Document, Document, Document and Other Medicare Myths

advertisement

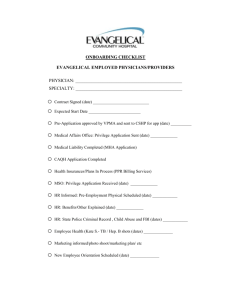

Document, Document, Document: “If it isn’t written it wasn’t done” and other Medicare Myths Presented by David M. Glaser, Esq. Fredrikson & Byron, P.A. (612) 347-7143 dglaser@fredlaw.com Gregory J. Warner Compliance Officer Mayo Foundation (507) 284-9029 gwarner@mayo.edu Our Agenda: Dispelling These Myths: • “If it isn’t written, it wasn’t done.” • “The carrier has total authority to determine medical necessity.” • “Reassignment violations are fraud.” • “NPs and PAs can’t bill high level visits.” • “Incident to services must be billed by the supervising physician.” • “All physician notes must be signed.” We will also discuss common misperceptions related to: • • • • Consultations. Preventive medicine. Teaching physician rules. Determining the date to refund overpayments. Separating Fact From Fiction • McCarthyism is alive and well, and living in the health care industry. • Carriers, consultants, clients and counselors are often guilty of mistakenly believing some policy or conventional wisdom is based in law. • Sometimes, they’ll use interesting techniques to change behavior. Question Authority • Is it a requirement or a guideline? • Medicare -- ask if it is in the statute, regulations, Medicare Carriers Manual, or carrier policy. • Get a copy of the rule in writing. • Ask your lawyer/consultant to explain all arguments supporting and refuting their position. • Determine if the rule was properly promulgated. • Just because they sound smart doesn’t mean they’re right. Scenario 1 • A physician saw 1700 patients, you have charts for 1200. The physician has some “seat of the pants” notes for some of the remaining patients scribbled on the backs of scratch paper. • You compare your charts against the documentation guidelines and discover the following: Audit Results Dr. A Dr. B Dr. C Dr. D Dr. E Under-coded Correctly-coded Over-coded 13% 50 15 0 33 76% 30 50 19 33 11% 20 35 81 33 “If it isn’t written, it wasn’t done.” • Good advice, but not the law. • Medicare payment is determined by the content of the service, not the content of the medical record. • The documentation guidelines are just that: guidelines (although the carrier won’t believe that). “If it isn’t written, it wasn’t done.” • Carriers typically point to Social Security Act Section 1833(e), which they often cite incorrectly as 1833(d)(1)(e) as support for their position. Role of Documentation: The Law • “No payment shall be made to any provider of services or other person under this part unless there has been furnished such information as may be necessary in order to determine the amounts due such provider or other person under this part for the period with respect to which the amounts are being paid or for any prior period.” Social Security Act §1833(e) Role of Documentation: The Cases • Carriers also often cite Anesthesiologists Affiliated v. Sullivan, 941 F.2d 678 (8th Cir. 1991). • In that case, the court rejected the defendant’s argument that even if the clinic made billing errors they were “merely a matter of unartful description of the services it provided.” Role of Documentation: The Cases • This situation is distinguishable from E&M cases because the anesthesiologists’ defense was even if they did not provide services as claimed, they provided other reimbursable services. • In short, that is a case where the bill does not accurately describe the work done. • In most E&M cases, the bill describes the work done, there is simply a lack of documentation. Role of Documentation: The Cases • A much better analysis is United States v. Krizek, 859 F. Supp. 5 (D.D.C 1994), 909 F.Supp. 32 (D.D.C. 1995, rev’d in part and aff’d in part 111 F.3d 934(D.C. Cir. 1997) The documentation in this case was “seriously deficient.” The court presumed certain work was done, despite a lack of documentation. • But See U.S. ex rel Semtner v. Medical Consultants, Inc., 170 F.R.D. 490 (1997). Role of Documentation: Interpretation • Common Sense – Fire – Scenario 2 • Regardless of any case law, the regulatory framework is quite clear. • The Code of Federal Regulations contains no general documentation requirements. 42 C.F.R. 4245 requires physicians to furnish “sufficent information.” (There are specfic requirements for teaching services.) Role of Documentation: Guidance from HCFA • The CPT Assistant explains: “it is important to note that these are Guidelines, not a law or rule. Physicians need not modify their record keeping practices at all.” CPT Assistant Vol. 5, Issue 1, Winter 1995 • HCFA has publicly stated that physicians are not required to use the Documentation Guidelines. Role of Documentation: Guidance from HCFA “Documentation Guidelines for Evaluation and Management Services Questions and Answers These questions and answers have been jointly developed by the Health Care Financing Administration (HCFA) and the American Medical Association (AMA) March 1995. 1. Are these guidelines required? No. Physicians are not required to use these guidelines in documenting their services. Role of Documentation However, it is important to note that all physicians are potentially subject to post payment review. In the event of a review, Medicare carriers will be using these guidelines in helping them to determine/verify that the reported services were actually rendered. Physicians may find the format of the new guidelines convenient to follow and consistent with their current medical record keeping. Their usage will help facilitate communication with the carrier about the services provided, if that becomes necessary. Varying formats of documentation (e.g. SOAP notes) will be accepted by the Medicare carrier, as long as the basic information is discernible.” Role of Documentation “6. How will the guidelines be utilized if I am reviewed by the carrier? If an evaluation and management review is indicated, Carriers will request medical records for specific patients and encounters. The documentation guidelines will be used as a template for that review. If the documentation is not sufficient to support the level of service provided, the Carrier will contact the physician for additional information.” Role of Documentation: Guidance from HCFA • Documentation is relevant only if there is doubt that the services were truly rendered: “7. What are my chances of being reviewed? Review of evaluation and management services will only occur if evidence of significant aberrant reporting patterns is detected (i.e., based on national, carrier or specialty profiles). Our reviews are conducted on a ‘focused’ basis--there is no random review.” Role of Documentation: Guidance from HCFA • The MCM confirms that documentation is relevant only when there is doubt services were really provided. MCM § 7103.1(I) says an overpayment exists if the “Physician Does Not Submit Documentation to Substantiate That He Performed Services Billed to Program Where There is Question as to Whether They Were Actually Performed . . .” (bold added). • The MCM does not articulate any documentation obligation, with the exception of the TPR. Role of Documentation: Interpretation • MCM Section 15501.B requires carriers to “instruct physicians to select the code for the service based upon the content of the service.” • Instructions from many carriers specify that physicians, not their office staff, are to select the code. For example, a Travelers Medicare Bulletin read: Role of Documentation: Travelers Medicare Bulletin • “Physician involvement in code selection--E&M Codes were designed to encourage physicians to become more closely involved in coding. Since office staff are not normally able to assess the differences in the amount or intensity of work associated with each encounter and since the physician is responsible (financially and legally) for submitted claims, it is essential that the physician actually code for the services provided.” (Underlining in original.) Role of Documentation: OIG Interpretation • The OIG agrees: “accurate coding is achieved when physicians select codes which consistently fit the services physicians actually provided.” OIG Report Number OEI-04-92-01060, Physician Use of New Visit Codes, May 1995. Role of Documentation: Interpretation HCFA has taken a similar position: “Although good documentation can establish the medical necessity and good quality of care for a procedure, it is not necessarily true that poor documentation proves that the medical necessity for a procedure was not present or that poor quality of care was rendered.” OIG Report Number OEI-07-91-00680, Physician Office Surgery, June 1993, Medicare and Medicaid Guide (CCH) ¶ 41, 497, page 36063. Choosing a Code • Time is irrelevant unless 50% of the time is counseling or coordination of care and that is documented coordination of care. • History, exam, decision making. • Documentation for risk management and billing are related, not identical. Role of Documentation: The Bottom Line • Good advice, but not the law. • Poor documentation increases the difficulty of prevailing in an audit. • As of now, the carriers are instructed to use both the 1995 and the 1997 Guidelines, choosing the result most favorable to the physician. • “If it isn’t a rule, it isn’t an overpayment.” Audit Review Results - What Do They Mean? Documentation Documentation Documentation Does Not Exceeded Code Supports Code Support Code Under coded Correctly coded Over coded Dr. A Dr. B Dr. C Dr. D Dr. E 13% 50 15 0 33 76% 30 50 19 33 11% 20 35 81 33 Common Dilemma: Should We Quantify Exposure • The government may use it against you. • It is an effective method of convincing skeptics. Common Dilemma: Should We Quantify Exposure • If you do it, include a disclaimer like “our chart reviews are not audits designed to determine whether we have been overpaid or underpaid. First, they are not a statistically valid sample. Moreover, they only review the documentation, without attempting to determine the amount of work you actually performed. Therefore, these figures are far from scientific. Common Dilemma: Should We Quantify Exposure However, since a Medicare review would base the initial overpayment determination solely on the documentation, these figures give you some idea of how your charts would fare in the first phase of a Medicare review.” Common Dilemma: Retrospective vs. Concurrent Reviews • Consultants/Lawyers argue duty to refund mandates concurrent reviews. • This logic seems flawed. • Anecdotal evidence suggests concurrent reviews are more effective. Scenario 2 • The president of your group is very productive. One day, a patient calls and complains she was billed for a complete physical, but she never removed any clothes. A review of that physician’s appointment book reveals that the physician worked from 9-3, took lunch, and saw 67 patients, 6 of which were billed as comprehensive physicals. The documentation supports all but 5 of the visits. (There is a comprehensive physical documented for the woman who called.) Scenario 3 • One of your physicians likes to perform thorough exams of patients. The carrier medical director feels that the exams could have been more cursory, and denies the exams as being not medically necessary. “The Carrier Has Total Authority to Determine Medical Necessity.” • While carriers like to believe this, many courts have adopted the “treating physician rule.” • The theory is that the patient’s physician is objective. Therefore, the physician’s opinion receives deference. • Medicare’s legislative history supports this argument. “The Carrier Has Total Authority to Determine Medical Necessity.” “It is a well-settled rule in Social Security Disability cases that the expert medical opinion of a patient’s treating physician is to be accorded deference by the secretary and is binding unless contradicted by substantial evidence… This rule may well apply with even greater force in the context of Medicare reimbursement. The legislative history of the Medicare Statute makes clear the essential role of the attending physician in the statutory scheme; ‘the physician is to be the key figure in determining utilization of health services.’” Gartmann v. Security of the U.S. Department of HHS, 633 F.Supp. 671, 680-681(E.D. N.Y. 1986). “The Carrier Has Total Authority to Determine Medical Necessity.” • A carrier is expected to place “significant reliance on the informed opinion of the treating physician” and to give “extra weight” to the treating physician’s opinion. Baxter v. Sullivan, 923 F.2d 1391, 1396 (9th Cir. 1991). “The Carrier Has Total Authority to Determine Medical Necessity.” • MCM § 7300.5.B forbids carriers from recouping an overpayment on the basis of a lack of medical necessity if a situation is ambiguous enough that the carrier requests its own physician consultant to review whether the services are covered. • This should place the burden of proof on a carrier during an appeal. • It provides a firm ground for challenging the carrier’s arguments that office visits can be denied as not medically necessary. Scenario 4 • You have a new doctor join the staff. The billing staff, recognizing that it takes 6 months to get a provider number, simply use a recently departed physician’s number while waiting for the new number to arrive. “It Is Fraud to Violate the Reassignment.” • Half myth, half truth. • Reassignment in a nutshell: Only the person performing a service can bill for it. • The reassignment rules create exceptions allowing other organizations to bill for a physician’s service. Technically, these exceptions apply only to physicians and suppliers of services. Reassignment Violations Don’t Create an Overpayment • At least one false claim complaint (U.S. ex. rel Semtner v. Medical Consultants, Inc.) has included counts based on reassignment violations. However, that complaint ignores a key fact. • MCM 3060.D says a violation of the reassignment rules does not create an overpayment. MCM 3060.D • “An otherwise correct Medicare payment made to an ineligible recipient under a reassignment or other authorization by the physician or other supplier does not constitute a program overpayment. It does allow revocation of assignment. MCM 3060.D (cont.) Sanctions may be invoked under §3060.13 against a physician or other supplier to prevent him from executing or continuing in effect such an authorization in the future, but neither the physician or other supplier nor the ineligible recipient is required to repay the Medicare payment.” Reassignment Violations Don’t Create an Overpayment • The question is whether a claim can be false even when it does not result in an overpayment. Courts have differed on that question. • U.S. ex rel. Schumer v. Hughes Aircraft Company, 63 F.3d 1512, 1525 (9th Cir. 1995) and U.S. v. Kensington Hospital, 760 F. Supp. 1120, 1127 (E.D. Pa. 1991) allow the government to penalize claims even without proof of damages. Reassignment Violations Don’t Create an Overpayment • By contrast, Stinson v. Provident Life & Accident Ins. Co., 721 F. Supp. 1247, 1258-59 (S.D. Fla. 1989) and Young-Montenay, Inc. v. U.S., 15 F.3d 1040 (Fed. Cir. 1994) hold that absent damages, false claims penalties are inappropriate. • Even most courts that don’t require specific proof of damages require some impact on the Federal Treasury. Scenario 5 • An oncologist documents a consult as “Ms. Patient was referred to me by Dr. Smith to manage her colon cancer.” At the initial visit, the oncologist begins a course of chemotherapy. The oncologist mails a copy of his chart notes back to Dr. Smith with a brief cover letter thanking Dr. Smith for the referral. “It’s not a consult if you assume care of the problem.” • Key test: is there a transfer of care. A transfer is the shift in responsibility for the patient’s complete care to the receiving physician at the time of the referral, where the receiving physician documents approval of care in advance. • Consultants may initiate diagnostic and therapeutic services after the initial or a subsequent visit. “If the chart says referral, it can’t be a consult.” • The use of the word “referral” should be discouraged, because it is misleading, but its presence does not change the reality of the visit. • Determine whether a physician is seeking an opinion or advice regarding a specific problem. Is it a Consult or Visit? • “A request for a consultation . . . and the need for consultation must be documented in the patient’s medical record.” MCM 15506.D. • A written report must be provided to the referring physician. This can be a letter or communication via the chart. (What about a carbon copy?) Is it a Consult or Visit? • Any subsequent visit (i.e., not something to complete the initial consultation) is an established patient or SH visit. • Can have a consultation within a group if the consultant is in a separate specialty. • Don’t forget -- Need all three key components: history, exam and medical decision-making. Is it a Consult or Visit? • Consultation for pre-operative clearance: Medicare pays the appropriate consultation code for a pre-operative consultation for a new or established patient performed by any physician at the request of a surgeon, as long as all of the requirements for billing the consultation codes are met. • These rules only apply to Medicare. For all other payors, rely on the CPT definition. Scenario 6 • You have a OB/GYN NP who sees patients referred in from Internal Medicine physicians. She has been billing the visits as consultations. “NPs and PAs Can Not Bill for a Consultation.” • HCFA spokespeople, and most carriers say that nurse practitioners and physician assistants can not bill for a consultation. • This disregards the language in MCM 15501.G that suggests that PAs, NPs, CNSs and midwives can perform any service in CPT codes 99201-99499 when performed incident to a physician’s services. MCM § 15501.G “Services Furnished Incident To Physician’s Service By Nonphysician Practitioners-Advise physicians when evaluation and management services are furnished incident to a physician’s service by a nonphysician practitioner who meets the criteria in §§ 2154, 2156, 2158 or 2160, the physician may bill the CPT code that describes the evaluation that service furnished. MCM § 15501.G (cont.) When evaluation and management services are furnished incident to a physician’s service by a nonphysician employee of the physician, not as part of a physician service, and the employee does not meet the criteria in §§ 2154, 2156, 2158 or 2160, the physician bills code 99211 for the service.” “NPs and PAs Can’t Bill a Level 4 or a Level 5.” • HCFA spokespeople and carriers have often said that NPs and PAs can not perform complex medical decision making, and therefore can not bill any high level visit. • No authority is cited for that proposition. • Even if they can not perform high level decision making, NPs and PAs can do comprehensive H & Ps, allowing high level established patient visits. “NPs and PAs must bill exclusively independently or ‘incident to.’” • As long as you meet the requirements for billing “incident to” you can bill “incident to” and get paid 15% more, even if you have an independent number. • Know the “incident to” requirements, including: – W-2 or leased employee relationship. – Initial and ongoing contact with a clinic MD. – MD supervision in the office suite. – The service can not be in a hospital/SNF A good lesson • Sometimes professional and other associations have an agenda, and may inadvertently mischaracterize a legal situation. Beware. “‘Incident to’ Services must be billed under the Supervising Physician” • There is no national guidance stating whose UPIN should be on the claim. I prefer billing under the attending physician’s number, but either approach seems defensible. MCM 2050.3 • “In highly organized clients, particularly those that are departmentalized, direct, personal physician supervision may be the responsibility of several physicians as opposed to an individual attending physician. In this situation, medical management of all services provided in a clinic is assured. A physician ordering a particular service need not be the physician who is supervising the service. Therefore, services performed by therapists and other aides are covered even though they are performed in another department of the clinic.” Scenario 7 • You have been providing routine screening exams to patients, and billing them to Medicare with a proper “V” diagnostic code to get a denial. You discover Medicare has been paying the claims. You also discover that you have not received an ABN from the patient. Senario 8 • My grandmother, who has high blood pressure, diabetes, and a host of other conditions she loves to mention, calls and schedules an “annual physical.” Preventive Medicine • This is one of the most confusing coding issues. • Split billing is the answer. • The covered visit is provided in lieu of part of the preventive medicine’s service of equal value to the visit. The physician may charge the beneficiary the difference between the physician’s current established charge for the preventive medicine service and the established charge for the covered visit. MCM § 15501.E Screening • There could be covered and non-covered procedures performed during an encounter. Consider each test individually. Procedures which are for screening for asymptomatic conditions are non-covered; those ordered to diagnose or monitor a system, medical condition or treatment are “evaluated for medical necessity and, if covered, are paid.” Modifier 32. “You Can’t Bill Without a Waiver.” • Legally, a physician is not required to give a beneficiary advanced written notice that the preventive visit is uncovered. However, the physician is responsible for notifying the patient in advance of his/her liability for charges for services that are not medically necessary to treat the illness or injury. “You Can’t Bill Without a Waiver.” • Technically, it is better to refer to them as an advanced beneficiary notice. • ABNs are only required when an otherwise covered service is considered not medically necessary. • If the law excludes a service, no waiver is required. • That said, waivers are an excellent patient relations tool. “All charts must be signed.” • Carriers/consultants often claim that signatures are required. • There is no rule requiring signatures for clinic services. • Conditions of participation for hospitals/other facilities may require signatures in the chart; COPs are different from reimbursement rules. Scenario 9 • A teaching physician is involved in three different procedures at the same time. The key portions of the three procedures do not overlap. The Conflict: Regs vs. Manual • MCM 15016 says: “In order to bill for two overlapping surgeries, the teaching surgeon must be present during the key portions of both operations. In the case of three concurrent surgical procedures, the role of the teaching surgeon (but not anesthesiologist) in each of the cases is classified as a supervisory service to a hospital rather than a physician service to an individual beneficiary and is not payable under the Medicare fee schedule.” The Conflict: Regs vs. Manual • The rules have no comparable limitation. 42 CFR § 415.172 says: “In the case of surgical, high risk, or other complex procedures, the teaching physician must be present during all critical portions of the procedure and immediately available to furnish services during the entire service or procedure.” “Teaching Physician Rules Only Apply in Academic Centers.” • Determine if independent billing is possible: – Is the individual in an approved residential program? – Does the time count toward their graduation requirements? – Is the service in a hospital or a clinic? • Be particularly careful with fellows. “Teaching Physician Rules Only Apply in Academic Centers.” • Understand the teaching physician rules. For E & M services the attending physician must either: – Be present while the resident performs the service; or – Personally perform the key components of the service. • The documentation must reflect the teaching physician’s role. “All Billing Errors Are Fraud, So They Should be Reported to The OIG Using the Self-Disclosure Protocols.” • Take the government at its word; distinguish between “fraudulent” (intentionally or reckless false) and innocent “erroneous” claims. The Draft Compliance Program Guidance repeats Janet Reno’s quote that “we are not seeking to punish someone for honest billing mistakes.” • If someone wasn’t trying to take advantage of the system, I wouldn’t label the conduct as fraudulent. Scenario 10 • Your cardiologists has rounded on a patient following cardiac surgery. The cardiac surgeon has been following the patient throughout the stay. The cardiologist has billed subsequent hospital visits. “Only one physician can provide hospital care.” • Carriers are told “if the services of a physician other than the surgeon are required during a post operative period for an underlying condition or medical complication, the other physician reports the appropriate evaluation and management code. No modifiers are necessary on the claim. An example is a cardiologist who manages underlying cardiovascular conditions of a patient.” MCM § 4822. Calculating Voluntary Refunds • One of the most common questions when refunding money is “how far back should I go.” • First, determine when the relevant rule was promulgated. Don’t refund before you were reasonably on notice. How Far Back Do You Go? • The False Claims Act – Six years. – Three years from the date when “facts material to the right of action are known or reasonably should have been known” by the United States, but no more than ten years after the violation. • Waiver of overpayments when “without fault” and recovery violates equity and good conscience. The Law: 42 U.S.C. §1395gg(c) • There shall be no adjustment as provided in subsection (b) (nor shall there be recovery) in any case where the incorrect payment has been made (including payments under section 1814(e)) with respect to an individual who is without fault or where the adjustment (or recovery) would be made by decreasing payments to which another person who is without fault is entitled as provided in subsection (b)(4), if such adjustment (or recovery) would defeat the purposes of Title II or Title XVIII or would be against equity and good conscience. Adjustment or recovery of an incorrect payment (or only such part of an incorrect payment as the Secretary determines to be inconsistent with the The Law: 42 U.S.C. §1395gg(c) (Cont.) purposes of this Title) against an individual who is without fault shall be deemed to be against equity and good conscience if (A) the incorrect payment was made for expenses incurred for items or services for which payment may not be made under this Title by reason of the provisions of paragraph (1) or (9) of section 1862(a) and (B) if the Secretary’s determination that such payment was incorrect was made subsequent to the third year following the year in which notice of such payment was sent to such individual; except that the Secretary may reduce such three-year period to not less than one year if he finds such reduction is consistent with the objectives of this Title. (citations omitted) Carriers/Intermediaries Always Believe You are at Fault • “The law prescribes special rules when an overpayment is discovered (i.e., it is determined that a payment was incorrect) subsequent to the third calendar year after the year in which it was made. Under these rules, deem an overpaid physician without fault without further development in the absence of evidence to the contrary, i.e., if there is no indication that the physician was at fault. Where the beneficiary was liable, HCFA waives recovery from the beneficiary if he was without fault. Carriers/Intermediaries Always Believe You are at Fault (Cont.) (This provision provides limited relief to physicians since, in most cases, the facts which bring to light the overpayment are sufficient basis for determining whether the physician was at fault.) Do not deem a physician without fault under this provision with respect to overpayments for noncovered services which are part of a pattern of billing for similar services. In such cases, initiate necessary development to establish whether the physician was without fault.” Medicare Carriers Manual Section 7106. Limitation on Reopening Claims • Both the Medicare Intermediary Manual and the Carriers Manual indicate that claims may only be reopened after 48 months when there is evidence of “fraud or similar fault.” • “Fraud or similar fault” requires some intentional wrongdoing. Fraud or Similar Fault • Deception by a person who knows that the deception may result in authorized benefits to someone; • An act which approximates fraud, i.e., the furnishing of information which the individual knows is incorrect or incomplete, or the deliberate concealment of information, with or without a judicial finding of fraud; • A pattern of program abuse by physicians or suppliers resulting from practices that are inconsistent with accepted sound fiscal, business, or medical practice, such as: Fraud or Similar Fault (Cont.) – The furnishing of services that are in excess of the individual’s needs, or of a quality that does not meet professionally recognized standards of health care; or – The submittal of incorrect, incomplete or misleading information that results in payment for services: • That were not furnished; • More expensive than those furnished; or • That were not furnished under the conditions indicated on the bill. Fraud or Similar Fault (Cont.) – The submittal of, or causing the submittal of, bills or requests for payment containing charges for Medicare patients that are substantially in excess of the amounts the physician or supplier customarily charges; – An act or pattern of program abuse involving collusion between the supplier and the recipient that results in higher costs or charges to the Medicare program; or – Any act that constitutes fraud under Federal or State law. Fraud or Similar Fault (Cont.) • A Determination that “Fraud or Similar Fault” is present depends on the facts. For example, a claim may be reopened more than 4 years after payment was approved, if the evidence establishes a pattern of billing by a physician for weekly routine visits to patients in a nursing home for whom, under established standards of good medical practice, not more than one visit a month is medically reasonable and necessary.