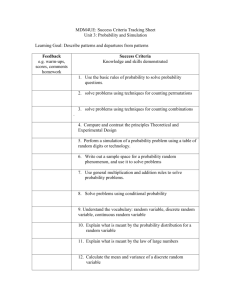

Statistics in Finance

advertisement

Probability

702341 QA in Finance/ Ch 3 Probability in Finance

Probability

Probability is a measure of the possibility of an event

happening

Measure on a scale between zero and one

Probability has a substantial role to play in financial

analysis as the outcomes of financial decisions are

uncertain

e.g. Fluctuation in share prices

702341 QA in Finance/ Ch 3 Probability in Finance

The classical approach to probability

The range of possible uncertain outcomes is known

and equally likely

EXPERIMENT, SAMPLE, EVENT

consider the tossing of a fair coin:

the range is limited to two

the tossing of the coin is the experiment

the two possible outcomes refer to the sample space

the outcome whether it is head or tail is the event

702341 QA in Finance/ Ch 3 Probability in Finance

The classical approach to probability

P(A)

No. of outcomes associated with the event

Total number of outcomes

702341 QA in Finance/ Ch 3 Probability in Finance

The empirical approach to probability

In finance, we cannot rely on the exactness of a

process to determine the probabilities

Consider ‘the return of financial assets’

The range is unlimited

In such situations the probability of a given outcome

Z, P(Z), is

No. of Z occurences

P(Z)

No. of exp eriments

702341 QA in Finance/ Ch 3 Probability in Finance

The empirical approach to probability

E.g. Consider a sample of 100 daily movements in a

share price. Assume that of the 100 absolute

movements, five movements were 0.5 Baht each, 15

were 1 Baht each, 20 were 1.5 Baht each, 30 were 2

Baht each, 20 were 2.5 Baht and 10 were 3 Baht each

702341 QA in Finance/ Ch 3 Probability in Finance

Basic rules of probability

These rules are :

the addition rule concerned with A or B happening

the multiplication rule concerned with A and B occurring

Which of these rules is applicable will depend on

whether the combined events are

INDEPENDENT or MUTUALLY EXCLUSIVE ???

702341 QA in Finance/ Ch 3 Probability in Finance

Mutually exclusive

Two events cannot occur together

Sample space = {1,2,3,4,5,6}

A is the event that the face of die shows odd number:

A = {1,3,5}

B is the event that the face of die is even number:

B = {2,4,6}

AΛ B = { } = Ø

A and B is MUTUALLY EXCLUSIVE

702341 QA in Finance/ Ch 3 Probability in Finance

Mutually exclusive

A

B

702341 QA in Finance/ Ch 3 Probability in Finance

The addition rule applied to nonmutually exclusive events

P(A or B) = P(A) + P(B) – P(A and B)

A

B

Assume that the FTSE 100 index may rise with a probability of 0.55 and

fall with the probability of 0.45. Also assume that a particular time interval

the S&P index may rise with a probability of 0.35 and fall with a

probability of 0.65. There is also a probability of 0.3 that both indices rise

together. What is the probability of wither the FTSE 100 index or the S&P

500 index rising

702341 QA in Finance/ Ch 3 Probability in Finance

The multiplication rule applied to nonindependent events

P(A and B) = P(A) * P(B A)

P(B A) is the conditional probability of B occurring

given that A has occurred

Suppose the probability of the recession is 25% and

long-term bond yields have an 80% chance of

declining during a recession What is the probability

that a recession will occur and bond yields will

decline?

702341 QA in Finance/ Ch 3 Probability in Finance

Bayes’ theorem

Manipulation of the general multiplication rule

The probability of the updated event An can be

updated to P(A|B) if Scenario B is known to have

occurred by using the following relationships

P( Ak / B)

P( Ak ).P( B / Ak )

iN

( P( A ).P( B / A ))

i 1

i

i

702341 QA in Finance/ Ch 3 Probability in Finance

Bayes’ theorem

Suppose the economy is in an uptrend three out of

every four years (75%). Furthermore, when the

economy is in an uptrend, the stock market advances

80% of the time. Conversely, the economy declines

one out of every four years (25%), and the stock

market declines 70% of the time when the economy is

in a recession.

702341 QA in Finance/ Ch 3 Probability in Finance

Random variable

Random Variable

A variable that behave in an uncertain manner

As this behavior is uncertain we can only assign

probabilities to the possible values of these variables.

Thus the random variable is defined by its probability

distribution and possible outcomes.

Two types of random variable: discrete and continuous

702341 QA in Finance/ Ch 3 Probability in Finance

Discrete probability

distribution

Variables that have only a finite number of possible

outcomes

For example …a six-sided die is thrown

Possibilities r=1

Probability that Z=r

0 PX j 1

1

2

3

4

5

6

1/6

1/6

1/6

1/6

1/6 1/6

PX 1

j

702341 QA in Finance/ Ch 3 Probability in Finance

Discrete probability

distribution

Event: Toss two coins

T

T

T

Count the number of tails

Probability Distribution

Values

Probability

0

1/4 = .25

1

2/4 = .50

2

1/4 = .25

T

702341 QA in Finance/ Ch 3 Probability in Finance

Continuous probability

distribution

Variables that can be subdivided into an infinite

number of subunits for measurement

For example …speed, asset returns

Consider: a movement in an asset price from 105 to

109 will give a return of … %

702341 QA in Finance/ Ch 3 Probability in Finance

Continuous probability

distribution

To overcome this practical problem, we must define

our continuous random variable by integrating what

is know as a probability density function (pdf)

f ( X )dX 1

702341 QA in Finance/ Ch 3 Probability in Finance

Expected value of a random

discrete variable

Expected value (the mean)

Weighted average of the probability distribution

E X X jP X j

j

e.g.: Toss 2 coins, count the number of tails,

compute

X jP X j

j

0 2.5 1.5 2 .25 1

702341 QA in Finance/ Ch 3 Probability in Finance

Expected value of a random

discrete variable

Expected value (the mean)

– Weight average squared deviation about the mean

2

E X X j P X j

2

2

– e.g. Toss two coins, count number of tails,

compute variance

X j P X j

2

2

0 1 .25 1 1 .5 2 1 .25 .5

2

2

2

702341 QA in Finance/ Ch 3 Probability in Finance

Computing the Mean for Investment

Returns

Return per $1,000 for two types of investments

P(XiYi)

Economic condition

Investment

Dow Jones fund X Growth Stock Y

.2

Recession

-$100

-$200

.5

Stable Economy

+ 100

+ 50

.3

Expanding Economy

+ 250

+ 350

E X X 100.2 100.5 250.3 $105

E Y Y 200.2 50.5 350 .3 $90

702341 QA in Finance/ Ch 3 Probability in Finance

Computing the Mean for

Investment Returns

Return per $1,000 for two types of investments

Investment

Economic condition Dow Jones fund X Growth Stock Y

P(XiYi)

.2

Recession

-$100

-$200

.5

Stable Economy

+ 100

+ 50

.3

Expanding Economy

+ 250

+ 350

100 105 .2 100 105 .5 250 105 .3

2

2

X

2

2

X 121.35

14, 725

200 90 .2 50 90 .5 350 90 .3

2

2

Y

37,900

2

Y 194.68

2

702341 QA in Finance/ Ch 3 Probability in Finance

Probability Distribution

Important probability distributions in finance

Discrete:

BINOMIAL

POISSON

Continuous:

NORMAL

LOG NORMAL

702341 QA in Finance/ Ch 3 Probability in Finance

Binomial probability distribution

Only two possible outcomes can be taken on by the

variable in a given time period or a given event.

e.g. getting head is success while getting tail is failure

For each of a succession of trials the probability of

two outcome is constant

e.g. Probability of getting a tail is the same each time

we toss the coin

702341 QA in Finance/ Ch 3 Probability in Finance

Binomial probability distribution

Each binomial trial is identical

e.g. 15 tosses of a coin; ten light bulbs taken from a

warehouse

Each trial is independent

the outcome of one trial does not affect the outcome

of the other

702341 QA in Finance/ Ch 3 Probability in Finance

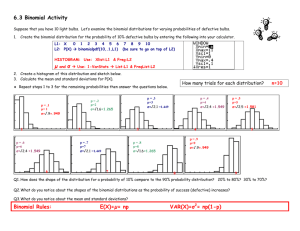

Binomial probability distribution

Su2

j=2

Sud = Sdu

j=1

Sd2

j=0

Su

S

Sd

J = number of success

702341 QA in Finance/ Ch 3 Probability in Finance

Binomial probability distribution

The probability of achieving each outcome depends on:

1. the probability of achieving a success

2. the total number of ways of achieving that outcome

e.g. consider the case of j = 1 (Sdu = Sud)

1. each way has a probability of 0.25

2. there are two ways to achieving an outcome

702341 QA in Finance/ Ch 3 Probability in Finance

Binomial probability distribution

Combination rule

n!

n X

X

P X

p 1 p

X ! n X !

P X : probability of X successes given n and p

X : number of "successes" in sample X 0,1,

, n

p : the probability of each "success"

n : sample size

or the number of binomial trials

702341 QA in Finance/ Ch 3 Probability in Finance

A binomial tree of asset prices

The most common application of the binomial

distribution in finance is ‘security price change’

It is assumed that over the next small interval of time

security price will wither rise (‘a success’) or fall (‘a

failure’) by a given amount

The binomial distribution is an assumption in some

option pricing models

702341 QA in Finance/ Ch 3 Probability in Finance

A binomial tree of asset prices

3 stages in developing the expected value of asset price:

create a binomial lattice

determine the probabilities of each outcome

multiply each possible outcome by the appropriate

probability and sum the products to arrive at the

expected value

702341 QA in Finance/ Ch 3 Probability in Finance

A binomial tree of asset prices

In each of the time period the asset

may rise with probability of 0.5, or

it may fall with a probability of 0.5

Su2

Su

Sud = Sdu

S=50

Sd

suppose: u= 1.10, d = 1/1.10

T0

Sd2

T1

T2

702341 QA in Finance/ Ch 3 Probability in Finance

A binomial tree of asset prices

Su2

(60.50)

Su

(55)

Sud = Sdu

(50)

S=50

Su

(45.45)

T0

T1

Sd2

(41.32)

T2

702341 QA in Finance/ Ch 3 Probability in Finance

A binomial tree of asset prices

The expected value is calculated as:

(60.50 x 0.25) + (50.0 x 0.50) + (41.32 x 0.25)

= 50.46

The variance is

(60.50-50.46)2 x 0.25 + (50.0-50.46)2 x 0.50 +

(41.32-50.46)2 x 0.25

= 46.18

702341 QA in Finance/ Ch 3 Probability in Finance

The Poisson distribution

Discrete events in an interval

The probability of One Success in an interval is

stable

The probability of More than One Success in this

interval is 0

e.g. number of customers arriving in 15 minutes

e.g. information which causes market price to move

arrive at a rate of 10 pieces per minute

702341 QA in Finance/ Ch 3 Probability in Finance

The Poisson distribution

e

P X

X!

P X : probability of X "successes" given

X

X : number of "successes" per unit

: expected (average) number of "successes"

e : 2.71828 (base of natural logs)

702341 QA in Finance/ Ch 3 Probability in Finance

The Poisson distribution

ex. Find the probability of 4 customers arriving in 3

minutes when the mean is 3.6.

e3.6 3.64

P X

.1912

4!

ex. information which causes market price to move

arrive at a rate of 10 pieces per minute. Find the

probability of only eight pieces of information

arriving in the next minute ???

702341 QA in Finance/ Ch 3 Probability in Finance

The normal distribution

Most important continuous probability distribution

Bell shaped

f(X)

Symmetrical

Mean, median and

mode are equal

X

f ( X )dX 1

Mean

Median

Mode

702341 QA in Finance/ Ch 3 Probability in Finance

The normal distribution

f X

1

e

1

2

2

X

2 2

f X : density of random variable X

3.14159;

e 2.71828

: population mean

: population standard deviation

X : value of random variable X

702341 QA in Finance/ Ch 3 Probability in Finance

The normal distribution

Probability is the area under the curve!

P c X d ?

f(X)

c

d

X

702341 QA in Finance/ Ch 3 Probability in Finance

The normal distribution

There are an infinite number of normal distributions

By varying the parameters and µ, we obtain

different normal distributions

An infinite number of normal distributions means an

infinite number of tables to look up !!!

702341 QA in Finance/ Ch 3 Probability in Finance

Standardizing example

Z

X

6.2 5

0.12

10

Standardized

Normal Distribution

Normal Distribution

10

5

Z 1

6.2

X

Z 0

0.12

Z

702341 QA in Finance/ Ch 3 Probability in Finance

P 2.9 X 7.1 .1664

Z

X

2.9 5

.21

10

Z

X

7.1 5

.21

10

Standardized

Normal Distribution

Normal Distribution

10

Z 1

.0832

.0832

2.9

5

7.1

X

0.21

Z 0

0.21

Z

702341 QA in Finance/ Ch 3 Probability in Finance

P 2.9 X 7.1 .1664(continued)

Cumulative Standardized Normal

Distribution Table (Portion)

Z

.00

.01

Z 0

Z 1

.02

.5832

0.0 .5000 .5040 .5080

0.1 .5398 .5438 .5478

0.2 .5793 .5832 .5871

0.3 .6179 .6217 .6255

0

Z = 0.21

702341 QA in Finance/ Ch 3 Probability in Finance

The normal distribution

Example:

We wish to know the probability of a given asset,

which is assumed to have normally distributed returns,

providing a return of between 4.9% and 5%. The

mean of the return on that asset to date is 4%, and the

standard deviation is 1%

702341 QA in Finance/ Ch 3 Probability in Finance

The normal distribution

Example:

The earnings of a company are expected to be $4.00

per share, with a standard deviation of $40. Assuming

earnings per share are a continuous random variable

that is normally distributed, calculate the probability

of actual EPS will be $3.90 or higher.

702341 QA in Finance/ Ch 3 Probability in Finance

The normal distribution

Example:

The earnings of a company are expected to be $4.00

per share, with a standard deviation of $40. Assuming

earnings per share are a continuous random variable

that is normally distributed, calculate the probability

of actual EPS will be between $3.60 and $4.40.

702341 QA in Finance/ Ch 3 Probability in Finance

The lognormal distribution

Modern portfolio theory assumes that investment

return are normally distributed random variable.

Is that true ?

702341 QA in Finance/ Ch 3 Probability in Finance

The lognormal distribution

However, this is not true, investment return can only

take on values between -100% and % which are

not symmetrically distributed, but skewed.

100%

E (r )

702341 QA in Finance/ Ch 3 Probability in Finance

The lognormal distribution

Mathematical trick !!!

Distribution of Vt/Vo is Lognormal

Distribution of ln(Vt/Vo) is Normal

Vt

P ln

V0

Vt

P

V0

0

Vt /V0

ln( Vt / V0 )

702341 QA in Finance/ Ch 3 Probability in Finance