ch12

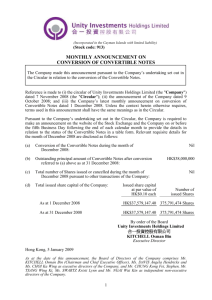

advertisement

CHAPTER TWELVE CONVERTIBLE SECURITIES © 2001 South-Western College Publishing Outline Convertible Bonds Characteristics Pricing of Convertible Bonds Why Companies Issue Convertible Bonds Unusual Features Convertible Preferred Stock Background on Preferred Stock The Conversion Feature 2 Outline Warrants Characteristics Pricing of Warrants Warrants and Leverage Accounting Implications: An Optional Technical Note Dilution of Earnings Common Stock Equivalents and Other Potentially Dilutive Securities Computation of PEPS and FDEPS 3 Convertible Bonds: Characteristics Convertible bonds give their owner the right to exchange the bonds for a set quantity of some other asset. This other asset is normally shares of stock in the same company. The number of shares the bondholder receives per $1,000 par value when converting the bond is called the conversion ratio. 4 Convertible Bonds: Characteristics par value conversion price = conversion ratio conversion conversion current = X stock price value ratio premium over market conversion conversion value = price value 5 Pricing of Convertible Bonds Over time, a convertible bond will increasingly act like a share of stock or like a non-convertible bond. A bond whose conversion price is substantially above the current market price of the associated common stock is a busted convertible. A convertible in a company whose stock has appreciated is an example of a common stock equivalent. 6 Metamorphosis of a Convertible Bond Acts like a Stock common stock equivalent stock price conversion price new convertible bond rising stock price declining or slow rising stock price time busted convertible Acts like a Bond 7 Pricing of Convertible Bonds Convertible bonds should never sell for less than their conversion value. With a busted convertible, the conversion feature has little value. Convertible bonds provide for upside potential while reducing downside risk. 8 Pricing of Convertible Bonds The premium payback period is the time required for the enhanced income from the bond (relative to the equivalent number of stock shares) to offset the premium over the conversion value. The premium payback period is sometimes called the break-even time. 9 Calculating Premium Payback Period market conversion price market value conversion ratio Premium payback period = market conversion price - stock price bond interest - conversion ratio dividends per share conversion ratio 10 Why Companies Issue Convertible Bonds Convertible bonds can usually be offered at a lower interest rate than would otherwise be required. All convertible bonds are callable. If called, a convertible bond must be (1)sold, (2)redeemed, or (3)converted. Corporations like to issue convertible bonds because of the likelihood that they will never have to repay the debt. 11 Convertible Bonds: Unusual Features Interest payments: A few convertible bonds do not pay interest twice a year, but monthly or quarterly, for example. Underlying asset: Many convertible bonds are convertible into the securities of another company. Some are convertible into cash. LYONs: Many companies issue zero coupon bonds, or liquid yield option notes (LYONs). A number of these are convertible into the company’s common stock. 12 Convertible Preferred Stock Preferred stock is attractive to corporations because of the tax-exempt nature of most dividend income. From an investment perspective, preferred stock is a fixed income security. Preferred stock is identified by its annual dividend. The fundamentals of conversion are the same as those for convertible bonds. 13 Warrants: Characteristics A warrant is a nondividend-paying security giving its owner the right to buy a certain number of shares at a set price directly from the issuing company. Warrants have no voting rights. Outside the United States, warrants are often issued in conjunction with a new debt issue, thus enabling a lower interest rate than would otherwise be required on the issue. Warrants can be detachable or non-detachable. 14 Pricing of Warrants The exercise price is the price at which an investor holding warrants may buy the underlying shares. When the stock price rises above the exercise price, the warrant is in-the-money, and has intrinsic value. If the stock price is below the exercise price, the warrant is out-of-the-money. Speculators buy warrants because of the leverage they provide. 15 Pricing of Warrants warrant price actual market value 45º 45º exercise price stock price 16 Accounting Implications: An Optional Technical Note When common stock equivalents are present, accountants must determine both primary and fully diluted earnings per share. Primary earnings per share (PEPS) is based on common shares outstanding plus shares considered to be common stock equivalents. Fully diluted earnings per share (FDEPS) reflects the dilution of earnings per share that would occur if all possible convertible securities were converted. 17 Accounting Implications Convertible bonds and convertible preferred stock are considered common stock equivalents and are used in the PEPS calculation if their yield was less than twothirds the yield of the average AA bond yield at the time the security was issued. A convertible that is not a common stock equivalent is classified as an other potentially dilutive security and may be used in the FDEPS calculation. 18 Computation of PEPS primary earnings = per share net income adjustments preferred available to for stock common + common stock - dividends shareholders equivalents weighted average number of common and common stock equivalent shares outstanding 19 Computation of FDEPS net income adjustments available to common + for common stock shareholders equivalents adjustments for + other potentially dilutive securities - preferred stock dividends fully diluted = earnings weighted average number of common shares, per share common stock equivalent shares and other potentially dilutive securities outstanding during the reporting period 20 Review Convertible Bonds Characteristics Pricing of Convertible Bonds Why Companies Issue Convertible Bonds Unusual Features Convertible Preferred Stock Background on Preferred Stock The Conversion Feature 21 Review Warrants Characteristics Pricing of Warrants Warrants and Leverage Accounting Implications: An Optional Technical Note Dilution of Earnings Common Stock Equivalents and Other Potentially Dilutive Securities Computation of PEPS and FDEPS 22