Reason for submission of SCV Effectiveness Report

Single Customer View (SCV)

Effectiveness Report

And

Marking Effectiveness Report

[Insert Deposit Taker Name as per

Financial Services Register]

[Insert FRN #]

[Insert Date of submission]

1

Single Customer View (SCV) Effectiveness Report and Marking

Effectiveness Report

As outlined in Policy Statement PS6 /15, ‘Depositor and dormant account protection’ 1 from

3 July 2015 every authorised deposit-taker with depositors eligible for deposit protection must provide an SCV effectiveness report and a Marking effectiveness report to Financial

Services Compensation Scheme (FSCS) and the Prudential Regulation Authority (PRA) to provide details of how the firm meets PRA requirements in relation to SCV systems and the marking of eligible deposits and accounts.

Such reports must be provided: a) Within three months of receiving a Part 4A permission to accept deposits; b) Promptly upon request by FSCS or the PRA.

Firms are also required to notify the PRA and FSCS within three months of a material change in a firm’s SCV or marking systems, including confirmation of compliance from the firm’s governing body. The PRA or FSCS may request the relevant report following such a notification.

The reports should include an a uthorised signature on behalf of the firm’s governing body confirming that the firm satisfies the SCV and/or marking requirements. (Part 9 of this report). If a firm is only submitting a marking effectiveness report or an SCV effectiveness report rather than both, the relevant part of this report can be deleted.

If a section or field is not applicable (for example if referring to a PRA rule that has yet to take effect), please state ‘n/a’ and explain why the section/field is not applicable.

When sending the reports to the PRA:

All Credit Unions should send their reports to:

Credit Union Supervision Team

Prudential Regulation Authority

20 Moorgate

London

EC2R 6DA

Phone: 020 3461 7000 (Firm Enquiries Team)

SCVImplementationReports@bankofengland.co.uk

Other Deposit Takers should submit this report to their normal PRA Supervision contact by email or post. Please copy in the following email:

Singlecustomerview@bankofengland.co.uk

.

When sending the reports to FSCS, all firms should direct their reports to: fasterpayoutenquiries@fscs.org.uk

For full details of the reporting requirements firms should refer to Chapters 14, 15, 50 and

52 of the Depositor Protection Part of the PRA Rulebook, available on the PRA website.

1 PRA, PS6/15, ‘Depositor and dormant account protection’, http://www.bankofengland.co.uk/pra/Pages/publications/ps/2015/ps615.aspx

2

Further information covering SCV requirements can also be found in FSCS Guide to SCV which is available on our website www.fscs.org.uk/industry/single-customer-view and from the SCV Assurance team at FSCS by email fasterpayoutenquiries@fscs.org.uk

Any additional attachments should be clearly marked with your Firm name, FRN number, SCV primary contact name and the title of the document.

SCV Effectiveness Report

Part 1: Contact Details

1.1 Firm Details

Deposit Taker Name – (exactly as per Financial Services

Register)

Firm Registration Number (FRN)

1.2 SCV Contacts

Compliance Officer (where applicable)

Primary Contact Name

Telephone Number

Email Address

Mailing Address

Secondary Contact Name

Telephone Number

Email Address

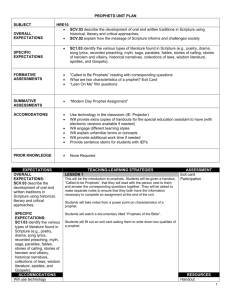

Part 2: Reason for submission of SCV Effectiveness Report

2.1

Place a tick in the relevant box to indicate the reason for your SCV Effectiveness Report submission.

3

Requested by the PRA or FSCS (as part of SCV Verification / following a material change / ad hoc request)

Newly Authorised

Other (Please Specify the reason below)

4

Part 3: SCV System and File Information

3.1 File generation date

3.1.1

Please provide the date when you last produced a full SCV file .

3.1.2

Please provide the date when you last produced a full Exclusions file

(if applicable).

3.2 File generation time

3.2.1

Please state the time it takes for you to generate a full SCV file.

3.2.2

Please state the time it takes for you to generate a full Exclusions file

(if applicable).

3.3 System/File Information

Please provide a description of your SCV system and how it has been implemented.

This should include any procedures and controls used to generate the SCV file and the creation of the exclusion file.

[Deposit Takers should delete italics text before populating with their own information]

Deposit Takers should provide a brief description of their SCV system which may include:

Any software or systems used to produce the SCV file.

Whether any specific account types or data sets are managed by a third party;

The source, date and rate of any Exchange Rates that have been applied to your SCV file (if relevant);

A summary of the approach taken to the provision of keys and codes for your SCV file

Whether you have provided keys and codes for your SCV systems exclusions; and

Whether you have applied to the PRA for any modifications and waivers

3.4 Security Measures

Please provide a description of the security measures you have in place to protect the SCV files including who has access and whether there are any key person dependencies.

5

3.5 Testing of the SCV file

Please provide a description regarding testing of the process to produce the SCV file and exclusion file.

This should include consideration of how the files are produced in a default scenario, the frequency of testing and how reconciliation to the firm’s core systems is carried out.

[Deposit Takers should delete italics text before populating with their own information]

This section may include a high level summary of the types of testing performed on your

SCV system. It may include issues such as:

What testing you undertook to identify/prevent individuals appearing more than once in the SCV file;

What performance testing have you undertaken in relation to verify that you can generate your SCV file within the required period?;

A brief description of the testing you undertook in relation In Flight Transactions.

Any reconciliations you carry out before submitting the SCV file.

3.6 Dependencies (Third party or key person)

3.6.1

Please provide the name of any third party dependencies to produce the SCV file; this can be external companies or parent/subsidiaries.

3.6.2

Please state any software suppliers and the name of the software that are used to support the production of your SCV.

3.7 Treatment of Legally Dormant Accounts

Please outline your current treatment of legally dormant accounts and provide more information on whether you have transferred the balance of these accounts to a reclaim fund for dormant accounts

(Dormant Accounts are those defined under the Dormant Banks and Building Societies

Accounts Act 2008 as being accounts where there have been no transactions for fifteen years)

6

3.8 Reconciliation

Please outline your process for verifying that the SCV contents reconciles to the core

IT/banking system

3.9 Exclusion file

Please detail below the Exclusion file production process

3.10 Other relevant factors

Please detail below any other factors relevant to the design of your SCV system or to an assessment of whether your SCV system meets with the stated Depositor Protection requirements.

[Deposit Takers should delete italics text before populating with their own information]

For example, please provide a brief description of the approach taken in relation to the application of ‘In Flight Transactions’, any waiver in place etc..

3.11 Large corporates or other eligible depositors not in the SCV or exclusions file

Please detail your proposed approach to be able to provide, upon the request of the PRA or

FSCS, aggregated deposit information for any large corporate depositors or other eligible depositors, if they are not included in the SCV file

7

Part 4: Future SCV system and file information

4.1 Ongoing maintenance

Please indicate what your plans for the ongoing maintenance of the SCV system are.

[Deposit Takers should delete italics text before populating with their own information]

This may include:

How you plan to maintain an accurate list of keys or codes for your SCV and exclusions;

A brief summary of what processes you have/will be implementing to check the eligibility of your members;

How you plan to ensure that the relevant modifications and waivers are sought when necessary; and

How new products and systems will be integrated into the SCV system.

4.2 Future Material Changes

Please provide brief details of any known or expected material changes to your SCV system after this submission e.g. planned mergers or changes in IT systems, and the date you expect the change to take place.

Please note that you are required to notify the PRA and FSCS within three months of the date of change, and an SCV effectiveness report may be requested following this.

4.3 Ongoing assurance

4.3.1 Please indicate how your board of directors will ensure that they remain satisfied that the Deposit Taker ’s SCV system continues to satisfy the PRA’s SCV requirements.

Please provide details of the dates and scope (if know) of any planned internal or external audit assurance work that will be performed over your SCV ‘readiness’.

Internal audit

External audit

Other assurance methods

8

4.3.2 Please provide a statement of whether your SCV system has been reviewed by external auditors, and if so stating the findings of that review.

Any additional attachments should be clearly marked with your Firm name, FRN number,

SCV primary contact name and the title of the document

Part 5: Number of Single Customer Views

5.1

Are you submitting a full or sample SCV file?

5.2.1 What is the exact number of records in tables A, B and D of the SCV file you are submitting?

5.2.2

What is the exact number of records in table C of the SCV file you are submitting?

5.3.1 What is the exact number of records in tables A, B and D of your full SCV file?

5.3.2

What is the exact number of records in table C of your full

SCV file?

5.4

If you have any accounts that have been excluded from the SCV file, please provide the total number excluded and the reason for the exclusion

Part 6: Transmission Method

6.1 SCV File transfer method

Please indicate how you will send the SCV file to FSCS by placing a tick in the relevant box

See FSCS Guide to SCV for additional information on SCV transmission

Web portal upload (FSCS preferred option)

SFTP

9

Connect Direct (if existing connection already in place with FSCS)

Part 7: SCV File Format

7.1

. SCV File Technical Format

Place a tick in the relevant box to indicate your preferred choice.

See FSCS Guide to SCV for additional information on file format of SCV files.

. CSV (FSCS preferred option)

. TXT

. XLS(X) (Excel)

Other (Please describe your preferred format below)

7.2 SCV File Security

Please indicate if you are using encryption software by placing a tick in the relevant box.

PGP (FSCS preferred option)

Other (please describe the proposed transfer and related security controls below)

7.3

SCV Filename

Please provide details of your intended file name (s) by ticking the relevant box or providing details of your intended file name.

Please note any files with unrecognised file names will be destroyed and resubmission will be required.

10

If using FSCS preferred file name, please tick here.

If not using FSCS preferred file name, please provide details of your SCV file name below.

7.4

. SCV File Header

Please provide details of your file header format by placing a tick in the relevant box, or by providing details of your intended file header.

If using FSCS preferred header format, please tick here.

If not using FSCS preferred file header, please use the space below to provide details of any

SCV file header.

7.5

SCV File Footer

Please confirm your proposed file footer format by placing a tick in the relevant box.

If using FSCS preferred footer format, please tick here.

If not using FSCS preferred file footer, please use the space below or an attachment to provide details of any SCV file footer.

7.6

SCV File Column Delimiter

Place a tick in the relevant box to indicate your preferred choice. Please note characters used as a column delimiter must not be used in any other fields within SCV file.

Pipe delimited (FSCS preferred option)

Other - Please state your proposed column delimiter

11

7.7

SCV File Row Delimiter

Place a tick in the relevant box to indicate your preferred choice. Please note characters used as a row delimiter must not be used in any other fields within SCV file.

Carriage return line feed (CRLF)

Line Feed (LF)

(FSCS preferred option)

Excel file

Other - Please state your proposed row delimiter

7.8

SCV File Field Contents/Data Structure

7.8.1.1

How many files will make up your SCV submission?

7.8.1.2

If more than one file, please use the space below to define how you have split tables A,

B C and D across multiple files. Please confirm whether each file contains fit for straight through records, not fit for straight through records, or a combination of both.

7.8.2.1

Please tick the box to confirm that the SCV data fields are supplied in the exact order/sequence as documented in Depositor

Protection 12.9/50.11 [delete as applicable].

7.8.2.2

If SCV data fields are not provided in the same order/sequence as Depositor Protection

12.9/50.11 [delete as applicable], please use the space below to define the field order in each file.

7.8.3.1

Please tick the box to confirm that the SCV data fields are populated with the exact data types as defined in Depositor Protection

Sourcebook.

7.8.3.2

If the data types are not the same as defined in the Depositor Protection Sourcebook, please use the space below to define the field order in each file.

12

7.9

. SCV File Blank Fields

Place a tick in the relevant box to indicate your preferred choice.

Please note, numeric empty fields must be represented by ‘0’ (zero)

Spaces - FSCS preferred option

Null value

Zero field length with delimiter

Other - Please state your preferred method for populating blank fields

7.10 SCV File Address Format

Place a tick in the relevant box to indicate your preferred choice

One specific address format should be applied consistently to all SCV files

Format A – PAF format

Format B - Multi line format

7.11

. SCV File Date of Birth Format

Place a tick in the relevant box to indicate your preferred choice

DDMMYYYY - FSCS preferred format

Date of Birth column provided but left blank

Part 8: SCV File Account Status Codes and Product Codes

8.1

Account status code

Depositor protection rules require firms to provide an explanation of any code or keys used.

FSCS intend to use the Account Status Code to identify which accounts are fit for straight through payout (FFSTP) and which are not (NFFSTP).

Where possible, FSCS would prefer that Deposit Takers provide a single unique code representing one scenario or a single unique code representing multiple scenarios.

All account status codes that appear in the SCV file and Exclusion file should be included in table below or provided in a separate file (see 8.3 for a template).

13

Account Status

Code (exactly as shown on SCV file)

Description(s)

Fit for Straight through payout (Yes /No) or

Exclusion

GA

XN

A

F

EXAMPLES

Gone Away

Gone Away & Fraud

Active and operating normally

Fraud

No

No

Yes

No

B Beneficiary Exclusion

Active and operating normally Yes

Account Status

Code (exactly as shown on SCV file)

PLEASE INSERT YOUR OWN CODES BELOW

Description(s)

Fit for Straight through payout (Yes /No) or

Exclusion

8.2

Product Codes

FSCS intend to use the product types and descriptions to identify the type of accounts depositors hold on the SCV file.

It is important to note that the product type information is critical to this process, while the description information will help inform analysis rather than prevent the file from being processed.

Product Code

(exactly as shown on SCV file)

Description(s)

14

SA

Junior

CS

EXAMPLES

Shares account

Junior Savings

Christmas Savings

BA

Product Code

(exactly as shown on SCV file)

Business account

PLEASE INSERT YOUR OWN CODES BELOW

Description(s)

8.3

Account Status Codes and Product Codes

If you operate a large amount of Account Status Codes or Product Codes and cannot fit all your codes in the spaces provided please send the attached Excel sheet populated with the complete code listings when sending in this SCV Effectiveness Report.

Account Status Code

Template.xlsx

Product Code

Template.xlsx

15

Part 9: Statement of compliance

We confirm that we, the Board of Directors of [insert name of Deposit Taker] , can provide an

SCV file (i.e. the information required by Depositor Protection 12.9) to the FSCS within 72/24 hours [delete as applicable] of a request being received from the FSCS or PRA and confirm that our SCV system satisfies the Depositor Protection requirements.

We confirm that this report has been signed by [insert name of signatory] on behalf of the

Board of Directors of [insert name of Deposit Taker].

Depositor Protection rules requires firms to be able to: a) provide to the PRA or FSCS all single customer views within 72 hours of a request by the PRA or FSCS (from 3 July 2015 – 31 November 2016), and b) provide to the PRA or FSCS all single customer views and exclusions views within 24 hours of a request by the PRA or FSCS (from 1 December 2016).

Signed:

Position:

Date:

16

Marking Effectiveness Report

Part 1: Contact Details

1.1 Firm Details

Deposit Taker Name – (exactly as per Financial Services

Register)

Firm Registration Number (FRN)

1.2 Marking Contacts

Compliance Officer (where applicable)

Primary Contact Name

Telephone Number

Email Address

Mailing Address

Secondary Contact Name

Telephone Number

Email Address

Part 2: Reason for submission of Marking Effectiveness

Report

2.1

Place a tick in the relevant box to indicate the reason for your SCV Effectiveness Report submission.

Requested by the PRA or FSCS (as part of SCV Verification / following a material change / ad hoc request)

Newly Authorised

Other (Please Specify the reason below)

17

Part 3: Marking Information

3.1 Date and time of identifying eligible deposits and accounts

3.1.1

Please provide the date when you last supplied details of eligible deposits and accounts to FSCS or the PRA.

3.2 Please state the time it takes you to provide these details to FSCS or the

PRA from the point of request.

3.3 System/File Information

Please provide a description of system to satisfy marking requirements (Depositor

Protection 11.1-11.2) and how it has been implemented.

This should include any procedures and controls used to supply detailed of eligible deposits and accounts to the FSCS or the PRA.

[Deposit Takers should delete italics text before populating with their own information]

Deposit Takers should provide a brief description of their system which may include:

Whether any specific account types or data sets are managed by a third party;

A summary of the approach taken to the provision of keys and codes to mark eligible deposits and accounts; and

Whether you have applied to the PRA for any modifications and waivers

3.4 Testing marking arrangements

Please provide a description regarding testing of the system to satisfy marking requirements.

3.5 Dependencies (Third party or key person)

3.6.

Please outline any factors or dependencies relevant to the design and operation of your systems or to an assessment of whether the systems satisfy the marking requirements.

18

Part 4: Ongoing maintenance and assurance

4.1 Ongoing maintenance

Please indicate what your plans for the ongoing maintenance of the marking system are.

[Deposit Takers should delete italics text before populating with their own information]

This may include:

How you plan to maintain an accurate list of keys or codes;

A brief summary of what processes you have/will be implementing to check the eligibility of your members;

How you plan to ensure that the relevant modifications and waivers are sought when necessary; and

How new products and systems will be integrated into the marking system.

4.2 Ongoing assurance

4.2.1 Please indicate how your board of directors will ensure that they remain satisfied that the firm’s system continues to satisfy the PRA’s marking requirements.

Please provide details of the dates and scope (if know) of any planned internal or external audit assurance work that will be performed in relation to marking systems.

Internal audit

External audit

Other assurance methods

4.2.2 Please provide a statement of whether your marking system has been reviewed by external auditors, and if so stating the findings of that review.

Any additional attachments should be clearly marked with your Firm name, FRN number, marking primary contact name and the title of the document

19

Part 5: Number of Marked deposits and accounts

5.1

How many deposits are marked as eligible in accordance with Depositor Protection 11.1

5.2 How many accounts are marked which contain or may contain eligible deposits in accordance with Depositor

Protection 11.2

Part 6: Statement of compliance

We confirm that we, the Board of Directors of [insert name of Deposit Taker] , attest that our firm satisfies the marking requirements set out in Depositor Protection 11.1 and 11.2.

We confirm that this report has been signed by [insert name of signatory] on behalf of the

Board of Directors of [insert name of Deposit Taker].

Signed:

Position:

Date:

20