VAT introduction : administrative issues / by Paulo Dos

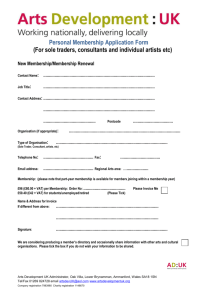

advertisement

VAT Introduction-Administrative issues By Paulo dos Santos CARTAC Who is afraid of the VAT???? The VAT today • 120 countries have a VAT • 4 billion people pay it • It raises more than US$18 billion or 25% of total tax revenue VAT introduction—The Chronology • • • • 1948 1967 1970/80 1990 • • • • France, at manufacturing level Brazil, at all levels (Brazilian states) It spread to 63 countries More than 120 countries have VAT VAT is efficient in small islands (Under 1 million population) 90 80 83 70 60 64 50 58 40 30 20 62 57 38 10 0 C-Efficiency 57 Sub-Saharan Africa Asia and Pacific Americas EU (plus NW & CH) Central Europe N. Africa Middle East Small Islands The situation in the Caribbean region • In operation – Barbados, Dominican Republic, Haiti, Jamaica, and Trinidad & Tobago • Repealed – Belize, Grenada Why some countries repeal VAT? • Political commitment to repeal it • Poor performance due to poor planning for introduction • Inadequate definition of registration threshold The VAT implementation flow Decide on VAT Introduction Prepare for VAT introduction Decide on policy Aspects Introduce the VAT Decide on administrative aspects Operate the VAT The most-mentioned constraints to VAT introduction • • • • Tax administration effectiveness Culture of bookkeeping Adult literacy level Implementation cost Tax administration effectiveness • Weak administration = poor VAT performance • But… • Under a weak administration any tax performance will be poor • Some countries use VAT as part of a strategy to strengthen tax administration • Train staff during VAT introduction Culture of bookkeeping Why bookkeeping? • Pricing product accurately • Knowing if business is making or losing money • Knowing the cash flow (short & long run) • Working with bankers (financing) • Paying taxes due Culture of bookkeeping How to change it? • The Peruvian culture regarding invoices • Enforce bookkeeping requirement • Establish threshold that ‘filters’ those unable to bookkeeping Country Niger Adult Literacy Rate 14 VAT Revenue (% of total) 27.6 Burkina Faso 19 28.7 Mali 31 27.0 Senegal 33 37.1 Egypt 51 17.9 Decide on the VAT policy aspects • Tax base • Tax rate – 1 positive rate – Zero rate for exporters • Registration threshold Registration threshold (in selected countries) • • • • • • • • • Ivory Coast Madagascar Chad Sri Lanka Barbados Rwanda Trinidad & Tobago Fiji El Salvador • • • • • • • 50,000 45,000 40,000 33,000 30,000 28,000 25,000 • 7,000 • 5,700 Decide on VAT administrative aspects • Which organization is going to administer the VAT? • How frequently should taxpayers file and pay? • What the invoicing requirements should be? • How will VAT refund operate? Which organization is going to administer the VAT? • Customs – Most VAT revenue come from imports • Inland Revenue Department – VAT is based on financial records as income tax – VAT applies to domestic transactions as well – VAT should apply on services too Despite the decision, coordination is a must. • Customs information on VAT paid on imports • Customs information on exports • Joint audit (post release) How frequently should taxpayers file and pay? • Transaction-based tax requires frequent reporting • But the volume of returns and payment can be large • Different treatment according to taxpayer size • Possible problems – Compliance control – Cross-checking – Revenue flow Invoicing requirements • Invoices are like checks drafted on the Treasury. • What should be the invoice contents? • How final-consumer invoice should be? • How to enforce compliance with invoicing requirements? Invoice information • • • • • • Seller and purchaser names and TIN Seller’s address Date of issuing Invoice number Description of goods and services Indication of unit and total selling price, including VAT paid • Date of printing • Range of serial numbers printed on that date Final consumption invoice: a decision has to be made… • Invoice or tickets show the VAT paid • Invoice or tickets do not show the VAT paid How to enforce compliance with invoicing requirements? • Controlling invoicing printing – L.A. experience • Controlling invoicing issuing – Massive control • Controlling invoice registration – Invoicing information cross-checking – Start with large taxpayers' purchases How will VAT refunds operate? • Why the refunds? • How to deal with VAT excess credit – Carry forward – Refund tax credit • Computer screening of refund claims – Information cross-checking • Audit of claims – – – – Focus on the period of the claim First time claimers Usual claimers In-depth audit (fraud indications) Prepare for VAT introduction Establish the VAT introduction team • The team leader • The team members – – – – – – – Legal issue Training, taxpayer education and publicity Customs controls Registration and taxpayer assistance Filing and payment procedures Audit IT Prepare the introduction budget • To be managed by the project leader • Subject to audit by the Auditor General • Should cover all the project expenses: training, travel, office accommodations, consultants, publicity, IT, etc. Get external assistance • International expert for 18-24 months • Short-term experts – – – – Training Legislation drafting Design of audit and refund programs Etc. Prepare VAT legislation • • • • Draft VAT legislation and regulations Consultation with relevant parties Review related legislation Get legislation passed Develop and deliver staff training and taxpayer education • Start training with implementation team • Train all staff to be involved with VAT operation • Train trainers (updating training) • Educate VAT payers, accountants and tax preparers Prepare and execute publicity programmes • Publicity expert can be required • But, implementation team will do most of the work – – – – Participate in radio and TV shows Participate in seminars Setting up help telephone line Setting up Internet site Develop and put in place registration procedures • Ensure that those with sales above the registration threshold are registered • Try to unify the TIN • VAT introduction can be an opportunity to clean up the old taxpayer register. Develop taxpayer assistance procedures • Prepare the VAT information guide – (What is VAT? Why is it better than other taxes? Which rates will apply? What will be exempted?) • Prepare the guide to VAT registration – Registration form, post-registration procedures • Prepare the guide to completing the VAT return – Explain VAT legislation and operation Develop filing and payment procedures • Unique form for filing and payment • Full self-assessment system • Prompt action on non compliance. Develop audit procedures • VAT audit is different from income tax • Duration of visits vary – Trader complexity, size, reliability • First months, focus on taxpayer education • Following months, enforce compliance Prepare procedure and policy manuals • • • • Prepare instruction manuals asap Manuals should be clear and comprehensive Should be available through Intranet Should be used for training of new staff or retraining of old staff Develop and test IT systems • • • • • • • Taxpayer registration Processing monthly returns and payments Information validation Detection returns with inconsistencies Controlling stopfiling and delinquent accounts Selecting taxpayers for audit Screening of refund applications for audit Develop the procedures for the transition from a consumption tax to a VAT • Credit should be granted to traders to avoid double taxation • But, require evidence that tax was effectively paid to avoid excessive claims Implement the VAT • Set up taxpayer service unit • Set up unit to monitor compliance with filing and payment • Set up audit unit • Put in place IT systems • Deliver VAT return forms to registered taxpayers Operate the VAT • Review VAT operations • Put in place the systems for enforcement of Filing & Payment requirements • Put in place the audit program Conclusions • In administrative terms, VAT is feasible in the Caribbean countries • Strong political commitment • Well prepared implementation plan • Resources for implementation • International/regional assistance