Chinese financial markets

advertisement

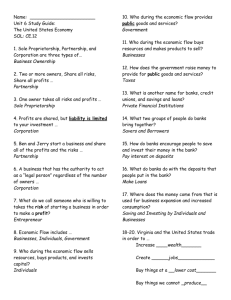

INTRODUCTION TO BANKING THE CHINESE FINANCIAL SYSTEM, SPRING 2014 PV VISWANATH LUBIN SCHOOL OF BUSINESS P.V. Viswanath LEARNING OBJECTIVES What is a bank? What does it do? What makes a bank different from other financial intermediaries? Why does the banking sector need more regulation than other financial sectors? What is the role of the central bank? What is the role of banks and other financial institutions in situations of systemic failure? • What is the “too big to fail” problem? • How can troubled banks be restored? • What are asset management companies and what is their role in restoring troubled banks? • • • • • P.V. Viswanath 2 WHAT IS A BANK? • The primary role of a bank is to take in funds – called deposits – from those with money, pool them, and lend them to those who need funds. • They are intermediaries between depositors and borrowers. Deposits can be available on demand (such as a checking account) or with some restrictions (such as savings and time deposits). • Banks are used by depositors in many countries, not only as an investment vehicle, but also as an intermediary that facilitates payments and as a temporary parking spot for money. For this purpose, deposits need to be short-term. Loans, usually, need to be longer-term, e.g. those made to corporations either for working capital or for capital projects. As such, banks engage in maturity transformation, i.e. the conversion of short-term liabilities (deposits) to long-term assets (loans). • Because of this mismatch in maturities that is an essential part of their business, they are subject to interest rate risk. This risk, in addition to the normal default risk on their loans, has the potential to expose depositors to risk. • It is precisely a riskless intermediary, though, that depositors seek in their banks. Since banks play an important part in the payments system, a default by banks would cripple the financial system. Hence banks are heavily regulated. Jeanne Gobat, What is a Bank?, Finance and Development, March 2012, p. 38-39. P.V. Viswanath 3 BANK REGULATION • Regulators require that banks have sufficient capital to absorb any losses that they might bear because of the risks previously mentioned. • The Basel Accords issued by the Basel Committee on Banking Supervision consist of a set of recommendations, dealing primarily with the minimum capital requirements. • Basel I and Basel II primarily relate to the required level of reserves that must be held by banks for various classes of loans and other investments and assets in accordance with their perceived risk. Basel III is supposed to strengthen bank capital adequacy by increasing bank liquidity and decreasing bank leverage. • Other regulations may pertain to client confidentiality and money laundering. • In China and in several other countries, banks are also used for credit allocation – to direct credit to favored sectors. P.V. Viswanath 4 MONETARY POLICY • Banks also play a role in the transmission of monetary policy, one of the government’s most important tools for achieving economic growth without inflation. • Simply put, we can understand the price level essentially as the amount of money available for transactions (the money supply times the frequency with which money is re-used, i.e. money velocity) divided by the amount of goods. Hence if the money supply increases too much relative to the amount of goods and services available, the inflation rate will increase. If there is not enough money supply, transactions will be difficult to conduct. • Furthermore, increasing the money supply reduces the real cost of loans (at least in the short run) and encourages more investment; often, this can jumpstart a weak economy, thus increasing economic growth without increasing inflation. However if the economy is operating close to capacity or if producers lack confidence in the economy, the result will simply be higher inflation. P.V. Viswanath 5 MONETARY POLICY • The central bank (the People’s Bank of China – PBOC – in the case of China, the Fed in the case of the US) controls the money supply at the national level, but banks, as mentioned above, facilitate the flow of money in the markets in which they operate. • Central banks can reduce (increase) the money supply by increasing (decreasing) banks’ reserve requirements (i.e. the proportion of deposits that banks must hold in vault cash or with the central bank). The greater the reserve requirements, the lower the amount of loans that the banks can make. • Central banks can also conduct open market operations, i.e. selling or buying securities. When the central bank sells government securities to the banks, they have to pay for them, which reduces the amount of funds available to them to loan out to borrowers. • A sharp increase in required bank reserves relative to supply can lead to a credit crunch which can lead to higher borrowing costs as customers pay more for scarcer bank funds. For example, on June 20, 2013, the overnight repurchase rate set a record at 13.91 percent, before the PBOC injected funds, bringing rates back down closer to normal. The credit crunch may have been due to the desire of the PBOC to restrict excessive credit growth. http://www.economist.com/blogs/economist-explains/2013/07/economist-explains-2 P.V. Viswanath 6 TOO BIG TO FAIL • As mentioned previously, banks play a central role in the processing of payments through the checking system and through electronic funds transfers. The payments system is a complex network of local, national and international banks and often involves government central banks and private clearing facilities that match up what banks owe each other. • The payment system also includes credit and debit cards. Obviously, a well-operating payments system is a prerequisite for an efficiently performing economy. Breakdowns in the payments system are likely to disrupt trade and economic growth significantly. • The larger the bank, the greater the number of networks that it is likely to be involved in. As a result, it is more difficult for the monetary authorities to let the bank fail. This leads to the phenomenon of “too big to fail.” This, in turn, causes moral hazard – that is, banks knowing that the monetary authority will rescue them, are likely to take greater risks than they would have, otherwise. P.V. Viswanath 7 RESOLUTION OF TROUBLED BANKS • Through fraud or mismanagement or excessive risk taken by managers, banks can come close to insolvency. In such situations, countries need to have mechanisms in place to handle the exit of a bank from the system with minimum economic disruption and loss of confidence in the banking system. • Alternatively, if it is decided that the bank cannot be allowed to default – perhaps due to a toobig-to-fail policy – steps have to be taken to somehow resuscitate the bank. There are several possibilities. • One, a well-managed bank could be found to take over all or part of the business of the insolvent bank. The acquiring bank purchases the good assets of the failed bank and assumes its deposit liabilities. The deposit insurer or the government provides cash or government bonds to make up for the difference between the good assets purchased and the liabilities assumed. • A receiver is appointed to recover monies for the government and other creditors by disposing of the bad assets of the failed bank, either through sale or by managing them and recovering as much as possible from the debtors. Alternatively, the acquiring bank itself could take over the bad assets and manage them. • The key, here, is that the inept management policies of the failed firm are discontinued; in this case through replacement of old management by capable managers of the acquiring firm. P.V. Viswanath 8 THE EQUITY INFUSION STRATEGY • A second possibility is to try and get a direct capital infusion by the existing shareholders or having them dilute their interest by selling new shares to different investors. • Why would shareholders invest more money in such a bank? One reason might be pressure from the regulator, with the threat of the bank being shut down. • If a new share sale is undertaken, the new shareholders would be willing to invest only if they can get a better deal than existing shareholders. • In this case, the idea is that the operating strategy of the bank makes sense, i.e. the bank has a good operations team, but for some other reason – perhaps excessive leverage or a rogue trader – the bank’s equity has dropped to perilous levels. • A third possibility, especially if the failed bank is state-owned, is for the government to put in additional equity. Again, the reason for the drop in reserves is important. If the reason is mismanagement, then addition of new funds with existing management retained is unlikely to solve the problem. P.V. Viswanath 9 ASSET MANAGEMENT COMPANIES • Although the bank itself should be in a better position to manage problem assets because of the bank’s knowledge of the borrower and the ownership of loan files and collateral, sometimes successful workout of loans requires specialized skills and resources that may not be present at an individual bank, so in some circumstances Asset Management Companies (AMCs) may be better at disposing of troubled assets. • Asset management can be handled by public or private entities, but must be based on the correct incentives so that borrowers will repay their debts and assets will be sold for the highest obtainable prices. Successful asset recovery will reduce the cost of dealing with a banking crisis. • When a substantial amount of bad loans and assets has to be transferred to an AMC over a short period of time, it is often difficult to find a private investor willing to own such an AMC without asking for far-reaching government guarantees covering the future value of the asset portfolio. In this situation, the government is in a more favorable position owning the AMC itself rather than providing guarantees, since it might then benefit from any future upward price movements of the AMC’s assets. In addition, it is difficult to formulate guarantees that would give a private owner strong incentives to sell the assets at the best prices; this could lead to further losses for the state. • In other words, there may be a significant issue of liquidity. Then, rather than pay a sizeable liquidity premium to a private AMC, the government may set up its own AMC. P.V. Viswanath 10 THEMES • Banks are special because they provide a location for clients to keep money relatively risk-free for short periods of time, either for precautionary purposes or to facilitate financial transactions. • The key aspect of financial transactions in the economy means that banks particularly need to be regulated that customers have access to their funds when they need them. The alternative can be financial collapse. • When banks fail, they need infusions of new capital; Asset Management Companies can play an important in restoring the health of failed banks. • Banks also play an important role in the transmission of monetary policy, which the Fed orchestrates either through reserve requirements or through open market operations or both. P.V. Viswanath 11