of purchase, she expected the company would pay a dividend of 50 cents per share and that the stock price would increase to $13 after one year. The actual dividend paid was 40 cents per share, and she just sold her stocks for $11.50 per share. © Captus Press Inc., 2012 4. The expected rate of return on the stock was _______. (a) (b) (c) (d) (e) 8.18% 22.73% 18.18% 21.82% 4.55% The answer is (b). © Captus Press Inc., 2012 Why? E(P1 ) P0 E(D1 ) E(r ) P0 13 11 .50 11 .2273 © Captus Press Inc., 2012 5. The realized rate of return was _______. (a) (b) (c) (d) (e) 8.18% 3.48% 22.73% 20.87% 17.27% The answer is (a). © Captus Press Inc., 2012 Why? P1 P0 D1 r P0 11.5 11 .40 11 .818 © Captus Press Inc., 2012