How Markets Work

advertisement

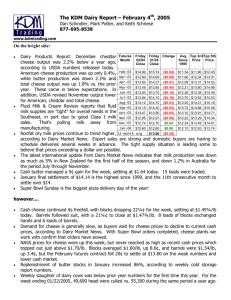

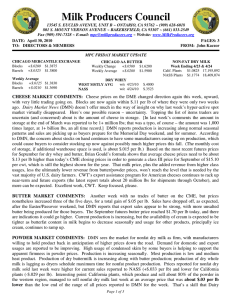

How Markets Work ECO 285 - Dr. D. Foster Three (Economic?) Questions: 1. What to produce? 2. How to produce? 3. For whom to produce? We must decide! Scarcity Choices Costs Consider the market for gasoline… Price Supply Pe = $3 Demand Quantity Qe How does this help us to answer the what, how & for whom questions? Markets prices = signals Serves to reward producers for fulfilling our desires. Forces consumers to conserve on the consumption of goods (and services, and resources . . .). Adam Smith “It is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from their regard to their self interest. We address ourselves, not to their humanity, but to their self-love, and never talk to them of our necessities, but of their advantages.” Prices … are a rationing device! When a good is increasingly scarce, its price rises and we are forced to reduce consumption. Equally? Of course not! How else to ration? First come, first served? Brute force? Discrimination? Equal portions? [Marxist? No!] Scenario: Kuwait falls into the Gulf. New S $10.50 S $5.00 $3.00 D Q1 Q2 Q3 Quantity How do suppliers react to the P=$5 ? How do consumers react to the P=$5 ? What if we fix prices (a ceiling) at $3.00 ? In the long run, we expect that producers will search for and find additional supplies, Q and P. What will be said if P=$5? Markets don’t work! Prices are not fair! These prices are outrageous! This is an example of price gouging! This is an indictment against greedy sellers! All are incorrect/meaningless: $5 is an equilibrium price what it takes to allocate this scarce resource! Macro lesson – The Law of Unintended Consequences Dairy Price Supports Began during G. D. of 1930s. 1981 - cheese giveaway. 1983 - $1 billion to “retire” 10,000 dairy cows. No effect. 1986 - $1.3 billion to slaughter dairy cows. No effect on milk, but on beef . . . 1991 - USDA buys butter at $1/lb. to sell abroad at 60 cents/lb. 1996 - Congress approves cartel in New England to raise milk prices 21%. 1999 - Milk price calculation simplified . . . Macro lesson – The Law of Unintended Consequences Dairy Price Supports Basic Formula Price (BFP) = last month's average price paid for manufacturing grade milk in Minnesota and Wisconsin + [current grade AA butter price X 4.27 + current non-dry milk price X 8.07 - current dry-buttermilk price X 0.42] + [current cheddar cheese price X 9.87 + current grade A butter price X 0.238] - [last month's grade A butter price X 4.27 + last month's nondrymilk price X 8.07 + last month's dry-buttermilk price X 0.42] - [last month's cheddar cheese price X 9.87 + last month's grade A butter price X 0.238] + (present butter fat - 3.5) X [current month's butter price X 1.38] - [last month's price of manufacturing grade milk in MinnesotaWisconsin X 0.028]. Macro lesson – The Law of Unintended Consequences Dairy Price Supports Lessons? Plenty of them . . . Cost to consumers of higher prices: Butter = 2*ROW, Cheese = 1.5*ROW, Milk=1.26*ROW Cost to taxpayers for dairy subsidies: 0 to $2.6 billion, depending on market conditions. Health harm - more expensive for poor and elderly to get calcium. No incentive to innovate in U.S. dairy industry (New Zealand milk is produced at about half our cost). Since 1930, the number of dairy farmers have declined by 95%. How Markets Work ECO 285 - Dr. D. Foster