presentation - Smart Woman Securities

advertisement

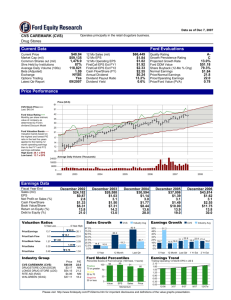

smartwomansecurities November 7, 2007 Financial Metrics: Part 2 MORGEN PECK EQUITY RESEARCH ANALYST FIDELITY INVESTMENTS These materials are made for educational purposes and should not be distributed. All materials are for SWS members’ use only Announcements • Business Overview section of Investment Project due today! • Competition section is due next Wednesday (11/14) • NO seminar on Wednesday 21st because of Thanksgiving Break! • Investment Project Mentors In This Seminar: • Recap of last week • Understand cash flows • How earnings’ season affect stocks • Valuation (yes, again) • Case study Recap From Last Week • Financial statements are critical to making investments • Income Statement gives us information on profitability over time – Revenues – expenses = profit – Important metrics: revenue growth, EPS growth, operating profit – We use EPS for valuation (P/E) • Balance Sheet gives us information about financial health at point in time – Assets = Liabilities + Equity – Important metrics: Return on Equity, Return on Assets, Debt/Equity, Current Assets/Current Liabilities Questions From Last Week • Don’t we want liabilities to go down over time? – Liabilities are NOT a bad thing, they are a necessity for a firm and they should increase as the firm grows • Firm owing its suppliers money because of strong demand for the firm’s product is a good thing – We only worry when liabilities growing faster than assets. That is a bad thing Questions From Last Week • Revenues – cost of goods sold – selling, general & administrative expenses (SG&A) = operating profit • Another way to think of operating margin is: – For every $1 the firm makes in revenues, operating margin is the % of that $1 that the firm keeps after operating expenses • If firm has operating margin of 30%, for every dollar of revenue, it “costs” firm 70c to produce that dollar & they can keep 30c as profit Mistake from last week • In bread example, your company does not “borrow” money from mutual funds like Fidelity – Fidelity gives money to the firm in exchange for shares and the firm does not have to ever pay back Fidelity – Firm does have to pay back money borrowed from banks SWY example: P/E & EPS growth drive stock price SAFEWAY INCORPORATED (SWY) Price 32.96 1997 65 1997 1998 1998 1999 19992000 2000 20012001 2002 2002 2003 2003 2004 2004 StockVal® 2005 2005 2006 2007 2007 2008 2008 HI LO ME CU GR 50 40 30 25 20 2009 63 17 33 33 1.2% 10-31-1997 11-02-2007 15 PRICE 35 30 HI LO ME CU 25 20 33.7 6.7 15.4 14.9 15 10 10-31-1997 11-02-2007 5 PRICE / YR-FORWARD EPS ESTS 60 40 HI LO ME CU 20 0 -20 41.0 -26.0 13.8 18.4 12-31-1997 09-30-2007 -40 EARNINGS-PER-SHARE YTY % CHANGE PFE: P/E compression & EPS growth deceleration hurt stock price PFIZER INCORPORATED (PFE) Price 23.67 1997 52 1997 1998 1998 1999 19992000 2000 20012001 2002 2002 2003 2003 StockVal® 2004 2004 2005 2005 2006 2007 2007 2008 2008 HI LO ME CU GR 44 36 32 28 24 2009 49 21 33 24 0.0% 10-31-1997 11-02-2007 20 PRICE 49 42 HI LO ME CU 35 28 55.9 10.0 17.9 10.2 21 14 10-31-1997 11-02-2007 7 PRICE / YR-FORWARD EPS ESTS 52 39 HI LO ME CU 26 13 56.9 -23.3 16.6 -23.3 0 -13 12-31-1997 09-30-2007 -26 EARNINGS-PER-SHARE YTY % CHANGE My contact info if you ever have questions • morgen.peck@fmr.com • 617-563-0042 Statement of Cash Flows Cash Flows • Statement of cash flows provides relevant information about a company’s cash inflows and outflows • Net Income ≠ Cash generated!! – Net income is a function of accrual accounting which smoothes cash flow – Cash can’t be manipulated • Cash flows help investors (and creditors) assess – Future funding needs – Liquidity (cash to run daily/annual operations) – Long-term solvency (ability to pay bills and service debt) Sources: Intermediate Accounting; Spiceland., Sepe, Tomassini; 3rd edition; Irwin/McGraw-Hill Publishing Company, 2001 Income Statement vs. Cash Flow Statement • Income statement uses accrual accounting to smooth cash flow, which tends to be lumpy. – Revenue recognition • Does a company recognize revenue when end product has been produced, when it’s shipped, when customer receives it? Orders often placed at end of the quarter. – Cost recognition • Does a company recognize cost when the end product has been produced, when it receives payment for the product? – There is a LOT of discretion by the CFO in terms of how s/he can account for items in the income statement • Cash flow is literally the cash being generated and used by the company over a certain period of time Cash Flows • 3 sections of the cash flow statements – Operating Activities • How much cash do the firm’s core operations generate? – Investing Activities • How much cash firm is spending on long term assets to grow (capex) or on acquisitions – Financing Activities • How much cash firm is spending to finance its growth (debt borrowed & equity issued) • How much cash firm is returning to shareholders (dividends, share repurchases) Cash Flows from Operating Activities • Inflows – Cash received from customers (remember accounts receivables) • Outflows – Buying inventory (remember accounts payables) – Paying salaries and wages – Paying suppliers (also accounts payable) Sources: Intermediate Accounting; Spiceland., Sepe, Tomassini; 3rd edition; Irwin/McGraw-Hill Publishing Company, 2001 Reconciling Net Income and Operating Cash Flow Operating cash flow statement takes Net Income and makes adjustments so investors can see how much cash the business generated INCOME STATEMENT Revenues - CGS (includes Depreciation & Amortization) Gross Profit - Selling, General & Administrative Costs - Research & Development - Other Operating Expenses Operating Income - Interest Expense -Taxes Net Income Earnings Per Share Diluted Shares Outstanding CASH FLOW STATEMENT Operating Cash Flows: Net Income + Depreciation & Amortization + Amortization on Research & Development + Changes in A/R, Inventory, A/P Operating Cash Flow Cash Flows from Investing Activities • Inflows – Cash received from sales of PP&E (selling an plant the firm doesn’t need anymore). Pretty infrequent. • Outflows – Purchasing long-term assets (PP&E) = capital expenditures (aka capex) (building a new plant) – Acquisitions of other companies Sources: Intermediate Accounting; Spiceland., Sepe, Tomassini; 3rd edition; Irwin/McGraw-Hill Publishing Company, 2001 Cash Flows from Financing Activities • Inflows – Cash received from borrowing (i.e. firms borrow cash from banks to make acquisitions) – Cash received from issuing stock (i.e. firm issues shares to raise money) • Outflows – Repaying debt (i.e. firms eventually have to pay back what they borrowed from the bank) – Paying dividends to shareholders – Repurchasing stock Sources: Intermediate Accounting; Spiceland., Sepe, Tomassini; 3rd edition; Irwin/McGraw-Hill Publishing Company, 2001 How To Read Cash Flow Statements • Its usefulness – You can actually see where cash is going and how the company spends it – Changes in the B/S can be explained by looking at CF statement – Get a better understanding of a company’s investing and financing activities because these aren’t obvious in the I/S • Its limitations – When companies make acquisitions, it is often difficult to fully reconcile all of the cash inflows and outflows w/ the B/S Source: ©2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton Most Important Metric from CF statement: Free Cash Flow • Free Cash Flow = Operating Cash Flow – Capital Expenditures: Represents the cash that a company has left over after paying money required to maintain/expand its asset base INCOME STATEMENT Revenues - CGS (includes Depreciation & Amortization) Gross Profit - Selling, General & Administrative Costs - Research & Development - Other Operating Expenses Operating Income - Interest Expense -Taxes Net Income Earnings Per Share Diluted Shares Outstanding Sources: Vince Hanks, Motley Fool, fool.com; Investopedia CASH FLOW STATEMENT Operating Cash Flows: Net Income + Depreciation & Amortization + Amortization on Research & Development + Changes in A/R, Inventory, A/P Operating Cash Flow - Capital Expenditures FREE CASH FLOW Other Helpful FCF Metrics – FCF/Net Income = quality of earnings (the higher the better) – YoY growth in FCF • Negative free cash flow is not bad in itself. If free cash flow is negative, it could be a sign that a company is making large investments. If these investments earn a high return, free cash flow should turn positive some day Cash Flows (AEOS) In Millions of USD (except for per share items) 2Q06 1Q06 4Q05 Net Income/Starting Line Depreciation/Depletion Amortization Deferred Taxes 72.10 21.71 -10.68 64.16 19.23 3.12 107.54 19.15 -5.13 Non-Cash Items Changes in Working Capital Cash from Operating Activities 10.04 180.15 273.31 11.49 -43.75 54.26 5.20 142.01 268.77 Capital Expenditures Other Investing Cash Flow Items, Total -71.44 -27.61 -31.71 22.93 -21.79 -247.15 Cash from Investing Activities -99.05 -8.78 -268.94 Financing Cash Flow Items Total Cash Dividends Paid Issuance (Retirement) of Stock, Net 2.62 -16.88 4.35 3.24 -11.21 -1.71 -11.14 -19.94 Issuance (Retirement) of Debt, Net -0.30 -0.17 -0.19 Cash from Financing Activities -10.20 -9.86 -31.27 Foreign Exchange Effects Net Change in Cash Cash Interest Paid, Supplemental Cash Taxes Paid, Supplemental -1.27 162.79 56.46 2.42 38.04 43.16 1.62 -29.83 46.09 From Google Finance Lynch’s Views on Cash • In 1988, Lynch owned 5 million shares of Ford which was at $38 a share • He saw in Ford’s B/S statement that it had $16.30 in net cash/share – Net cash/share = (cash – debt)/diluted shares outstanding • So he saw it as buying a company not for $38, but for $21.70 – This made its PE ratio something like 3.1 – (Current stock price – net cash/share)/EPS • Ford went up 40% after he decided to hold his shares of Ford valuation Valuation • From looking at financials, we get information that we use in valuation • We use either EPS or FCF in valuation – EPS >> use P/E – FCF >> use discounted cash flow (DCF) • Because FCF can be lumpy, this is often why many investors use P/E analysis for valuation Discounted cash flow (DCF) • Discount the profits (dividends, earnings, or cash flows) that the firm will generate over time – Estimate yearly cash flows – Estimate the discount factor based on the risk (10% is a safe assumption, but use a higher rate for riskier cash flow) • Determine the “intrinsic value” of the business – Expect a business to make $1000 at the end of each year and then fold after 3 years, estimating a discount rate of 10% • DCF = $1000/(1.1)+$1000/(1.12)+ $1000/(1.13) = $2,487 • You should only pay $2,487 for this business. So if there are 100 shares outstanding, a fair price for the stock would be $24.87 DCF & Comparables = 2 Good Valuation Techniques • Research analysts typically create models and perform DCF valuation – Compare estimated value with actual stock price (if value > stock price, stock is a good buy) • Comparable analysis: – To determine if company is under or overvalued compared to peers or to the company’s EPS growth rate • P/E Ratio how earnings affect stocks Earnings • Quarterly earnings – How much profit a company made or lost during the past quarter – Given in EPS • Usually company also holds an earnings call where they discuss their earnings and company financial performance • Earnings seasons – Differ by company, but typically they come in the month after the end of the quarter • Earnings vs. consensus – Consensus from Wall Street analysts on what EPS will be – If the company beats estimates, the stock tends to go up – If the company falls short, the stock tends to go down • However, other aspects may also cause stock to move (management earnings call, announcement about part of the business, etc.) Implications for Investors • More volatility in the markets during earnings season • Earnings can paint a picture of an industry or a market as a whole – For example, 3Q07: all financials stocks are missing estimates right now • Even if companies beat estimates, still depends on investors’ opinions – For example, earnings may beat estimates but futurelooking guidance may be below analyst expectations 3Q Earnings Disasters • ALGN guided 4Q07 revenues 4% below expectations: stock down 35% in one day AMMD: Another earnings disaster • AMMD lowered 4Q guidance because of operational problems: stock off 35% WCG: Another disaster (fraud, not earnings) • FBI raids company HQ: stock down 70% in one day ABAX: Good 3Q EPS • 3Q EPS came in slightly ahead of estimates, stock +20% in one day Looking at Financial Statements Income Statement I Like MERIDIAN BIOSCIENCE VIVO • • • • • Relatively consistent high teens revenue growth High GM that are improving over last 3 years High & improving operating profit margins Always profitable Very fast EPS growth 2000 Sep-00 FY 2001 Sep-01 FY 2002 Sep-02 FY 2003 Sep-03 FY 2004 Sep-04 FY 2005 Sep-05 FY 2006 Sep-06 FY INCOME STATEMENT Net Sales Cost of Sales Gross Profit R&D Selling & Marketing General & Admin. EBITDA EBIT Interest Income Pretax Income Provision for Income Taxes Tax Rate Net Income EPS CY EPS Mgmt Guidance First Call Estimates Diluted Weighted Average Shares $ 57.1 21.7 35.4 2.3 12.3 10.8 15.0 10.2 0.4 7.7 (0.2) -2% 7.9 0.24 $ $ 33.0 56.5 25.8 30.7 3.4 11.0 11.5 9.6 4.9 0.2 2.5 (4.6) -187% 7.1 0.22 $ 0.07 $ 59.1 24.5 34.6 2.9 9.7 10.8 14.9 11.2 0.0 9.5 3.2 34% 6.2 0.19 $ 0.19 $ 65.9 27.6 38.3 3.9 10.6 11.0 16.6 12.8 0.0 11.6 4.6 39% 7.0 0.21 $ 0.22 $ 79.6 33.9 45.7 4.4 12.5 14.1 18.7 14.7 0.0 13.2 4.0 30% 9.2 0.27 $ 0.28 $ 93.0 38.2 54.8 3.9 15.0 15.7 24.5 20.2 0.0 19.6 7.0 36% 12.6 0.35 $ 0.38 $ 108.4 43.7 64.7 4.8 16.5 16.5 32.2 26.9 1.1 28.1 9.7 35% 18.3 0.46 0.50 32.8 33.2 33.6 34.3 36.3 40.2 -1% -36% -52% -10% 5% 55% 130% -13% 11% 11% 14% 11% 21% 13% 15% 28% 17% 31% 38% 30% 17% 31% 33% 32% 54.3% 5.9% 19.4% 20.3% 17.0% 8.6% 927.4% 12.6% 58.5% 4.9% 16.5% 18.2% 25.3% 19.0% 245.6% 10.6% 58.1% 5.9% 16.1% 16.7% 25.2% 19.4% 23.4% 10.7% 57.4% 5.5% 15.7% 17.7% 23.5% 18.4% 13.6% 11.5% 58.9% 4.2% 16.1% 16.9% 26.3% 21.7% 41.6% 13.5% 59.7% 4.4% 15.2% 15.2% 29.7% 24.8% 43.1% 16.9% GROWTH & MARGINS GROWTH (YoY) Revenues EBITDA EBIT EPS MARGINS Gross R&D S&M G&A EBITDA EBIT Incremental EBIT Net 62.1% 4.0% 21.5% 18.9% 26.2% 17.8% 13.9% Income Statement I Don’t Like TYSON FOODS TSN • • • Totally inconsistent revenue growth that has been bad recently Look how low their gross & operating margins are!!! Pathetic! They are not always profitable (negative EPS in FY06) 2000 FY Sep-00 2002 FY Sep-02 2003 FY Sep-03 2004 FY Sep-04 2005 FY Sep-05 2006 FY Sep-06 INCOME STATEMENT Total Revenue CGS Gross Profit SG&A EBITDA Operating Income Interest Expense Pre-Tax Income Income Taxes (benefit) Tax Rate Net Income EPS CY EPS YoY EPS growth Diluted Shares Outstanding Street Estimates Mgmt Guidance 7410 23367 24549 26432 26014 6453 21550 22805 24550 24266 957 1817 1744 1882 1748 609 877 831 880 939 348 1354 1295 1463 1310 348 887 837 973 809 116 305 296 275 227 234 593 661 683 564 83 210 235 256 199 35.5% 35.4% 35.5% 37.5% 35.3% 151.0 386.5 281.0 482.1 364.8 $ 0.67 $ 1.09 $ 0.80 $ 1.36 $ 1.02 $ $ 1.08 $ 0.97 $ 1.14 $ 1.02 $ 125.5% 224.9 $ 354 1.09 $ -26.7% 351 0.74 $ 25559 24626 933 935 527 10 229 -211 -73 34.5% -138.3 (0.40) (0.35) 69.3% -24.7% -138.8% 356 1.30 $ 357.3 1.06 $ 348.75 (0.04) 1.26-1.33 0.95-1.08 -14c to 1 c GROWTH & MARGINS GROWTH (YoY) Revenues SG&A EBITDA EBIT EPS 122% 49% 68% 88% 126% 5% -5% -4% -6% -27% 8% 6% 13% 16% 69% -2% 7% -10% -17% -25% -2% 0% -60% -99% -139% 7.8% 3.8% 5.8% 3.8% 1.7% 7.1% 3.4% 5.3% 3.4% 1.1% 7.1% 3.3% 5.5% 3.7% 1.8% 6.7% 3.6% 5.0% 3.1% 1.4% 3.7% 3.7% 2.1% 0.0% -0.5% MARGINS Gross SG&A as % Sales EBITDA EBIT Net 12.9% 8.2% 4.7% 4.7% 2.0% Balance Sheet I Like • • MERIDIAN BIOSCIENCE VIVO • 2000 Sep-00 FY Growing cash & equivalents PP&E not growing too fast >> not capital intensive business Very high ROE & ROA 2001 Sep-01 FY 2002 Sep-02 FY 2003 Sep-03 FY 2004 Sep-04 FY 2005 Sep-05 FY 2006 Sep-06 FY BALANCE SHEET Cash & Equivalents A/R, net Inventories PP&E, net TOTAL ASSETS Current Debt Accounts Payable Long Term Debt TOTAL LIABILITIES & EQUITY ROIC ROE ROA Debt/Cap Net cash/share 5 14 16 18 85 8 3 27 85 $ 5 13 12 17 66 8 2 24 66 5.7% 23.9% 9.4% 51.5% (0.84) $ 3 13 13 18 65 4 2 24 65 15.0% 26.4% 9.5% 49.2% (0.74) $ 2 15 14 18 66 1 2 22 66 14.7% 27.1% 10.7% 43.9% (0.62) $ 2 18 14 17 69 1 3 17 69 18.6% 30.4% 13.5% 34.2% (0.46) $ 33 17 17 17 111 1 3 3 111 17.5% 21.5% 14.0% 3.1% 0.82 $ 40 20 18 18 121 0 4 2 121 17.9% 20.5% 15.8% 1.9% 0.96 Balance Sheet I Don’t Like TYSON FOODS TSN 2000 FY Sep-00 • • • • Cash is going down PP&E is HUGE % of total assets >> capital intensive business They have a lot of debt Terrible ROA & ROE. They are negative in FY06 because NI is negative. 2002 FY Sep-02 2003 FY Sep-03 2004 FY Sep-04 2005 FY Sep-05 2006 FY Sep-06 BALANCE SHEET Cash/Equivalents Accounts Receivable Inventories PP&E TOTAL ASSETS Current Debt Accounts Payable Total Debt TTL LIAB + EQUITY ROA ROIC ROE Debt/Total Capital 43 508 965 2141 4841 185 333 1542 4841 41% 51 1101 1885 4038 10562 254 755 3987 10372 3.6% 7.8% 10.9% 50% 25 1280 1994 4039 10486 490 838 3604 10543 2.7% 7.5% 8.8% 44% 33 1240 2063 3964 10464 338 945 3362 10464 4.6% 8.4% 10.3% 41% 40 1214 2062 4007 10504 126 961 2995 10504 3.5% 7.1% 8.2% 38% 28 1183 2057 3945 11121 992 942 3979 11121 NM NM NM 40% FCF Statement I Like • MERIDIAN BIOSCIENCE VIVO • • • • 2000 Sep-00 FY Net change in working capital (change in A/R, inventories, A/P) is not big Capex = D&A FCF and FCF/share is increasing FCF as % of NI is >100% VIVO pays a dividend (and it’s growing) 2001 Sep-01 FY 2002 Sep-02 FY 2003 Sep-03 FY 2004 Sep-04 FY 2005 Sep-05 FY 2006 Sep-06 FY FREE CASH FLOW Net Income Depreciation Amortization Net Change in WC Capital Expenditures FREE CASH FLOW FCF/Share FCF Yield FCF as % of NI Dividend $ 7.9 2.0 2.8 (7.6) (4.0) 2.0 0.06 $ 24.9% 3.4 7.1 2.3 2.5 3.3 (1.9) 24.2 0.74 $ 339.9% 3.7 6.2 2.3 1.4 2.3 (3.6) 9.1 0.27 $ 145.4% 4.0 7.0 2.4 1.4 (0.4) (1.8) 10.5 0.31 $ 150.2% 5.0 9.2 2.6 1.5 (1.7) (2.4) 10.3 0.30 $ 111.8% 5.8 12.6 2.6 1.7 1.5 (2.6) 15.6 0.43 $ 124.1% 7.2 18.3 2.7 2.6 (2.2) (3.1) 19.0 0.47 103.9% 11.1 FCF Statement I Don’t Like • • TYSON FOODS TSN • • 2000 FY Sep-00 2002 FY Sep-02 Net Income is negative some years Capex>D&A >> capital intensive business Change in working capital is very volatile FCF is very volatile, sometimes negative 2003 FY Sep-03 2004 FY Sep-04 2005 FY Sep-05 2006 FY Sep-06 FREE CASH FLOWS NI +D&A -Cap Ex - Change in WC FCF FCF/share FCF Yield FCF as % of NI 459 281 482 365 467 458 490 501 (632) (402) (486) (571) 294 51 (158) 186 530 334 279 426 $ 1.50 $ 0.95 $ 0.79 $ 1.19 $ 13% 7% 4.9% 7.4% 137% 119% 57.9% 116.7% (138) 517 (531) (19) (226) (0.65) -4.0% NM Key Points • Use balance sheets to assess a company’s financial position at a point in time – Look at key ratios to analyze a company’s business • Income statements measure profitability – Look at the company’s profitability over time in terms of gross & operating profit, gross & operating margins • Use statement of cash flows to follow the cash – Look at where cash is going; free cash flow is a key metric! • Valuation: comparisons to other companies & for one company across time Next Seminar • Synthesis: Putting it all together to make an investment recommendation – Putting it all together – How to make stock pitches – Case studies Q&A appendix Sarbanes-Oxley • In 2002, President Bush signed the Sarbanes-Oxley Act into law to "re-establish investor confidence in the integrity of corporate disclosures and financial reporting.“ – Financial fraud cases (such as those of Enron, WorldCom, Tyco, Adelphia, AOL, and others) – End of the "boom" years for the stock market. • Requires all public companies to submit both quarterly and annual assessments of the effectiveness of their internal financial auditing controls to the Securities and Exchange Commission (SEC). – Each company's external auditors must also audit and report on the internal control reports of management and any other areas that may affect internal controls. • The details of the Sarbanes-Oxley Act address many of the tactics companies have used to "cook the books" over the years.