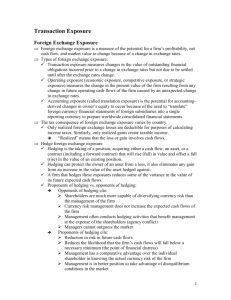

Foreign exchange exposure

advertisement

Multinational Business Finance Yinghong.chen@liu.se 5/21/2013 11-1 Transaction Exposure • Foreign exchange exposure is a measure of how a firm’s profitability, net cash flow, and market value will change because of a change in exchange rates. • An important task of the financial manager is to measure foreign exchange exposure and to manage it so as to minimize the potential loss from exchange rate changes through hedging activities. 5/21/2013 2 Types of FX Exposure: Transaction and Operating exposure and translation exposure • Transaction exposure measures changes in the value of outstanding financial obligations • Transaction exposure stems from existing contractual obligations. • Therefore, easy to hedge. (offset the exposure by an opposite transaction). For example: Foreign currency receivables can be offset by selling the foreign currency forward. 5/21/2013 11-3 Transaction and Operating Exposure • Transaction exposure and operating exposure exist because of unexpected changes in future cash flows due to an exchange rate change. • The difference between the two is that transaction exposure is a contractual obligation, while operating exposure focuses on foreign currency cash flows generated from operation that might change because of a change of exchange rates. 5/21/2013 11-4 Economic Exposure • Operating exposure, and transaction exposure are called economic exposure. • Operating exposure measures the change in the expected value of the firm resulting from an unexpected change in exchange rates. • Expected changes in exchange rate can be calculated through Parity conditions. The rest is unexpected. 5/21/2013 11-5 Types of Foreign Exchange Exposure • Translation exposure, also called accounting exposure, results from translating foreign currency denominated balance sheet of foreign subsidiaries into the parent´s reporting currency so the parent can report a consolidated balance sheet. • The two basic procedures for translation used today are the current method and the temporal method. • The exposure is not real, it is called Balance sheet loss or gain; but can be important for managers. • It only becomes material when the subsidiary closes down and the residual value is repatriated back to home country. 5/21/2013 11-6 Exhibit 11.1 Conceptual Comparison of Transaction, Operating, and Translation Foreign Exchange Exposure 5/21/2013 11-7 Operating Exposure • Operating Exposure is the firm’s uncertainty with respect to its future operating cash flows. • If PV = present value of a firm, then the firm is exposed to foreign currency risk if ΔPV/Δe 0. • Operating exposure derives from the operating analysis; hence planning for operating exposure involves the interaction of strategies in finance, marketing, purchasing 8 and production. Real Exchange Rates and Exposure • Currency changes are accompanied by changes in relative price levels, which can offset the impact of the currency change. • Hence, it is impossible to determine exposure to a given currency change without considering simultaneously the offsetting effects of these price changes. • If relative prices remain constant and the law of one price holds, then the rate of change in the exchange rate equals the difference in inflation rates between the two countries. That is, the real exchange rate is constant, and PPP holds. • The firm’s foreign cash flows will vary with the foreign rate of inflation. • The exchange rate also depends on the differential rates of inflation; the movement of the exchange rate will cancel out the effect of the change in the foreign price level. Real home currency cash flows will be unaffected. 9 Contracts fixed in foreign currency • If the firm has contracts fixed in foreign currency terms, it will be affected by exchange rate risk even if relative prices are unaffected and PPP holds. • Examples are debt with fixed interest rates, long-term leases, labor contracts and rent. • However, if real exchange rates do not change, what we see here is really inflation risk and not forex risk. That is, the same effect can occur domestically, as well. • If contracts are indexed to relative inflation, that is, if the real exchange rate remains constant, forex risk is eliminated. P.V. Viswanath 10 Effects of Real Exchange Rate Changes • A decline in the real value of a nation’s currency makes its exports and import-competing products more competitive. And vice verse. • E.g. if Brazil’s inflation rate stays high, but its exchange rate stays constant, the real exchange rate will be rising and its products will be at a competitive disadvantage. • Hence there could be exchange risk even without changes in nominal rates. 11 To be or not to be: Why Hedge? • MNEs possess a multitude of cash flows that are sensitive to changes in exchange rates, interest rates, and commodity prices. • These three financial price risks are the subject of the growing field of financial risk management. • Many firms attempt to manage their currency exposures through hedging. 5/21/2013 11-12 To be or not to be: Why Hedge? • Hedging is the taking of a position, i.e. a cash flow, an asset, or a contract (including a forward contract) that will rise (fall) in value and offset a fall (rise) in the value of an existing position. • While hedging can protect the owner of an asset from a loss, it also eliminates any gain from an increase in the value of the asset. 5/21/2013 11-13 To be or not to be: Why Hedge? • The value of a firm, according to financial theory, is the net present value of all expected future cash flows. Nothing is certain yet. • Currency risk is defined roughly as the changes in expected cash flows arising from unexpected exchange rate changes. • A firm that hedges these exposures reduces some of the variations in the value of its future expected cash flows. 5/21/2013 11-14 Exhibit 11.2 Impact of Hedging on the Expected Cash Flows of the Firm E(V)´ E(V) E(V)´<E(V) 5/21/2013 The cost of hedging needs to be taken into account! 11-15 Argument Against Hedge • Opponents of hedging argue: – It is costly to hedge. Currency risk management does not increase the expected cash flows of the firm. It decreases volatility only. – Shareholders are capable of diversifying currency risk through holding a diversified portfolio. Less costly alternatives. – Management often conducts hedging activities that benefit management at the expense of the shareholders (agency theory perspective) – Market is efficient. Managers cannot outguess the market. – If all parity conditions holds, there is no need for hedging. 5/21/2013 11-16 Argument For Hedge • Proponents of hedging argue: – Reduction in risk in future cash flows improves the planning capability of the firm – Reduction of risk in future cash flows reduces the bankruptcy probability (financial distress) – Lower volatility increases firm´s borrowing capacity – Management has a comparative advantage over the individual shareholder in knowing the actual currency risk of the firm – Management is in better position to take advantage of disequilibrium conditions in the market –. 5/21/2013 11-17 Measurement of Transaction Exposure • Transaction exposure measures gains or losses that arise from the settlement of existing financial obligations whose terms are stated in a foreign currency. • The most common example of transaction exposure arises when a firm has an account receivable or payable denominated in a foreign currency. 5/21/2013 11-18 Exhibit 11.3 The Life Span of a Transaction Exposure 5/21/2013 11-19 Measurement of Transaction Exposure • Foreign exchange transaction exposure can be managed by contractual, operating, and financial hedges. • The main contractual hedges are the forward, futures, money market hedge, and options market hedge. • Operating and financial hedges are the use of risksharing agreements, leads and lags in payment terms, swaps, and other strategies. 5/21/2013 11-20 Measurement of Transaction Exposure • The term natural hedge refers to an off-setting operating cash flow, for example, a payable arising from the conduct of business to offset a receivable. • A financial hedge refers to either an off-setting debt obligation (such as a loan) or some type of financial derivative such as an interest rate swap. • Care should be taken to distinguish operating hedges from financial hedges. 5/21/2013 11-21 Transaction Exposure • With reference to Trident’s Transaction Exposure, the CFO, Maria Gonzalez, has four alternatives: – Remain unhedged; – hedge in the forward market; – hedge in the money market, or – hedge in the options market. • These choices apply to an account receivable (AR) and an account payable (AP). 5/21/2013 11-22 Transaction Exposure • A forward hedge involves a forward (or futures) contract and a source of funds to fulfill the contract. • In some situations, funds to fulfill the forward exchange contract are not already available or due to be received later, but must be purchased in the spot market at some future date. This type of hedge is “open” or “uncovered” and involves considerable risk because the hedge must take a chance on the uncertain future spot rate to fulfill the forward contract. • The purchase of such funds at a later date is referred to as covering. 5/21/2013 11-23 Transaction Exposure • A money market hedge also involves a contract and a source of funds to fulfill that contract. • In this instance, the contract is a loan agreement. • The firm seeking the money market hedge borrows in one currency and exchanges the proceeds for another currency. • Funds to fulfill the contract – to repay the loan – may be generated from business operations, this type of money market hedge is covered. • Alternatively, funds to repay the loan may be purchased in the foreign exchange spot market when the loan matures (uncovered or open money market hedge). 5/21/2013 11-24 Transaction Exposure • Hedging with options allows for participation in any upside potential associated with the position while limiting downside risk. • The choice of option strike prices is a very important aspect of utilizing options. 5/21/2013 11-25 Exhibit 11.5 Trident’s Hedging Alternatives, Including an ATM Put Option Net exposure of the firm with put option 5/21/2013 11-26 Risk Management in Practice • The treasury function of most private firms, typically responsible for transaction exposure management, is usually considered a cost center. • The treasury function is not expected to add profit to the firm’s bottom line. • Currency risk managers are expected to be conservative. 5/21/2014 11-27 Risk Management in Practice • Transaction exposure management programs are generally divided along an “option-line”; those that use options and those that do not. • Firms that do not use currency options rely almost exclusively on forward contracts and money market hedges. 5/21/2014 11-28 Risk Management in Practice • Many MNEs have established rather rigid transaction exposure risk management policies that mandate proportional hedging. • These contracts generally require the use of forward contract hedges on a percentage of existing transaction exposures. • The remaining portion of the exposure is then selectively hedged on the basis of the firm’s risk tolerance, its view of exchange rate movements, and confidence level. 5/21/2014 11-29 Trident´s transaction exposure U.S. Dollar market Trident´s weighted average cost of capital =12% (3% for 30 days) US 3 month borrowing rate=8% (2% for 90 days) US 3 month investment rate 6% (1,5% for 90 days) Sales=$1764000 90 days Account receivable 100000£. Spot rate =$1,7640/£ F90 =$1,7540 S90 =1,7600 (forcasted by the advisor) British pound market UK 3 month borrowing rate=10% (2,5% for 90 days) UK 3 month investment rate 8% (2% for 90 days) June (3 month) put option for £1000000 with a strike price of $1,75/£, premium is 1,5%. What is the dollar amount of the 1M£ sales in 3 month time? 5/21/2014 11-30 Trident´s transaction exposure: 1000000£ receivable • Remain unhedged: possible to get 1760000$ as forcasted by the advisor. But considerable risk! • Hedge with a forward sell of 1000000£ to get 1754000$ in 90days at the forward rate of $1,7540/£. • Money market hedge: borrow british punds 1000000/(1+0,025)=975610£ now and convert it to dollars. 975610*1,7640=1720976$. Invest it or save it to get the interest. 1720976*1,03=1772605$>1754000$ better than the forward! • Purchase put option costs 1000000£*0,015*1,7640=26460$, in 90 days, 26460$*1,03=27254$. If the future spot rate is $1,76/£, the payment =1760000-27254=1732746$. Note, the put option hedge has unlimited upside potential. But the upside still not better than unhedged due to the cost of the option. (note the strike price=1,75$/£, the lowest amount is 1722746$ with no upper limit.) 5/21/2014 11-31 Exhibit 11.4 Valuation of Cash Flows by Hedging Alternative for Trident 5/21/2013 11-32 Valuation of Hedging Alternatives for an Account Payable (ex 2 ) Call option used to hedge the payable. 5/21/2014 11-33 OPERATING EXPOSURE MANAGEMENT 5/21/2013 11-34 What is Operating Exposure? Operating exposure (also called competitive exposure, and strategic exposure) measures the change in the firm´s present value resulting from the expected changes in future operating cash flows denominated in foreign currency (caused by an unexpected change in exchange rates!). Note: All the expected exchange rate changes should be already incorporated in the financial plan, thus should not influence the firm value. 5/21/2014 11-35 How to measure Operating Exposure? Two difficulties • Measuring the operating exposure of a firm requires forecasting and analyzing all the firm’s future individual transaction exposures together with the future exposures of all the firm’s competitors and potential competitors worldwide. • To analyze the longer term exchange rate changes that are unexpected and its impact on the firm– is the goal of operating exposure analysis. ∆FV/ ∆E* 5/21/2013 11-36 Operating cash flows and financing cash flows Differentiating cash flows of MNEs: •Operating cash flows arise from business activities: that is, from intercompany (between unrelated companies) and intracompany (between units of the same company) receivables and payables, rent and lease payments, royalty and license fees and management fees. •Financing cash flows are from financing activities, that is payments for loans (principal and interest), equity injections and dividends. 5/21/2013 11-37 Exhibit 12.1 Financial and Operating Cash Flows Between Parent and Subsidiary 5/21/2013 11-38 Attributes of Operating Exposure • Operating exposure is important for the long-run health of a business. • However, operating exposure is inevitably subjective because it depends on estimates of future cash flow changes over an arbitrary time horizon. • Planning for operating exposure is a management responsibility because it relates to the interaction of strategies in finance, marketing, purchasing and production. 5/21/2013 11-39 Attributes of Operating Exposure An expected change in foreign exchange rates is not of concern. From an investor’s perspective, if the foreign exchange market is efficient, information about expected changes in exchange rates should be reflected in a firm’s market value. Only unexpected changes in exchange rates, or an inefficient foreign exchange market, should cause market value to change. 5/21/2013 11-40 Example: • We discuss the dilemma facing Trident as a result of an unexpected change in the value of the euro, €, the currency of denomination for Trident´s German subsidiary. • There is concern over how the subsidiary´s revenues (price and volumes in euro terms), costs (input costs in euro terms), and competitive landscape will change with a fall in the value of the euro. 5/21/2013 11-41 Exhibit 12.2 Trident Corporation and Its European Subsidiary: Operating Exposure of the Parent and Its Subsidiary 5/21/2013 11-42 Measuring the Impact of Operating Exposure • Trident Europe: – Case 1: Euro Devaluation €, no change in any variable. – Case 2: Increase in sales volume; other variables remain constant. – Case 3: Increase in sales price; other variables remain constant. 5/21/2013 11-43 The objective of the Operating Exposure management The objective of both operating and transaction exposure management is to anticipate and influence the effect of unexpected changes in exchange rates on a firm’s future cash flows. To meet this objective, management can diversify the firm’s operating and financing base. Management can also change the firm’s operating and financing policies. 5/21/2013 11-44 Benefits of diversification Management team is prepositioned both to recognize disequilibrium when it occurs and to react competitively if the firm´s operations are diversified internationally . Recognizing a temporary change in worldwide competitive conditions permits management to make changes in operating strategies. Domestic firms do not have the option to react in the same manner as an MNE. 5/21/2013 11-45 Benefits of diversification • If a firm’s financing sources are diversified, it will be prepositioned to take advantage of temporary deviations from the international Fisher effect. i$ –i€ =PUS -PEU • However, to switch financing sources from one capital market to another, a firm must have the ability to operate in the international investment community. • Again, this would not be an option for a domestic firm. 5/21/2013 11-46 6 Proactive policies of Management of Operating Exposure • Operating and transaction exposures can be partially managed by adopting operating or financing policies that offset anticipated foreign exchange exposures. • The six most commonly employed proactive policies are: – – – – – – 5/21/2013 Matching currency cash flows Risk-sharing agreements Back-to-back ( parallel loans), or credit swaps. Currency swaps Leads and lags Reinvoicing center 11-47 Proactive Management of Operating Exposure Example: a US firm has a continuing export sales to Canada. In order to compete effectively in Canadian markets, the firm invoices all export sales in Canadian dollars. This policy results in a continuing receipt of Canadian dollars month after month. This series of transaction exposures could be continually hedged with forwards, futures or options, etc. Or using operating exposure management methods described as follows: 5/21/2013 11-48 Matching currency cash flows One way to offset an anticipated continuous long exposure to a particular company is to acquire debt denominated in that currency (matching). Alternatively, the US firm could seek out potential suppliers of raw materials or components in Canada as a substitute for US and other foreign firms. In addition, the company could engage in currency switching, in which the company would pay foreign suppliers with Canadian dollars. 5/21/2013 11-49 Exhibit 12.4 Matching: Debt Financing as a Financial Hedge 5/21/2013 11-50 Proactive Management of Operating Exposure: Risk Sharing • Currency Risk-Sharing: – a method to manage a long-term cash flow exposure. – This is a contractual arrangement in which the buyer and seller agree to “share” or split currency movement impacts on payments between them. – This agreement is intended to smooth the impact on both parties of volatile and unpredictable exchange rate movements. 5/21/2013 11-51 Risk Sharing: Ford and Mazda Risk Sharing Agreement between Mazda and Ford. Ford agrees to pay all purchases in Japanese Yen to Mazda as long as the spot exchange rate on the day of invoice is between 115 yen/$ to 125 yen/$. If however the exchange rate falls out of this range, Mazda and Ford will share the difference equally. What happens if the rate falls to 110 yen/$? 5/21/2013 11-52 Proactive Management of Operating Exposure Back-to-Back Loans: A back-to-back loan, also referred to as a parallel loan or credit swap, occurs when two business firms in separate countries arrange to borrow foreign currency for a specific period of time, but totally circumvent the foreign exchange market . See the following slides. At an agreed terminal date they return the borrowed currencies. Such a swap creates a covered hedge against exchange loss, since each company, on its own books, borrows the same currency it repays. 5/21/2013 11-53 Exhibit 12.5 Using a Back-to-Back Loan for Currency Hedging 5/21/2013 11-54 Proactive Management of Operating Exposure • There are risks involved in the widespread use of the back-to-back loan: 1. It is difficult for a firm to find a partner, termed a counterparty for the currency amount and timing desired. 2. A risk exists that one of the parties will fail to return the borrowed funds at the designated maturity – although each party has 100% collateral (denominated in a different currency). 5/21/2013 11-55 Proactive Management of Operating Exposure • Currency Swaps: – A currency swap resembles a back-to-back loan except that it does not appear on a firm’s balance sheet. – In a currency swap, a firm and a swap dealer or swap bank agree to exchange an equivalent amount of two different currencies for a specified amount of time. 5/21/2013 11-56 Exhibit 12.6 Using a Cross-Currency Swap to Hedge Currency Exposure 5/21/2013 11-57 Proactive Management of Operating Exposure • Leads and Lags: Re-timing the transfer of funds – Firms can reduce both operating and transaction exposure by accelerating or decelerating the timing of payments that must be made or received in foreign currencies. – Intracompany leads and lags is more feasible as related companies presumably embrace a common set of goals for the consolidated group. – Intercompany leads and lags requires the time preference of one independent firm to be imposed on another. 5/21/2013 11-58 Proactive Management of Operating Exposure • Reinvoicing Centers: There are three basic benefits arising from the creation of a reinvoicing center: – Managing foreign exchange exposure – Guaranteeing the exchange rate for future orders – Managing intrasubsidiary cash flows 5/21/2013 11-59 Exhibit 12.7 Use of a Reinvoicing Center 5/21/2013 11-60 Proactive Management of Operating Exposure • Some MNEs now attempt to hedge their operating exposure with contractual hedges. • Merck and Eastman Kodak have undertaken long-term currency option positions hedges designed to offset lost earnings from adverse exchange rate changes. • The ability to hedge the “unhedgeable” is dependent upon: – Predictability of the firm’s future cash flows – Predictability of the firm’s competitor’s responses to exchange rate changes 5/21/2013 11-61