NEISD vs. State Peer Group - North East Independent School District

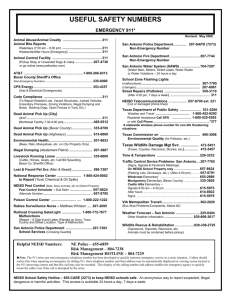

advertisement

COMPRESSION Piecing Together a New Plan 2011-2012 Board Budget Study Session #1 May 16, 2011 Agenda 1 Legislative Update • • 2 Preliminary General Fund Budget • • 3 Budget Bills Fund Formula Bills Expenditure Increases and Reductions Education Jobs Funding Annual Benchmarking Update 2 State Budget Bill Update 3 House & Senate Budgets 2010-2011 House Senate House/ Senate Difference $36.0B $33.2B $37.0B ($3.8B) Facility Funding 1.2B 1.6B 1.6B -0- SSI & At-Risk Programs 4.4B 3.3B 3.6B ($0.3B) Tech & Instruct Materials 1.2B 0.3B 0.7B ($0.4B) Other 7.3B 7.0B 7.1B ($0.1B) $50.1B $45.4B $50.0B ($4.6B) ($4.7B) ($0.1B) Statewide Estimates Foundation Program TOTALS Proposed Budgets vs. 2010-2011 Overall, the Senate’s version of the 2012-2013 biennial budget provides $4.6B more in education funding than the House’s budget. Although it does not provide funds for enrollment growth or additional hold-harmless for declining property value, it provides nearly as much total funding as is estimated for the 4 2010-2011 biennium. House & Senate Budgets Difference from Minimum Need Statewide Estimates 2010-2011 Budget TEA Versus Senate ($7.5B) ($2.9B) (14.2%) (5.5%) $50.1B New Enrollment 1.8B Hold-Harmless for Property Value Decline 1.0B MINIMUM FOR 2012-2013 Versus House $52.9B The Texas Education Agency requested nearly $55B for the biennium. If the only changes made to the 2010-2011 budget were minimal increases for new enrollment and hold-harmless for property value decline, the minimum need for the 2012-2013 biennium would be $52.9B. The House and Senate versions of the budget fall $7.5B and $2.9B short of that mark, respectively. 5 Formula Funding Bills House Version 6 2010-2011 Revenue vs. 2011-2012 Difference from Current Law Revenue Estimate NEISD General Fund 2010-2011 2011-2012 Current Law Difference Property Tax Revenue $282.8M $277.5M ($5.3M) Other Local Revenue 4.4M 3.9M (0.5M) 188.9M 201.5M 12.6M 23.5M 23.5M 0.0M 6.2M 5.6M (0.6M) $505.8M $512.0M $6.2M State Revenue TRS Revenue Federal Revenue & Other Total Revenue Under current law, increases to Weighted Average Daily Attendance would increase State Funding by $7.7M. Decreases in property tax revenue would trigger an increase to State funding (via hold-harmless) of approximately $5M. 7 2010-2011 Revenue vs. 2011-2012 Based on House Bill 2485 NEISD General Fund 2010-2011 2011-2012 HB 2485 Difference Property Tax Revenue $282.8M $277.5M ($5.3M) Other Local Revenue 4.4M 3.9M (0.5M) 188.9M 151.9M (37.0M) 23.5M 23.5M 0.0M 6.2M 5.6M (0.6M) $505.8M $462.4M ($43.4M) State Revenue TRS Revenue Federal Revenue & Other Total Revenue Under House Bill 2485’s funding formula, NEISD will see a decline in revenue of $43.4M in 2012 compared to 2011. Revenue would drop another $3M in 2013 and $2M in 2014. 8 2011-2012 Effective Revenue Loss House Bill 2485 -- Difference from Current Law NEISD General Fund 2011-2012 Current Law 2011-2012 HB 2485 Difference Property Tax Revenue $277.5M $277.5M $0.0M Other Local Revenue 3.9M 3.9M 0.0M 201.5M 151.9M (49.6M) 23.5M 23.5M 0.0M 5.6M 5.6M 0.0M $512.0M $462.4M ($49.6M) State Revenue TRS Revenue Federal Revenue & Other Total Revenue Compared to the current funding formula law, NEISD will lose nearly $50M in 2012, all in State revenue. The State’s share of total General Fund revenue would fall from 39% to 33%. 9 Formula Funding Bills Senate Version 10 2010-2011 Revenue vs. 2011-2012 Based on Senate Bill 22 NEISD General Fund 2010-2011 2011-2012 SB22 Difference Property Tax Revenue $282.8M $277.5M ($5.3M) Other Local Revenue 4.4M 3.9M (0.5M) 188.9M 164.8M (24.1M) 23.5M 23.5M 0.0M 6.2M 5.6M (0.6M) $505.8M $475.3M ($30.5M) State Revenue TRS Revenue Federal Revenue & Other Total Revenue Under Senate Bill 22’s funding formula, NEISD will see a decline in revenue of $30.5M in 2012 compared to 2011. Revenue would remain relatively flat thereafter. 11 2011-2012 Effective Revenue Loss SB 22 -- Difference from Current Law NEISD General Fund 2011-2012 Current Law 2011-2012 SB22 Difference Property Tax Revenue $277.5M $277.5M $0.0M Other Local Revenue 3.9M 3.9M 0.0M 201.5M 164.8M (36.7M) 23.5M 23.5M 0.0M 5.6M 5.6M 0.0M $512.0M $475.3M ($36.7M) State Revenue TRS Revenue Federal Revenue & Other Total Revenue Compared to the current funding formula law, NEISD will lose nearly $37M in 2012, all in State revenue. The State’s share of total General Fund revenue would fall from 39% to 35%. 12 Formula Funding Bills What if None Passes? 13 Budget Bill but No Funding Bill? If the Legislature passes an appropriations bill but does not change the Foundation School Program’s funding formulas to distribute only the amount appropriated, the Commissioner of Education could: • Fully fund 2011-2012, and prorate 2012-2013 • Needs approval by the Governor • Legislative Budget Board would propose to the next Legislature (January 2013) to take shortage from Rainy-Day to finish out 2012-2013 Sources: Legislative Budget Board; Moak, Casey & Associates 14 Budget Bill but No Funding Bill? • If the 83rd Legislature denies the January 2013 Rainy-Day request, Commissioner stops payments to districts in May 2013 • From an total allocation perspective, this hurts property-rich districts since proration is based on available property tax base • From a cash perspective, however, this disproportionally hurts propertypoor districts that have their State aid payments spread evenly throughout the year • • Property-wealthy districts receive more State funds in September & October, and live off property tax revenue beginning in January Proration is a delay, not a reduction • Statute mandate any cut in 2013 would have to be added to the 20142015 biennium budget Sources: Legislative Budget Board; Moak, Casey & Associates 15 Budget Bill but No Funding Bill? The Commissioner of Education has the authority to change the “compressed tax rate.” From Texas Education Code §42.2516 “The commissioner shall determine the state compression percentage for each school year based on the percentage by which a district is able to reduce the district's maintenance and operations tax rate for that year, as compared to the district's adopted maintenance and operations tax rate for the 2005 tax year, as a result of state funds appropriated for distribution under this section for that year from the property tax relief fund established under Section 403.109, Government Code, or from another funding source available for school district property tax relief.” Quote from Robert Scott: “Please don’t put me in that spot.” Source: TASA Capital Watch Alert 16 Tax Rate Compression • When the 79th Legislature lowered property taxes, they did not lower local property tax rates to $1.00. • The Legislature lowered each district’s rate to 66.67% of it’s 2005 rate. Almost every district in the state taxed @ $1.50 at the time, so 66.67% compression = $1.00. • If the State fails to provide adequate funding to districts, such that the total available revenue (local & state) per Weighted Average Daily Attendance is not comparable to pre-2006 amounts, then the commissioner must adjust the compression rate. Sources: Legislative Budget Board; Moak, Casey & Associates 17 Tax Rate Compression HYPOTHETICAL SITUATION • Commissioner changes NEISD’s compression from 66.67% to 68% • 68% X $1.50 = new $1.02 compression rate • NEISD’s current tax rate is $1.04 ($1.00 compression + $0.04 enrichment pennies) • If NEISD does raise it’s taxes by $0.02, the State will penalize NEISD by taking away approximately $4 million of Tier II State funding. • Only 2¢ of our tax rate would be “golden pennies” instead of the 4¢ we now have (local tax rate only 2¢ above compressed rate). 18 General Fund Forecast 19 General Fund Forecast • Reflects house version of budget and formula funding bills • These reflect current “near-worst-case” scenario • • Does not yet reflect Education Jobs Fund • • Situation more grim if either (a) law to use Rainy-Day fund to cover 10-11 biennial deficit or (b) law to delay August FSP payment do not pass. This will be addressed later in the presentation Significant Assumptions • Approximately 1,050 new students • Start-up costs for two new schools opening in August 2012 • General Fund absorbs significant costs from State-killed programs, such as Technology Allotment, Student Success Initiative, Adult Ed and shared service arrangement for Regional Day School for the Deaf 20 General Fund Forecast • Based on HB 2485 1st Year Change 2011–2012 Forecast 2nd Year Change 2012–2013 Forecast 3rd Year Change 2013–2014 Forecast $505.8 ($43.4) $462.4 ($3.1) $459.3 ($2.0) $457.3 Expenditures 485.8 (16.8) 469.0 10.3 479.3 5.5 484.9 Increase (Decrease) to Fund Balance $20.0 ($6.6) ($20.0) ($27.5) 71.9 91.9 85.3 65.3 Ending Fund Balance $91.9 $85.3 $65.3 $37.8 Months of Operating Fund Balance 2.4 2.3 1.7 1.0 (in millions) Revenue Beginning Fund Balance 2010-2011 Forecast Revenue/Student $7,606 ($760) $6,846 ($155) $6,691 ($134) $6,557 Expenditures/Student $7,305 ($361) $6,944 $39 $6,983 ($31) $6,952 The revenue reductions based on HB2485 continue past the next biennium (into at least 2013-2014). Almost $27M in fund balance will be eroded over 2 years, and dramatically more in 2014 if the 2013 Legislature doesn’t increase funding. 21 Expenditure Increases for 2011-2012 Costs to Absorb Educational Programs Losing Grant Funding $3,000,000 Set-aside for Repayment of QSCBs 1,700,000 Increased District Share of Health Insurance 1,795,000 Other Increases for New Schools, Inflation, Infrastructure 2,813,000 Contingency Allowance 2,500,000 Total Expenditure Increases $11,808,000 22 Expenditure Reductions for 2011-2012 Central Office Positions Frozen/Eliminated (~52 FTEs, 6.2%) Eliminate Retention Supplement ($2,550,000) (6,140,000) Utility Savings (450,000) Reduce Contract Days for Teachers > 187 days (250,000) Central Office Department Budget Reductions (350,000) Reduce Contract Days by 2 for Admin & Paras >190 days (577,000) Total Before Campus Reductions ($10,337,000) Campus Reduction Goals Elementary School Teachers(130 FTEs, 6.4%) ($7,865,000) Middle School Teachers(37 FTEs,3.8%) (2,173,000) High School Teachers(59 FTEs, 4.6%) (3,551,000) General Assistants & Clerical Admin – All levels(90 FTEs, 5.4%) (2,716,000) Campus Admin & Other Professionals – All Levels (25 FTEs, 3.7%) (1,879,000) Total Potential Campus Reductions ($18,184,000) Grand Total Reductions ($28,521,000) 23 Reductions to Teacher Staffing Levels Elementary School Teachers Middle School Teachers High School Teachers Total Current Allocation Reduction Goal Resignees/ Retirees To-Date 2,030.7 130 100 (30) 953.6 37 38 1 1,284.5 59 63 1 4,268.8 226 201 (28) 5.3% 4.7% % of Current Allocation Teacher Turnover Rate: 2005-2006 10.1% 2006-2007 11.7% 2007-2008 11.2% 2008-2009 10.4% 2009-2010 8.2% Difference If 2010-2011’s turnover rate is 8%, total teacher turnover would be 341. If 2010-2011’s turnover rate is 6%, total teacher turnover would be 255. 24 Cost Avoidances for 2011-2012 Eliminate Pay Raise $9,280,000 Not Adding Teaching Staff to Accommodate Enrollment Growth 4,060,000 Reduce Contingency Allowance & AARs 2,000,000 Total Cost Avoidance Total Reductions from 2010-2011 Actual Total Cost Avoidances for 2011-2012 Net Change Compared to Planned 2011-2012 Cost Structure $15,340,000 $28,521,000 15,340,000 $43,861,000 An earlier example showed that HB2485 revenue compared to current law revenue for 2012 was nearly $50M lower. Similarly, in addition to expenditure reductions of $28.5M resulting from this legislation, NEISD is planning $15.3M in cost avoidances. This represents planned expenditure growth that will no longer occur. The total change to NEISD’s anticipated cost structure due to the under-funding of education is $43.9M. 25 Education Jobs Bill 26 Education Jobs Bill • North East ISD was allocated $10,594,000 • Funds must be used for compensation and benefits of schoollevel employees for the following allowable purposes: • • To retain, recall, or rehire employees • To restore reductions in salaries, including furlough days Funds were intended to be distributed for use in 2010-2011 • All Federal guidance refers to 2010-2011 • Currently reviewing TEA guidance for proper use in 2011-2012 • Update will be provided to Board of Trustees on May 23, 2011 27 Benchmarking Update 28 NEISD vs. 100 Largest Texas ISDs General Fund Expenditures per Student 100 90 districts spent more per student) NEISD spent $250 per student more than the weighted average of the group, a difference of 3.5%. 80 Rank within Top 100 North East ISD ranked 75th out of the 100 largest Texas ISDs for per Student spending for 2009-2010. (25 70 60 50 40 30 20 10 - 29 State Peer Group 2009-2010 Selected Demographics Enrollment Wealth/ WADA EDS % Target Revenue Arlington 63,385 $267,494 59.8% $5,003 Conroe 49,323 $337,689 35.6% $5,463 Fort Bend 69,066 $288,134 35.2% $5,228 Garland 57,654 $193,456 57.2% $4,999 Katy 58,444 $284,551 29.1% $5,602 Klein 44,695 $241,173 36.2% $5,160 Lewisville 50,664 $391,246 25.6% $5,842 Northside 91,464 $292,113 50.3% $5,382 Round Rock 42,777 $424,603 28.7% $5,981 Peer Group Average 58,608 $297,224 41.2% $5,380 North East 65,217 $357,700 42.8% $5,704 District 30 NEISD vs. State Peer Group General Fund Expenditures per Student Dollars Spent per Student Variance $100 North East ISD spent $414 more than the average of our peer group, mainly in the areas Instruction, Staff Development, School Leadership and Maintenance. $202 $414 $80 $59 $60 $48 $46 $40 $20 $$(20) $27 $25 $21 $20 $25 $10 $2 $0 ($12) $(40) $(60) ($59) $(80) 31 NEISD vs. State Peer Group General Fund Expenditures per Student % Difference in Student Spending 60% Although North East ISD spent $202 more for instruction than our peer group average, that represents only a 5% difference. Alternatively, NEISD spent 209% more than our peer average on Social Work Services, but that represents only $27 per student. 209% 54% 50% 40% 32% 30% 18% 20% 10% (0%) (10%) 17% 10% 5% 9% 7% 0% 8% 6% 3% (4%) (20%) (30%) (40%) (50%) (52%) (60%) 32 NEISD vs. State Peer Group Function 11 - Instruction NEISD State Peers Difference % Difference $4,665.7 $4,463.5 $202.2 4.5% Payroll as a % of Total 96.3% 96.9% Student / Professional FTE 15.43 15.36 (0.07) (0.4%) Student / Para FTE 103.88 103.60 (0.28) (0.3%) Salary / FTE – Professional $55,422 $52,951 $2,471 4.7% Salary / FTE – Para $18,239 $18,509 ($270) (1.5%) General Fund Only Function 11 per Student Payroll makes up almost all Function 11 costs! Compared to our peers, NEISD has similar student-to-staff ratios, and similar costs for instructional assistants. NEISD pays 4.7% higher salaries for professional instructional staff. 33 NEISD vs. State Peer Group Function 13 – Curriculum & Staff Development NEISD State Peers Difference % Difference Function 13 per Student $137.4 $89.2 $48.2 54.0% Payroll as a % of Total 82.1% 80.2% 1.9% Student / Professional FTE 835.0 2,128.9 1,293.9 60.8% Student / Para FTE 5,176.0 10,468.9 5,292.9 50.5% Salary/ FTE – Professional $67,912 $80,921 ($13,009) (16.1%) Salary / FTE – Para $32,632 $31,161 $1,471 4.72% General Fund Only Compared to our peers, NEISD has significantly lower ratios for staff devoted to curriculum and staff development. TEA data reporting standards do not allow for a comparison of what positions each district codes to this function. For NEISD, it comprises mostly deans. 34 NEISD vs. State Peer Group Function 23 – School Leadership NEISD State Peers Difference % Difference Function 23 per Student $481.3 $435.7 $45.6 10.5% Payroll as a % of Total 96.2% 98.0% Student / Professional FTE 315.4 309.5 (5.9) (1.9%) Student / Para FTE 214.2 212.0 (2.2) (1.0%) Salary / FTE – Professional $83,736 $77,054 $6,682 8.7% Salary / FTE – Para $25,410 $23,675 $1,735 7.3% General Fund Only Payroll makes up almost all Function 23 costs! Compared to our peers, NEISD has similar student-to-staff ratios in school administrative positions. NEISD pays 8.7% higher salaries for professional administrative staff and 7.3% more in paraprofessional staff. 35 NEISD vs. State Peer Group Function 33 – Health Services NEISD State Peers Difference % Difference Function 33 per Student $104.1 $78.8 $25.3 32.1% Payroll as a % of Total 95.5% 97.7% Student / Professional FTE 875.4 902.4 27.0 3.0% Student / Para FTE 1,015.8 3,885.5 2,869.7 73.9% Salary / FTE – Professional $55,380 $51,534 $3,846 7.5% Salary / FTE – Para $18,816 $21,244 ($2,428) (11.4%) General Fund Only Payroll makes up almost all Function 33 costs! Compared to our peers, NEISD has a similar student-to-staff ratio for professional health staff (i.e., nurses). NEISD has a significantly lower ratio for paraprofessional health staff. TEA reporting standards do not allow for detail of the types of paraprofessional positions at our peers; for NEISD this is mainly clinic assistants. 36 NEISD vs. State Peer Group Function 51 – Facilities Maintenance & Operations NEISD State Peers Difference % Difference Function 51 per Student $763.7 $704.4 $59.3 8.4% Payroll as % of Budget 57.8% 48.4% 9.4% Utilities as a % of Budget 25.6% 33.8% (7.2%) Payroll Cost per Student $433.7 $324.3 $109.3 33.7% Student / Auxiliary FTE 93.5 138.7 45.2 32.6% Salary / FTE – Auxiliary $29,450 $27,792 $1,658 6.0% Utilities Cost per Student $195.3 $237.8 ($42.4) (17.8%) General Fund Only Compared to our peers, NEISD has a lower student-to-staff ratio in custodial and maintenance positions. NEISD pays 6.0% higher salaries for auxiliary staff. NEISD has a significant savings in utilities compared to our peers. 37 State Peer Group Spending vs. Target Revenue Target Revenue/ WADA Operating Costs/ WADA Ratio of Costs to Target M&O Tax Rate Arlington $5,003 $5,661 113.1% $1.0400 Conroe $5,463 $5,524 101.1% $1.0400 Fort Bend $5,228 $6,012 115.0% $1.0400 Garland $4,999 $5,444 108.9% $1.0400 Katy $5,602 $6,185 110.4% $1.1266 Klein $5,160 $5,556 107.7% $1.0400 Lewisville $5,842 $6,458 110.5% $1.0400 Northside $5,382 $5,957 110.7% $1.0400 Round Rock $5,981 $6,256 104.6% $1.0400 Peer Group Average $5,380 $5,896 109.6% $1.0496 North East $5,704 $6,227 109.2% $1.0400 District 38 Upcoming Meetings 1 May 23 2 June 13 – Call for Public Hearing June 27 – Public Hearing 39 Questions?