Group 1

advertisement

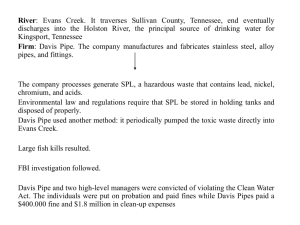

Enron: Accounting expertise to the rescue Steve Salterio Ph.D. CA Associate Professor of Assurance School of Accountancy with the assistance of the following students: Jill Considine Alan Jin Amy Kane Matt Martorello The Story Line What was Enron? Why did Enron come to prominence? What happened at Enron? What were the accounting warning signs? What does accounting research say about why they were ignored? What are the organizational impediments to leveraging expertise? Brief History of Enron 1985 - Houston Natural Gas merges with InterNorth, a natural gas company based in Omaha, Neb., to form an interstate and intrastate gas pipeline company with 37,000 miles of pipe. 1986 - Kenneth Lay is appointed chairman and chief executive officer. 1989 - Over the years, the company becomes the largest natural gas merchant in North America and the United Kingdom Brief History of Enron Aug. 2000 - Shares hit an all-time high of $90.56 Dec. 2000 – Enron announces Jeffrey Skilling (President) will take over as CEO. Aug. 14, 2001 - Skilling resigns; the company attributed his departure to “personal reasons”. Brief History of Enron Aug. 22, 2001 Sherron Watkins, a vice president, writes to CEO Lay, warning him that the company might "implode in a wave of accounting scandals." Brief History of Enron Oct. 12, 2001 David Duncan, Andersen’s audit partner in charge of Enron, says Andersen's lawyers had suddenly began emphasizing Andersen's policy allowing destruction of “unneeded” documents. Duncan organizes a two-week document destruction effort to discard many records. Oct. 16, 2001 - Enron reports its first quarterly loss in over four years after taking charges of $1 billion on “poorly performing businesses”. Where did the billion go? The Raptors partnerships Enron gave a related party called “Raptor” 3.7 million shares of Enron common stock Enron received $1.2 billion in notes receivables IOU’s from a company Enron owned Enron called this income! Andersen’s Duncan accepts this accounting in 2000 and 2001 over the objections of Andersen’s technical accounting partners Cash Asset 3% Cash Guarantee Cash Asset Guarantee < 3% Cash Transactions Source: WSJ, 1/21/02 Then what happened? 12-2-01 – Enron files Ch. 11 bankruptcy 01-09-02 -- Justice Department opens a criminal investigation 01-10-02 – Andersen admits Houston office shredded documents 01-17-02 – Enron fires Andersen 01-25-02 -- Enron Vice Chairman commits suicide 02-02 David Duncan, Andersen auditor in charge of Enron audit, is charged with obstruction of justice Then what happened? 03-02 Andersen firm is charged with obstruction of justice 04-02 David Duncan plea bargains for a reduced sentence in return for implicating the entire Andersen firm in the obstruction of justice charge 06-02 Andersen is found guilty of obstruction of justice and ends the 89 year practice of auditing. Dispelling Accounting Myths 1. Auditors create financial statements. WRONG 2. There is a comprehensive accounting rule book – you just have to look up the right answer. WRONG 3. There is no judgment in accounting. WRONG 4. The auditor is a independent third party. IT DEPENDS HOW YOU LOOK AT IT How do auditor’s deal with difficult accounting issues? By definition, you can’t look up a rule Consult others on the audit team others in your office others auditing in the same industry in other offices All this consultation is mediated by computer data bases, electronic mail and expert systems that collect data “just in case” Finally consult national office technical “gurus” Accounting research: Based on Naturalistic Decision Making Theory Situation assessment stage Searching data bases for prior similar cases where the facts are roughly the same to current case External data bases Firm specific data bases Can be considered an information search task Two units: Central Research Unit (Salterio 1994, 1996) Accounting Consultation Unit (Salterio and Denham 1997) Accounting Expertise Measures: CRU’s Examine managers who interface with computer system to advise audit partners about appropriate accounting policies. Effectiveness measures (Table 2, Salterio 1996) over six month “tour of duty” managers Increase number of “on point” findings from 4.26 per case to 7.63 per case (66% increase) Review time (e.g. quality control) decreases 0.93 to 0.68 (33% decrease) Number of reviewer enquiries decreases Accounting Expertise Measures: CRUs Efficiency measures (Table 3) Time employed by managers to Search strategy of managers Search computer data bases on line decreased by 2.5 minutes Total time to perform research reduced by .7 hour More complex search using more Boolean operators per search Number of potential precedents examined Total number of precedents increase 12.5 Average number of precedents increase 3.3 CRU Research conclusions Salterio (1996) shows that in searching for “precedents” used by local offices there is a significant expertise effect for those located in the Central Research Unit for six months Think about the amount of expertise gained through years of national office residency that partners in the Accounting Consultation Unit gain Accounting Consultation Units Salterio (1994, 1996) done in US Salterio and Denham (1997) done in Canada but strong analogy can be made to US setting (and most of the research was repeated in US environment) Was not allowed to study Andersen, the only member of the then “Big 6” firms to refuse to participate Organization Memory Theory OM is composed of the individual memories of firm members plus the firm’s standard operating procedures (SOP’s), organizational structure and organizational culture as well as any internal and /or external archives (data bases) SOP’s are embedded both in human routines as well as computer systems OM Theory: Discovering organizations 2 Canadian firms (and all US firms studied) are classified as discovering organizations: Ability to scan the environment Customer focus Audit office client is focus hence understanding business reason for issue is key Search processes employed Resources – both people and data high Informal and formal searches made utilizing all resources available Goal to come up with “best” answer that complies with GAAP OM Theory: Discovering organizations Firm wide peer review looks for: Consultations that should have been made even if not mandatory by firm policy. Consistency across clients was “gold standard” Emphasis on early consultation Standard operating policies An objection by the ACU partner to the accounting desired by the local office partner (and called for by the client management) must be reported on and judged by the senior managers of the audit firm. Almost never was an ACU position overruled. Remember, the only Big 6 firm I was unable to get assess to was Andersen (see 3rd page (674) of Salterio and Denham (1997)). Andersen’s Professional Standards Group Until roughly 1990 Andersen had followed similar practices to other Big 6 firms A very strong and powerful national office technical group If anything, they were the most conservative auditors of all of the Big 6 In early 1990’s Andersen changed its policy to help local office partners obtain new business Indeed it was a “selling point” at Andersen Andersen’s Professional Standards Group Objects to Enron 1999 Carl Bass repeatedly objects to early Enron accounting for the various partners (i.e. the Raptors) his objections continued in 2000 His continual objections caused Duncan (at the behest of Enron) to ask Andersen’s national office to remove Bass. National office accepted his request and transferred Bass. Andersen’s SOP Limits Professional Standards Group Unlike the other firms, the local office partner (i.e. Duncan) could overrule the technical partner (i.e. Bass) by reference to the practice director in his own office. Overruling does not have to be referred to Andersen’s CEO and executives as in other audit firms. Business Week highlighted this practice difference in its coverage of Enron in early 2002 If Andersen had followed others’ SOPs? Senior Andersen managers would have been in the decision making loop in 1999. Rarely do senior audit firm managers overrule technical partners in other firms. Enron’s initial rogue accounting could have been stopped in 1999!!!! Lack of expertise was not the reason Andersen failed in its audit responsibility!!!! Could Andersen have prevented Enron’s implosion? Maybe not, but the accounting might not have been used to prolong the life of Enron. Enron might have had difficulty surviving if the correct accounting had been done in 1999. Early discovery could have prevented many of the transactions that were entered into in 2000 and 2001 that caused the vast majority of the losses. Academic research to the rescue??? Well maybe not, . . . . . But, what if I had been able to get into Andersen in 1996-97? Would they have listened to the finding that they were an outlier among their peers? Some interesting evidence: In Canada, one of the conditioned learning firms moved to the discovery mode after my research was made public. The mixed firm has also moved strongly to a discovery mode. Leveraging expertise Andersen had: state of the art computer technology, computer systems and people to operate and develop the technology cutting edge technology which it applied to both manage the individual audit and to manage the firm as a whole. some of the best minds in accounting industry were located in their Professional Standards Group and were supported with state of the art technological and systems resources Leveraging expertise but the firm’s organizational memory was set up in such a fashion that the experts and their support systems were used to support marketing the firm instead of ensuring the highest quality accounting experts, expert systems and technology without assess to managerial power to prevail can result in the same decisions that would be made in the absence of such expertise.