Outline for

advertisement

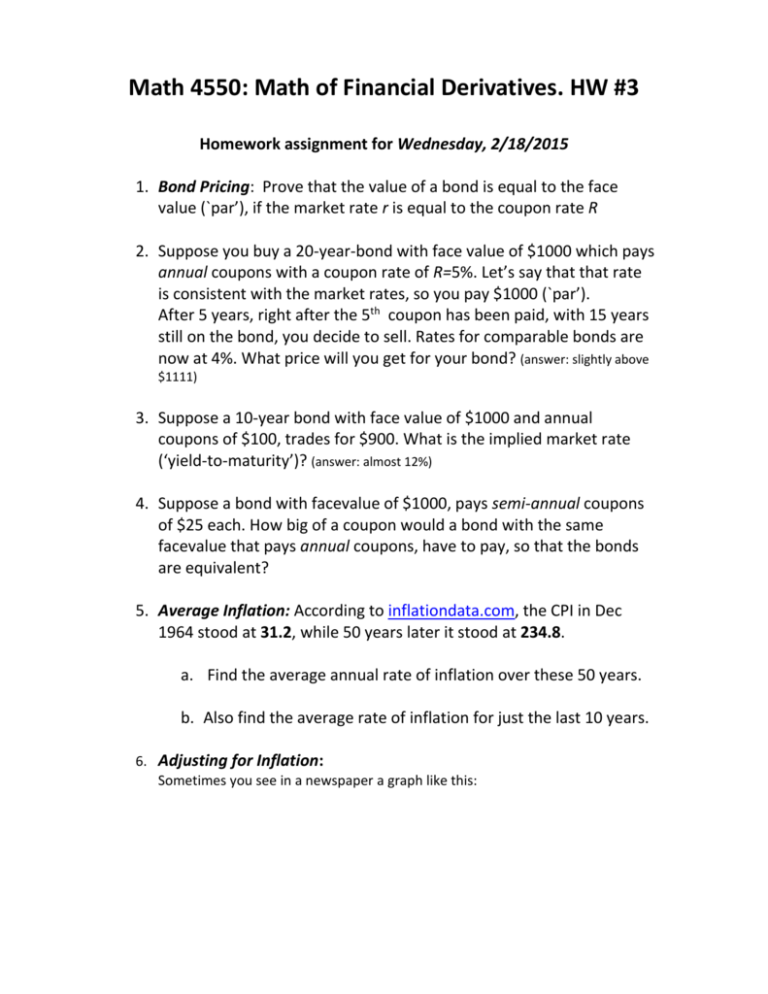

Math 4550: Math of Financial Derivatives. HW #3 Homework assignment for Wednesday, 2/18/2015 1. Bond Pricing: Prove that the value of a bond is equal to the face value (`par’), if the market rate r is equal to the coupon rate R 2. Suppose you buy a 20-year-bond with face value of $1000 which pays annual coupons with a coupon rate of R=5%. Let’s say that that rate is consistent with the market rates, so you pay $1000 (`par’). After 5 years, right after the 5th coupon has been paid, with 15 years still on the bond, you decide to sell. Rates for comparable bonds are now at 4%. What price will you get for your bond? (answer: slightly above $1111) 3. Suppose a 10-year bond with face value of $1000 and annual coupons of $100, trades for $900. What is the implied market rate (‘yield-to-maturity’)? (answer: almost 12%) 4. Suppose a bond with facevalue of $1000, pays semi-annual coupons of $25 each. How big of a coupon would a bond with the same facevalue that pays annual coupons, have to pay, so that the bonds are equivalent? 5. Average Inflation: According to inflationdata.com, the CPI in Dec 1964 stood at 31.2, while 50 years later it stood at 234.8. a. Find the average annual rate of inflation over these 50 years. b. Also find the average rate of inflation for just the last 10 years. 6. Adjusting for Inflation: Sometimes you see in a newspaper a graph like this: where raw (`nominal’) prices (i.e., the original prices at the time, here in black) of a commodity is contrasted with those prices adjusted for inflation (here in red). This makes comparisons over time more true, and puts those `good old days’ of 25c-hamburgers and 50c-gas in perspective. a. I would like you to create a similar graph for a commodity of your choosing (oil, gold, wheat, coffee, whatever). To do this, first get monthly raw data for the commodity over whatever time period you can get (at least 30 years). (I have several useful links on my web site. The best is probably the site of the World Bank. Then use the monthly CPI data from inflationdata.com, to calculate inflation-adjusted prices, and display both in one graph. You will need to do that in a spread sheet: so download (or copy) the inflation data into a column, and download the commodity data in another column, and then figure out the adjustment formula for each month. Annotate the graph as in the picture above. b. Do the same for the federal minimum wage from its inception in 1938 (when it was $.25) until today. That is, graph the actual wage, as well as the wage adjusted for inflation. The best site for raw data is http://www.dol.gov/whd/minwage/chart.htm When was the minimum wage the lowest, and when was it the highest, after adjusting for inflation? For both problems, please print out the graph only. (No need to submit the Excel sheet.) Be sure that your graphs have the time line on the x-axis.