Development - HR BioTech Connect

Preparing for the Future

Susan M. Snyder, Hay Group

Marc Wallace, Hay Group

November 15, 2011

Agenda

1

2

About Hay Group

Increasing R&D effectiveness

3 Sales force compensation

© 2011 Hay Group. All rights reserved 2

01

About Hay Group

Our areas of expertise

We help organizations work.

Reward Services

Leadership and

Talent

Building Effective

Organizations

Hay Group

Insight

© 2011 Hay Group. All rights reserved 4

Our global presence and capability

86

Offices in 47 countries

© 2011 Hay Group. All rights reserved

2200

Employees worldwide

7000

International clients

$450 million

Sales

5

Representative life sciences clients

© 2011 Hay Group. All rights reserved 6

Powerful HR tools to help your people flourish

Putting 60 years of Hay Group expertise at your fingertips

Powerful and intuitive tools available online or electronically

Competitively priced

Created specifically for HR professionals and line managers

Support recurring processes across the employee lifecycle

© 2011 Hay Group. All rights reserved 7

An invitation for you...

http://www.haygroup.com/surveys/Best_Companies_2011/

2011 BEST COMPANIES FOR LEADERSHIP SURVEY

© 2011 Hay Group. All rights reserved 8

02

Increasing R&D effectiveness

Game-changing times

Cost to value

Reduced tolerance for risk

Generics

Greater regulation

Cost pressure

Price control

Longer lead time for product development

Patent expiration

Decline in R&D productivity

© 2011 Hay Group. All rights reserved 10

The market share of biotech drugs is continuously increasing

2000

9%

2014E

23%

77%

91%

Biotech Medicines Conventional Medicines Biotech Medicines Conventional Medicines

The share of biotech drug sales is expected to reach almost a quarter of total drug consumption by 2014, compared to less than one-tenth in 2000

© 2011 Hay Group. All rights reserved 11

Global biotech sector is getting to stabilize

The industry appears to have turned the corner, though it has not returned to pre-crisis levels of normalcy

Across the established biotech centers, revenues grew by 8% — identical to growth in 2009 after adjusting for the

Genentech acquisition, but well below the 12% seen in 2008 or the high doubledigit growth rates the industry was able to deliver in many prior years

© 2011 Hay Group. All rights reserved

90

60

30

0

Global Biotechnology Revenues (USD bn)

2009 2010

180 000

120 000

60 000

0

Global Biotechnology Employees

172 690

178 750

2009 2010

Note: Figures pertain to 622 public companies

Source: Ernst & Young Report 2011 12

Biotech is moving towards profitable business model

Global Biotechnology Net Income (USD bn) Global Biotechnology R&D Exp. (USD bn)

5 25

4 20

3 15

2 10

1 5

0 0

2009 2010 2009 2010

Large numbers of firms undertook drastic cost-cutting measures to survive. These efforts resulted in a much stronger bottom line, propelling a sector that has bled red ink for most of its history to unprecedented levels of aggregate profitability

But while the focus on operating efficiency has its benefits, it has come at a high cost. In an industry where R&D is by far the biggest expenditure, it was inevitable that deep spending cuts would lead companies to slash R&D expenditures

–

R&D expenses, which had plummeted by 21% in 2009, grew by a modest 2% in 2010 — a positive development, but far below the investments that biotech companies have historically made in innovation. In

2009, 64% of US companies and 55% of European companies decreased their R&D spend; in 2010, those numbers fell to 49% and 45%, respectively

Note: Figures pertain to 622 public companies

© 2011 Hay Group. All rights reserved

Source: Ernst & Young Report 2011 13

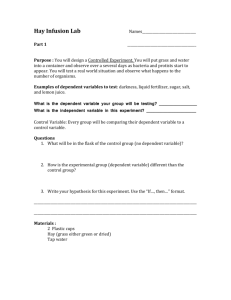

R&D productivity is down…

© 2011 Hay Group. All rights reserved

R&D productivity ratio =

New drug approvals of major players

Total R&D spend (USDbn) of major players

14

….while R&D expense is up

© 2011 Hay Group. All rights reserved 15

In 2011, we undertook a study to identify causes of R&D underperformance

© 2011 Hay Group. All rights reserved 16

Our diagnosis

Organizations aren’t leveraging the human talent that they have

Scientists are motivated in unique ways, and must be led accordingly

Most R&D leaders do not create engaging climates that energize their teams

While R&D leaders must demonstrate technical expertise, many have not expanded their leadership portfolio to include providing alignment, feedback, and collaboration

Many R&D professionals do not believe that performance is linked to recognition; instead, they think that mediocrity is tolerated

Instead of enabling innovation, organizations are inadvertently putting hurdles in place by allowing slow decision-making, risk-aversion, and lack of collaboration

© 2011 Hay Group. All rights reserved 17

Leading scientists isn’t easy

Scientists enjoy solving problems, need recognition, and tend to be loners

Avoid anything that puts barriers between scientists, regardless of their title or level of expertise

Facilitate free flow of information and iterative feedback loops among scientists

Create opportunities for collaboration, both formally and informally

Provide rewards in the form of recognition, reputation and respect (including from top management, peers inside and outside the company, and patients)

Allow the opportunity to present at conferences and to customers to build their own and the company’s reputation

Clarify and celebrate the link between their work and its practical impact on the business and patients

18 © 2011 Hay Group. All rights reserved

Measuring engagement: climate

Climate indicates how energizing the work environment is for employees

It accounts for up to 30 percent of the variance in key performance measures

Up to 70 percent of the variance in climate is driven by how leaders behave

Fully engaged employees are 2.5 times more likely to exceed performance expectations than their ‘disengaged’ colleagues

Leadership styles

Organizational climate

Aligned and motivated employees

50-70% of variance in organizational climate can be explained by differences in leadership style

Up to 30% of variance in results can be explained by differences in organizational climate

© 2011 Hay Group. All rights reserved

Results

19

The climate gap in R&D

How does it feel to be in R&D in large life science organizations?

67% report that their current environment is tolerable (15%) or de-motivating (52%)

These results are worse than those reported by other LS functions except Manufacturing

Research is worse off than Development, and when compared to other industries, ranks at the bottom of the list

20 © 2011 Hay Group. All rights reserved

Digging deeper: organizational climate

Organizational climate drives performance

Good working environments – or climates – energize and focus people to do their best.

Mediocre climates dampen motivation and diminish performance

Research shows that these aspects of climate have the biggest impact on performance:

Flexibility Responsibility Standards Rewards Clarity

Team commitment

No unnecessary rules, procedures or policies.

New ideas are easily accepted

Employees are given authority to accomplish tasks without constantly checking for approval

Challenging but attainable goals are set for the organization and its employees

Good performance is recognized and rewarded

People know what is expected of them and how they contribute to organization goals

People are proud to belong to the organization

… and of all the things that influence climate, leaders have the biggest influence

© 2011 Hay Group. All rights reserved 21

Digging deeper: climate

Only 17% are in High Performance climates and firing on all cylinders

16% are in Energizing situations, but they are lacking the Clarity that drives business results

15% are getting by in Tolerable climates, but Flexibility (innovation) drops along with Clarity and Team

Commitment (collaboration)

© 2011 Hay Group. All rights reserved

52% of the sample are disengaged, struggling across all dimensions, and De-Motivated

22

Comparing two organizations: climate

Company 1 Company 2

Products approved, 2007

– July 2011: 4

Products approved, 2007

– July 2011: 9

More leaders creating positive climate correlates with R&D productivity

© 2011 Hay Group. All rights reserved 23

Leadership styles drive much of climate

Leadership strength is defined by flexibility

Leaders who can tailor their behavior, or leadership styles, to a situation create positive climates

Those who do not create negative climates

Our research database, containing assessments on over 550,000 individuals from over 4,900 organizations, shows that the following styles have the biggest impact on climate

Coercive

Achieving immediate compliance

Authoritative

Providing long term direction and vision

Affiliative

Creating harmony and avoiding conflict

Democratic

Building commitment and encouraging new ideas

Pacesetting Coaching

Accomplishing tasks to high standards

Supporting long term development

© 2011 Hay Group. All rights reserved

…

24

Leadership drives engagement

Leadership differences in R&D

Outstanding R&D leaders maintain their technical credibility and go beyond it

Provide direction and feedback

Engage their teams in problem-solving and collaboration

Leadership Styles in High Performance Climates

(feedback from 124 direct reports on 26 leaders)

Leadership Styles in De-Motivating Climates

(feedback from 453 direct reports on 77 leaders)

© 2011 Hay Group. All rights reserved 25

Comparing two organizations: style

Company 1 Company 2

Products approved, 2007

– July 2011: 4

Products approved, 2007

– July 2011: 9

Leaders who use a broad range of styles create more positive climate…. which correlates with R&D productivity

© 2011 Hay Group. All rights reserved 26

Engagement alone is insufficient

Work environments have to turn motivation into productivity

Engagement

Employee effectiveness

Enablement

© 2011 Hay Group. All rights reserved 27

The business case for engaging

and

enabling employees

High engagement only

High engagement + high enablement

Employee performance

Increase in employees above performance expectations

Employee retention

Reduction in turnover rates

Customer satisfaction

Customer satisfaction rates

Financial success

Revenue growth

10% -40% 71% x2.5

50% -54% 89%

Based on linkage case studies using

Hay Group’s global normative database x4.5

© 2011 Hay Group. All rights reserved 28

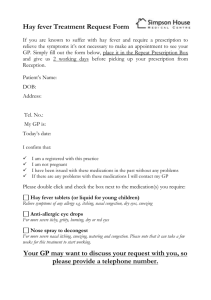

Issue #1

Lack of feedback and development

I have a good idea of the possible career paths available to me

Rate your opportunities for learning and development

Rate your immediate supervisor on providing you with clear and regular feedback

Rate your immediate supervisor on coaching you in your development

Training is available on an ongoing basis so that I can continue my learning and development

Rate your company on providing training so that you can do your present job well

0

© 2011 Hay Group. All rights reserved

20

R&D Norm

42

59

49

57

62

Life Science Norm

71

55

64

65

73

60

68

40

% Favorable

60 80 100

29

Issue #2

Lack of focus on – and recognition for – outstanding performance

R&D Norm Life Science Norm

The better my performance, the better my opportunity for career advancement

46

58

The better my performance, the better my pay will be

45

56

Poor performance is usually not tolerated at the company

0 20

47

40

% Favorable

60

60

80

© 2011 Hay Group. All rights reserved

100

30

Issue #3

Obstacles to innovation and collaboration

Employees are encouraged to take reasonable risks (e.g., try new ideas or new ways of doing things) in an attempt to increase the effectiveness of the organization

Decisions are made without undue delay

Rate cooperation among employees where you work or within your location

This company encourages cooperation and sharing of ideas and resources across the company

My work group receives high quality support from other units on which we depend

0

© 2011 Hay Group. All rights reserved

20

R&D Norm

52

Life Science Norm

62

48

61

51

58

60

66

40

% Favorable

60

70

78

80

31

100

Things you can do to improve R&D

Our prescription

Clarify the definition of outstanding performance

– for individuals and for the function

Determine the critical few metrics that align to that definition of excellence

Align recognition and reward to those metrics, and give clear feedback about them on an ongoing basis

Build leadership capability to broaden beyond technical excellence, with special focus on developing the ability to provide feedback and to coach

Differentiate technical leadership from project / program leadership, and establish / communicate a project leadership career track

Develop matrix leadership skills in program management

Enable innovation

Push decision-making to the lowest capable level

Remove obstacles to collaboration, especially across boundaries

© 2011 Hay Group. All rights reserved 32

03

Sales force compensation

“I’m from a drug company ... and

I’m here to help !”

Perceived strengths

Hay Group Managed Markets SFE research / Pharma Executive article

Account Managment Effectiveness

100%

80%

60%

40%

20%

0%

Focused on performance Creates results for customers

Strategy is understood Culture is well managed

Optimistic Confident Not sure

© 2011 Hay Group. All rights reserved 35

False confidence

Hay Group Managed Markets SFE research / Pharma Executive article

60%

Strength of Payer Relationships

Please select the best relationship you have achieved with national and regional payers

.

50%

40%

30%

20%

10%

0%

Preferred Vendor

National Payers

Value Add

Regional Payers

Trusted Advisor

© 2011 Hay Group. All rights reserved 36

Limited coverage across the healthcare ecosystem

Hay Group Managed Markets SFE research / Pharma Executive article

Neglecting New Customer Relationships

Percentage of companies that HAVE NOT attempted a B2B reltionship

Employers / Unions

Group Practices

Hospitals

Retailers

Wholesalers / Trade

0% 25% 50%

Percentage of Responses

75% 100%

© 2011 Hay Group. All rights reserved 37

Needed investments

Hay Group Managed Markets SFE research / Pharma Executive article

Gaps in Organizational Invesments

Please select the best descriptionof your priorities and investments.

100%

80%

60%

40%

20%

0%

Priority

Invesments

Important, but No

Investments

Low Priority

Critical for B2B partnerships and value creation !!

© 2011 Hay Group. All rights reserved 38

Application: a payer’s value-selling process

Brand

Integrated

Indications &

Offers

Call center support

Products

Collaborative

Research

Services

Identify opportunities

People

Develop solution

Analytic and presentation tools

Cost and

Quality

Guarantees

Pricing guardrails and oversight

Tailor value proposition

Negotiate and close

Identify client support team

Track ‘promised value’ measures

Conduct account reviews

Contract renewal tickler

Processes

Financials

© 2011 Hay Group. All rights reserved

Roles for sales and customer service

Measures, reminders and cross sells

Treatment

Compliance

Integrate with CRM

Sustain &

Grow Mutual

Market Share

39

Mutual economic impact of your investments

High

Difference

(from competitors)

$

$

Credible

Partner

$

Deal Killers

Low

$

Irrelevant

Low

Importance

(to Customers)

© 2011 Hay Group. All rights reserved

High Impact

$

High

Winners

Door Openers

40

So, what can a business-savvy commercial team do to create real customer value?

Five actions for creating value

1.

Think difference, importance and economic impact

2.

Surprise your customers with openness

3.

Measure your partnership strength

4.

Invest in leadership, teams and processes

5.

Cover the healthcare ecosystem

© 2011 Hay Group. All rights reserved 42

Top challenges

•

•

•

•

In 2011, Hay Group observed that clients focused on:

Reflecting roles

Reflecting strategy

Linking pay to organizational performance

Streamlining plans for simplicity

•

•

We did NOT see:

Routine updates of the plan

Redesigning to better reflect incumbent impact

This is reflected in the

2011 results as well.

© 2011 Hay Group. All rights reserved 43

Expectations for 2012

•

•

•

•

Based on the 2012 results, we expect that:

•

•

•

Sales compensation cost will be under increasing scrutiny

Trends in solution selling will temper leverage

Reviewing strategy and defining the implications for the sales plan will be emphasized

Traditional challenges will be addressed with broader redesign:

Goal setting

Long sales cycles

Team sales

2012 will focus on the link between growth and incentives

© 2011 Hay Group. All rights reserved 44

Rule #1: If you haven’t defined your sales roles, you can’t design sales incentives

Familiar friend

Farmer

Trusted advisor

Transactional

Field Rep

Hunter

Deal maker

Consultative

© 2011 Hay Group. All rights reserved 45

Conduct your own sales incentive and effectiveness audit

Attribute

1. Sales Strategy

Level One Questions (Triage)

Is the sales strategy clear, consistent and well understood?

2. Process Does the sales process meet business objectives and create customer value?

3. Roles &

Competencies

Are sales roles, competency models and job definitions comprehensive and actionable?

4. Size & Structure Is the sales force designed for optimal effectiveness and efficiency?

5. Motivation Are sales people motivated by an appropriate mix of incentives and rewards?

6. Management Is sales management disciplined and focused on performance?

7. Culture Is the required sales culture defined, cultivated and managed?

8. Implementation Is seamless integration achieved within sales and across functions?

© 2011 Hay Group. All rights reserved 46

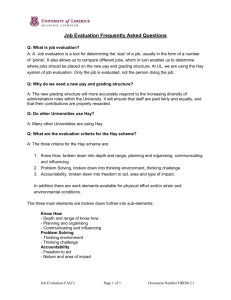

Incentive plans and metrics

Most organizations use 1-3 metrics.

The number of metrics remained consistent from last year 70% to this year 73%

Most organizations have between 1-4 sales incentive plans which are often differentiated by role

Number of different sales incentive plans

Performance metrics

11 +

14%

6-10 Plans

10%

5 Plans

6%

4 Plans

10%

3 Plans

10%

2 Plans

14%

1 Plans

36%

5 metrics

4%

4 metrics

13%

6 metrics or more

10%

1 metrics

15%

2 metrics

28%

3 metrics

30%

47 © 2011 Hay Group. All rights reserved

Eligibility and plan type

Annual eligibility

Component

Sales Representatives

Accounts Managers

Channel Managers

Inside Sales

1 st Line Sales Managers

Eligibility for plans remain high.

Chemicals and Insurance/ Financial

Services have the highest predominance of Base Salary with incentives than other sectors.

Plans for Account Managers and

Sales Reps were similar in components.

Percent of organizations offering plans

90%

73%

32%

41%

66%

Plan type

Component

Base salary with incentive tied to one or more performance metrics

Base salary with bonus (e.g. discretionary or profit-sharing)

Commission-based incentives (regardless of base salary/draw)

Other

Percent of organizations offering plans

62%

4%

27%

8%

© 2011 Hay Group. All rights reserved 48

Plan components

Plan Components

Individual Performance

District Performance

Region Performance

Subsidiary Performance

Division Performance

Corporate Performance

Team Performance

Other

Prevalence

75%

8%

8%

3%

18%

17%

16%

10%

© 2011 Hay Group. All rights reserved

100%

47%

50%

60%

45%

25%

32%

84%

Median

Value

We saw a slight dip in Individual prevalence from 82% to 75% though most organizations still make that a majority of their plan.

Other remains low in prevalence but has a high value in the plan assigned to it.

The splits between the organization level have more to do with the specific industry.

P75 Value P25 Value

100%

100%

80%

100%

80%

33%

85%

100%

60%

33%

20%

20%

20%

15%

20%

48%

49

TTC philosophy and recent payouts

Most organizations target above market performance for sales reps.

The distribution of incentives paid was fairly normal for this past year.

TTC Pay Philosophy for Sales

Reps

Below P40

0%

P40-P50

5%

P50-P60

76%

P60-P75

17%

Above P75

2%

Recent fiscal year incentives

Below Threshold

Threshold to target

Target to 1.5x target

Outstanding and above

P50 Value

5%

40%

30%

5%

P75 Value

12%

69%

55%

16%

P25 Value

0%

14%

15%

0%

Average

11%

42%

35%

12%

© 2011 Hay Group. All rights reserved 50

Common Goal-Setting Challenges

•

•

•

•

Common goal-setting challenges:

High demand volatility

Long selling cycles

Cycling

Variance across channels (heavy lifting)

© 2011 Hay Group. All rights reserved 51

High demand volatility

Many organizations – and industries – struggle with exceedingly high volatility of demand. This can frequently make it a challenge to set quality goals.

Common approach

Ranking

Strategic objectives

Rolling average

Positives

• Removes goal-setting entirely from the process

• Allows for some common sense

• Focuses more on the rational trend

Negatives

• Dilutes the link between pay and performance

• Common sense is not always that common

• Pay will lag sustained performance

– for good and bad

© 2011 Hay Group. All rights reserved 52

Long selling cycles

If the time from initiation to close is longer than the performance period of the incentive plan, it is challenging to define a goal.

Common approach

Milestones

Corporate Component

Positives

• Allows recognition of sales activities

• Many long selling cycles have significant non-selling activities.

• Measuring at a higher level reflects overall success

Negatives

• Potentially pays for activities, not end results.

• Assumes that the role is less selling and more marketing management

It is important to consider:

• The frequency of opportunities

• Where the incumbent has the most impact on the sales

53 © 2011 Hay Group. All rights reserved

Cycling

Cycling occurs when a good performance sets up bad performance and vice-versa.

Common approach

Rolling average

Individual goals

Different measures

Positives

• Smoothes variance

• Enforces ownership mentality in the territory or channel

• Focus on area where there is more impact

Negatives

• May allow for some coasting

• Requires increased planning and sales administration.

• Potential challenge for perceived plan equity.

© 2011 Hay Group. All rights reserved 54

Variance across channels

Channels are so different that some reps have a windfall, others have an unachievable target.

Common approach

Critical success factors

Differentiated measures

Positives Negatives

• Allows for flexibility within a strategic framework.

• Additional administration

• Best matches heavy lifting • Need to identify other measures.

© 2011 Hay Group. All rights reserved 55

Contact information

Susan M. Snyder, Hay Group

Senior Principal and US Director, Leadership & Talent in Life Sciences

Phone: (914) 659 - 7781

Susan.Snyder@haygroup.com

Marc Wallace, Hay Group

Vice President and US Director, Sales Force Compensation

Phone: (312) 228 - 1816

Marc.Wallace@haygroup.com

© 2011 Hay Group. All rights reserved 56

Thank you!

Susan M. Snyder, Hay Group

Senior Principal & US Director, Life Sciences Leadership &

Talent

Phone: (914) 659 - 7781

Susan.Snyder@haygroup.com

Marc Wallace, Hay Group

Vice President & US Director, Sales Force Compensation

Phone: (312) 228 - 1816

Marc.Wallace@haygroup.com